Novavax (NVAX.US) reported higher-than-expected revenue for the third quarter, primarily due to U.S. government grants for clinical trials. Despite a year-over-year decline in revenue, from $734.58 million to $187 million, the company is focusing on optimizing these grant opportunities. To address the smaller-than-anticipated COVID-19 vaccine market, Novavax has reduced its liabilities and is preparing to cut costs by an additional $300 million in 2024.

Management expects the U.S. market for COVID-19 vaccines to demand 30 to 50 million doses in the 2023-2024 season. They also highlighted that over 15 million people in the U.S. have received updated COVID-19 shots, which is lagging behind the previous year's vaccinations.

Novavax has secured broad access to its COVID-19 vaccine across U.S. pharmacies and has received authorization for its updated vaccine. The company has already made significant cost reductions, cutting operating expenses by 47% compared to the previous year, and is on track to exceed its global restructuring and cost reduction plan. Moving forward, Novavax is focused on initiating a cost reduction program targeting over $300 million in 2024, maintaining financial stability, and advancing its vaccine technology.

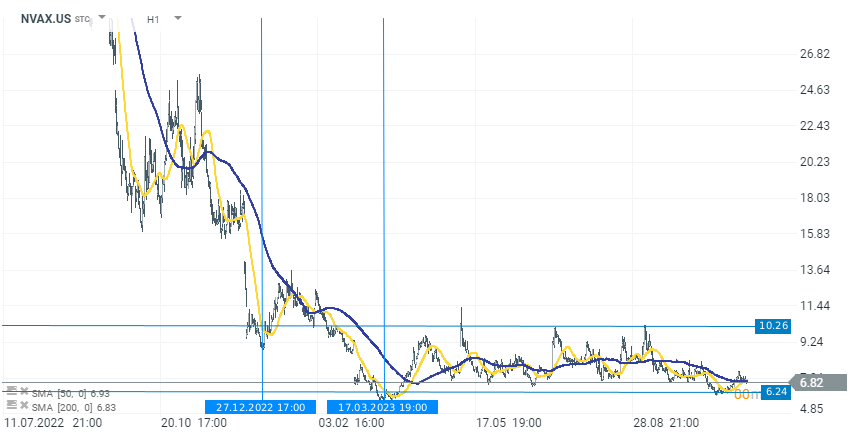

Looking at the chart technically, Novavax's (NVAX.US) price has been in a sideways channel since the beginning of this year fluctuating between $6.20 per share and $10.20 per share. Compared to 20221, the stock is trading lower by a glaring -98%. Today after the results, the stock is gaining 1.40% before the market open. Source xStation 5.

Will Europe run out of fuel?

US OPEN: War in Iran hits the markets

Sentiments on Wall Street are falling 📉S&P 500 earnings season highlight

Daily summary: The beginning of the end of disinflation?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.