Alphabet’s quarterly results were released at a unique moment, as the entire technology sector stands on the threshold of a transformation driven by artificial intelligence and the rapid expansion of cloud infrastructure. On one hand, investors expected another solid quarter; on the other, they increasingly questioned how far the company is willing to go in terms of investment spending to maintain its leadership position.

Once again, Alphabet confirmed that even in such a large-scale market, it can generate revenue growth that seemed unattainable just a few years ago. It is worth noting that this growth did not come from one-off actions or seasonal adjustments but is the result of a stable business model and the increasingly effective integration of AI into the company’s core services.

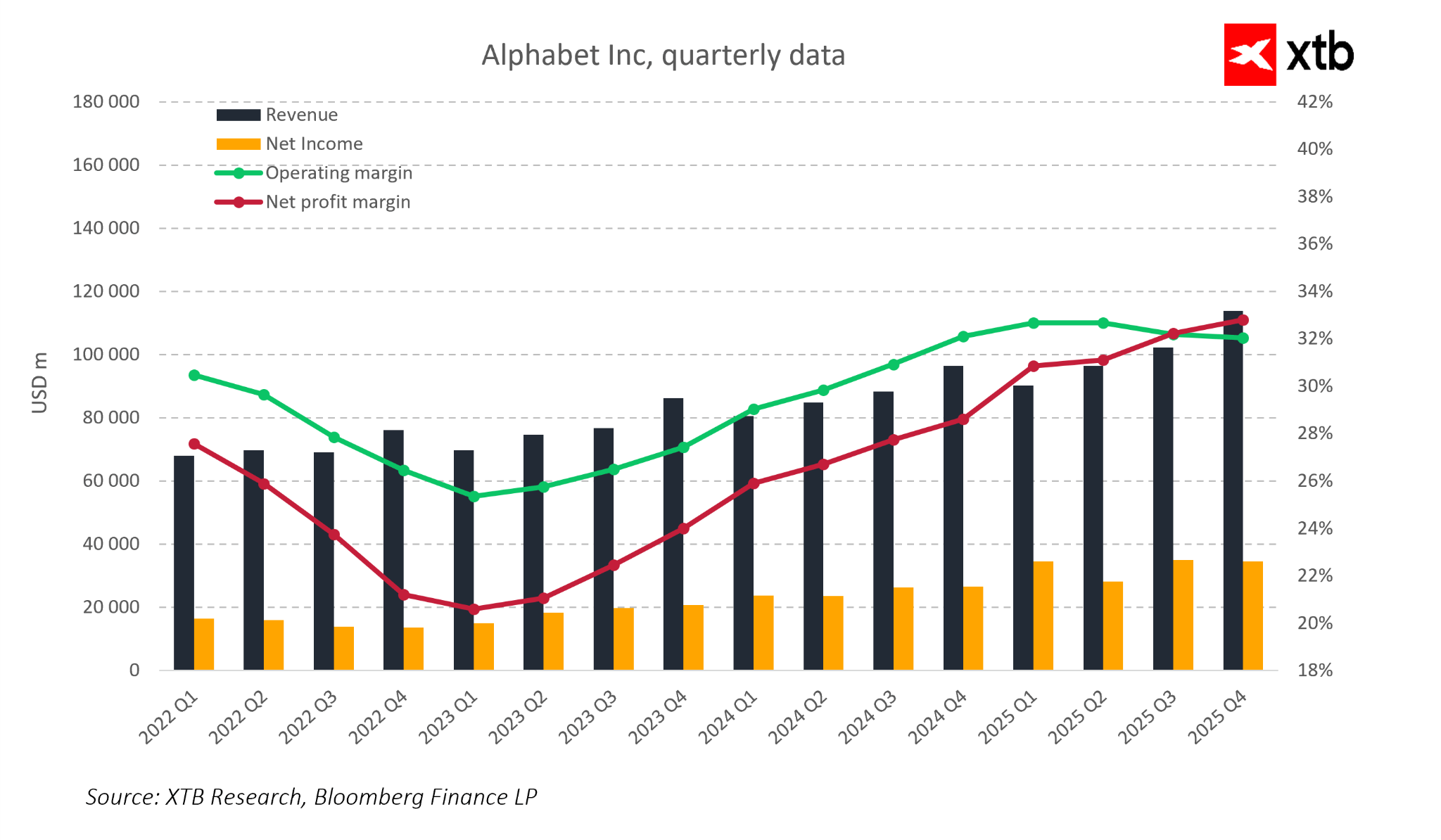

Revenues exceeded $113 billion, clearly surpassing market expectations and keeping the company in the elite group of firms that generate over $100 billion quarterly. This demonstrates not only the strength of current operations but also the stability and scale that give Alphabet a significant competitive advantage.

