Shares of the U.S. semiconductor chipmaker (INTC.US) are trading down nearly 22% today after quarterly results. The company intends to restructure the business and will lay off 15,000 employees (15% of about 110,000 full-time positions), retaining only the full-time positions necessary to continue operations. All this as part of a cost-cutting program ($10 billion in 2024).

However, this is not the biggest concern for investors. Weak results, as well as Intel's forecasts and news of a DoJ report targeting Nvidia, are putting further pressure on the semiconductor sector. According to CEO Pat Galsinger, Intel needs to fundamentally change the way it operates and has so far failed, on a satisfactory scale, to benefit from the AI trend wave. As a result, the company's shares are falling at the highest scale since October 2000, when the dot-com bubble burst.

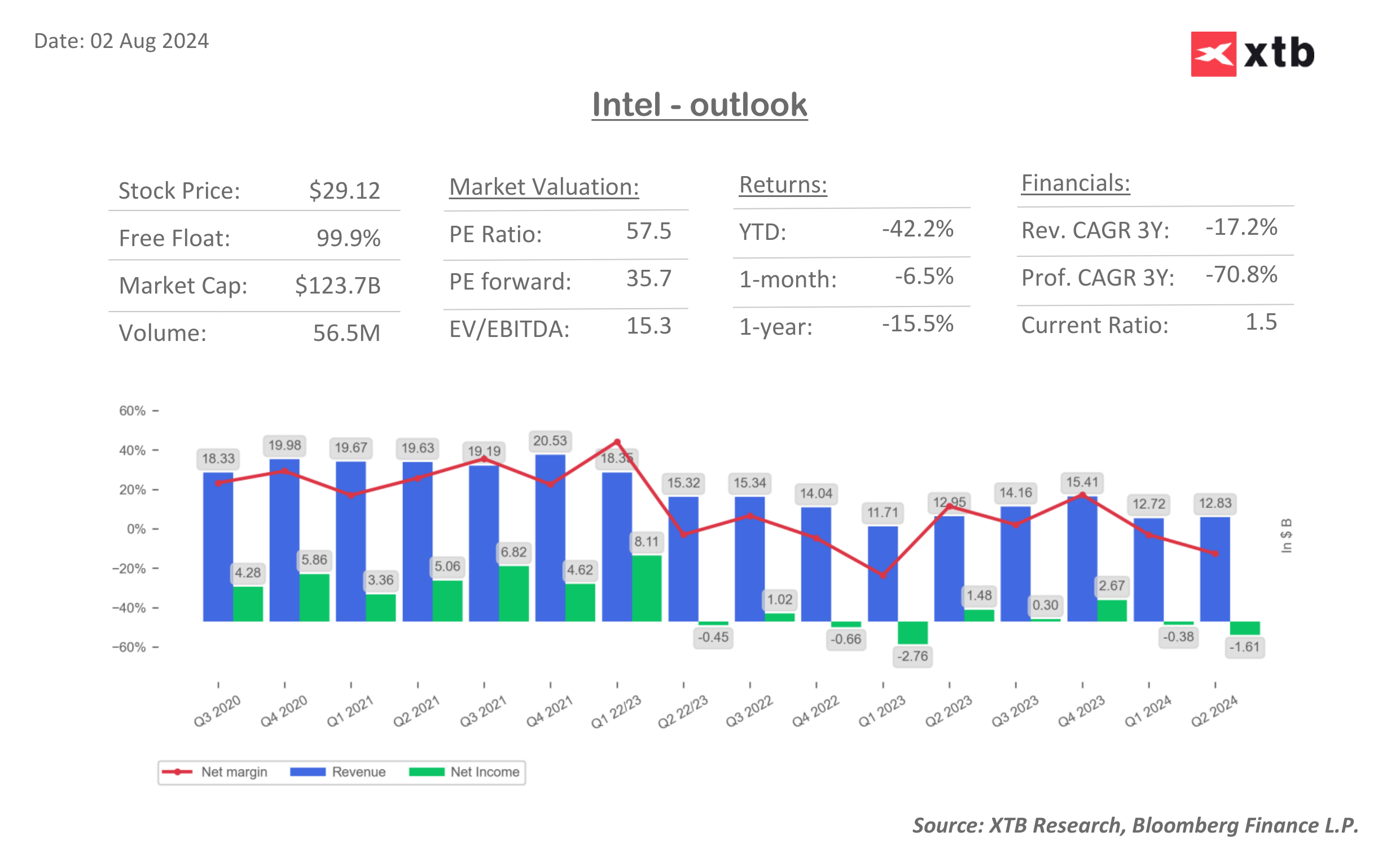

Revenues: $12.83 billion vs. $12.94 billion forecast (down 1% y/y)

