-

Strong revenue growth in investment banking and trading, driven by a revival in the mergers and acquisitions market, especially in the technology and healthcare sectors.

-

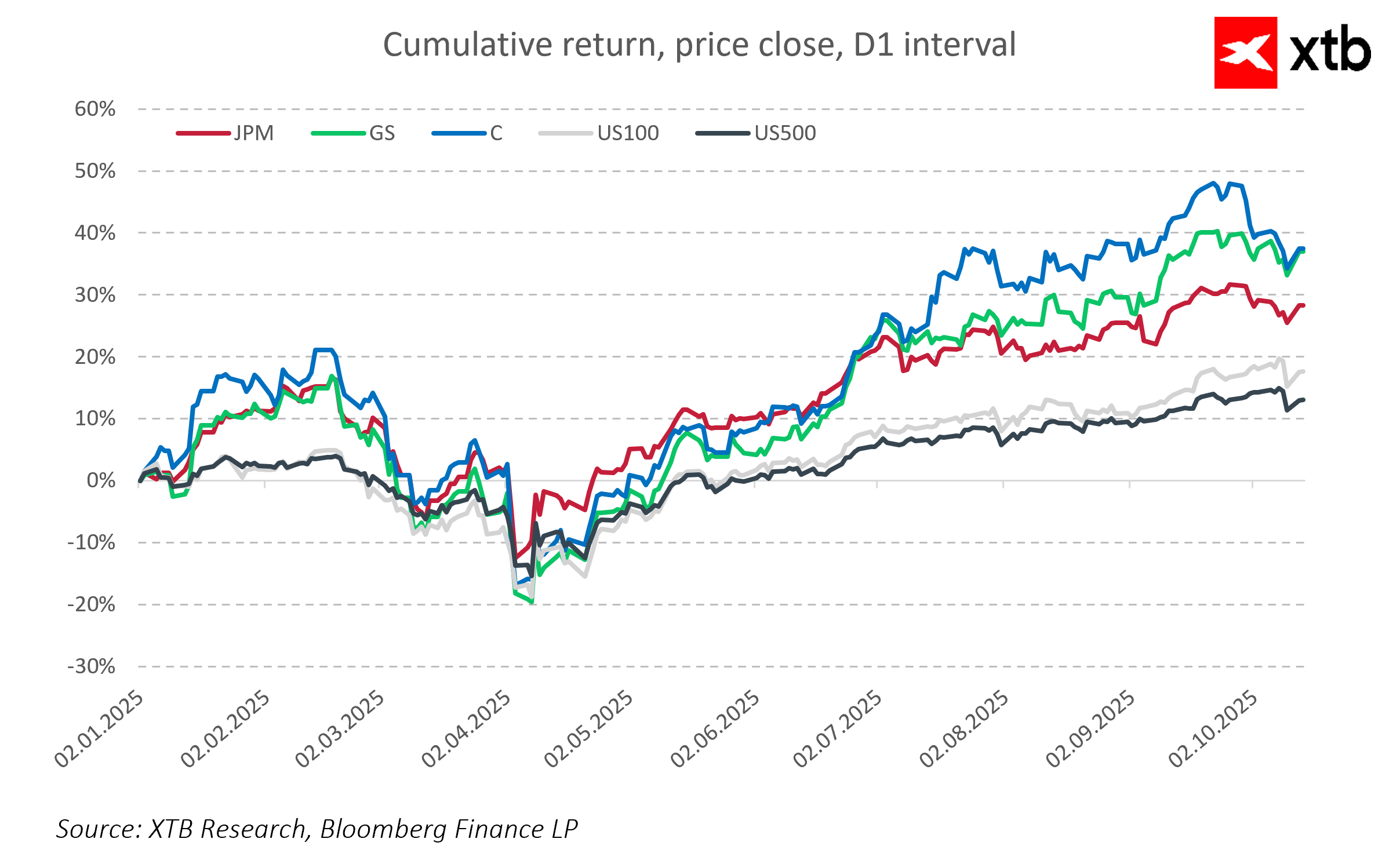

Bank stocks consistently outperform major market indices despite not directly benefiting from the AI boom.

-

Potential interest rate cuts by the Fed could pressure net interest margins, necessitating further diversification and investment in new business segments.

-

Strong revenue growth in investment banking and trading, driven by a revival in the mergers and acquisitions market, especially in the technology and healthcare sectors.

-

Bank stocks consistently outperform major market indices despite not directly benefiting from the AI boom.

-

Potential interest rate cuts by the Fed could pressure net interest margins, necessitating further diversification and investment in new business segments.

Q3 2025 brought strong results for the largest U.S. investment banks — JPMorgan Chase, Goldman Sachs, and Citigroup — which not only exceeded market expectations but also reaffirmed their key roles in the global financial landscape. Amid rising macroeconomic volatility and geopolitical uncertainty, all three institutions demonstrated resilience and adaptability, reflected in growing revenues and profits.

