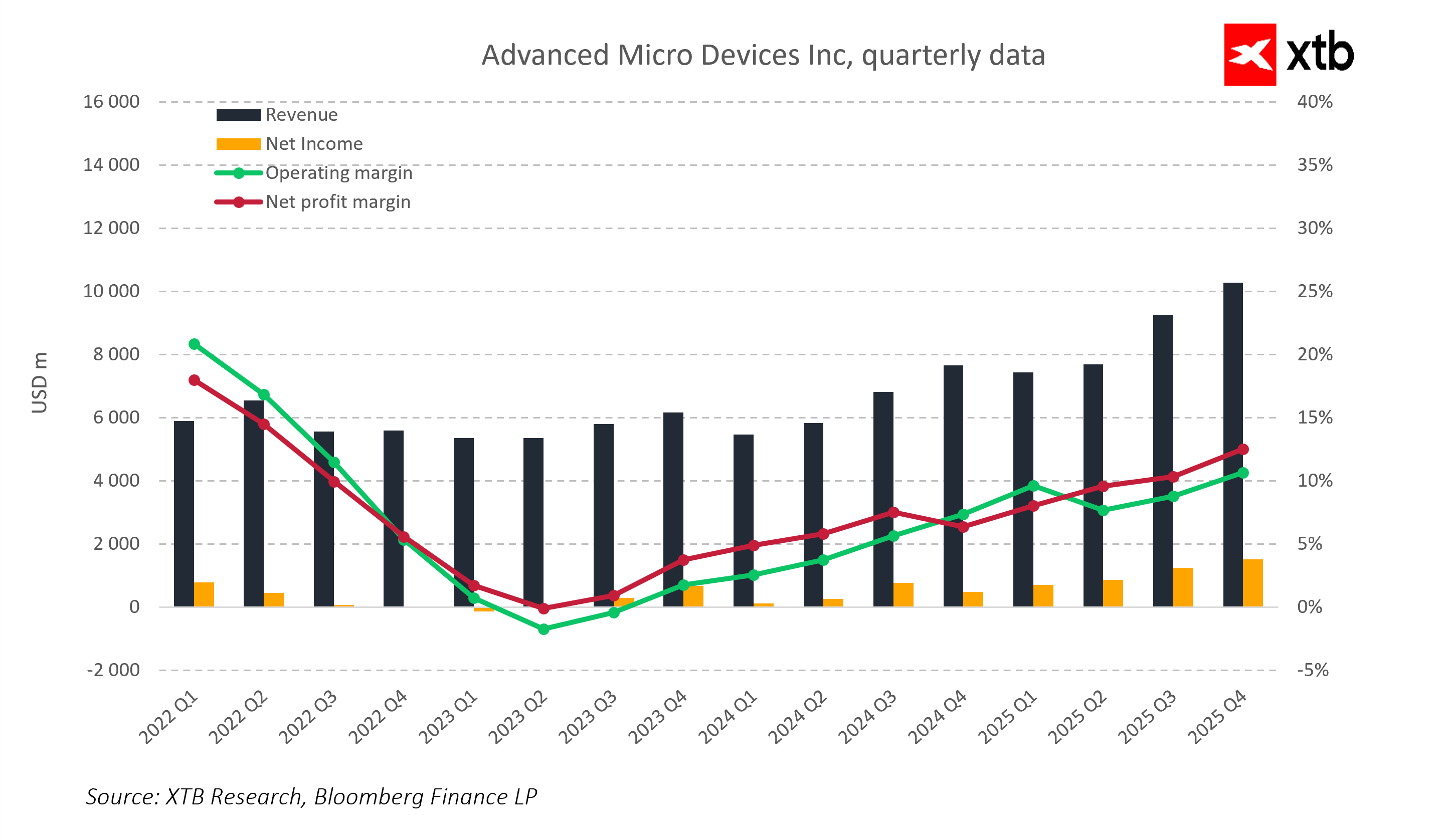

Advanced Micro Devices (AMD), one of the leading producers of processors and graphics cards, today reported its fourth-quarter 2025 results, which can be described in one word: impressive, although the market reacted mixedly. The company not only exceeded analysts’ expectations but also demonstrated that its chips rank among the top in performance and innovation. AMD closed the year with record revenues exceeding USD 10.27 billion in the quarter alone, a 34% year-over-year increase, significantly above analysts’ average expectations of USD 9.65 billion. Adjusted earnings per share (EPS) reached USD 1.53 versus forecasts of USD 1.32, showing that the company is not only growing rapidly but also maintaining strong profitability while expanding its business.