Adjusted earnings per share (EPS): $0.02 vs. $0.10 forecasts

For Q3 2024, Intel estimates revenue of $12.5 to $13.5 billion, vs. $14.38 billion expected. The company will likely report a $0.03 loss per share instead of the expected $0.3 profit. Sales in the data centre segment fell 3% year-on-year to $3 billion, while competitors are reporting record increases in this segment. The market sees this as evidence that Intel remains a 'marauder' against its peers and is an operational outlier. Sales in the PC sector rose 9% y/y, while sales in the Foundry Unit's services unit rose 4% y/y to $4.32 billion.

The end of the historic dividend?

-

The company will not pay its regular quarterly dividend, paid since 1992, as part of a program to cut costs and increase free cash flow

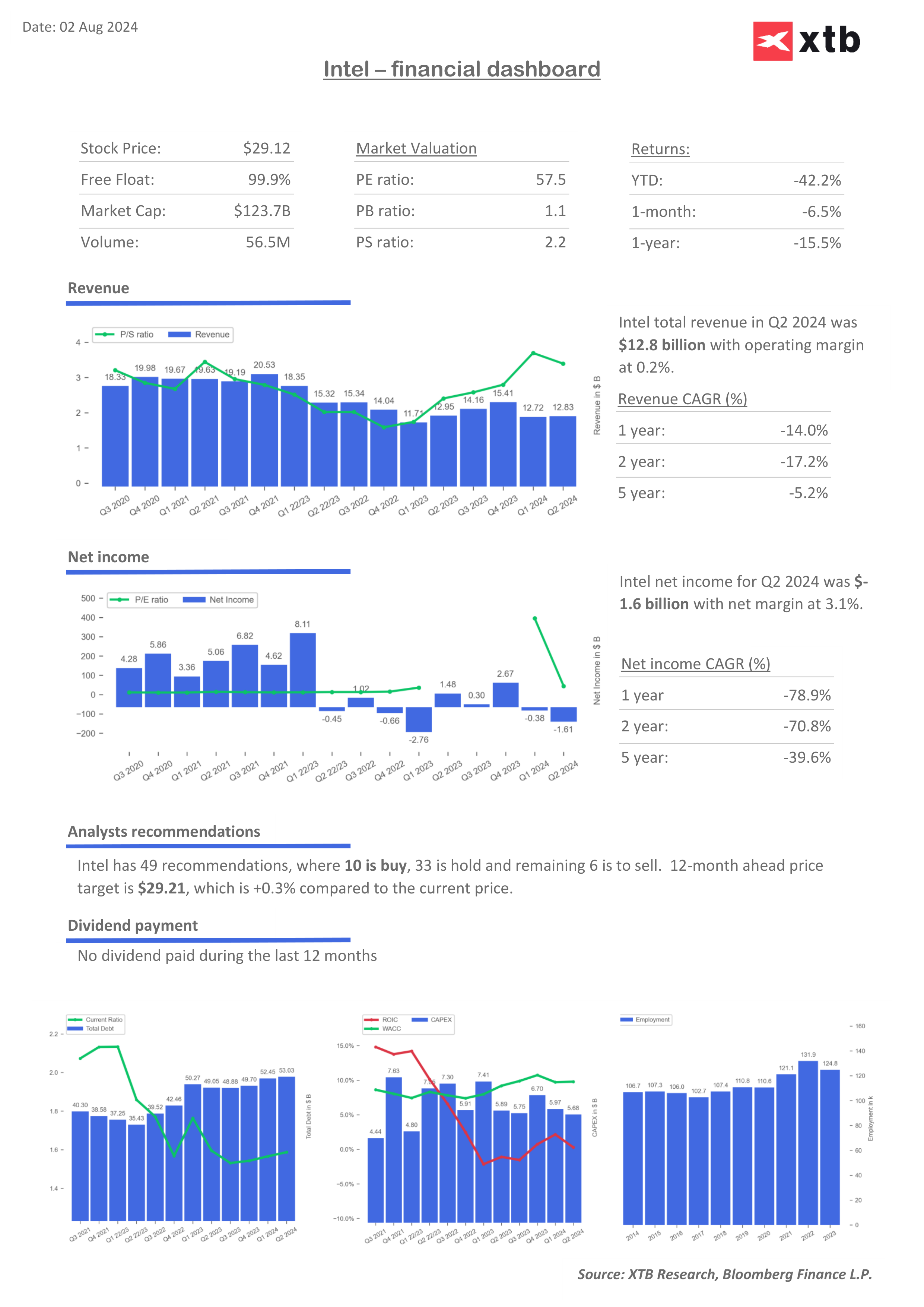

- Intel intends to cut CAPEX by 20% this year, which investors see as a risk of 'deepening' the gap with competitors, who have quite boldly increased capital spending, to grow the chip business, in 2024.

- Investors see signs that Intel's offerings are losing competitiveness in the market, and so far significant investments have failed to improve its business. CEO, Gelsinger prefaced that the company's transformation path will not be easy.

