The biggest company on Wall Street, Microsoft (MSFT.US) provided better than expected results on almost every measure and very strong performance of Azure and Copilot make investors believe in capitalizing AI trend. Alphabet (GOOGL.US) performance were also very strong, with strong Google Cloud and Google Ads momentum, driving net results 57% higher YoY. Intel (INTC.US) earnings were higher than expected but only slightly higher than expected sales, disappointing guidance with no changes in dividend policy pressured shares, which lose more than 8% after-market hours. Here are key facts and commentary.

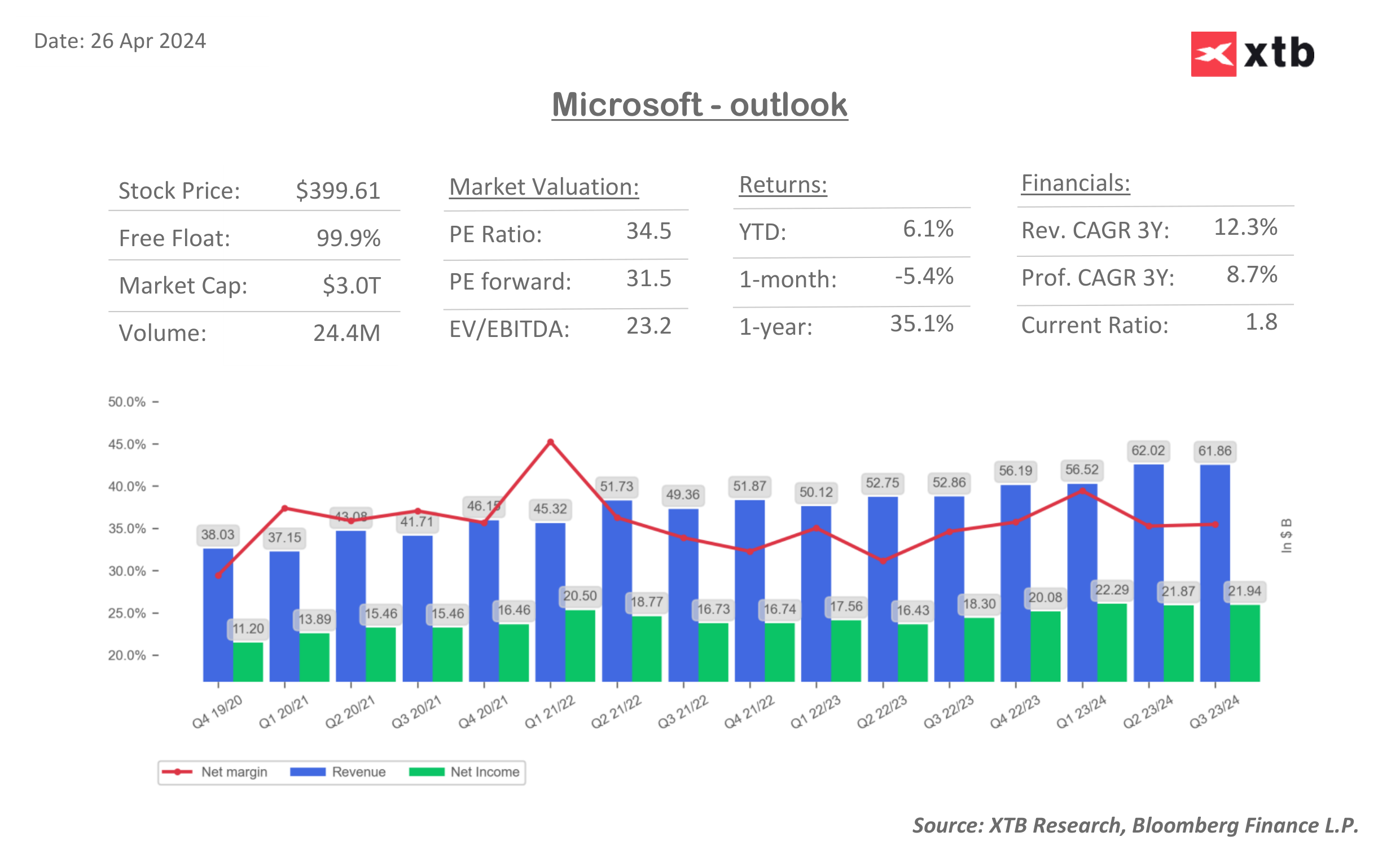

Microsoft (MSFT.US) - Outstanding Azure growth and AI Copilot building wide moat

- Revenues: $61.9B vs $60.9B exp. (17% YoY)

- Earnings per share (EPS): $2.94 vs $2.84 exp.

