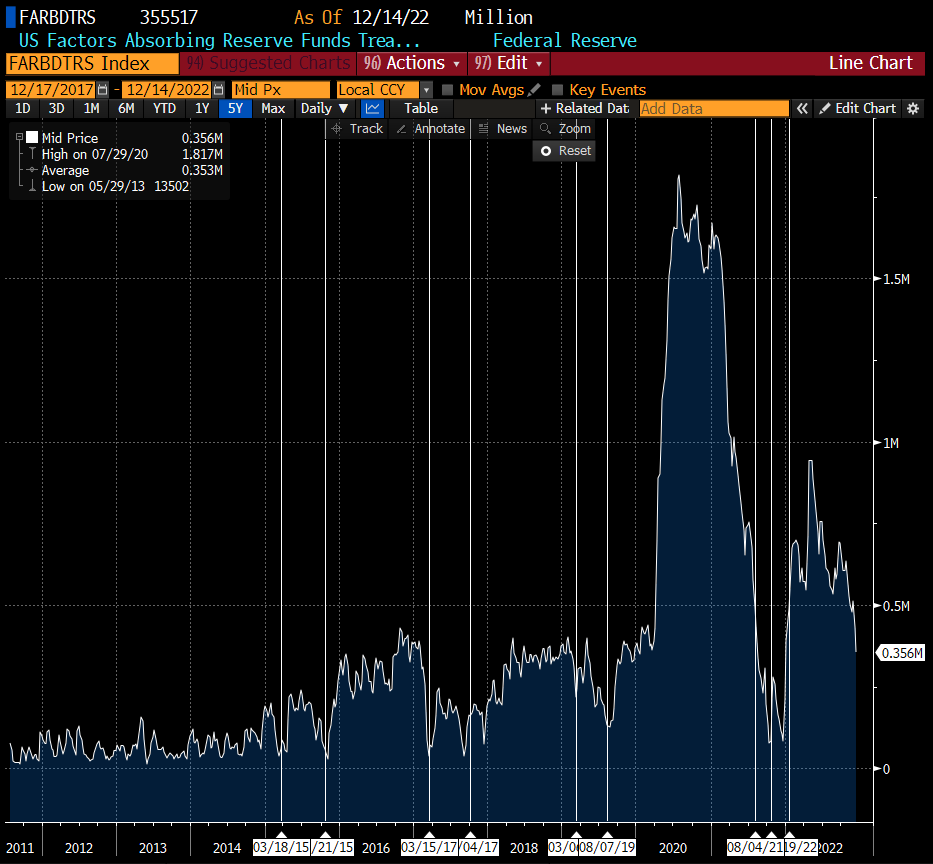

TGA is key to watch at the beginning of the next year

- Next year, the United States will again face the problem of reaching the debt limit, which is likely to be raised again.

- In order to "speed up" negotiations, the Treasury Department is getting rid of cash from the Treasury Department's main account just before the debt limit is reached. Moreover, usual operations cannot be financed by debt so TGA drains quickly. The TGA is the Treasury Department's main account for tax revenues and other government spendings.

- Looking at previous situations when the debt was approaching the limit, the TGA has been falling below $100 billion. A similar situation can be expected in the coming weeks.

- "Withdrawals" from the TGA mean a real increase in liquidity in private markets, as the Treasury Department releases "frozen" liquidity from its account.

- The limit is likely to be reached Q1 23, which means we should see additional liquidity in the markets in the coming weeks. On the other hand, right after the limit is raised, dollar liquidity may collapse, through the rebuilding of funds on TGA and QT by the Fed.

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile appThe dates marked show situations when the debt was approaching the limit. A drop in TGA means increased liquidity in private markets. Source: Bloomberg

