- NATGAS gains amid colder weather forecasts; consumption expectations grow

- Technicals are improving but volatility risk remains

- Oil faces resistance zone near $66 per barell

- NATGAS gains amid colder weather forecasts; consumption expectations grow

- Technicals are improving but volatility risk remains

- Oil faces resistance zone near $66 per barell

The U.S. Henry Hub natural gas market (NATGAS) continued its upward momentum early Monday as investors began pricing in forecasts of colder weather across the United States and Europe. With heating demand expected to rise, market sentiment has gradually shifted toward a pre-winter buying stance. Today, buying momentum is driving prices toward the $3.50 per MMBtu level. The market recently rolled over into the November contract, which traditionally brings higher seasonal pricing as consumption expectations grow.

- Since February of last year, natural gas has maintained a broader upward trend, despite occasional corrections. The most recent pullback, in August, bottomed near $2.65, which can now be viewed as a healthy consolidation phase within a longer-term recovery. As temperatures decline, seasonal fundamentals continue to support further price gains. Any short-term dip toward the $3.00 zone could once again attract institutional buying interest. The 200-day EMA near $3.30 currently serves as a key support level, while the 50-day EMA around $3.20 is turning upward, improving the technical outlook for continued price recovery.

- There remains an unfilled price gap below current levels, which could temporarily pull prices slightly lower before the next upward move. While such gaps often close, this isn’t guaranteed — particularly when strong fundamentals dominate investor sentiment. Looking ahead, many traders see the $4.00 mark as the next major psychological and technical target. Historically, this area has acted as both resistance and a profit-taking zone, making it a key reference point for long-term investors.

From current levels, any notable pullback may serve as a new opportunity to test buying strength, as traders continue to anticipate tighter supply conditions and rising heating demand in the coming winter months.

Source: xStation5

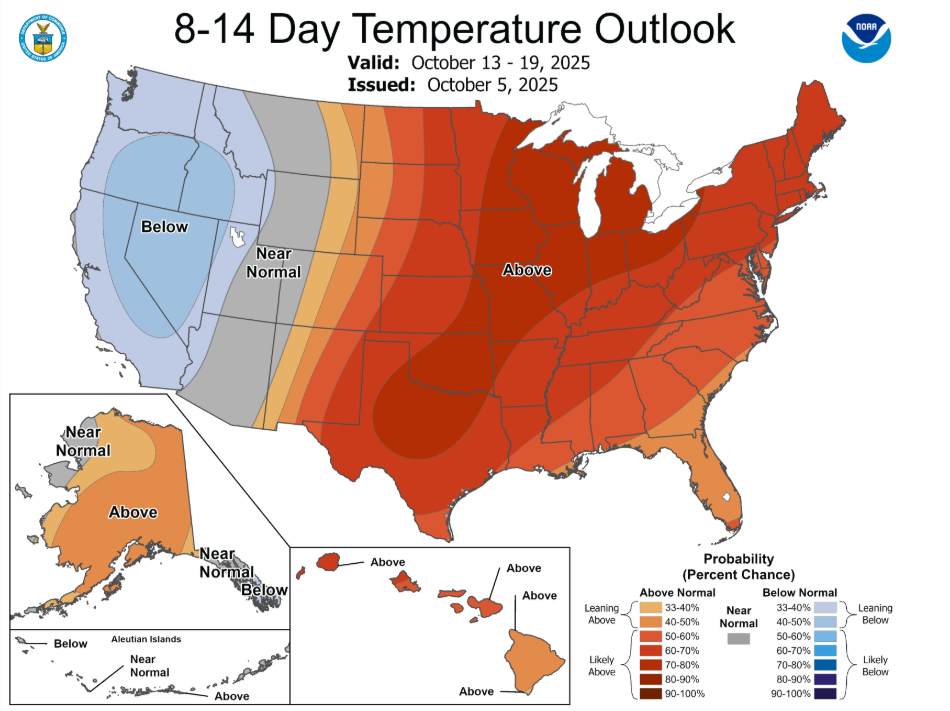

Weather maps from NOAA indicate a significant cooling trend across the western United States, while temperatures in Florida are expected to ease from recent highs.

Source: NOAA

Today, not only natural gas contracts are rising, but oil prices also gained earlier in the session. However, they ultimately failed to break above the $66 per barrel level, even as OPEC+ maintained its cautious supply increase of 137,000 barrels per day amid ongoing geopolitical tensions and Ukrainian attacks on Russian refineries. OPEC has signaled its readiness to pause or reverse production cuts in an effort to balance weakening demand with ongoing supply pressures. Brent futures prices are facing resistance zone near $65.5 per barell.

Source: xStation5

Chart of the Day: USD/JPY highly volatile ahead of US CPI

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.