US natural gas prices have been dropping significantly over the past few days. NATGAS dropped below $5 per MMBTu and is now testing a key long-term upward trendline. If sellers managed to push the price below this hurdle, we cannot rule out a pullback towards the price range that was normal for 2016-2021 period - $2.00-3.00 per MMBTu.

Situation on the NATGAS chart starts to look like price crashes following previous strong rallies (2012-2015 and 2018-2020). Prices dropped below the base of the upward wave following a rally back then. In such a scenario, and in case price break below $4.90-5.00 support zone, a pullback towards the $3.50 area maybe on the cards. However, are fundamentals also looking so bad? Source: xStation5

Situation on the NATGAS chart starts to look like price crashes following previous strong rallies (2012-2015 and 2018-2020). Prices dropped below the base of the upward wave following a rally back then. In such a scenario, and in case price break below $4.90-5.00 support zone, a pullback towards the $3.50 area maybe on the cards. However, are fundamentals also looking so bad? Source: xStation5

Weather

The United States are facing a winter attack right now. Should the situation from 2020 repeat, a strong price rally in the next few trading sessions cannot be ruled out. Of course, a spot prices range to as high as $30-50 per MMBTu depening on the hub what is caused by sudden increase in demand. However, it should be noted that spot prices depend on current, temporary consumption, while futures price take into account average consumption over a certain period of time.

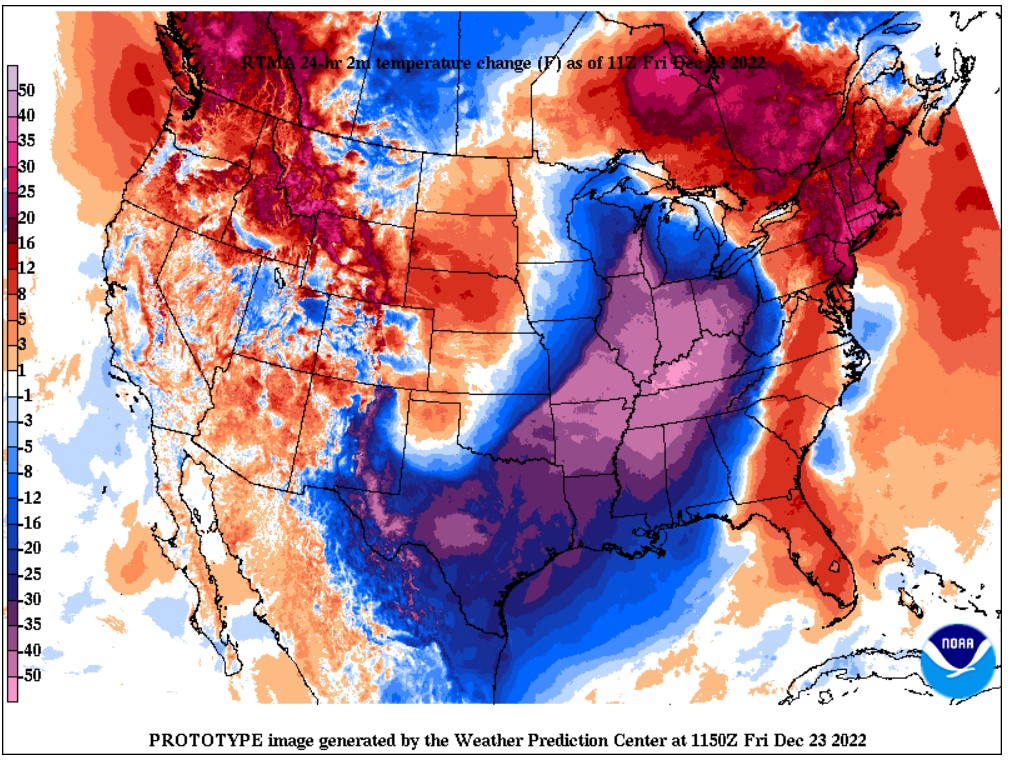

Current weather in the US can be described as a winter attack. Peak snowfall and lowest temperatures are expected around Christmas Eve. On the other hand, forecsats for the coming week are left unchanged - warming is expected. Source: NOAA

Current weather in the US can be described as a winter attack. Peak snowfall and lowest temperatures are expected around Christmas Eve. On the other hand, forecsats for the coming week are left unchanged - warming is expected. Source: NOAA