Key Financial Highlights Q4 2025

-

Total revenue: $113.8B, up 18% YoY

-

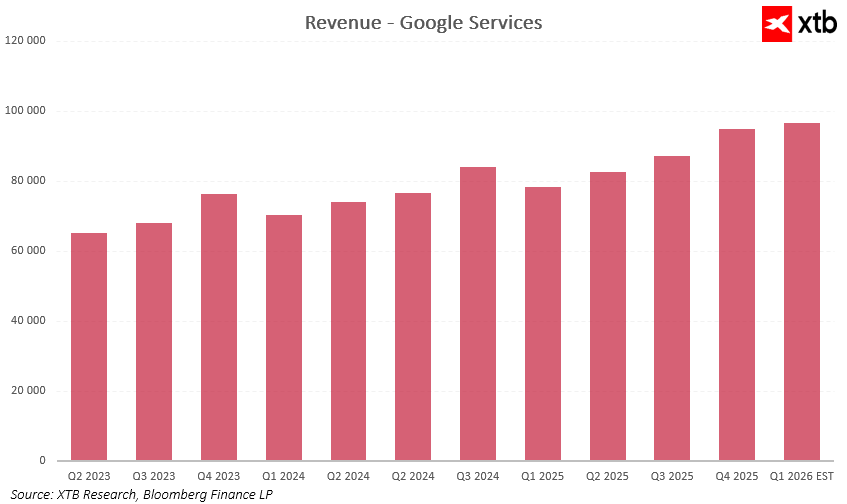

Google Services revenue: $95.9B, up 14% YoY

-

Google Search revenue: $63.1B, up 17% YoY

-

YouTube revenue: $11.4B, up 9% YoY

-

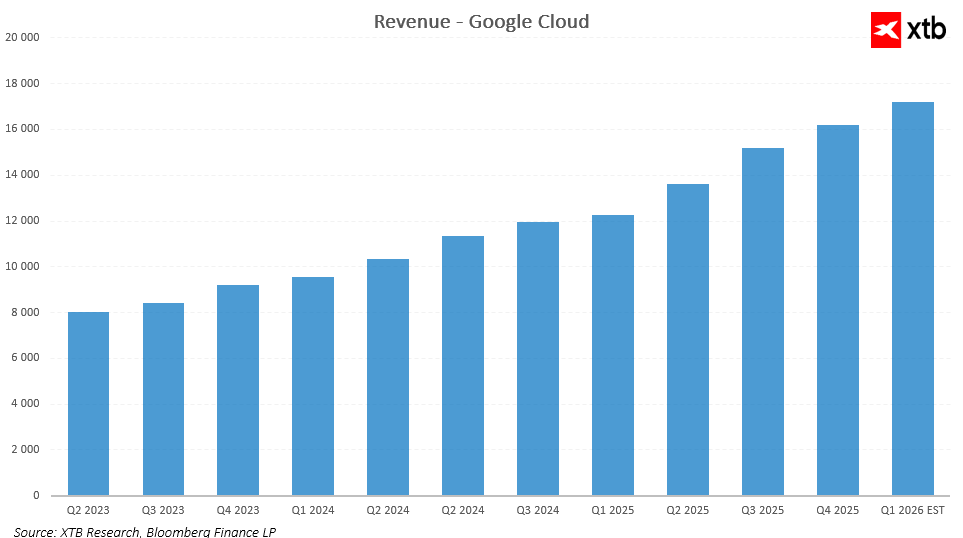

Google Cloud revenue: $17.7B, up 48% YoY

-

Operating income: $35.9B, up 16% YoY

-

Operating margin: 31.6%

-

Net income: $34.5B, up 30% YoY

-

EPS: $2.82, up 31% YoY

The Google Services segment remains the company’s foundation, but its significance is evolving alongside the growing role of artificial intelligence. AI is no longer just an add-on; it is becoming central to optimizing advertising campaigns, resulting in more efficient monetization of traffic and improved financial performance. YouTube revenue, while slightly below the most optimistic forecasts, remains an important source of stable income, and the expansion of subscriptions and additional services continues to increase its share of total revenue.

