Goldman Sachs (GS.US) stock rose over 2,5% on Monday after earnings and revenues topped Wall Street projections by a huge margin despite an uncertain macroeconomic environment. “We delivered solid results in the second quarter as clients turned to us for our expertise and execution in these challenging markets," said CEO David Solomon.

-

Earnings of $7.73 a share, well above Refinitiv estimates of $6.58 per share

-

Revenue of $11.86 billion, also topped market expectations of $10.86 billion as bond trading department generated roughly $700 million more revenue than expected.

-

Also wealth management revenue increased by 25% to $2.18 billion.

-

On the flip side, asset management revenue fell 79% to $1.08 billion, while its investment banking revenue decreased by 41% to $2.14 billion as deal-making slowed dramatically from a strong year-ago quarter.

-

Megabank also increased its quarterly dividend by 25%, to $2.50 per share.

-

Analysts are cautiously optimistic about Goldman stock with a Moderate Buy consensus rating and average price forecast of $373.91.

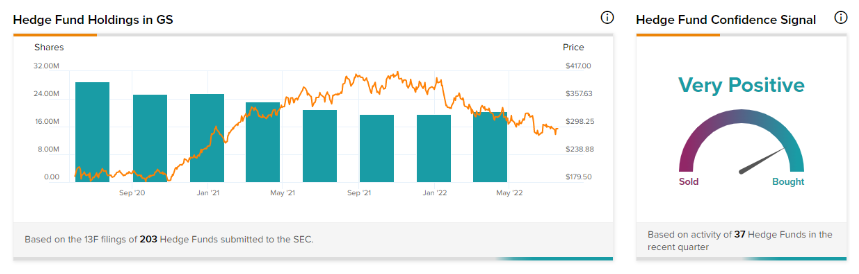

Confidence in Goldman Sachs is currently Very Positive, as 37 hedge funds increased their cumulative holdings of GS stock by 931,800 shares in the last quarter. Source: TipRanks Hedge Fund Trading Activity tool.

Confidence in Goldman Sachs is currently Very Positive, as 37 hedge funds increased their cumulative holdings of GS stock by 931,800 shares in the last quarter. Source: TipRanks Hedge Fund Trading Activity tool.

Goldman Sachs (GS.US) stock launched today's session higher, however sellers failed to break above major resistance at $312.65, which coincides with 38.2% Fibonacci retracement of the upward wave launched in March 2020 and lower limit of the descending channel. The nearest support to watch lies at $278.00. Source: xStation5

Goldman Sachs (GS.US) stock launched today's session higher, however sellers failed to break above major resistance at $312.65, which coincides with 38.2% Fibonacci retracement of the upward wave launched in March 2020 and lower limit of the descending channel. The nearest support to watch lies at $278.00. Source: xStation5

US Open: Indexes Stop on PPI, Banks in the Shadow of Data

MIDDAY WRAP: Mixed sentiment in Europe, declines on U.S. indices

Wells Fargo: Q4 was disappointing, but the forecasts for 2026 spark the imagination 💡🏛️

Saab shares surge as Scandinavian rearmament drives demand 📈

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.