Nvidia (NVDA.US) shares fell nearly 2.4% in after-hours trading on Wall Street following quarterly results that slightly missed market expectations in the data center (AI) segment.

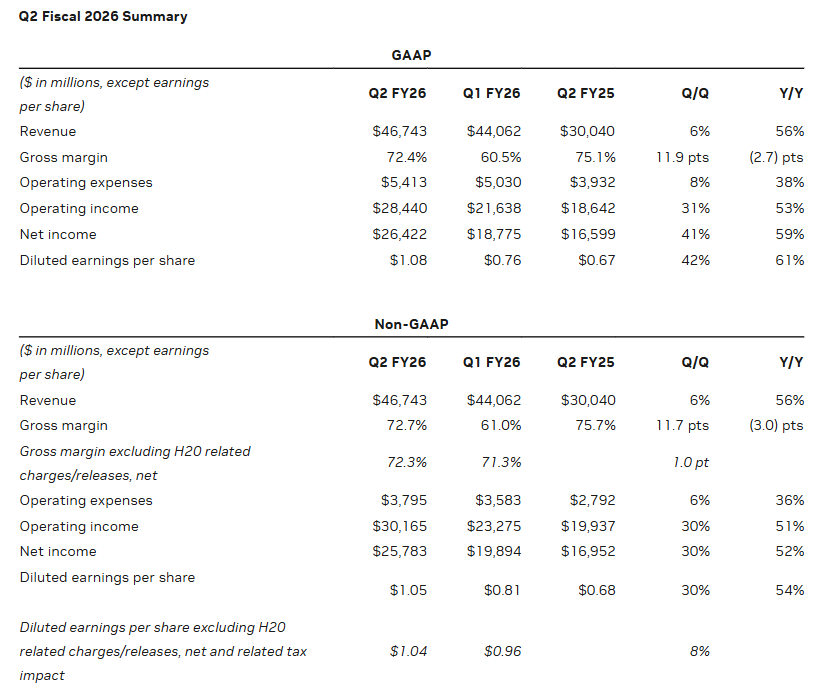

- The company reported revenue of $46.7 billion versus forecasts of $46.3 billion (6% QoQ and 56% YoY), with data center sales at $41.1 billion compared to expectations of $41.29 billion (5% QoQ and 56% YoY)

- Earnings per share came in at $1.05, above the consensus estimate of $1.01, with net income totaling $26.42 billion.

- For the third quarter, Nvidia projects revenue of around $54 billion, with a margin of error of about 2% in either direction.

- In Q2, the company excluded sales of its H20 chips to Chinese customers from its reported results. Blackwell data center sales revenue grew 17% sequentially, signalling still rising demand for AI solutions.

The board also approved an additional $60 billion share buyback program and declared a cash dividend of $0.01 per share, payable on October 2

Futures on Nasdaq 100 (US100) slightly lose after the Nvidia report as investors react to underperfoming data centers sales.

Source: xStation5

Nvidia fiscal Q2 2026 Earnings Report

Source: Nvidia

Nvidia Guidance

Revenue is expected to be $54 billion, but the company has not assumed any H20 shipments to China in the outlook.

- GAAP and non-GAAP gross margins are expected to be 73.3% and 73.5%, respectively, plus or minus 50 basis point (exiting the year with non-GAAP gross margins in the mid-70% range)

- Operating expenses are expected to be approximately $5.9 billion and $4.2 billion, respectively. Full year fiscal 2026 operating expense growth is expected to be in the high-30% range.

- Other income and expense are expected to be an income of approximately $500 million, excluding gains and losses from non-marketable and publicly-held equity securities.

Nvidia Business Segments Breakdown

Data Center

-

Revenue: $41.1B, +5% q/q, +56% y/y (core growth engine).

-

Expanded Blackwell platform adoption with major global enterprises (Disney, TSMC, SAP, Hyundai, Foxconn, Lilly).

-

Deepened presence in Europe, working with France, Germany, Italy, Spain, and U.K. to build industrial AI infrastructure and sovereign LLM initiatives.

-

Strengthened DGX Cloud expansion in Europe and AI supercomputer collaborations (U.S., Germany, U.K., Japan).

-

Delivered record performance on MLPerf benchmarks; introduced NVFP4 format for next-gen LLMs.

-

Partnerships in healthcare and science: collaborations with Novo Nordisk, Ansys, DCAI on drug discovery and quantum algorithms.

Gaming & AI PC

-

Revenue: $4.3B, +14% q/q, +49% y/y.

-

Launched GeForce RTX 5060 (Blackwell-powered), fastest-ramping x60 GPU in history.

-

Expanded DLSS 4 to 175+ titles, with adoption in upcoming blockbuster games.

-

Cloud gaming push: GeForce NOW Blackwell upgrade with Install-to-Play, doubling game library to 4,500+.

-

Partnered with OpenAI on open-weight models optimized for RTX GPUs, enabling faster local inference for developers.

Professional Visualization

-

Revenue: $601M, +18% q/q, +32% y/y.

-

New GPU launches: RTX PRO 4000 SFF Edition and RTX PRO 2000 Blackwell.

-

Expanded Siemens partnership to drive smart factory digitalization.

-

Rolled out new Omniverse libraries & SDKs for physical AI development.

Automotive & Robotics

-

Revenue: $586M, +3% q/q, +69% y/y.

-

Full-scale production of NVIDIA DRIVE AV platform for intelligent transportation.

-

Shipped NVIDIA DRIVE AGX Thor chips; released developer kits and modules for robotics (Jetson AGX Thor).

-

Announced Halos safety platform for robotics and Cosmos foundation models to accelerate robotics solutions.

-

Secured second consecutive win at Autonomous Grand Challenge for End-to-End Driving at Scale.

Data Center remains the clear growth driver, but Gaming surged on RTX 5060 momentum and AI PC adoption. Professional Visualization and Automotive/Robotics showed strong double-digit growth, highlighting diversification into industrial, simulation, and autonomous systems.

NVDA.US (D1 interval)

Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.