DE30

Let’s start today’s analysis with the German DAX (DE30). Looking at the D1 interval, we can see that the buyers managed to reach fresh all time high this week. However, the excitement did not last long. Sellers took the advantage and the index pulled back. Should sellers manage to hold the price below the resistance at 15,515 pts, a bigger downward correction may occur. In such a scenario the key support to watch lies near the 14,800 pts, where the lower limit of 1:1 structure as well as previous price reactions are located. On the other hand, if the price returns above the aforementioned 15,515 pts handle, a continuation of an upward trend is possible. In this case the 15,720 pts level could be the next resistance to watch.

DE30 D1 interval. Source: xStation5

DE30 D1 interval. Source: xStation5

US100

Looking at the technical situation on the US tech index - Nasdaq (US100), one can see that the index broke the upper limit of the local downward channel. Retest of an 13,420 pts support occurred later on and index resumed upward move. Looking at the H4 interval, the market bulls are approaching the next major resistance near 13,735 pts. Should buyers manage to uphold current momentum and break above the aforementioned resistance, the move towards an all time high at 14,060 pts is possible. On the other hand should sellers manage to hold the price below 13,735 pts, the downward correction may be on the cards.

US100 H4 interval. Source: xStation5

US100 H4 interval. Source: xStation5

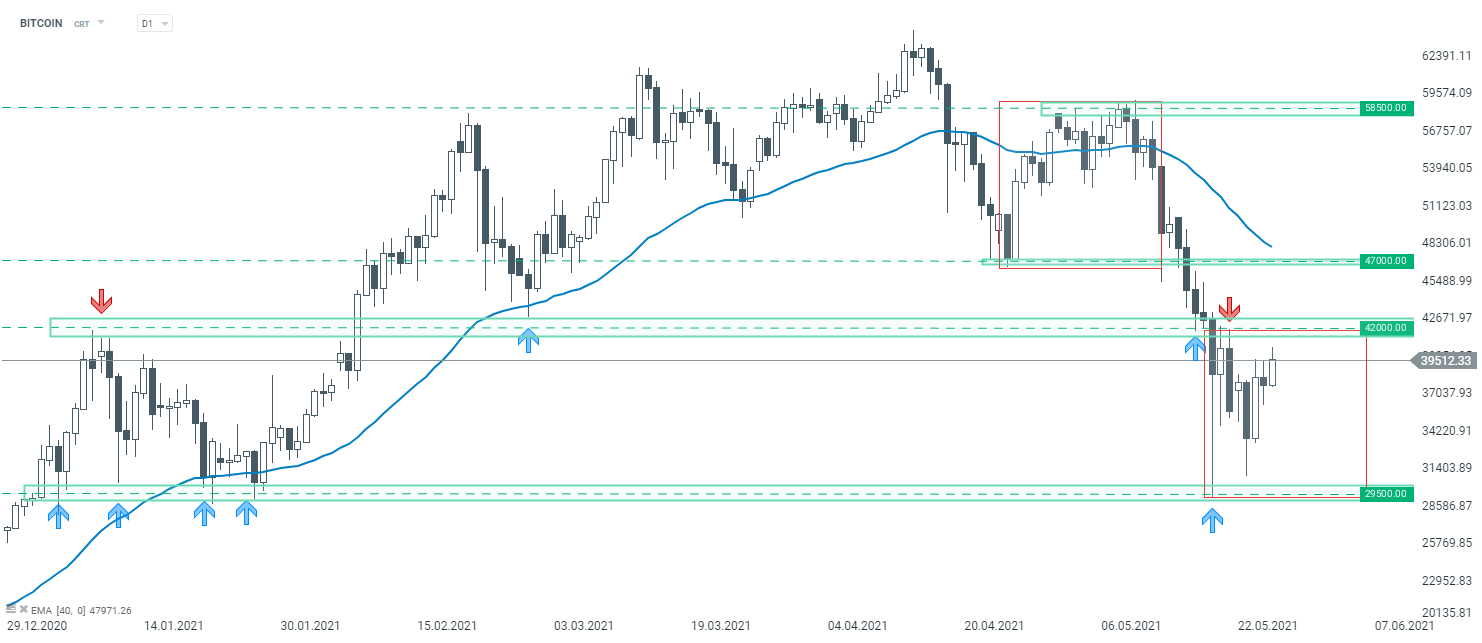

BITCOIN

Last but not least, let's take a look at the Bitcoin chart. The recent solid sell-off in crypto has pushed Bitcoin below 30,000 USD. However, buyers appeared at 29,900 support and the strong rebound came up. The resistance area at 42,000 USD is the key level in the short-term perspective. It is marked with the previous price reactions and the upper limit of 1:1 structure. According to the Overbalance methodology, as long as the price sits below, the main trend remains downward. However, if the buyers manage to break above it, the area near 47,000 USD will be the next resistance to watch.

BITCOIN D1 interval. Source: xStation5

BITCOIN D1 interval. Source: xStation5

Daily summary: Stocks Climb Despite Geopolitical Chaos, Dollar Retreats (05.01.2026)

The coup in Venezuela boosts Europe and local defense stocks⚔️

Daily Summary: Massive Gains in U.S. Indices Completely Wiped Out

US Open: A Powerful Start to the New Year for Nasdaq!

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.