This confirms that AMD’s EPYC and Ryzen processors, as well as AI accelerators, are world-class. The company’s products are attracting growing demand both in the personal computing sector and in AI-driven data centers. This clearly demonstrates that AMD effectively combines innovation with operational efficiency, establishing itself as a key player in the global chip market.

AMD’s quarterly results indicate that the company is ending the year with strong momentum. Management emphasizes that revenue and margin growth are being driven by the expansion of the AI segment, increased sales in high-performance computing and gaming, and the growing scale of operations in data centers. Although the market had anticipated an even higher forecast, AMD shows that it still sees significant potential for further growth, sending a clear signal to investors that the company remains one of the main beneficiaries of the global AI boom.

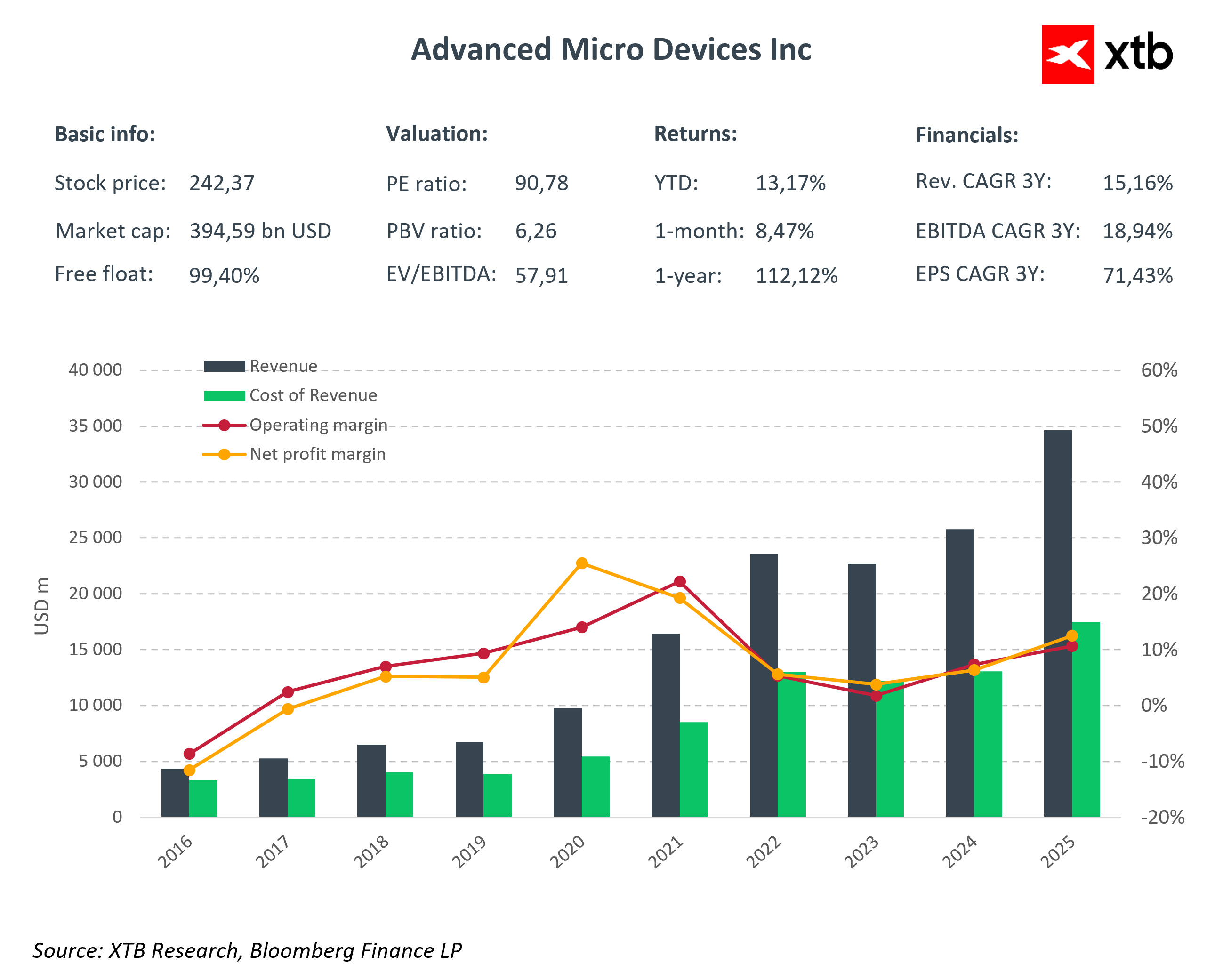

The quarterly performance chart confirms a clear upward trend in revenues and a gradual improvement in operating and net margins. While margins are rising, reflecting improving operational efficiency, they remain relatively moderate. A key challenge for the company will be to significantly increase these margins, which could substantially strengthen profitability and shareholder value.

Key Financial Results – Q4 2025

-

Data Center Segment: USD 5.38 billion (+39% YoY)

-

PC & Notebook Segment: USD 3.10 billion (+34% YoY)

-

Gaming Segment: USD 843 million (+50% YoY)

