- Stable business model: Recurring subscription revenues provide financial predictability.

- Resilience to market fluctuations: The company maintains profitability and generates cash even in difficult conditions.

- Safe haven for investors: The defensive nature of the business attracts capital during uncertain periods.

- Stable business model: Recurring subscription revenues provide financial predictability.

- Resilience to market fluctuations: The company maintains profitability and generates cash even in difficult conditions.

- Safe haven for investors: The defensive nature of the business attracts capital during uncertain periods.

Comcast: A Safe Haven in a Volatile Media World

When markets panic, investors look for safe havens. Comcast Corp is one such company. The U.S. media and telecommunications giant stands out with stable subscription revenues, solid cable infrastructure, and a growing streaming segment. It is a defensive stock that can attract capital like a magnet during periods of market chaos.

Company Profile – Comcast Corporation

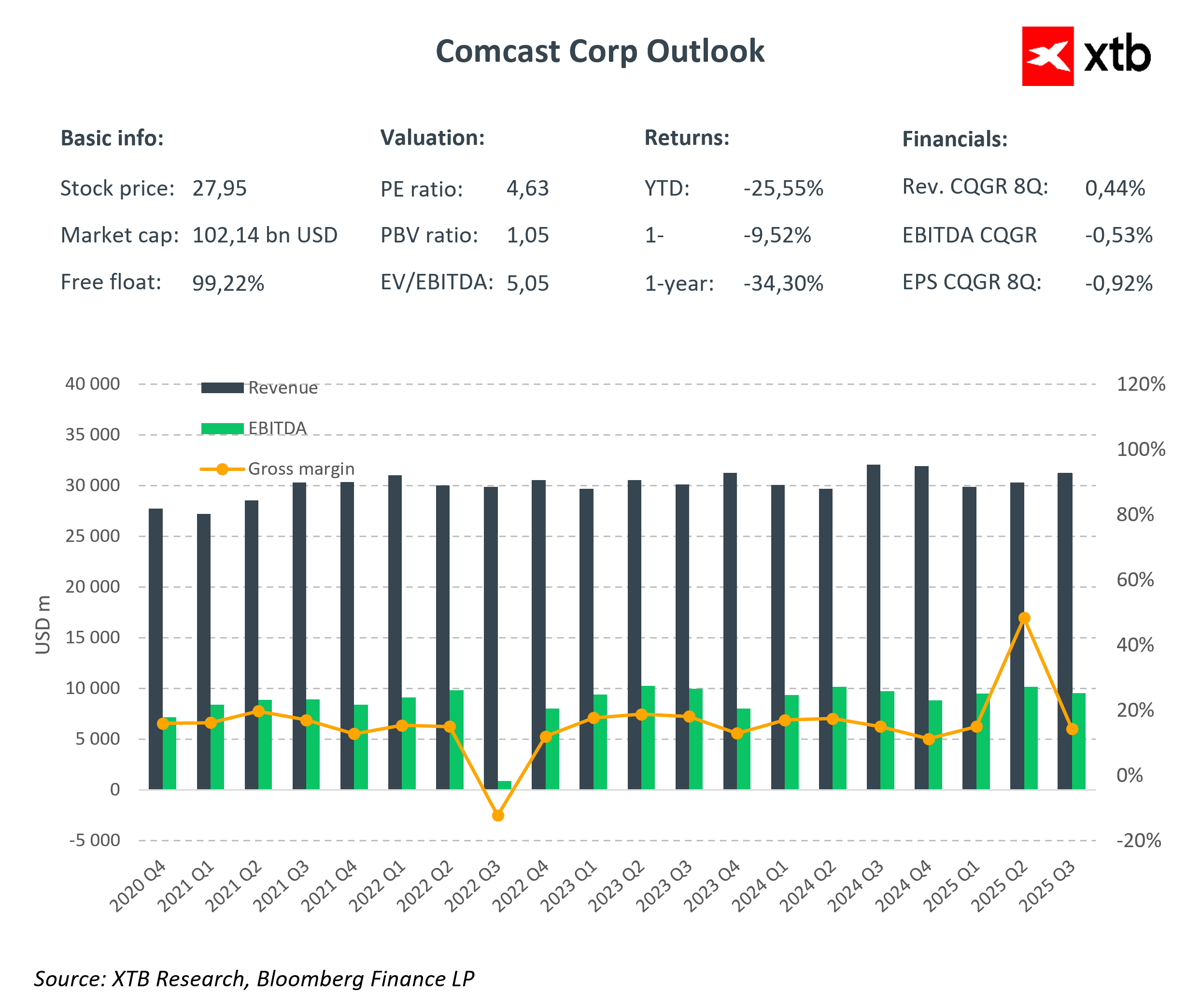

Comcast Corporation is a global leader in the media and telecommunications sector, offering broadband Internet, television services, and media content through its Comcast Cable and NBCUniversal segments. Currently, the company is significantly undervalued relative to its historical valuation and the industry. In times of market panic and rising uncertainty, investors seek companies with stable, defensive fundamentals, and Comcast fits this role perfectly.

Comcast’s Defensive Nature

Comcast’s business model is based on stable, recurring subscription revenues from broadband and television services, which are largely resilient to economic slowdowns. Comcast Cable, generating over 60% of total revenues, ensures a steady inflow from millions of customers. It is a true “safe haven” in volatile market conditions.

The NBCUniversal segment, though more cyclical, provides strong support in media and entertainment, benefiting from growing demand for content and the expansion of streaming platforms such as Peacock. Overall, Comcast maintains a dominant position in the U.S. broadband market. This advantage translates into predictable revenues and business resilience, making the company attractive to investors seeking stability in uncertain times.

