Silver gains over 1% today, similarly to platinum. Palladium, on the other hand, gains over 2%, while gold gains 0.5%. This is the effect of a very weak US dollar, although at the same time we do not observe a decrease in yields. The dollar is losing primarily against the yen, as the head of the Bank of Japan announced possible interest rate hikes at the next meeting, which will take place in a week, after the Fed's decision. Therefore, there is a chance that the huge divergence between the Fed and BoJ policy will decrease.

Looking at the chart, we observe a clear drop in USDJPY (inverted axis), which supports a rebound in silver. Silver rebounds from the vicinity of the lowest level since August 21. Of course, it is worth noting that a similar upward movement was visible on Friday, but it was significantly reduced by the end of the session. If high levels are maintained today, the next important resistance will be the 23.6% retracement of the last downward wave and the 200-session average located slightly above at 23.4 USD.

It is worth remembering that the yen is considered a "safe" currency along with USD, which is why we often observe a positive correlation between yen changes and the prices of precious metals, such as silver. Source: xStation5

It is worth remembering that the yen is considered a "safe" currency along with USD, which is why we often observe a positive correlation between yen changes and the prices of precious metals, such as silver. Source: xStation5

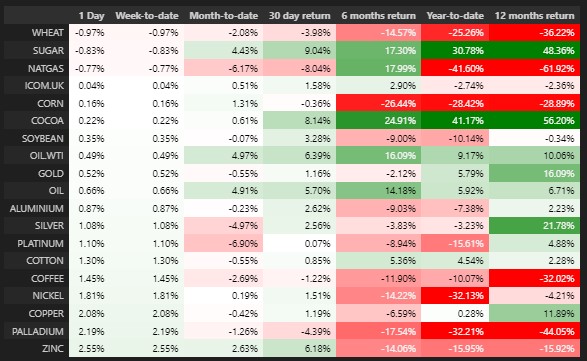

Silver is gaining 1% today, but we can see that there are even larger increases on other metals. Besides, we see that silver has been rather weak this year, although not as weak as industrial metals. Source: XTB

BREAKING: Massive increase in US oil reserves!

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

📈 Gold jumps 1.5% ahead of NFP, hitting its highest level since Jan. 30

Silver rallies 3% 📈 A return of bullish momentum in precious metals?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.