What stands out most this quarter is the growing role of Google Cloud. This segment has come a long way from a costly future investment to a significant revenue generator. Revenue exceeded $17 billion and is growing at a pace that indicates sustained demand for computing infrastructure and AI-based services. Google Cloud is no longer just a technology provider but is becoming a partner for enterprises, offering comprehensive cloud solutions that meet increasingly complex business needs.

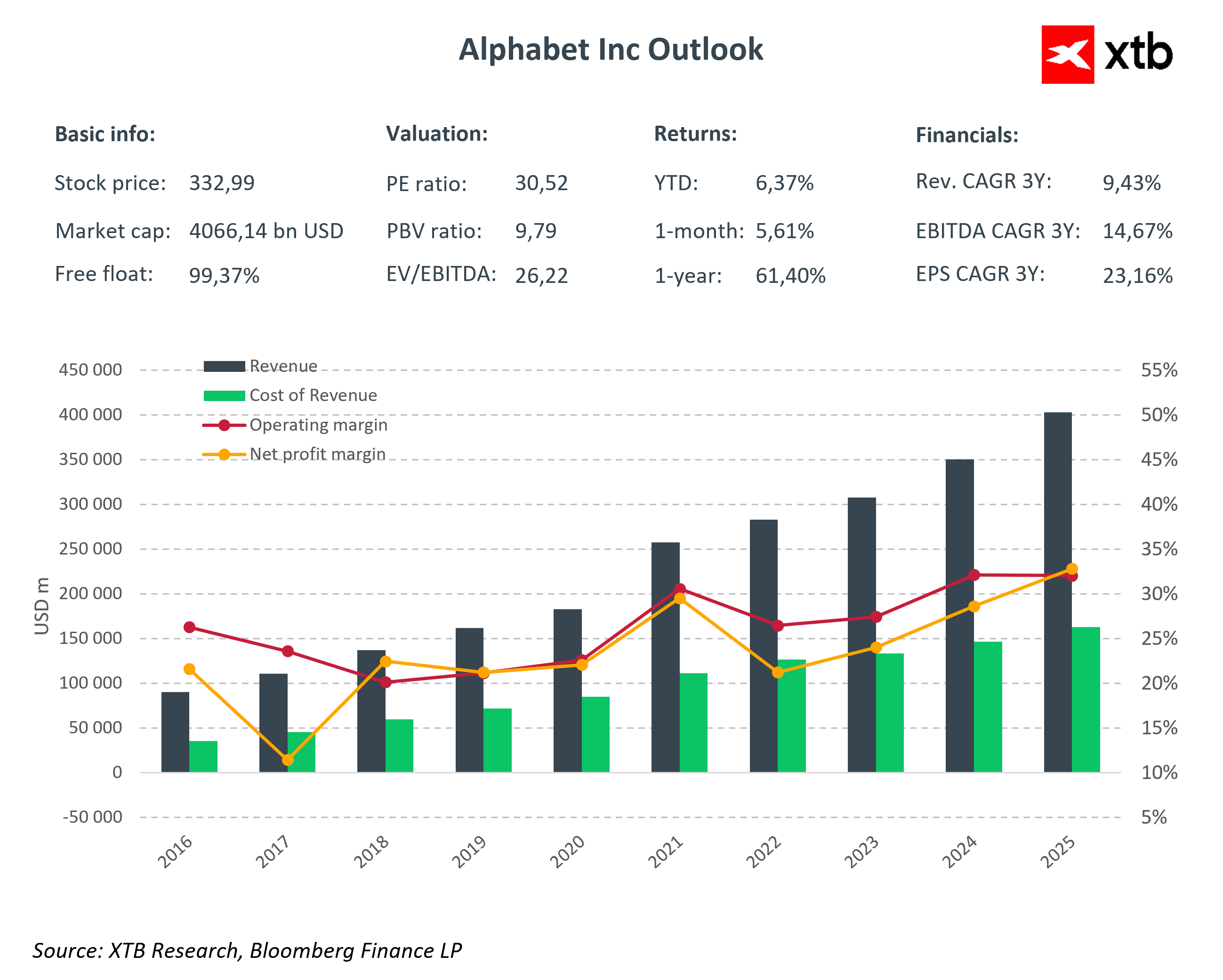

Revenues, net income, and operating and net margins show a clear upward trend. This systematic improvement in financial efficiency demonstrates that the company is not only scaling but also managing costs more effectively, leading to stronger operational results and profitability.