- Spending has put significant pressure on gross margins, which are now 35% versus 60% at their peak. The company sees catalysts for growth in AI chips dedicated to PCs and the transfer of production to its own factories, at a time when subcontractors currently do most of it.

- Intel is targeting $20 billion to $23 billion in CAPEX in 2025, compared to $25 billion to $27 billion in 2024, with additional pressure on the company from the US decision in May 2024 to halt sales of Intel chips to China's Huawei.

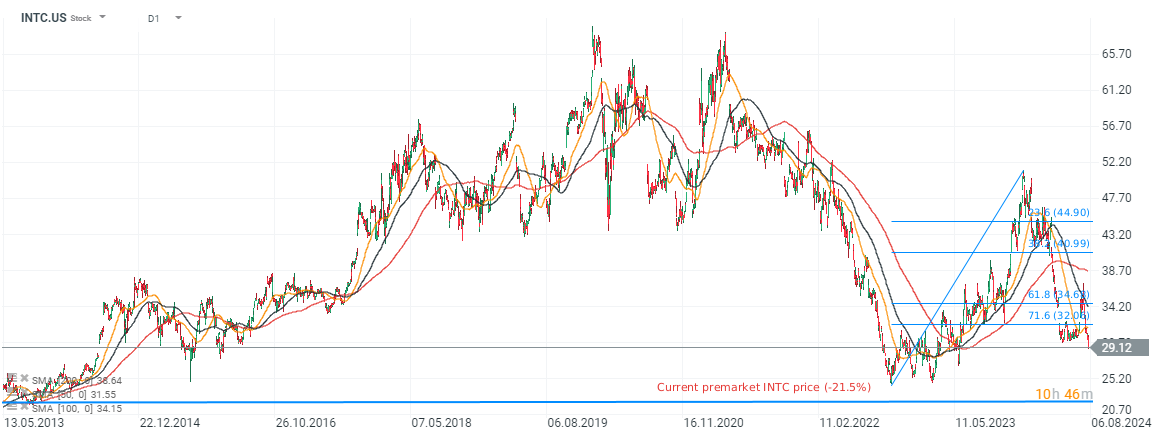

Intel shares (INTC.US), D1 interval

Intel's shares are experiencing a record sell-off and are testing the area of $23 unseen since 2013. At the same time, these are around the local minima of the sell-off, from 2013.

Source: xStation5

Intel financial dashboards and valuation multiples

We can see constantly high WACC level amid dropping ROIC with still very high trailing and forward price to earnings ratios at 57 and 35 level respectively.

Source: XTB Research, Bloomberg Finance L.P.

Source: XTB Research, Bloomberg Finance L.P.

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.