After yesterday's stock price rally, investors today continue to buy Tesla (TSLA.US) shares, which were further supported by Elon Musk's comments. The company's stock is gaining almost 7% today and is known for its price sensitivity to comments from its founder and major shareholder, Elon Musk. What's more, Musk's comments came at the 'right' time, after the company reported slightly higher-than-expected vehicle deliveries in the second quarter of the year. As a result, the stock is on track today to erase completely the declines it has recorded since January 1, 2024.

- Musk, however, does not seem to be referring directly to car sales and, commenting on the stock price rally, looked to the distant future. He conveyed that Tesla in the future will prove to be a leading developer of Optimus humanoid robots and a supplier of 'Robotaxi' autonomous cars. As a result, he pointed out - all those playing against Tesla in the long term are 'doomed to fail'.

- For Tesla, the most important issue remains the effectiveness of this potential expansion of its business into the robotaxi and automated robot segments. Musk's far-reaching plans for the company's future lay the groundwork for potentially high valuations for the company, due to the innovative nature of the changes being made, as well as Tesla's freedom from potential fluctuations in the EV segment. In his narrative, Elon Musk clearly equates Tesla to technology companies rather than auto manufacturers.

- At the same time, a potential bearish signal for stocks in the short term could be the news of the sale of a stake in Tesla by Nancy Pelosi, whose investment decisions remain among the most watched among members of Congress. The estimated value of the deal is between $250,000 and $500,000.

Tesla's shares have rallied nearly 75% from local lows in April 2024. The company will report quarterly financial results for Q2 2024, July 23. A conference call is scheduled for August 8, where the company will unveil a 'Robotaxi' vehicle. After Musk comments, Investors may expect future, additional and potentially meaningful cash flows from Optimus and Robotaxi business lines, however as for now, the company does not sell either of that products.

Tesla (D1 interval charts)

Tesla has broken out of the upper limits of the downtrend, initiated in July of the previous year, after this week's dynamic increases. The company's stock price is approaching local highs from December 2023, at $264 per share. Source: xStation5

As we can see above, RSI signals overbought conditions at 84 level and previous price reactions may signal a local peaks. However, Tesla is now one of the best US Big Tech performer and may attract investors, focusing on product updates and Elon Musk comments, as well as the company events. Also, on the chart, we can see a reversed 'head and shoulders' price pattern. Source: xStation5

As we can see above, RSI signals overbought conditions at 84 level and previous price reactions may signal a local peaks. However, Tesla is now one of the best US Big Tech performer and may attract investors, focusing on product updates and Elon Musk comments, as well as the company events. Also, on the chart, we can see a reversed 'head and shoulders' price pattern. Source: xStation5

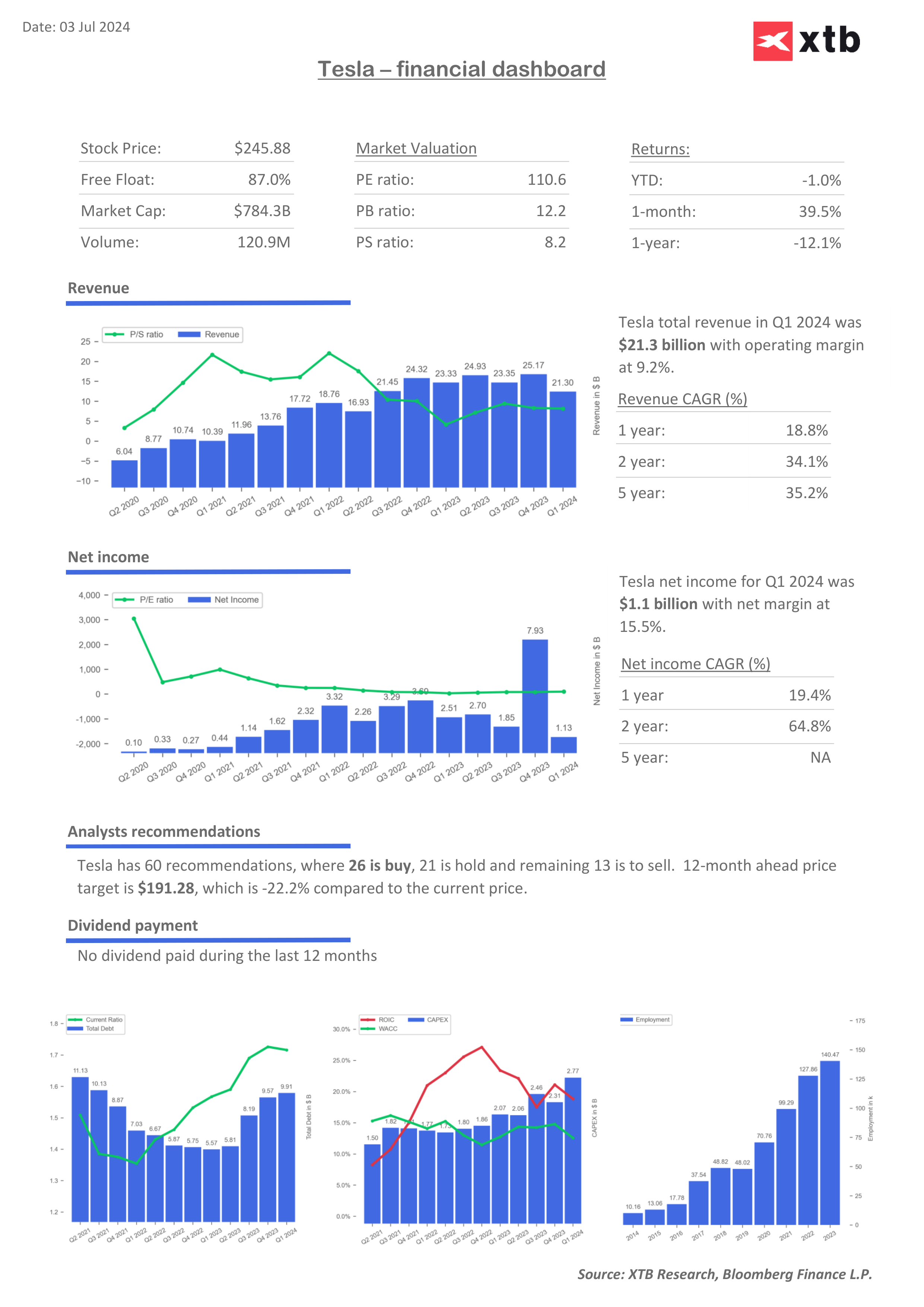

Source: XTB Research, Bloomberg Finance L.P.

Source: XTB Research, Bloomberg Finance L.P.

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.