EIA report released yesterday showed US natural gas inventories increasing 111 billion cubic feet in the previous week. It was higher build-up than expected and also marked the fifth straight week when inventories increased by more than 100 bcf. Moreover, such a streak has not occured in the previous five years!

US natural gas prices may drop by as much as 20% this week. While NATGAS price is distorted by contract rollover, price of the previous month's contract is nearing $5 per MMBTu. Such price action is not in-line with seasonal patterns. Market chatter on improved weather, that will see the start of the heating season delayed, as well as looming economic slowdown are playing a major role in the sell-off.

US natural gas inventories have been building up quicker recently than suggested by seasonal patterns. In theory, we are now at the seasonal peak of inventory rebuilding. Source: Bloomberg

US natural gas inventories have been building up quicker recently than suggested by seasonal patterns. In theory, we are now at the seasonal peak of inventory rebuilding. Source: Bloomberg

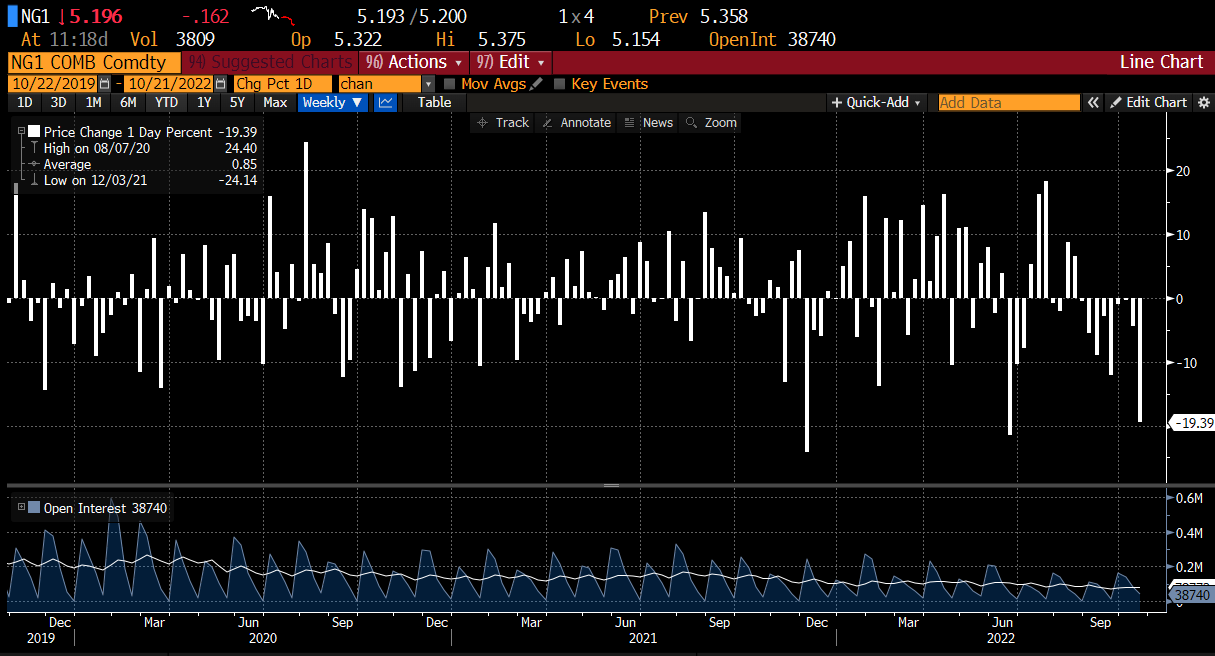

Generic natural gas contract is down almost 20% this week. It should be noted that in previous two such cases, strong declines were followed by another two weeks of 5-10% price drops. This could bring US natural gas prices below $5 per MMBTu mark. Source: Bloomberg

Generic natural gas contract is down almost 20% this week. It should be noted that in previous two such cases, strong declines were followed by another two weeks of 5-10% price drops. This could bring US natural gas prices below $5 per MMBTu mark. Source: Bloomberg

NATGAS launched today's trading higher due to contract rollover but one cannot rule out an attempt to fill in the bullish price gap and a move towards an upward trendline. As one can see, market got disconnected from seasonal patterns. Source: xStation5

NATGAS launched today's trading higher due to contract rollover but one cannot rule out an attempt to fill in the bullish price gap and a move towards an upward trendline. As one can see, market got disconnected from seasonal patterns. Source: xStation5

What else is there to know?

-

European natural gas inventories are 93% full

-

European natural gas prices drops over 4% today and moves below €120/MWh

-

US Freeport LNG terminal is expected to resume operations and exports in mid-November. This could in theory boost US prices but should also improve supply in Europe

Silver rallies 3% 📈 A return of bullish momentum in precious metals?

Daily summary: Weak US data drags markets down, precious metals under pressure again!

NATGAS slides 6% on shifting weather forecasts

Three markets to watch next week (09.02.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.