The high revenue and profit growth demonstrate that AMD’s products are seeing increasing demand in both traditional PCs and AI-driven data centers. Adjusted gross margin reached 57% (vs. 54% a year earlier), and operating margin was 28% (vs. 26% a year earlier), reflecting strong cost efficiency and the ability to maintain profitability while expanding market share.

Other Q4 2025 financial highlights:

-

Consolidated revenues: USD 10.27 billion (+34% YoY)

-

Operating profit: USD 2.85 billion (+41% YoY)

-

Adjusted EPS: USD 1.53 (+40% YoY)

-

Capital expenditures (CapEx): USD 222 million (+6.7% YoY)

-

R&D spending: USD 2.33 billion (+36% YoY)

Forward Guidance Q1 2026

-

Revenues: USD 9.5–10.1 billion

-

Gross margin: ~55%

-

Continued R&D investment and AI chip development

Business Segments

-

Data Centers: Growing demand for AI accelerators and EPYC processors drove a 39% increase in revenue to USD 5.38 billion, well above analysts’ expectations of USD 4.97 billion. AMD is gaining a larger share in the AI accelerator market, though it still trails dominant player NVIDIA.

-

PCs & Notebooks: The segment reached USD 3.10 billion (+34% YoY). Ryzen products maintain a strong position in the personal and business PC market, generating stable revenues with improving margins.

-

Gaming: Gaming revenues totaled USD 843 million (+50% YoY). While slightly below analysts’ expectations (USD 855.3 million), the growth trend shows that AMD’s graphics chips remain attractive to gamers and console manufacturers, supporting high-end segment margin expansion.

