NFP with a big revision

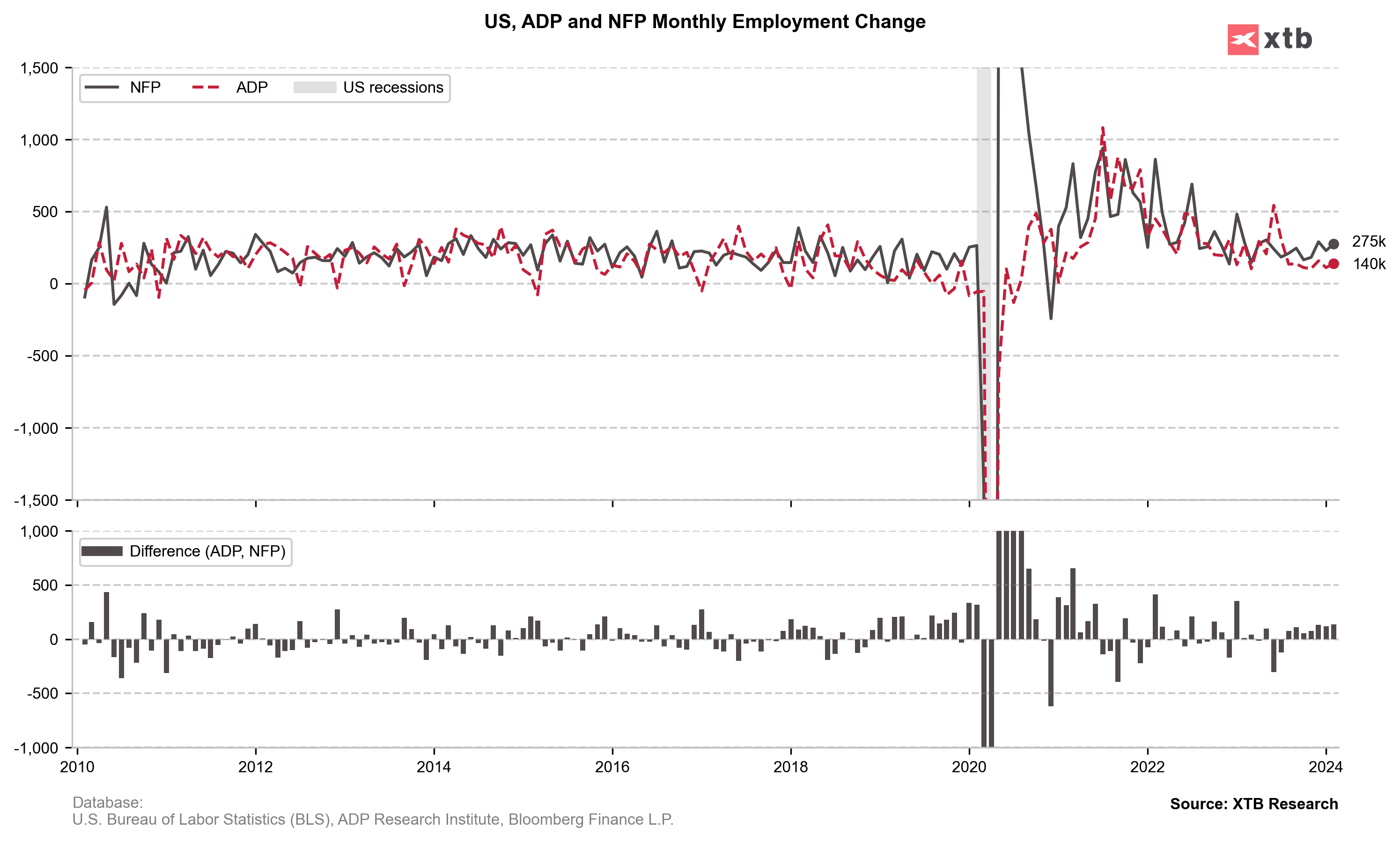

Today's NFP report showed another strong gain in US employment. Full-time job growth reached 275,000, following a very strong January. The snag is that January was very much revised downwards. As we wrote about in the preview, the percentage of surveyed companies that sent out their January surveys before the NFP was just above 50%. A revision was to be expected. Thus, the reading for January was revised down to 223,000 from 353,000.