Comcast Financial Performance

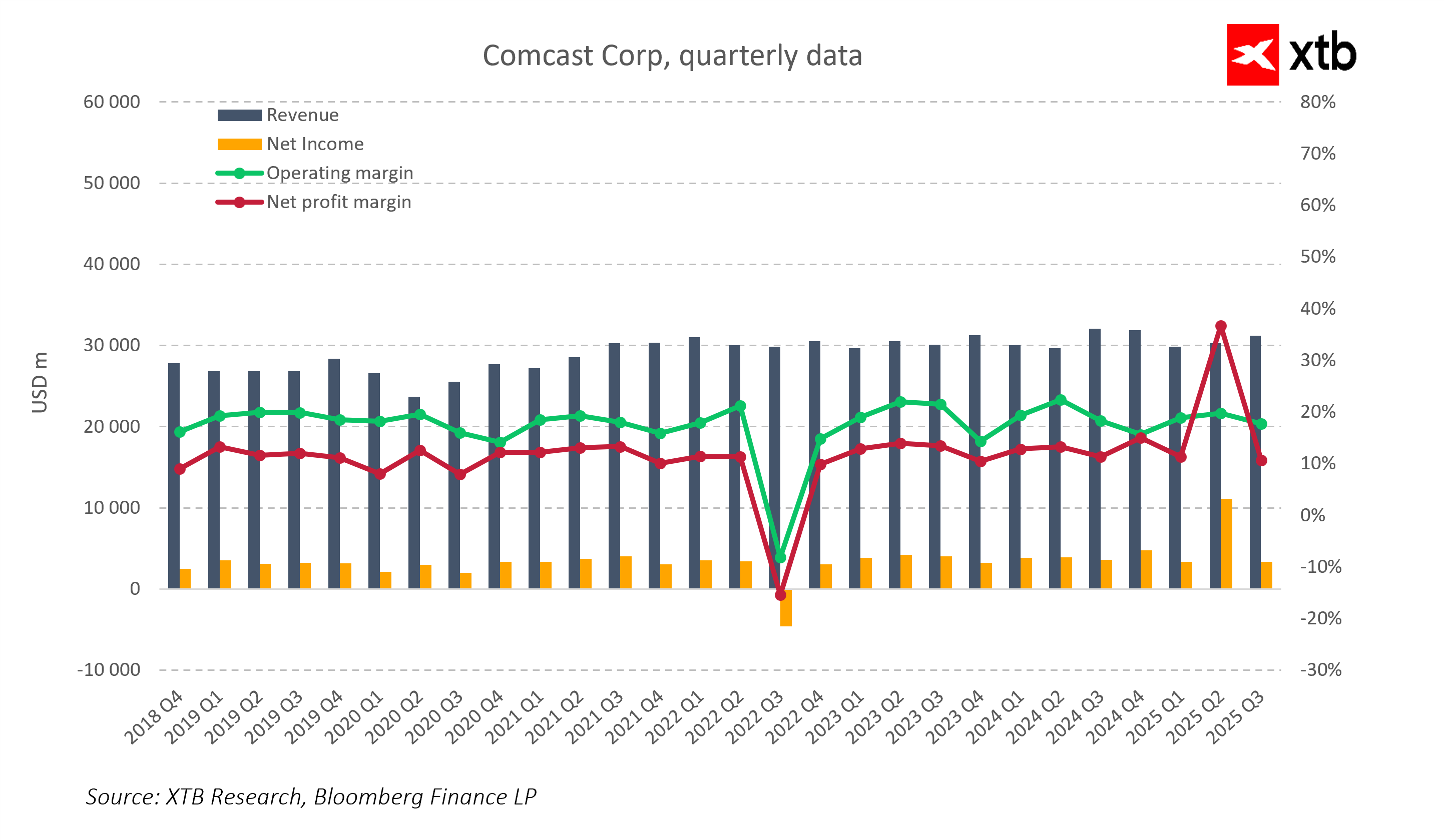

Comcast is a genuine leader in the media and telecommunications sector, consistently demonstrating that its business model is stable, market-resilient, and focused on long-term growth. The company maintains quarterly revenues of approximately $31 billion, immediately highlighting the strength of its business base and the predictability of its cash flows. Even when temporary fluctuations occur due to seasonal effects or exceptional events, such as the 2024 Olympic Games, Comcast quickly returns to a growth trajectory, confirming the resilience of its business model.