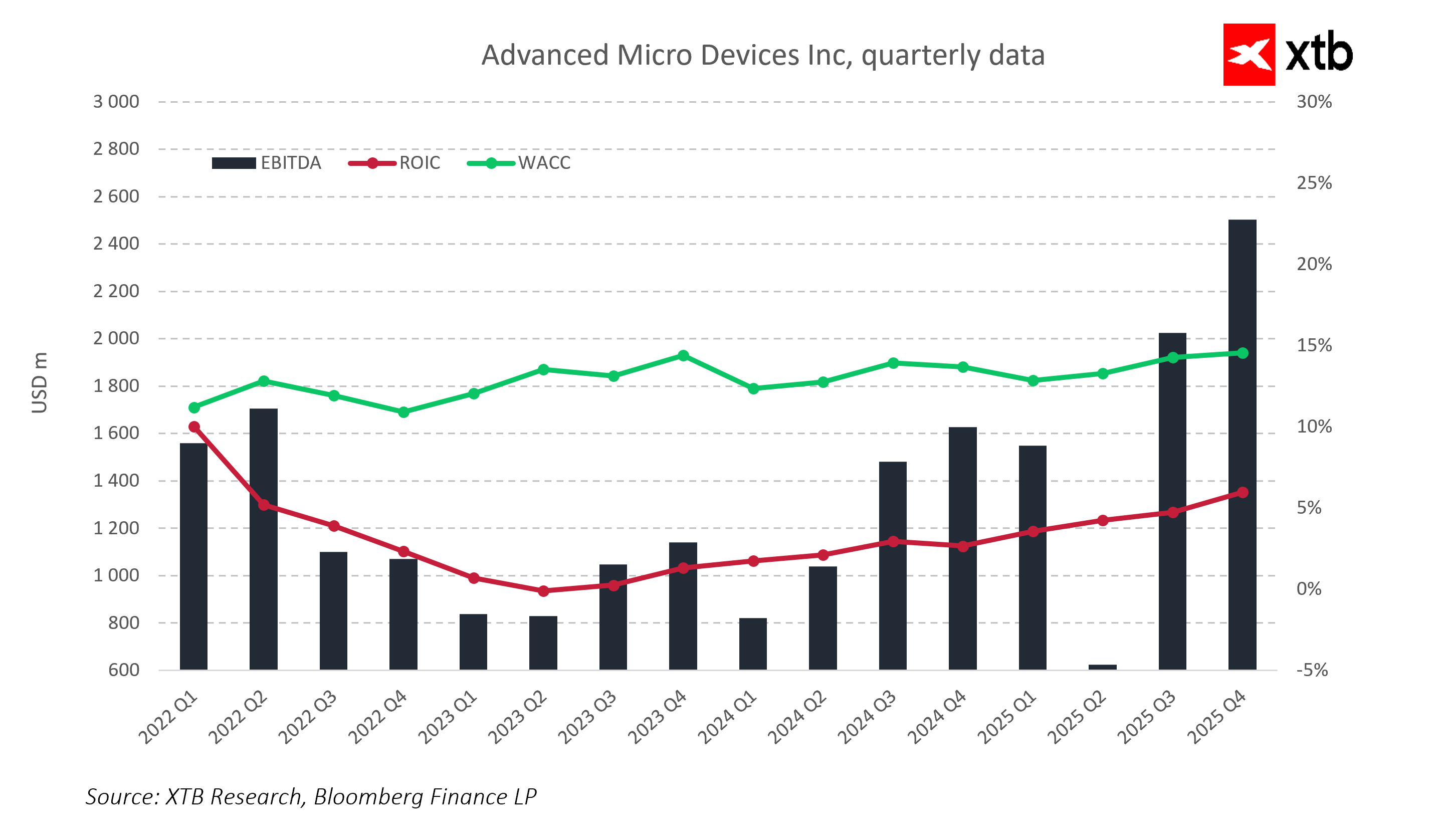

The financial data highlight increased cash generation and improved return on invested capital (ROIC). Notably, the company’s weighted average cost of capital (WACC) remains stable, reflecting effective financial management during a period of dynamic growth.

Outlook and Forecast

For Q1 2026, AMD expects revenues in the range of USD 9.5–10.1 billion, representing continued double-digit year-over-year growth. Gross margin is projected at approximately 55%, with capital expenditures planned at USD 222 million.

Although the forecast exceeds analysts’ average expectations (USD 9.39 billion), it fell short of the market’s more aggressive growth anticipation, resulting in a short-term decline in share price and highlighting the sensitivity of high P/E stocks to even slight deviations from expectations.

Management emphasizes that AMD is fully prepared for further expansion in AI and high-performance computing chip production. New EPYC processors and MI325 accelerators in the second half of the year are expected to boost sales in data centers and drive further revenue growth in key markets, including China.

Looking Ahead

AMD’s record Q4 2025 results confirm that the company is growing at an impressive pace and that its products rank among the best on the market. Revenue and profit growth exceeded expectations, and the raised guidance for the next quarter shows that management sees substantial potential for further growth.