Particular attention is drawn to the revival in the mergers and acquisitions (M&A) market, which played a significant role in the banks’ performance. Both JPMorgan and Goldman Sachs actively participated in some of the quarter’s largest deals, advising on key transactions worth tens of billions of dollars. This drove a notable increase in investment banking revenues, fueled by elevated advisory fees and underwriting commissions.

Citigroup, while more focused on restructuring its global operations, also benefited from the rebound in capital and transactional markets. The bank posted record revenues despite some earnings being weighed down by a one-time restructuring charge.

Overall, Q3 results indicate a stabilization and return to growth in the investment banking sector, which has faced regulatory pressures, market volatility, and economic uncertainty in recent years. At the same time, elevated loan loss reserves reflect a cautious approach and readiness to handle potential future risks.

JPMorgan Chase

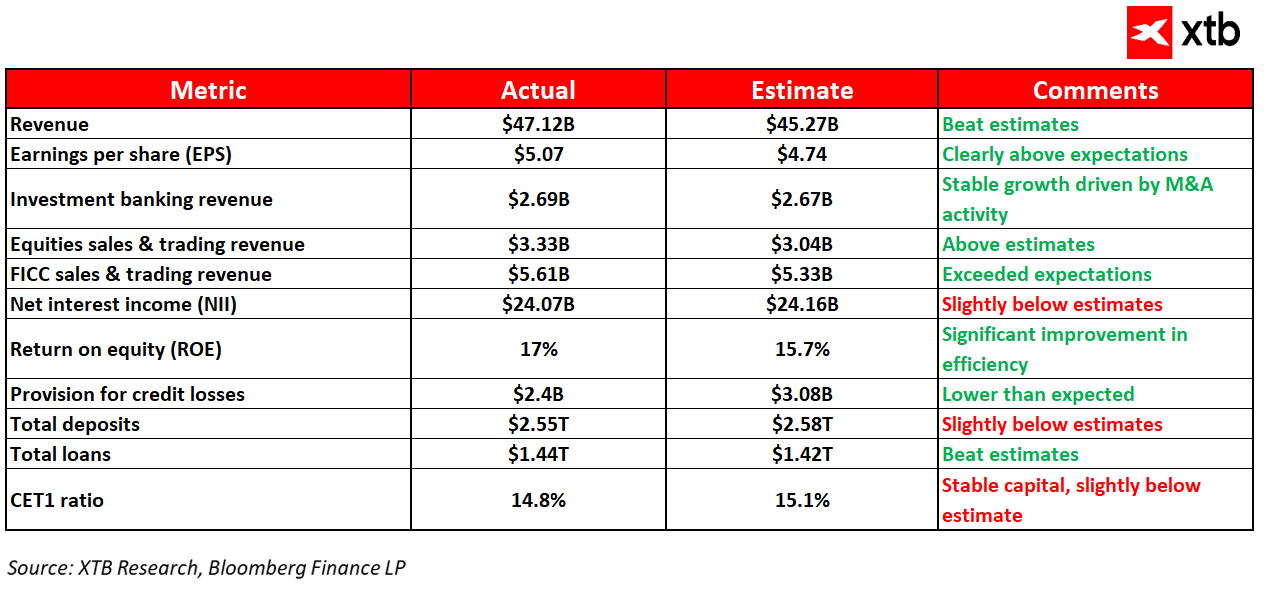

JPMorgan Chase closed Q3 2025 with very solid results, reaffirming its leadership in the universal banking sector. Revenues increased 9% year-over-year to $47.12 billion, driven by higher activity in capital markets and retail banking. Net income was $14.4 billion, up 12% compared to the same period last year.

JPMorgan clearly capitalized on market opportunities, surpassing analyst expectations by $1.85 billion. Record trading revenues — $3.33 billion in equities and $5.61 billion in fixed income, currency, and commodities (FICC) — were fueled by heightened market volatility and trading volumes.

Investment banking revenues reached $2.69 billion, reflecting the M&A revival, with JPMorgan advising on major deals such as 3G Capital’s acquisition of Skechers and a large energy sector merger, strengthening its corporate banking position.

Earnings per share (EPS) came in at $5.07, well above the $4.74 estimate, translating to a return on equity (ROE) of 17%, marking a significant improvement in efficiency.

Despite a challenging economic environment, JPMorgan maintained portfolio quality, with loan loss provisions of $2.4 billion below expectations and net charge-offs in line with forecasts at $2.59 billion.

On the balance sheet, total deposits stood at $2.55 trillion, slightly below estimates, while loans rose to $1.44 trillion, exceeding projections, signaling strong loan demand. The CET1 capital ratio remained robust at 14.8%, just below estimates.

The bank managed liquidity effectively, with cash and due from banks at $21.82 billion, slightly under projections, suggesting more active fund utilization. Operating expenses rose moderately by around 4%, reflecting investments in technology and security.

JPMorgan confirmed its position as one of the most versatile and efficient banks, adept at leveraging dynamic market changes while maintaining strong fundamentals and risk control.