- Net income: $21.94 billion vs $18.30 billion during Q1 2023

- Microsoft Cloud revenue: $35.1B vs $33.93B exp. (23% YoY, 31% YoY for Azure)

- Intelligent Cloud: $26.71B vs $26.25B exp.

- Productivity revenue: $19.57B vs $19.54B exp.

- Personal computing: $15.58B, vs. 15.07B exp.

Market positively responded to Microsoft CEO, Nadella comments of 'new era of AI transformation, driving better business outcomes across every role and industry' as Microsoft earnings showed significant double-digit growth despite almost $3 trillion market cap.

- Microsoft revenue from Azure and cloud services grew 31% on the yearly basis vs 30% in the Q4 2023 quarter. Analysts (Street Account) expected 28.6%. The company introduced surface PCs in Q1 with access to Copilot chatbot and started selling its Copilot AI add-on for small businesses with subscriptions to Microsoft 365 software during Q1.

- Microsoft hired Mustafa Suleyman, co-founder of artificial intelligence lab DeepMind, to run a new AI group, acquiring also a lot of specialists from the startup Inflection in a deal worth $650 million. Investors may see it as a signal of a building wide business moat.

- Gaming Q1 (fiscal Q3) gaming revenues were 51% higher YoY (55% from Activision Blizzard). Xbox content & services revenue came inn 62% higher YoY (61% from Activision Blizzard) but Xbox hardware sales declined 31% YoY.