The NFP report does not look bad only superficially. Of course, a month-on-month gain above 200k is a lot, but certainly the labour market is not as heated as some thought just a month ago. Source: Bloomberg Finance LP, XTB

FTEs are not people employed

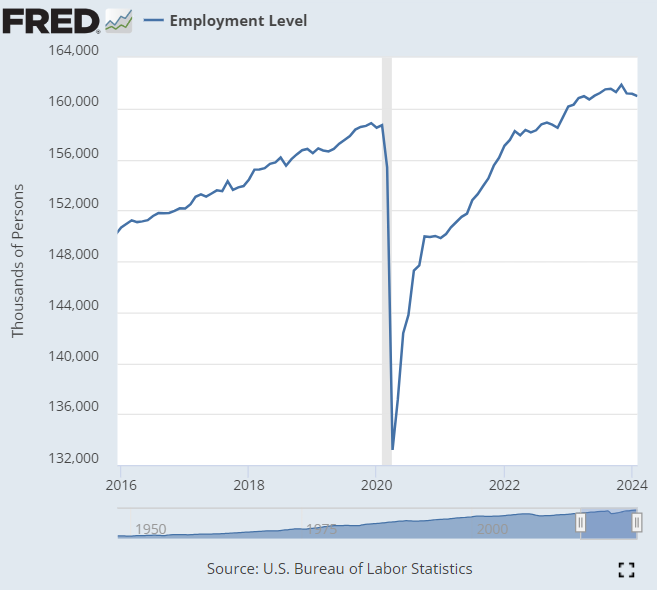

Another problem is that an increase in posts does not necessarily mean an increase in the number of people employed. In this respect, we have seen a significant decline in the number of people employed for a long time (since November). This data comes from the household survey. This report showed that the decline in employment for February was 184,000 to 160.968 million employed. This means that more and more people are working 2 or perhaps even more full-time jobs. This is not necessarily indicative of the strength of the labour market.