On the other hand, the planned increase in investment spending for 2026 has elicited mixed reactions from investors. Planned expenditures of $175–185 billion represent a more than 60% increase compared to the previous year and significantly exceed analyst forecasts. Such a massive investment push signals that Alphabet is not only maintaining its competitive edge but also building new foundations to dominate in the era of AI and cloud computing. These investments include expanding data centers, developing AI infrastructure, and expanding Google Cloud services.

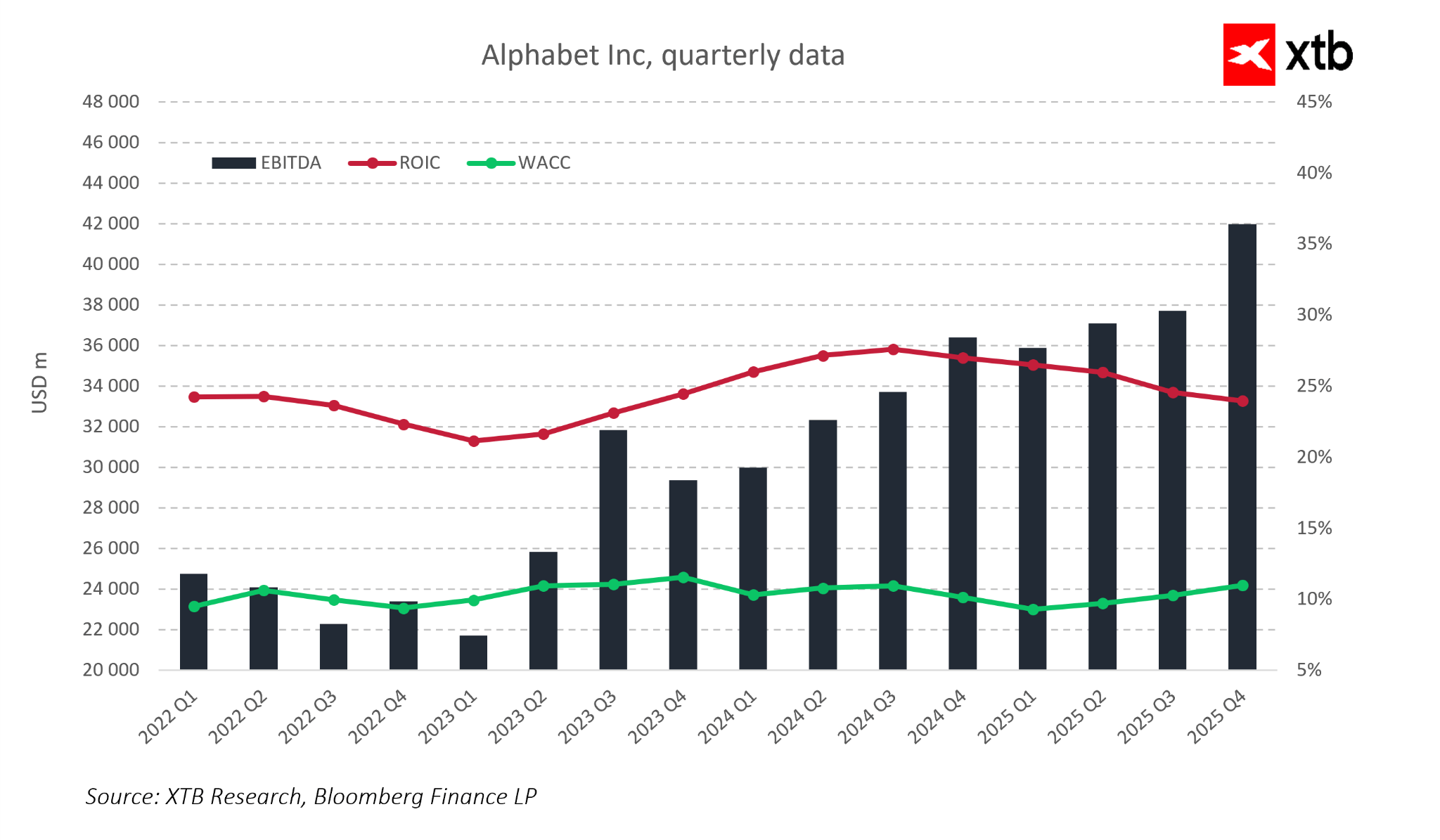

EBITDA and return on invested capital metrics confirm that Alphabet generates value exceeding its cost of capital, and the growth in EBITDA demonstrates a healthy balance between scaling the business and cost efficiency.

Market reaction to these forecasts was mixed. In after-hours trading, the stock experienced a sharp decline, which was quickly reversed, and shares ultimately closed the session higher. This reflects the duality of the situation: on one hand, investors appreciate record results and growth prospects, while on the other, they worry whether such large expenditures might temporarily affect margins and cash flow. However, from a long-term perspective, these investments appear strategically justified, as they build an advantage that could determine Alphabet’s position in the coming years.