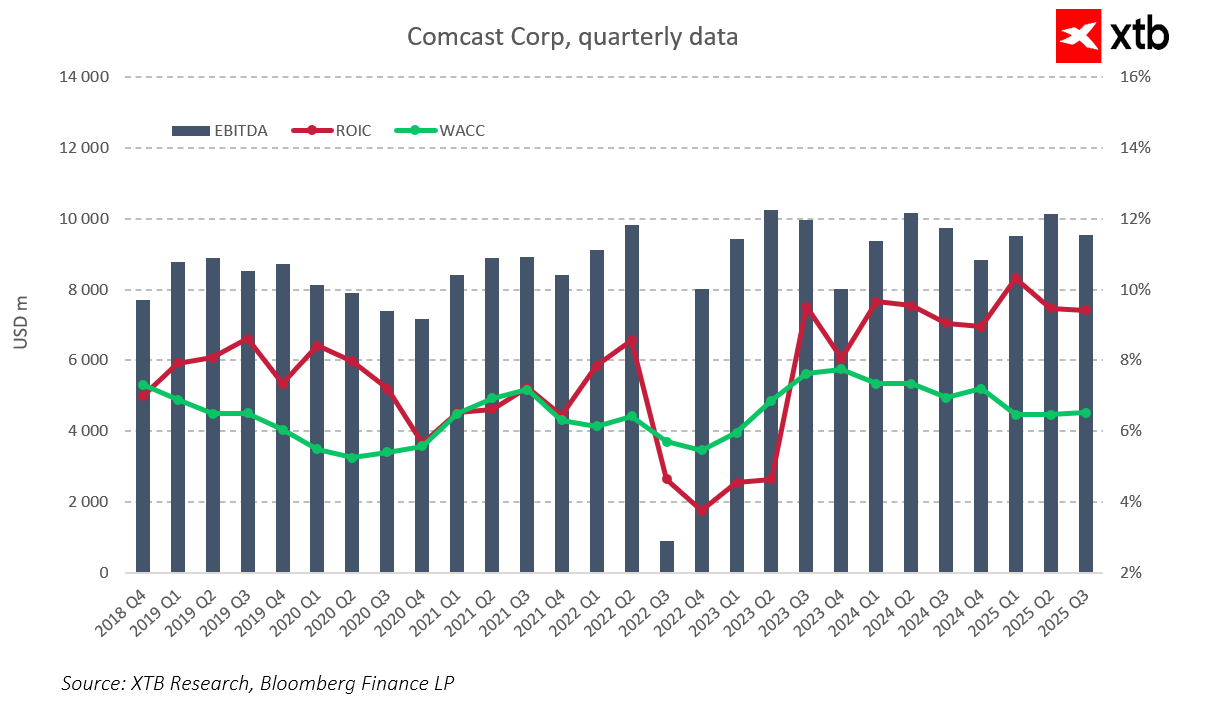

EBITDA remains in the $9–10 billion range, reflecting effective cost management and high operational resilience. A 3.7% decline in EBITDA in Q3 2025 was primarily due to strategic investments in the network, price structure simplification, and new service development. This is not a sign of weakness but a deliberate strengthening of competitive advantage and service quality. Comcast is unafraid to invest in the future, even if it temporarily affects quarterly metrics.

Margins remain solid and stable. High gross margins, along with maintained operating and net margins, demonstrate the company’s ability to preserve profitability even in challenging market conditions. This further proves that Comcast’s business model is designed to create long-term shareholder value.

Net income growth in Q2 2025 confirms the company’s flexibility and resilience. Despite pressure on broadband revenues and minor subscriber losses, Comcast generates real cash and maintains financial stability. Free cash flow increased by 45% year-over-year to $4.9 billion, providing a solid financial buffer and supporting a shareholder return program of $2.8 billion.

An even more telling metric is ROIC, which consistently exceeds the WACC. This shows that Comcast not only generates profits but does so efficiently, creating real value for investors. These results clearly confirm the company’s defensive nature. In times of uncertainty, investors can rely on solid fundamentals, predictable cash flows, and business resilience to market fluctuations.

