-

US indices traded mostly higher yesterday. S&P 500 gained 0.36%, Dow Jones moved 0.23% higher and Nasdaq added 0.35%. Russell 2000 dropped 0.79%

-

Upbeat moods could be spotted during the Asian session as well. Nikkei jumped 1.3%, S&P/ASX 200 traded 0.7% higher and Kospi gained 2.0%. Indices from China traded up to 1.0% higher

-

DAX futures point to a higher opening of the European cash session today

-

FOMC minutes showed that Fed sees possibility of an even tighter monetary policy if inflation stays at elevated levels

-

Bloomberg reports that United States and its allies are discussing capping Russian oil price in the $40-60 range

-

Beijing authorities announced that citizens who want to use in-person sports centers or entertainment venues will have to be vaccinated. A big jump in new Covid cases was reported in Shanghai

-

API report pointed to a 3.82 million barrel build in US oil inventories (exp. -1.1 mb)

-

Cryptocurrencies are trading mixed, although the overall scale of moves is relatively small. Bitcoin drops 0.3% while Ethereum gains 0.4%

-

Energy commodities trade slightly higher. Brent and WTI gain around 0.8% each, with Brent climbing back above $100 per barrel

-

Precious metals gain with silver being a top performer (+0.8%). Gold and platinum trade 0.5% higher

-

AUD and NZD are the best performing major currencies while USD, CHF and JPY are top laggards

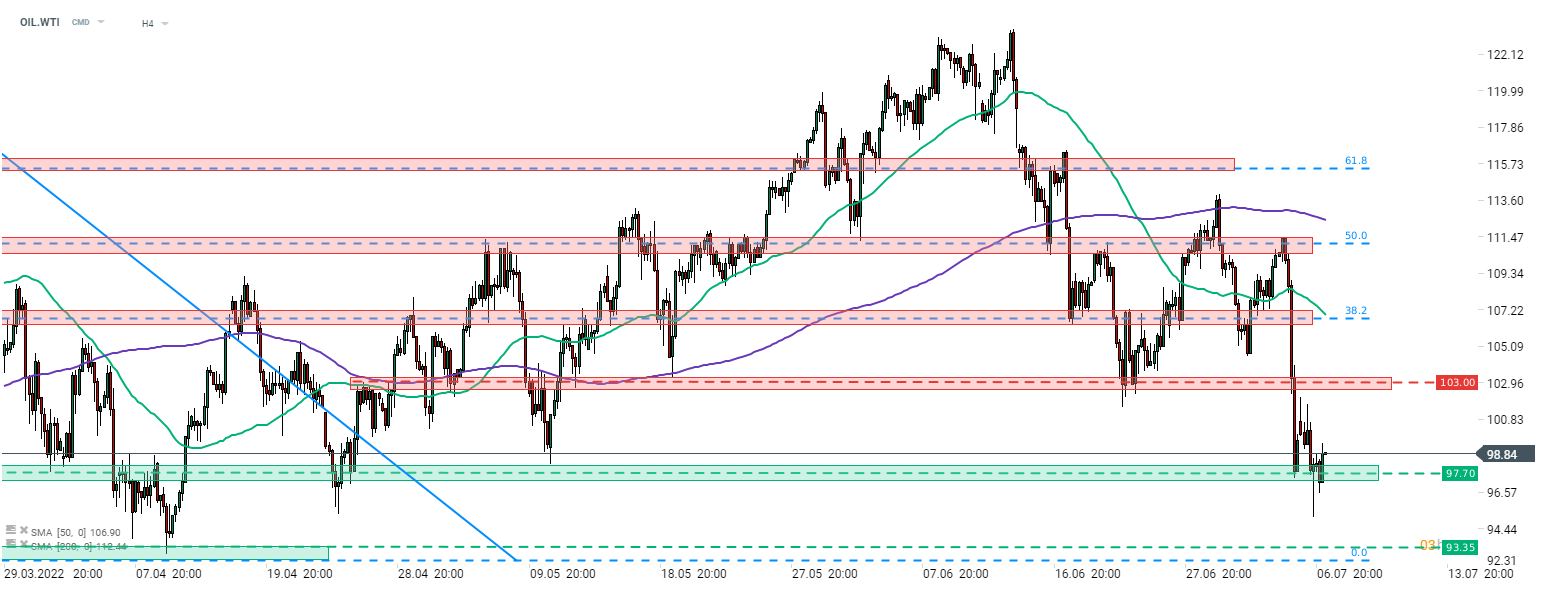

Oil halted recent sell-off but bulls struggle to launch a bigger recovery move. Taking a look at the WTI (OIL.WTI) chart, we can see that an attempt to launch such a move from the $97.70 area is made but the recovery lacks momentum. Source: xStation5

Oil halted recent sell-off but bulls struggle to launch a bigger recovery move. Taking a look at the WTI (OIL.WTI) chart, we can see that an attempt to launch such a move from the $97.70 area is made but the recovery lacks momentum. Source: xStation5

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

📈 Gold jumps 1.5% ahead of NFP, hitting its highest level since Jan. 30

Silver rallies 3% 📈 A return of bullish momentum in precious metals?

Daily summary: Weak US data drags markets down, precious metals under pressure again!

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.