US employment levels have been falling since November. Source: FRED

Rising unemployment rate

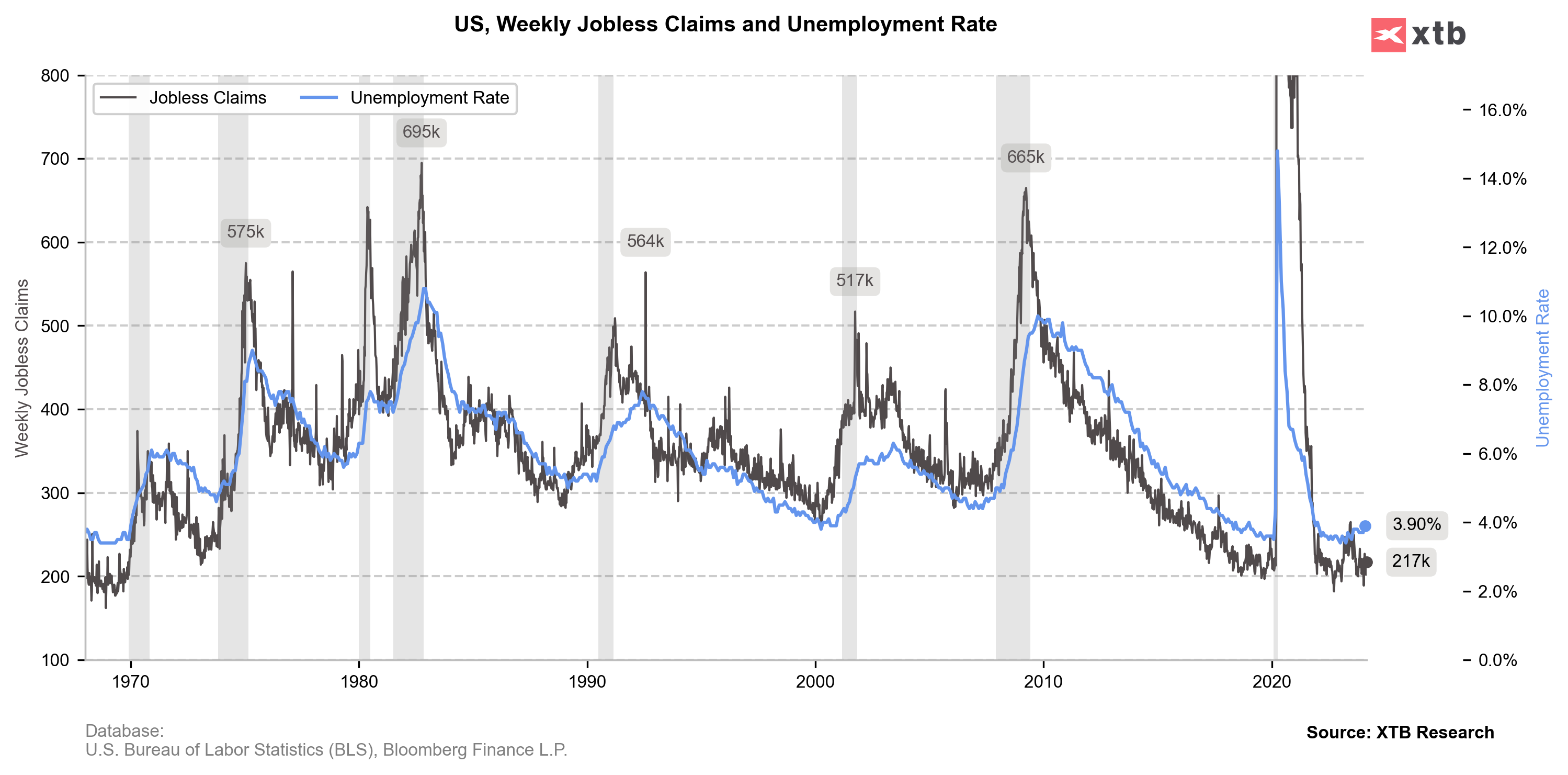

The unemployment rate also comes from the household survey, so it should come as no surprise that we have an increase in the number of full-time jobs and an increase in the unemployment rate. The rate rises to 3.9% from 3.7% and the rate was not expected to rise.

The unemployment rate is approaching 4.0%. In the past, exceeding this level has suggested the possibility of the economy entering a recession. Source: Bloomberg Finance LP, XTB

