How reliable is OPEC+?

One could say that OPEC+ has surprised with its decision last weekend. However, it's not a surprise that could lead to fundamental changes. The surprise is essentially just that anything has changed at all. In this text, we will briefly discuss the most important issues related to the OPEC+ decision and the voluntary cut by Saudi Arabia.

Complicated OPEC+ politics

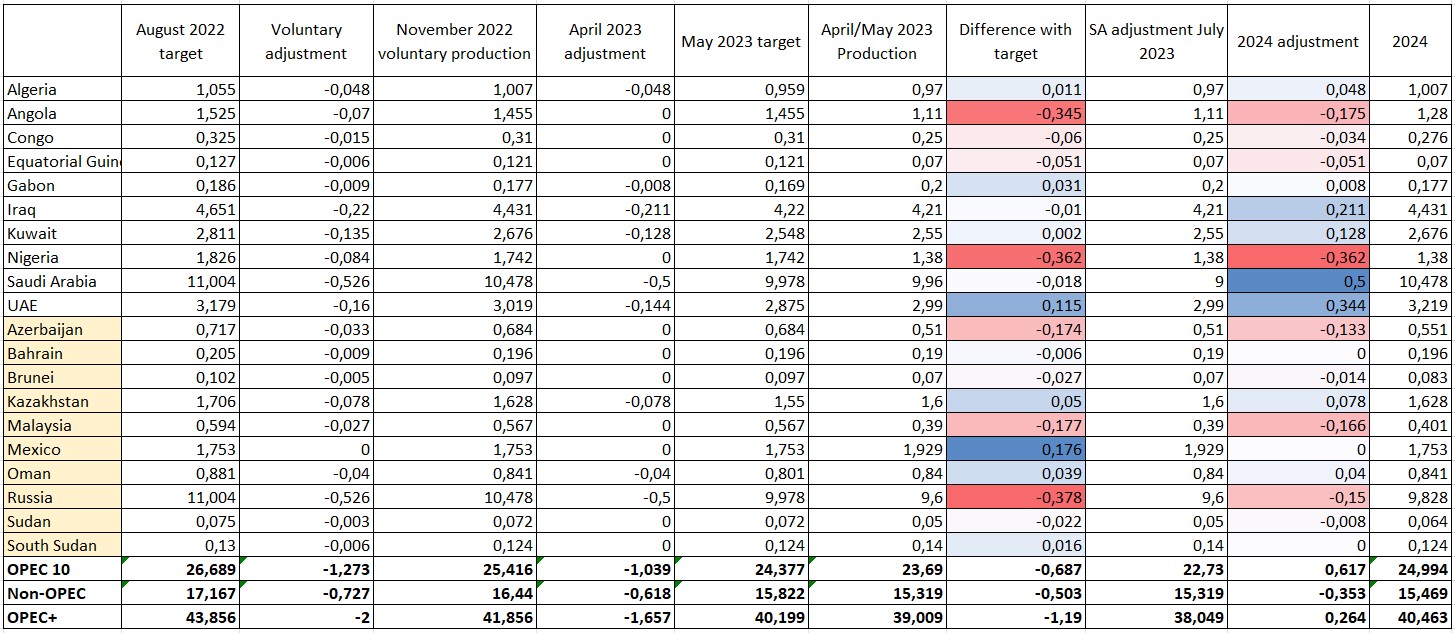

At this point, it is hard to understand what production plans OPEC+ has for the future, and particularly what numbers are being presented. OPEC+ decided in October last year to cut the production target compared to the reference numbers set in August of the same year. This was followed by an additional cut announced in April and currently an additional cut from Saudi Arabia and an extension of the entire agreement to 2024. In the media, however, one can read that OPEC+ will further cut production in 2024. This is not true. It is only an extension of the current agreement with an adjustment of production targets. In fact, the production target for 2024 is higher than the target for April 2023 and significantly higher than the current production level. Moreover, if all countries were to produce according to their plans, we would not only have a massive oversupply now, but also the production for the next year would be significantly larger. As you can see, everything is quite complicated, but perhaps the table below should shed some light on the situation we are in.

Individual actions of OPEC+ over the past year and the production target for 2024. As can be seen, OPEC+ currently produces significantly less than it can. Saudi Arabia additionally plans to cut production, which may lead to price support. Source: Bloomberg, OPEC, S&P Global, XTB

What did OPEC+ decide?

- The current production target for 2023 remains unchanged.

- Extension of the agreement to 2024 with a slight adjustment to the target.

- Saudi Arabia additionally cuts by 1 million barrels per day, which will reduce production to an extremely low level of 9 million barrels per day.

- In June, a new reference level is to be presented for Russia. Russia keeps its production secret over the course of a year, which may make it difficult to assess compliance with the agreement.

- United Arab Emirates with an increased production target.

- Lowered production targets for African countries like Nigeria or Angola, due to the inability to increase production.

What will the market look like?

It turns out that the beginning of this year is not going as the bulls in the oil market would have hoped. Oil is currently in oversupply, roughly at the level of 1 million barrels per day. Therefore, if nothing changes other than an adjustment by Saudi Arabia, the market will be "perfectly balanced" in July. However, it's worth remembering a few important things:

- Potential further increase in demand from China, but at the same time possible disappointment.

- Mexico plans to increase production up to 2.2 million barrels per day.

- Production in the USA is questionable for further growth due to a significant decrease in drilling rigs.

- The USA does not currently plan to significantly rebuild its strategic reserves, unless prices drop below 70 USD per barrel.

- Demand for fuels in the USA since the beginning of this year has not looked impressive.

- Additional demand from India and China is unlikely to significantly impact Arabian oil, as these countries currently use very cheap Russian oil.

- Russia sells oil to India and China with a 10-20 dollar discount compared to the benchmark, which is a problem for Saudi Arabia in the Asian market.

The current oversupply of 1 million barrels per day may be neutralized by Saudi Arabia. However, there are many uncertainties in the market, making it difficult to predict what the balance will look like in the second half of this year. Source: Bloomberg, XTB.

How price will react?

The decision to extend the agreement is not a surprise to the market. OPEC+ indicates that it prefers to show proactive policy, which may mean that it expects problems with demand. On the other hand, it may also be dictated by the desire for a price increase, although officially OPEC+ indicates that it has no price target. However, Saudi Arabia may have one, as its budget balances roughly at the level of 81 USD per barrel.

From a technical point of view, the price has set a triple bottom and is currently testing the lower of the necklines, where the target would be to reach approximately 85 USD per barrel. However, if the target related to the range of the upper neckline were to be realized, one could expect to reach around 95 USD per barrel or to the level of approximately 104-105, if we were textbook-waiting for confirmation of the break of the upper neckline at the level of about 88 USD per barrel. The extreme overselling on the Brent and WTI oil market also speaks for a revival in the second half of the year, although at the same time it must be remembered that the recent surprise from the OPEC+ cut in April was quickly reversed by investors.

Brent oil is currently testing the lower neckline, with a target of approximately 85 USD per barrel. Source: xStation5.

Brent oil is heavily oversold on the ICE exchange. WTI oil is even more oversold. Source: Bloomberg, XTB

Brent oil is heavily oversold on the ICE exchange. WTI oil is even more oversold. Source: Bloomberg, XTB

BREAKING: Massive increase in US oil reserves!

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

📈 Gold jumps 1.5% ahead of NFP, hitting its highest level since Jan. 30

Silver rallies 3% 📈 A return of bullish momentum in precious metals?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.