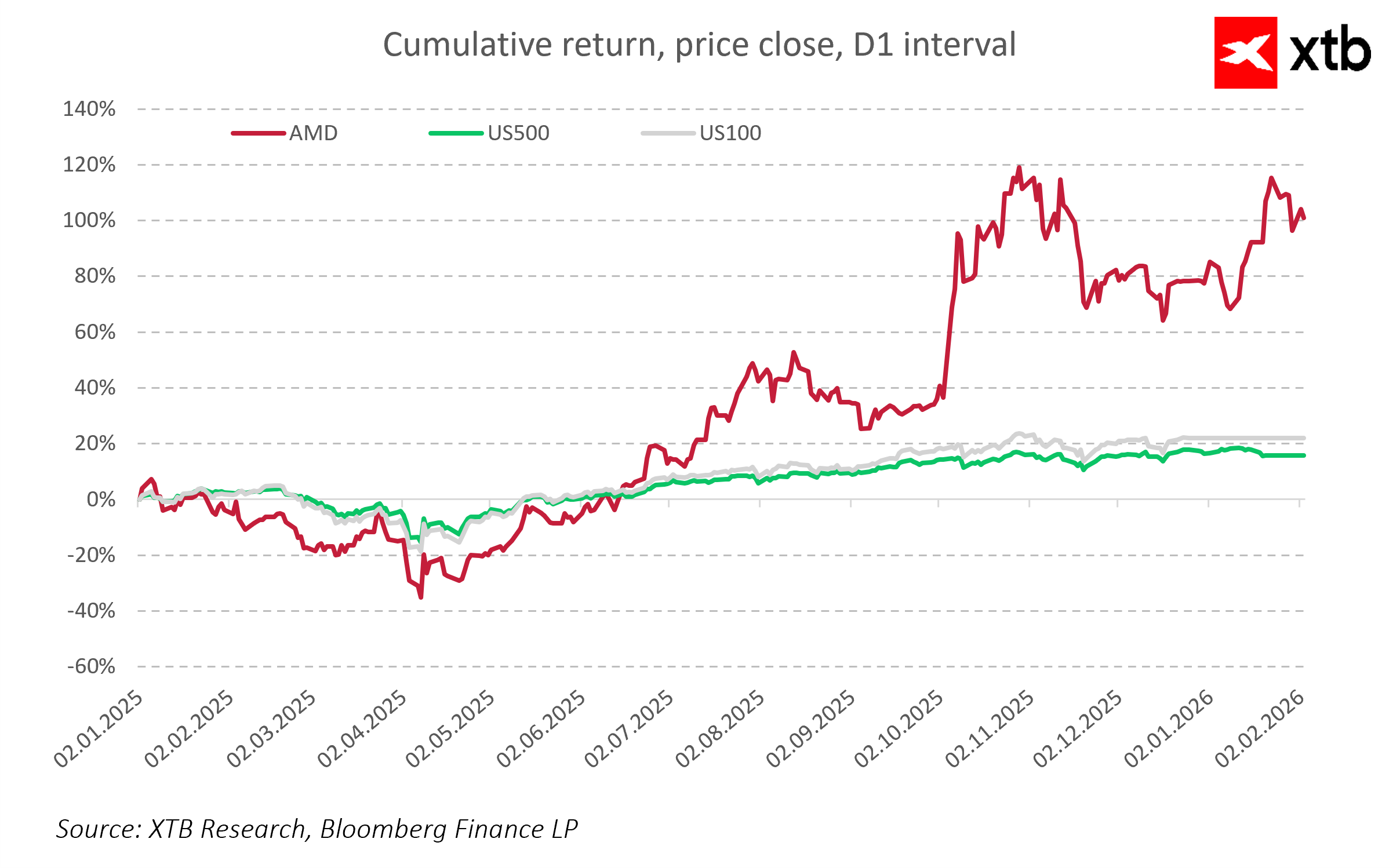

However, the market remains sensitive to high valuations. AMD’s high P/E ratio implies near-perfect pricing, and anything “only good, not great” can trigger short-term corrections. The post-earnings share price drop demonstrates that investors react not only to the numbers themselves but also to whether the company meets market expectations for growth pace.

In the long term, AMD’s fundamentals remain very strong: development of strategic segments (AI, HPC, data centers), maintenance of high margins amid growing demand, and investment in next-generation processors and accelerators suggest that the stock has potential for further growth, with current turbulence more likely a short-term correction than a signal of structural problems.

Key Takeaways

-

Strong revenue and profit growth: 34% revenue and 41% operating profit increase in Q4 2025

-

Leadership in strategic segments: AI, data centers, HPC, and gaming

-

High efficiency: 57% gross margin, 28% operating margin

-

Forward guidance indicates further growth potential: Q1 2026 revenues projected at USD 9.5–10.1 billion

US100 loses 1% amid Nvidia weakness 📉Heico crashes 13%

D‑Wave Quantum: Concrete Results Today, Big Dreams Tomorrow

Will Nvidia’s report reignite optimism on Wall Street?

Nvidia’s report blows past expectations on Blackwell 📈 Will the AI boom last?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.