Lower wage growth

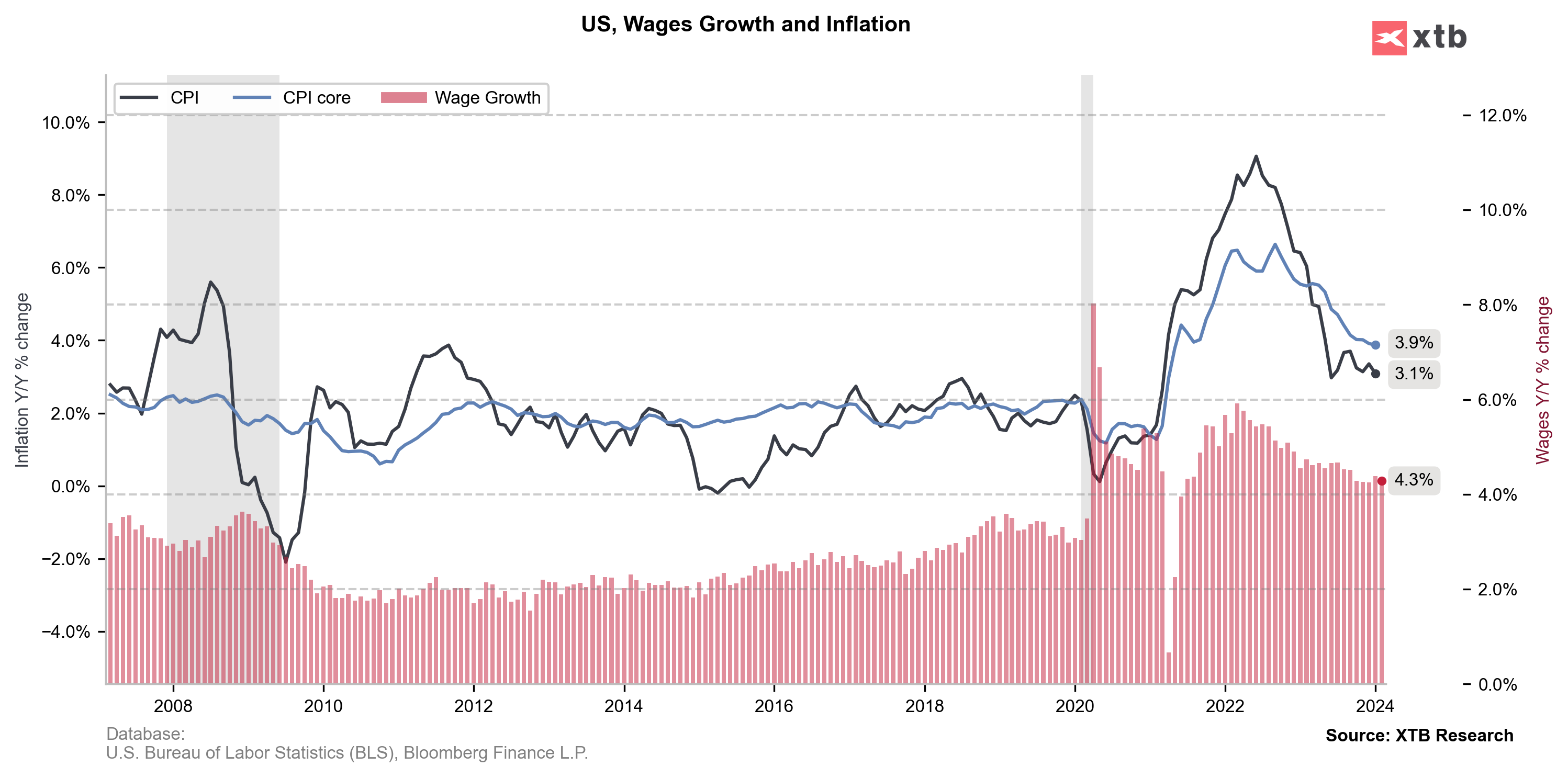

This data will certainly be welcomed by the Fed. Lower wage dynamics mean there is less prospect of a demand-led boost to inflation. However, the dynamics are still relatively high compared to the inflation target. According to the Fed, wages can grow at 3% for the inflation target to be met. Nevertheless, the monthly increase was only 0.1% m/m.

In contrast to the euro area, there are no rising wage pressures here, so the risk of a larger rebound in core inflation is limited for the time being. Source: Bloomberg Finance LP, XTB

Employment change will fall to zero?

Looking at an interesting comparison presented by ZeroHedge, which takes the NFIB employment survey and pushes it back a bit, this would suggest that a sizable drop in employment growth is lined up in the coming months, particularly in Q2 and Q3.

Source: ZeroHedge, Bloomberg

Is bad data good data?

Everyone can see that the details of the report are not good, although at the same time it is hard to say that the labour market looks weak. Of course, the report makes one think about the timing of the first reduction by the Fed. Will the bank decide to react before the problem actually occurs? Won't another negative revision await us in a month's time? Would this mean the publication of data to show the state of the economy too well ahead of the upcoming elections? The indices have rallied to historic highs and the dollar has started to lose ground. Nevertheless, the market is seeing more and more reluctance towards the dollar, with additional speculation that a possible hike by the BoJ could reverse the world's most important carry trade, which could threaten financial stability worldwide.

Is gold a warning of more global dedollarisation? Or merely benefiting from a wave of asset price inflation. Source: xStation5

Is gold a warning of more global dedollarisation? Or merely benefiting from a wave of asset price inflation. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.