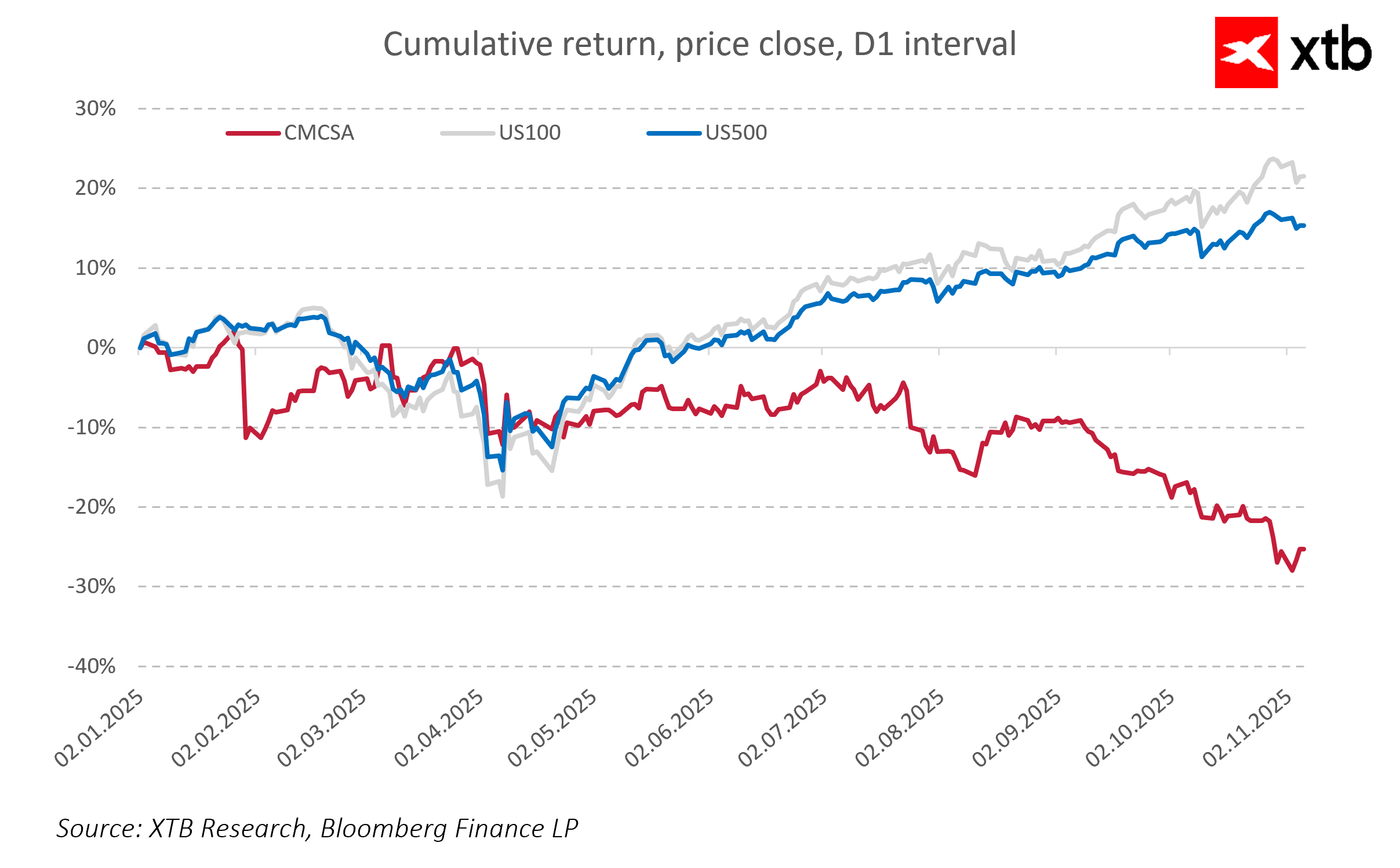

Compared to market valuations, Comcast looks very attractive. Low P/E and EV/EBITDA ratios indicate that, despite strong performance, the market still undervalues the company’s full potential. The stock’s decline this year, approaching a 52-week low, may actually present an investment opportunity, especially for those seeking a defensive, stable, and growth-oriented company.

Additionally, Comcast continues to increase investments in network development and innovative solutions, maintaining a competitive edge in broadband and TV services. The growing significance of wireless services, which added over 400,000 lines in the last quarter, demonstrates the company’s ability to respond dynamically to changing customer preferences.

Comcast combines all the features of a defensive company valued by investors during uncertain times. Revenue stability, operational resilience, cash generation ability, strategic investments in the future, and attractive valuation relative to business quality make it a genuine investment opportunity. During market panics, the company can attract capital, and over the long term, it offers solid growth prospects and security for shareholders.