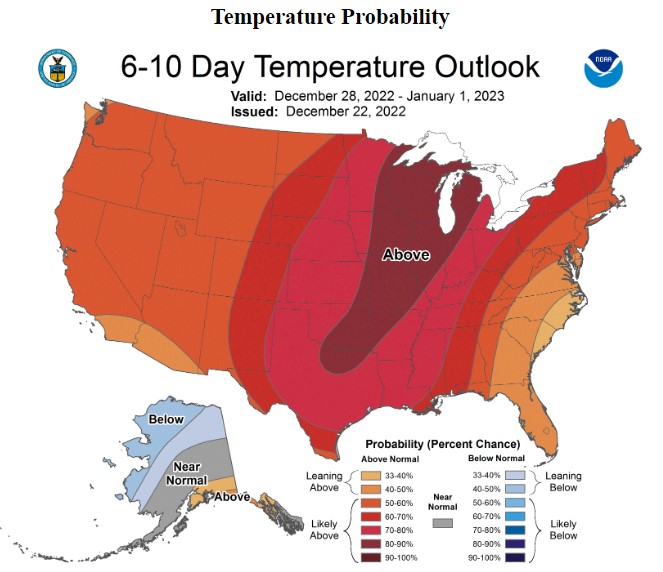

Weather forecasts for the end of the next week are left unchanged - it should be warmer. NOAA

Significant consumption

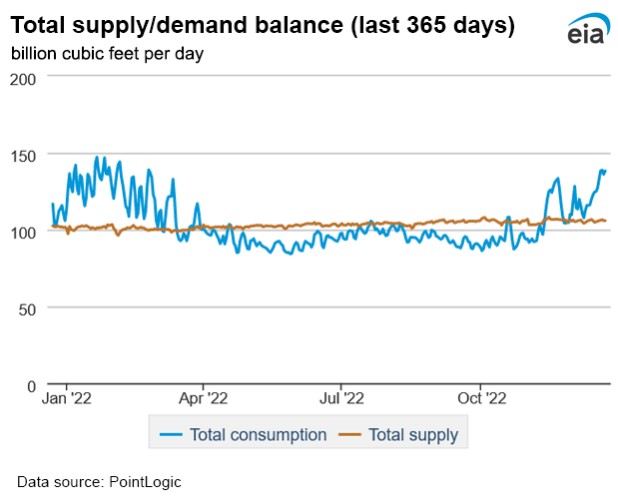

When we take a look at data on current gas consumption in the United States we can see that it has increased significantly in recent days and is much higher than it was a year ago.

US gas consumption is currently near last heating season's peaks. Source: EIA

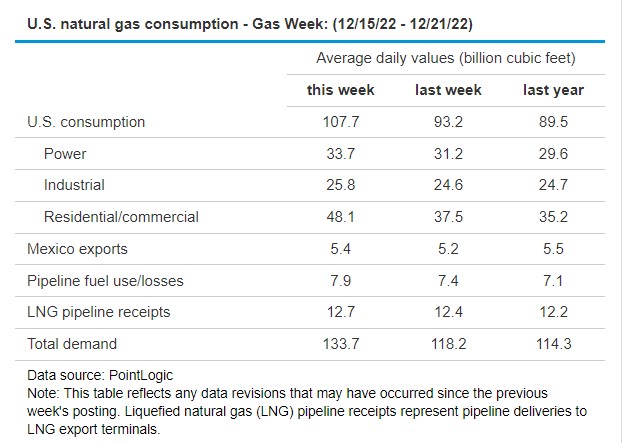

It can be seen that there is a significant increase in demand for heating (residential/commercial). Source: EIA

Drop in natural gas prices is driven by disappointment in yesterday inventories report. Stockpiles dropped les than expected. Overall, level of stockpiles is very higher but it cannot be ruled out that prices will jump again this year, should high levels of consumption persist.

Gold surges 2% testing $5300 level amid weakening US dollar 📈

Daily summary: Wall Street and EURUSD rise ahead of tomorrow’s Fed decision 🗽 Oil gains

Natural gas rebounds attempt 📈 U.S. East Coast weather in focus

Silver jumps 8% 📈 New records ahead? ❓

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.