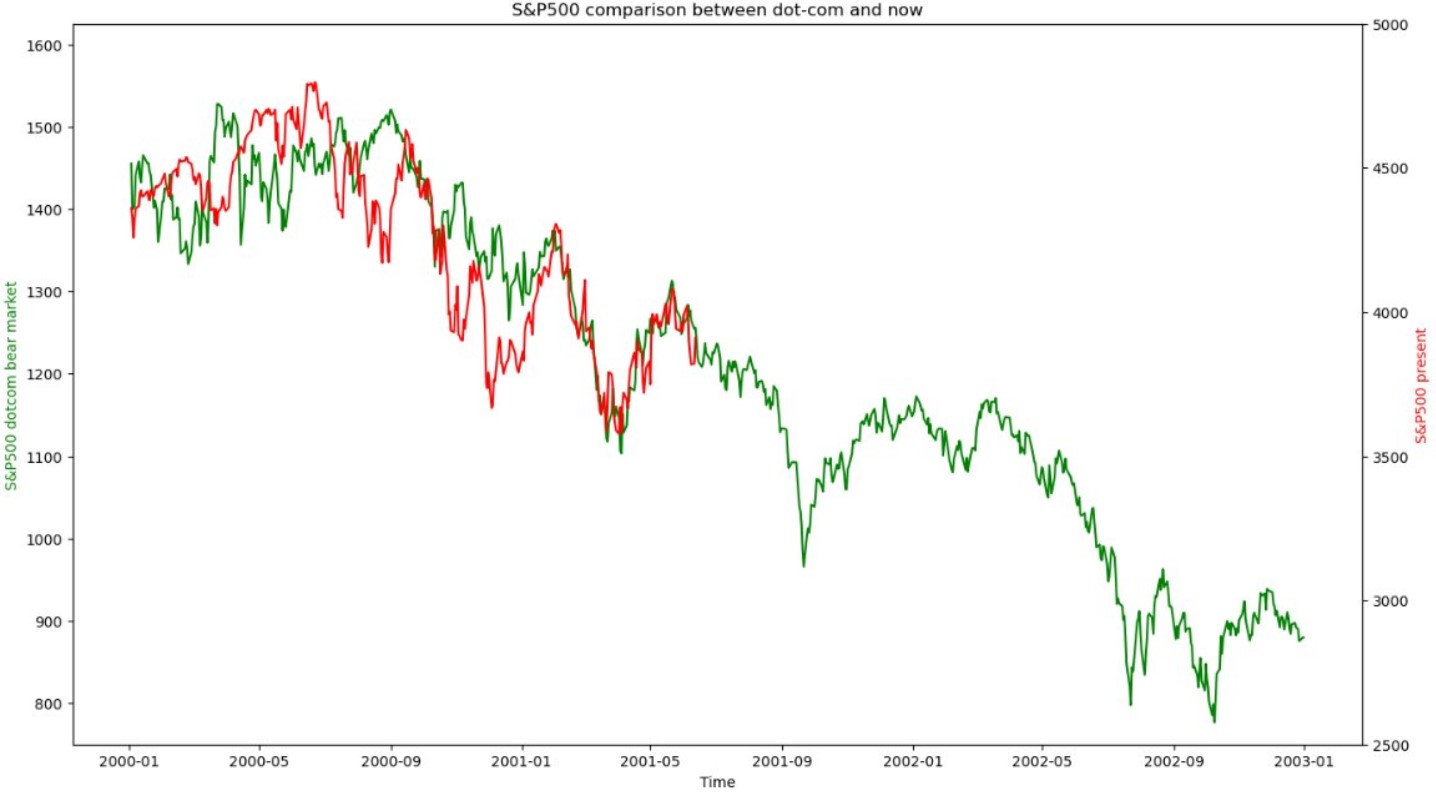

Bank reserves are crucial for the S&P and may increase temporarily

- The level of reserves of commercial banks in the Fed account has been a very important factor for the behavior of the SPX in the last 3 years.

- If the money from TGA goes to the private market, the S&P 500 may rebound and stay close to 4000 points or even higher if the Fed will limit reverse repo operations.

- On the other hand, it is expected that liquidity could be drastically reduced once a new debt limit is set. So after that the S&P 500 may continue its downward move.

Bank reserves and S&P500. Source: Bloomberg

As we can see on the chart above, the current price behaves similarly to the period of the dot-com bubble. It means that we are still in the downward trend and some correction moves may occur in the coming months. Source: Bloomberg, XTB

As we can see on the chart above, the current price behaves similarly to the period of the dot-com bubble. It means that we are still in the downward trend and some correction moves may occur in the coming months. Source: Bloomberg, XTB

Of course, we should remember that the market is closed today as Christmas Day fell on Sunday this year!

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.