-

Stars of tech rally show weakness

-

Apple expects strong demand for its 5G iPhone

-

One of Tesla's top shareholders cuts stake

-

Announcement of Tesla S&P 500 addition could come within days

-

Nasdaq gains in spite of Tesla and Apple weakness

US tech sector continues to climb but some weakness could have been spotted on drivers of the ongoing rally - Apple and Tesla. Both stocks booked strong gains on Monday during the first session of post-split trading but struggled in the following days. In our Stock Market Comment we take a look at recent news concerning both stocks.

Following a stunning rally market capitalization of Apple exceeded market capitalization of all companies in the Russell 2000 index. Source: Bloomberg, XTB

Following a stunning rally market capitalization of Apple exceeded market capitalization of all companies in the Russell 2000 index. Source: Bloomberg, XTB

Apple has experienced a strong rally following a drop triggered by coronavirus pandemic in February and March. The stock not only fully recovered from the aforementioned decline but rallied 150% off March's low. High price tag encouraged Apple to perform a stock split and the market rewarded this move with a 4.2% gain on Monday. Stock added to these gains later on and its capitalization exceeded capitalization of all stocks in Russell 2000 index on Tuesday.

Apple gained on Tuesday after reports saying the company asked its suppliers to produce 75 million 5G iPhones for later this year. News signalled that the US tech company does not expect a drop in demand. Having said that, recent weakness could be ascribed to general profit taking and to lesser extent news connected to EU tech tax. Fundamental outlook has been intact.

Apple launched yesterday's trading with a big bullish price gap but ultimately finished the session lower. Nevertheless, as long as the price sits above the lower limit of the Overbalance structure at $127, bulls remain in advantage and uptrend is maintained. Source: xStation5

Apple launched yesterday's trading with a big bullish price gap but ultimately finished the session lower. Nevertheless, as long as the price sits above the lower limit of the Overbalance structure at $127, bulls remain in advantage and uptrend is maintained. Source: xStation5

Tesla gained even more than Apple during the first session of post-split trading. Stock closed 12.5% higher on Monday but started to decline on Tuesday. However, unlike in Apple's case, there was a clear negative catalyst behind the drop. Tesla announced that it will offer new shares worth $5 billion "at the market". While in case of stock split investors retain rights to the same portion of profits (just split among larger amounts of shares), new stock offerings dilute ownership. Tesla shares were trading even 15% lower at one point of Wednesday's session after Baillie Gifford, UK investment firm, said it has reduced its stake at the company from 7.67 to 4.25%.

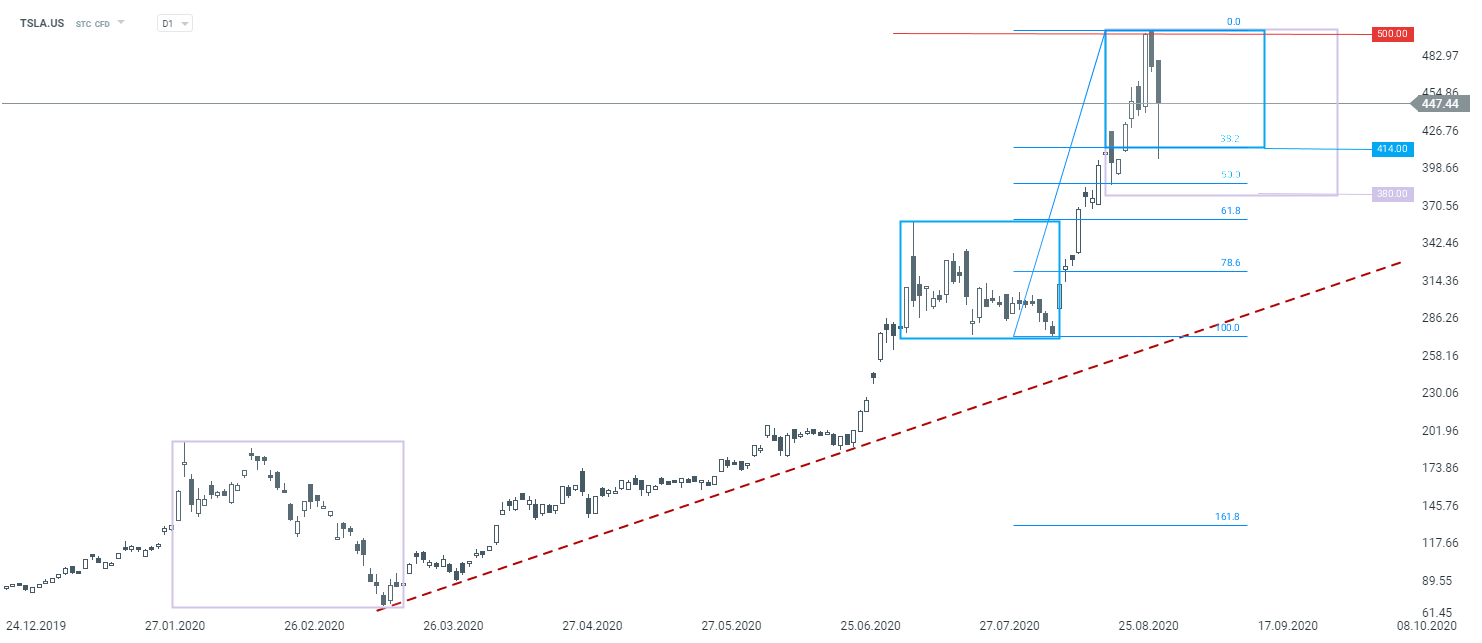

Share price of Tesla (TSLA.US) cratered yesterday but managed to finish trading off the daily lows. However, the stock is trading 6-7% lower in pre-market trade today. Support to watch can be found at $414. Source: xStation5

Share price of Tesla (TSLA.US) cratered yesterday but managed to finish trading off the daily lows. However, the stock is trading 6-7% lower in pre-market trade today. Support to watch can be found at $414. Source: xStation5

However, Tesla shares will be on the watch near the end of this week and at the beginning of the next as it is speculated that S&P Dow Jones indices could announce the addition of Tesla to S&P 500 index. S&P 500 was usually rebalanced on Friday in the middle of September with announcement coming 2 weeks earlier. Hence the announcement on Friday, September 4 cannot be ruled out. Announcement could create additional demand for Tesla shares from index funds and ETFs as they will adjust portfolios to better reflect broad market performance.

In spite of a mixed performance of its star members - Apple and Tesla - Nasdaq (US100) managed to close at yet another record high yesterday. Weakness can be spotted today but given recent parabolic rise, it should not be seen as a warning sign. Troubles could start once a stock breaks below psychological 12,000 pts handle that also marks the lower limit of Overbalance structure. Source: xStation5

In spite of a mixed performance of its star members - Apple and Tesla - Nasdaq (US100) managed to close at yet another record high yesterday. Weakness can be spotted today but given recent parabolic rise, it should not be seen as a warning sign. Troubles could start once a stock breaks below psychological 12,000 pts handle that also marks the lower limit of Overbalance structure. Source: xStation5

Arista Networks closes 2025 with record results!

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.