Source: xStation5

Source: xStation5

Source: XTB Research, Bloomberg Financial LP

Source: XTB Research, Bloomberg Financial LP

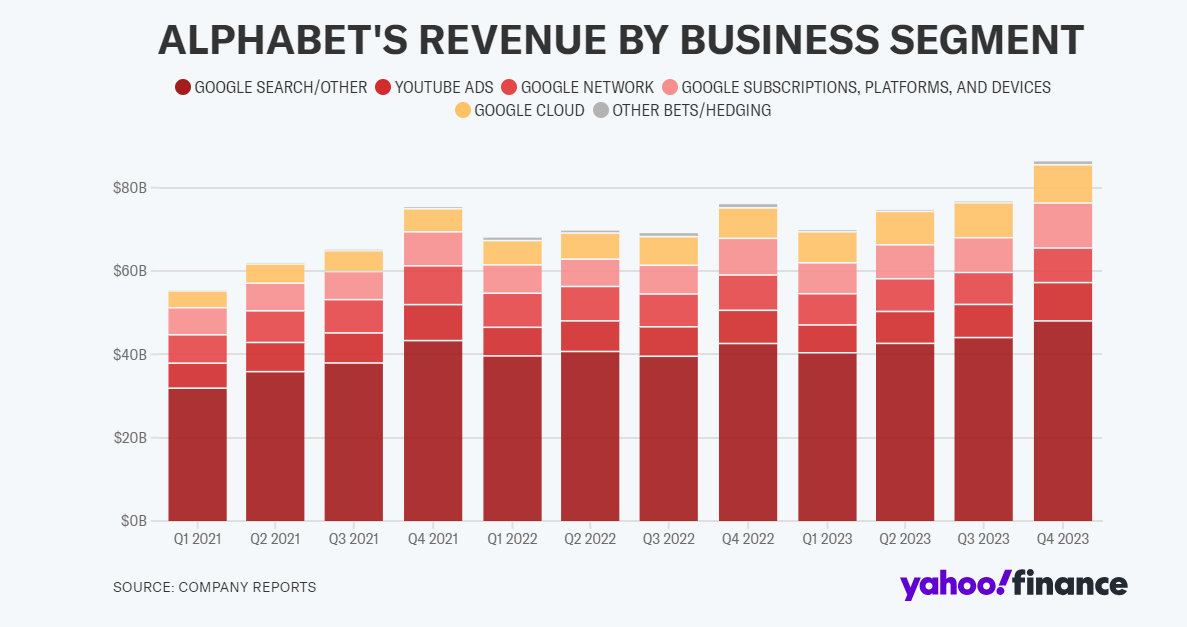

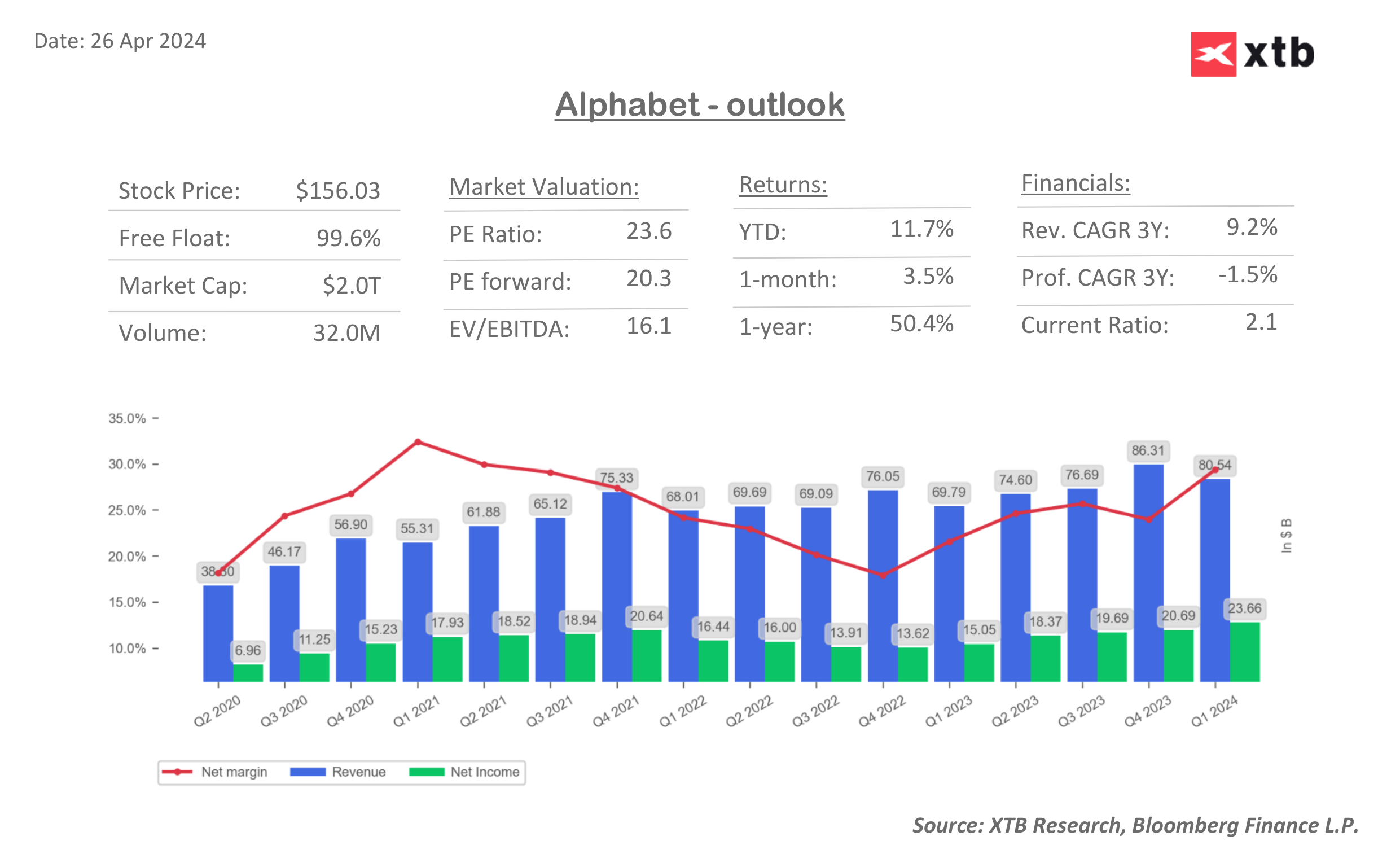

Alphabet (GOOGL.US) - Strong Google Ad performance with profitability catalysts from AI and Cloud