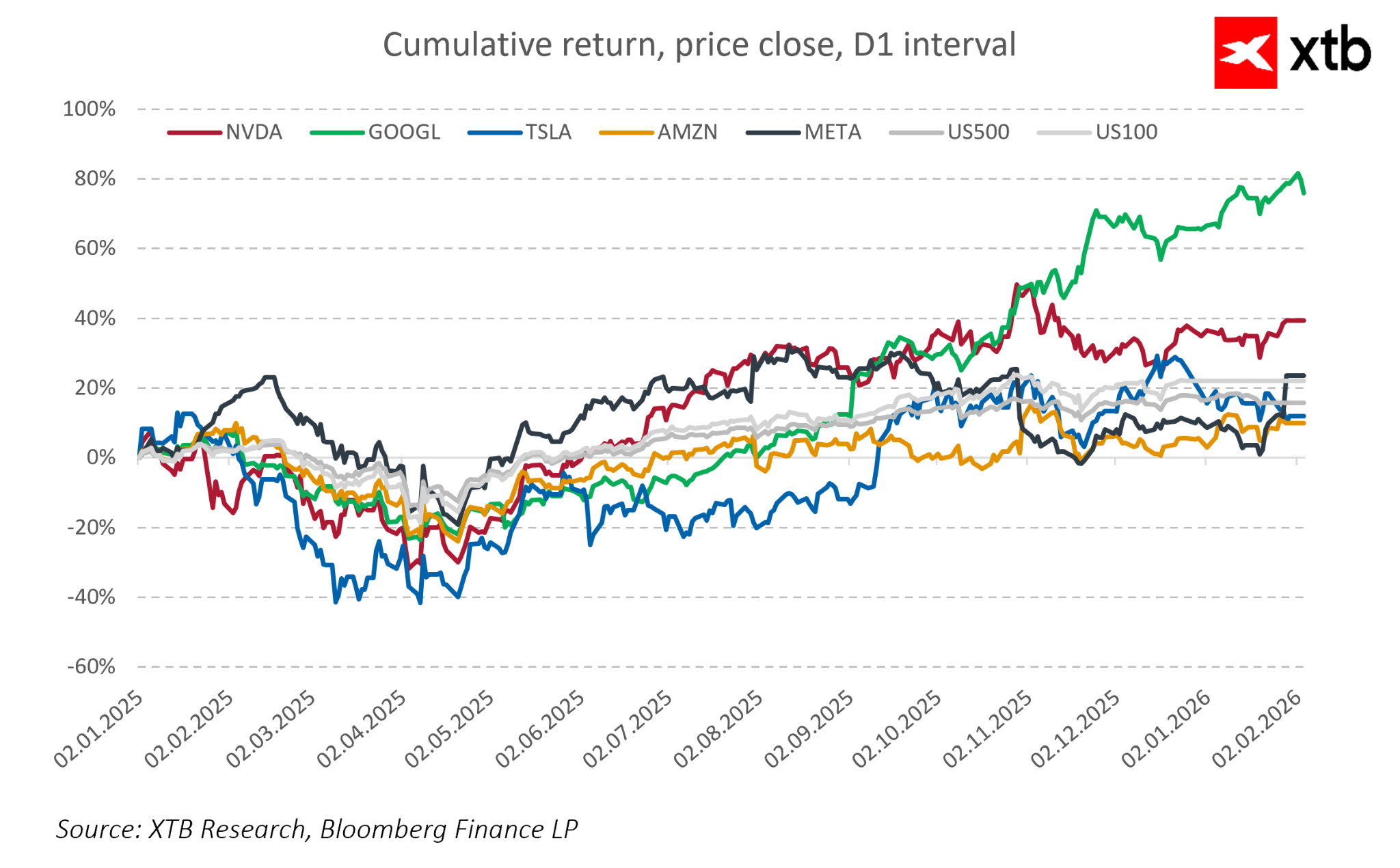

Comparing Alphabet’s market performance with other technology giants shows that since the beginning of 2025, the company has consistently delivered superior returns, strengthening investor confidence in its strategy and growth prospects.

In the background, long-term projects that were until recently considered costly experiments remain ongoing. The company now approaches them with greater discipline, minimizing losses while maintaining flexibility for the future. This stage of development reflects growing operational and strategic maturity.

Valuation Outlook

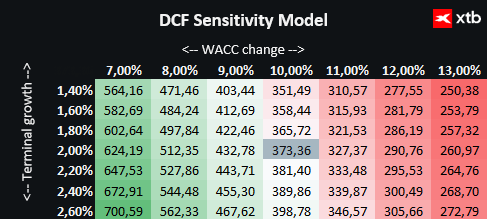

We present a valuation of Alphabet Inc. using the discounted cash flow (DCF) method. It should be emphasized that this is for informational purposes only and should not be considered an investment recommendation or precise valuation.

Alphabet is one of the largest global players in the technology sector, providing advanced solutions in search, advertising, digital subscriptions, and cloud services. The company benefits from growing demand for artificial intelligence and cloud services, and strategic investments in Google Cloud development and AI integration into the Google Services segment create a solid foundation for further growth.

It is worth noting that Alphabet maintains high profitability and a technological edge over competitors, which mitigates market risks and allows for safe growth planning in the coming years. At the same time, the valuation remains cautious, taking into account potential competitive pressures and the volatility of the global technology market.

Based on the DCF analysis, the estimated value per Alphabet share is $373.36, compared to the current price of $317, implying an upside potential of approximately 18%. This indicates that the company not only presents solid financial fundamentals but also offers an attractive perspective for investors who believe in the continued growth of AI, cloud, and digital advertising markets.