Goldman Sachs

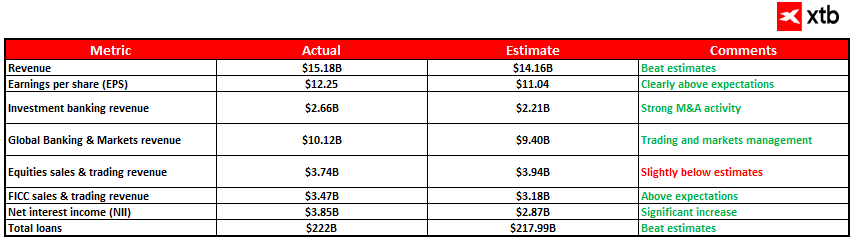

Goldman Sachs reported Q3 revenues of $15.18 billion, beating analyst expectations of $14.16 billion. EPS of $12.25 was well above the $11.04 estimate, highlighting strong profitability.

The investment banking segment performed exceptionally, delivering $2.66 billion in revenues, well ahead of the $2.21 billion forecast, driven by intense M&A activity. Goldman Sachs advised on key deals such as a major biotech acquisition by a pharmaceutical giant and a large transaction in the financial sector, reinforcing its global M&A leadership.

Global Banking & Markets — covering trading and capital markets services — generated $10.12 billion in revenues, surpassing the $9.40 billion estimate. Equities trading brought in $3.74 billion, slightly below projections, while FICC trading rose to $3.47 billion, beating the $3.18 billion estimate.

Net interest income (NII) was $3.85 billion, significantly above the $2.87 billion forecast, reflecting efficient interest income management in a rising rate environment.

Deposits increased 5.2% quarter-over-quarter to $490 billion, signaling growing client trust. Loans grew to $222 billion, beating expectations. Goldman Sachs maintained a strong capital position and risk management, supporting stable results and shareholder value growth.

Citigroup

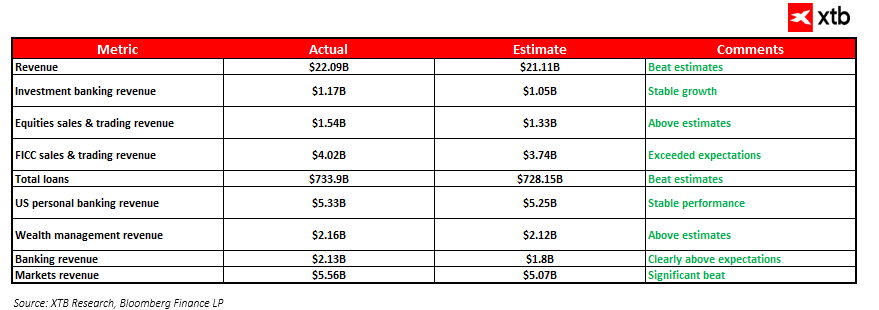

Citigroup confirmed a stable position in Q3 2025, posting revenues of $22.09 billion, exceeding estimates of $21.11 billion. Strength was especially evident in trading and investment banking segments, which powered results.

Investment banking revenues reached $1.17 billion, surpassing the $1.05 billion estimate. Equity sales & trading brought $1.54 billion (vs. $1.33 billion expected), while FICC sales & trading hit $4.02 billion, beating the $3.74 billion forecast.

Loan portfolio results were also positive: total loans stood at $733.9 billion, above the $728.15 billion estimate. U.S. personal banking revenues rose to $5.33 billion (vs. $5.25 billion expected), and wealth management contributed $2.16 billion, slightly above forecasts.

Corporate banking and markets segments significantly outperformed, generating $2.13 billion (vs. $1.8 billion forecast) and $5.56 billion (vs. $5.07 billion forecast), respectively, confirming Citi’s strong global market presence and corporate client service.

The results from these major U.S. banks in Q3 2025 illustrate a clear market rebound, fueled primarily by increased M&A activity and strong trading revenues. Rising volumes in tech and healthcare deals, in particular, have generated substantial advisory fees and underwriting commissions, boosting investment banking profits. At the same time, solid interest income reflects a favorable balance sheet structure, and a stable deposit base provides financial security.

It’s worth noting that although these banks’ stock performances do not match the spectacular gains seen in tech sectors related to AI, they consistently outperform major market benchmarks like the Nasdaq 100 and S&P 500. While not directly benefiting from the AI boom, banks indirectly profit from improved overall market sentiment and increased investor activity. Their stability, diversified operations, and growing revenues from investment banking and trading segments give them an edge over the broader market. This demonstrates that despite challenges, the banking sector can effectively capitalize on favorable economic and investment conditions to build a solid foundation for future growth.

However, despite these positive signs, the banking sector faces significant challenges. A key concern is the potential continuation of the Federal Reserve’s rate-cutting cycle. Lower interest rates could compress banks’ net interest margins, limiting profitability from traditional lending activities. In response, banks will likely need to further diversify revenue streams, invest in technology, and expand advisory and wealth management services.

Daily Summary – Indices rebound as oil markets await further developments

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

Iran: Situation overview and outlook

US OPEN: Wall Street buoyed by robust data and shifting sentiment

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.