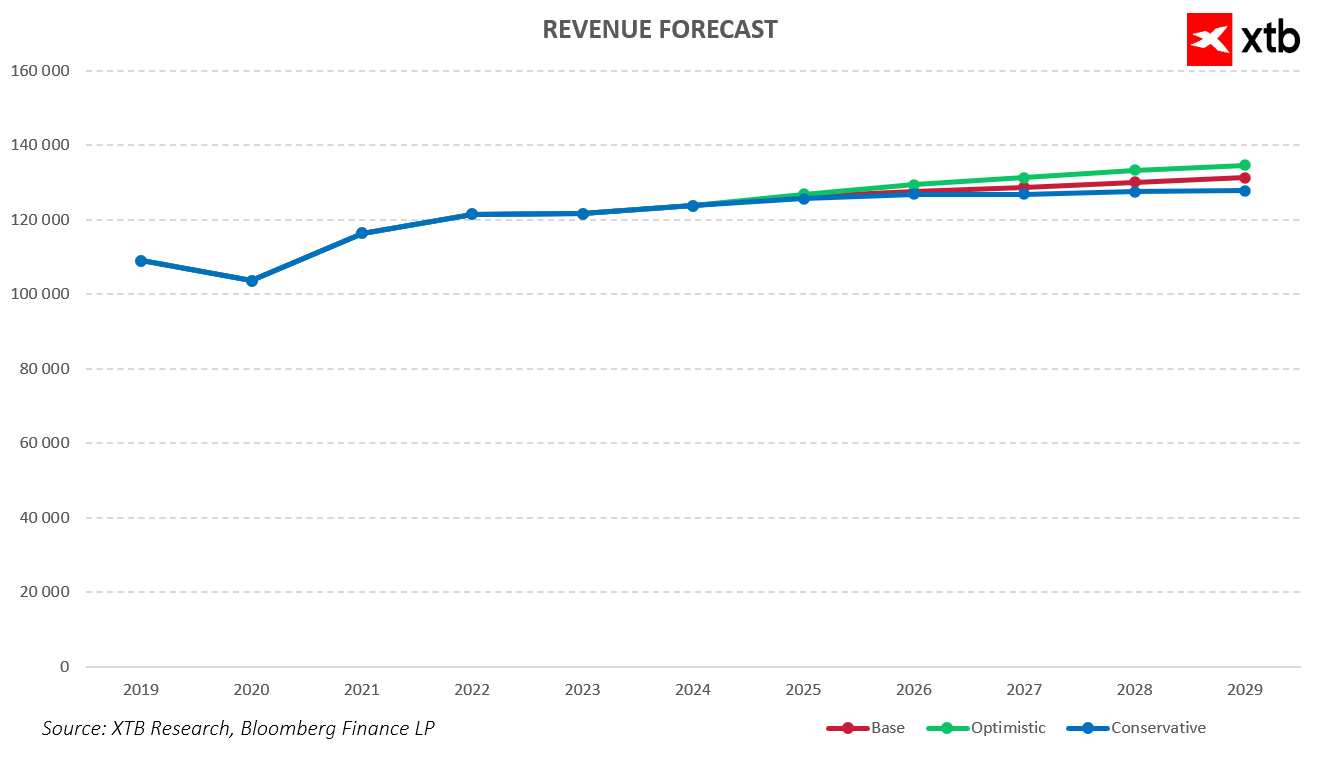

Revenue Forecast

For years, Comcast has proven that its business model is stable and resilient to market fluctuations, and revenue forecasts for the coming years only reinforce this strong position. Even in a volatile environment, the company maintains the ability to generate solid revenues, and scenarios indicate that the future may bring further shareholder value growth. Revenues grow systematically, reflecting predictable cash flows and the company’s ability to adapt to varying market conditions.

-

In the base scenario, Comcast revenues grow moderately, reaching $126.2 billion in 2025 and $131.3 billion in 2029. Such stable growth highlights the strength of the business fundamentals and the ability to maintain predictable inflows, typical of defensive companies.

-

The optimistic scenario assumes faster revenue growth, reaching $126.8 billion in 2025 and $134.6 billion in 2029. This scenario illustrates the company’s potential for accelerated development, especially in wireless services and new media content, which could drive growth beyond analysts’ expectations. In this view, Comcast not only maintains a competitive advantage but also demonstrates its ability to seize market opportunities in dynamic conditions.

-

The conservative scenario presents a more cautious perspective, assuming slower revenue growth from $125.6 billion in 2025 to $127.8 billion in 2029. Even at this slower pace, the company maintains stability and the ability to generate predictable inflows, attracting investors seeking safe, defensive investments.

