Price of oil continues an upward move started by the end of October 2020. In spite of the deteriorating pandemic situation around the world, crude trades over 50% higher compared to a low reached in November. What are the reasons behind this rally? Is there more fuel for gains? We will try to find answers to these questions.

Positive factors for oil:

-

USD weakening - US dollar has depreciated significantly since the US presidential elections

-

Weakening of the USD and bullish trend on the oil market heralds massive US stimulus incoming - Joe Biden plans to provide trillions of dollars to support economy, including direct payments to citizens

-

Demand in Asia - China has been buying big amount of commodities, including oil, since coronavirus pandemic arrived in the Western World

-

Vaccines - coronavirus vaccines arrived much sooner than expected, hinting that "return to normal" may also occur sooner

-

OPEC+ output limits - oil producers decided not to lift production quotas while Saudi Arabia pledged to limit its output further amid demand uncertainty

-

Inflation hedge - 2021 is expected to bring return of inflation and rising commodity prices are expected to be one of the factors contributing

Negative factors for oil:

-

Pandemic uncertainty - despite massive stimulus and beginning of vaccination, pandemic-related uncertainty remains

-

Mobility - coronavirus restrictions continue to limit mobility around the world, what has a negative impact on demand

-

Potential sell-off on Wall Street - valuations of US stocks are highly inflated what creates a risk of correction. In such a scenario, USD gains could have a negative impact on oil price

-

Changes in the automotive industry - further development and adoption of electric vehicles may limit demand for combustion engine vehicles due to environmental regulations

Is there fuel for more gains?

Oil prices have increased over 10% so far this year. More and more institutions project that prices may recover towards $65-70 per barrel. On one hand, OPEC is worried about the demand in the short-term. On the other, EIA forecasts that demand will begin to rise starting from mid-2021 and throughout 2022. However, 2022 is expected to be the last year of year-over-year increase in oil demand.

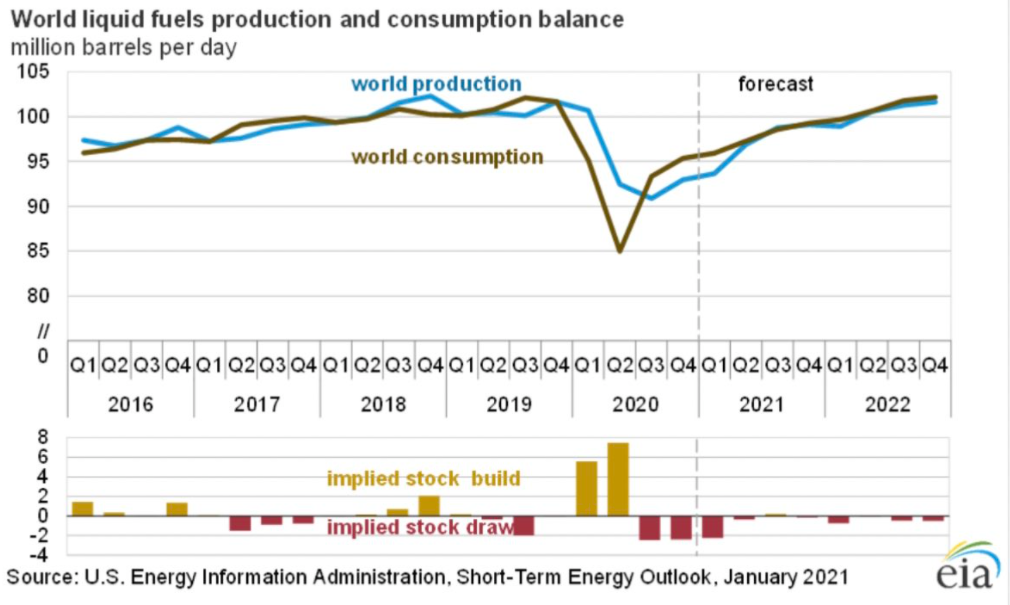

EIA forecasts a huge deficit on the oil market in the first half of 2021. Demand and supply is expected to balance each other until the end of 2022. Source: EIA

EIA forecasts a huge deficit on the oil market in the first half of 2021. Demand and supply is expected to balance each other until the end of 2022. Source: EIA

Oil futures curve has changed a lot. Over the course of a month 6- and 12-month spreads have widened significantly. Backwardation is not extreme yet (6- and 12-months) so there is room for prices to increase additional few dollars per barrel. Speculative positioning is moderate and is not flashing any warning signs yet. On the other hand, spread between June and December contracts shows that oil may be starting to be overvalued.

January-June spread (white line), January-December spread (yellow line), June-December spread (green line). Source: Bloomberg

January-June spread (white line), January-December spread (yellow line), June-December spread (green line). Source: Bloomberg

Technical Analysis

Brent oil has climbed towards an important supply area. Nevertheless, there is still some room for gains until key short-term resistance in the $60 area is reached (78.6% retracement and upper limit of the channel). RSI shows that commodity is overbought but seasonal patterns signal that we are near seasonal low and peak should be reached around February 10. Source: xStation5

Brent oil has climbed towards an important supply area. Nevertheless, there is still some room for gains until key short-term resistance in the $60 area is reached (78.6% retracement and upper limit of the channel). RSI shows that commodity is overbought but seasonal patterns signal that we are near seasonal low and peak should be reached around February 10. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

📈 Gold jumps 1.5% ahead of NFP, hitting its highest level since Jan. 30

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.