- Revenues: $80.54B vs $78.7B expected and $69.8B in Q1 2023 (15% YoY)

- Earnings per share (EPS) $1.89 vs. $1.51 exp. and $1.17 in Q1 2023

- Net income:$23.66B vs $15.05B in Q1 2023 (57% YoY)

- Google Ad revenue: $61.66B vs.$60.18B exp. and $54.55 in Q1 2023 (13% YoY)

- Google Cloud revenue: $9.57B vs. $9.37B exp. (28% YoY)

- YouTube revenue: $8.09B vs $7.73B exp. (21% YoY)

- Others: $495M vs $372.4M exp.

- Operating income: $25.47B vs $22.4B exp.

Google CEO, Sundar Pichai, said the company has clear paths to monetize AI breakthroughs. Through such channels as advertising, cloud and subscriptions. Looking at Q1 earnings, investors have no reason to don't believe in it. Alphabet’s Board authorized a repurchase program up to an additional $70.0 billion. The company declared the first ever cash dividend of 0.2% per share due to very strong performance of Google Search, YouTube and Cloud.

- Google Cloud revenues risen in high-pace, but the growth is still lower than Azure (31% YoY), even despite much lower scale of Google Cloud operations. Looking at Google overall, as a business, we may assume, that the company will be beneficiary of eventually further economic development as Google Search see almost no meaningful rivals on the horizon, and Google Ads business fundamentals are constantly improving with additional catalyst from AI and Cloud on profitability

- Despite that, ad business (fundamental for Google) is very, very strong with YouTube surpassing 20% YoY dynamics and strong overall ad sales. What's even more important to investors is that the company is bigger, but with rising sales also profitability rises. EBIT margin were 47% higher YoY and net income were 57% higher YoY

Source: Alphabet, YahooFinance

Source: Alphabet, YahooFinance Source: xStation5

Source: xStation5

Source: XTB Research, Bloomberg Financial LP

Source: XTB Research, Bloomberg Financial LP

Intel (INTC.US) - Lower than expected guidance and overall weak capitalizing on AI

- Revenue: $12.72B vs $12.71B exp.

- Adjusted EPS: $0.18 vs $0.13 exp. (GAAP loss of $(0.09) vs ($0.15) exp.

- GAAP Net Loss: $381M

- AI and Data Center revenues: $3.04 billion (5% YoY)

- Client Computing revenue: $7.53B, up (31% YoY)

- Mobileye revenue: $239 million

- Non-GAAP Gross margin: 45.1% vs 44.5 exp. (41% GAAP)

The company commented that it's confident in plans to drive quarterly growth momentum over 2024 and maintained the quarterly dividend at $0.125 per share. But the guidance is disappointing for Wall Street, as 5% growth in AI and Data Center shows definitely a very slow business pace (amid fast-growing peers). Intel CEO Pat Gelsinger underwhelmed on revenue outlook. Intel expects Q2 non-GAAP EPS of $0.10 per share on revenue between $12.5 billion and $13.5 billion vs analysts expected Q2 earnings of $0.26 EPS and $13.59 revenues (CapitalIQ). Markets see no huge business catalyst, despite a few billions from AI and data center sales. Intel expects 200bps of full-year gross margin improvement.  Source: xStation5

Source: xStation5

Kongsberg Gruppen after earnings: The company catches up with the sector

Market wrap: European indices attempt a rebound after Wall Street’s record selloff 🔨

Morning wrap: Tech sector sell-off (06.02.2026)

Amazon shares tumble 10% as investors recoil at the price of AI dominance

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.