Summary and Key Takeaways

-

Alphabet ends 2025 in excellent financial condition, achieving record revenues and showing growing profitability in both key segments.

-

Stable revenue growth and consistently high operational efficiency indicate that the company’s business model is resilient to market fluctuations while remaining flexible to the rapidly evolving technology sector.

-

Strong revenue growth combined with improved operating and net margins demonstrates better cost management and effective monetization of AI-based services.

-

The Google Services segment reinforces the company’s position as a leader in providing digital solutions for advertisers, while the dynamic growth of Google Cloud shows that Alphabet is successfully converting previous investments into a sustainable revenue source and value for enterprise clients.

-

Planned investment expenditures of $175–185 billion in 2026 reflect the company’s ambitious strategy: not just maintaining market leadership but actively shaping the future of AI and cloud services. Expansion of data centers, AI infrastructure, and Google Cloud services provide a foundation for long-term growth and increase barriers to entry for competitors.

-

Alphabet demonstrates that it can combine the scale of a global giant with innovation and strategic flexibility. Financial stability, strong technological positioning, and the ability to generate high profitability enable the company to pursue an aggressive investment strategy while minimizing risks associated with short-term market fluctuations.

US100 loses 1% amid Nvidia weakness 📉Heico crashes 13%

D‑Wave Quantum: Concrete Results Today, Big Dreams Tomorrow

Will Nvidia’s report reignite optimism on Wall Street?

Nvidia’s report blows past expectations on Blackwell 📈 Will the AI boom last?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.