Regardless of the scenario, revenue forecasts indicate that Comcast remains a stable and predictable company capable of maintaining solid business fundamentals and capitalizing on growth opportunities in various market conditions. This makes the company attractive both to investors seeking security and to those focused on long-term value growth.

Valuation Perspective

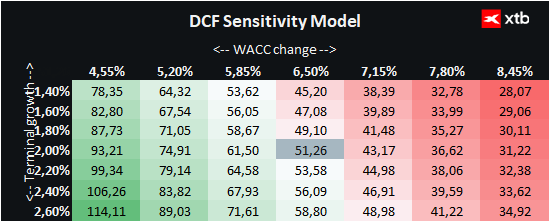

We present a DCF-based valuation of Comcast for informational purposes only; it should not be considered an investment recommendation or precise valuation.

The valuation is based on the base-case revenue and financial performance forecast. A constant WACC of 6.5% was assumed throughout the forecast period. Terminal value was estimated using a conservative 2% growth rate. Other financial parameters were averaged from the last five years to provide a realistic view of the company’s financial situation.

Based on this, Comcast’s fair value per share is approximately $51.26, implying potential upside of 83% compared to the current market price of $27.95. The valuation takes into account various risks, including changing market conditions, increasing competition, and macroeconomic challenges. Comcast’s long-term success will depend on maintaining stable growth, effective cost management, and continued development of its network infrastructure and media service offerings.

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Boeing gains amid news about potential huge 737 MAX order from China 📈

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

Bitcoin loses the momentum again 📉Ethereum slides 5%

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.