-

US indices plunged yesterday amid concerns over monetary policy tightening and overall deterioration in global economic outlook due to pandemic situation in China

-

S&P 500 dropped 3.20%, Dow Jones moved 1.99%, Nasdaq plunged 4.29% and Russell 2000 finished trading 4.21% lower

-

Situation calmed during the Asia-Pacific session with indices from the region trading mixed. Nikkei dropped 0.3%, S&P/ASX 200 moved 1.2% lower, Kospi dropped 0.4% while indices from China traded up to 1.3% higher

-

DAX futures point to a higher opening of the European cash session today

-

According to media reports, United States is weighting a ban on US companies selling advanced chips to China

-

Chinese Vice Premier Liu He said that China is standing by its Covid Zero policy. China will launch another round of mass testing in Beijing

-

US President Biden said that he is worried that Russian President Putin has no way out of Ukraine and its creates uncertainty over what he will do next

-

European Commission President von der Leyen said that progress was made in talks with Hungary on Russian oil embargo

-

Japanese household spending dropped 2.3% YoY in March (exp. -2.9% YoY)

-

Australian retail sales increased 1.2% QoQ in Q1 2022 (exp. +1.0% QoQ)

-

Tesla halted production at factory in Shanghai, China due to supply chain issues

-

Cryptocurrencies are trying to recover from yesterday's plunge today. Bitcoin briefly dipped below $30,000 handle during the overnight trade but has managed to recover above $31,500 since

-

Oil continues to pull back after a massive plunge yesterday - WTI trades near $102 per barrel while Brent drops below $105 per barrel

-

Precious metals regained strength as US dollar lost its shine. Palladium gains over 3% while silver and platinum trade around 1% higher. Gold gains 0.5%

-

AUD and NZD are the best performing major currencies while USD and JPY lag the most

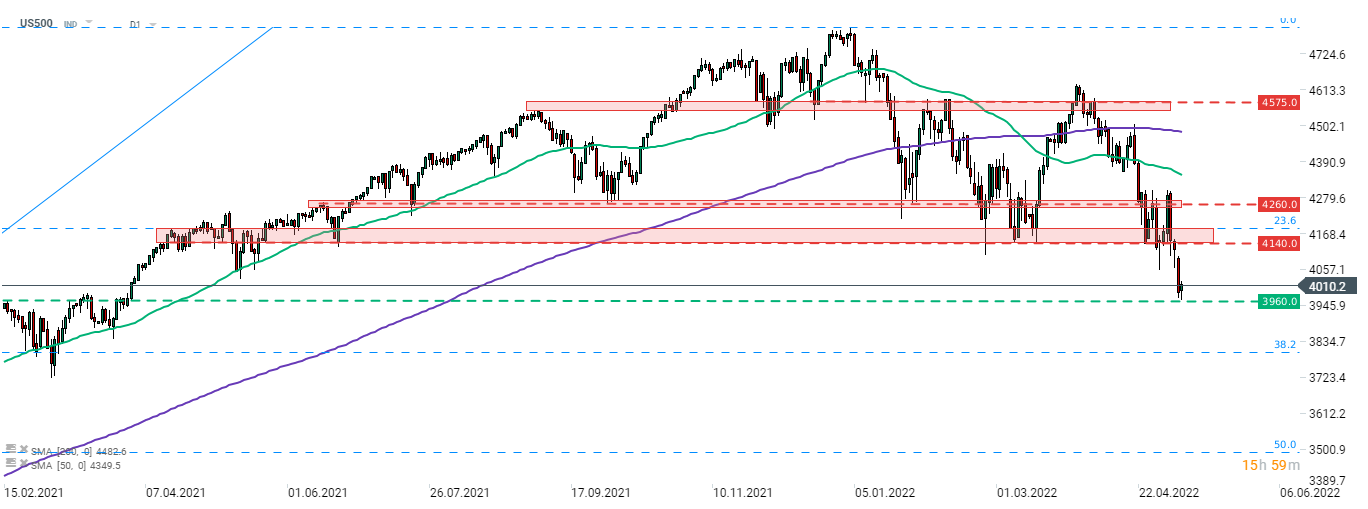

S&P 500 (US500) dropped below 4,000 pts handle yesterday and tested a 3,960 pts support. Declines were halted there and index futures started to regain ground during the Asian trading. US500 managed to climb back above 4,000 pts mark but rebound lacks momentum and may be fragile. Source: xStation5

S&P 500 (US500) dropped below 4,000 pts handle yesterday and tested a 3,960 pts support. Declines were halted there and index futures started to regain ground during the Asian trading. US500 managed to climb back above 4,000 pts mark but rebound lacks momentum and may be fragile. Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.