-

US indices took a dive yesterday. S&P 500 dropped 1.69%, Dow Jones moved 1.19% lower and Nasdaq slumped 2.18%. Russell 2000 dropped 0.71%

-

Indices from Asia traded lower as well. Nikkei dropped 1.7%, S&P/ASX 200 moved 0.6% lower and Kospi declined 0.9%. Indices from China traded mixed

-

DAX futures point to a lower opening of the European cash session today

-

Reports surfaced claiming that Russia has used chemical weapons against Ukrainian soldiers and civilians in Mariupol. However, this claims were neither confirmed by Ukraine President Zelensky, nor by the Western military or intelligence

-

Shanghai authorities divided the city into smaller areas and classified each area into one of three categories. This was done to allow more targeted restrictions rather than a citywide lockdown

-

Chinese Premier Li Keqiang said that new measures will be studied and adopted to better support economy as concerns over economic outlook mount

-

US State Department ordered all non-essential government employees to leave Shanghai amid deteriorating Covid situation

-

Some media hint at possibility of lockdown being imposed in Guangzhou, a major manufacturing hub housing China's busiest airport

-

Cryptocurrencies trade higher on Tuesday. Bitcoin gains 1.5% and approaches $40,000 area. Ethereum gains 1.4% and tests $3,000 area

-

Oil is trading around 1% higher today. Brent approaches $100.50 while WTI trades near $96.30

-

Precious metals trade higher with platinum and palladium adding more than 1%

-

AUD and NZD are the best performing major currencies while CAD and JPY lag the most

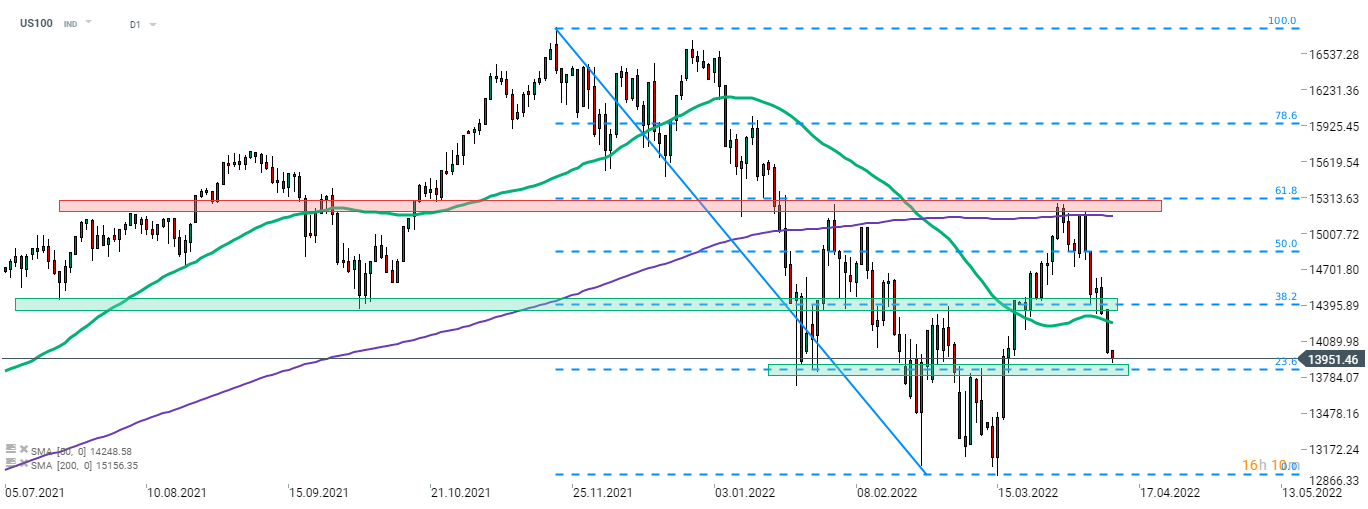

Rising US yields continue to put pressure on equities, especially the tech sector. Nasdaq-100 (US100) dropped over 2% yesterday and moved below the psychological 14,000 pts level. Index is eyeing a test of the support zone ranging around 23.6% retracement of the downward move launched in November 2021 (13,850 pts area). Source: xStation5

Rising US yields continue to put pressure on equities, especially the tech sector. Nasdaq-100 (US100) dropped over 2% yesterday and moved below the psychological 14,000 pts level. Index is eyeing a test of the support zone ranging around 23.6% retracement of the downward move launched in November 2021 (13,850 pts area). Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.