- Wall Street opens higher after lower than expected CPI in the US

- US500 futures on this year high above 4500 points

- Barkin from FED says that inflation is still too high

Wall Street opens with strong gains after lower than expected CPI figures. S&P 500 gains 0.8% and Nasdaq 100 is up by 0.5%. CPI figures show that US inflation significantly cooled last month, offering hope that the Federal Reserve can end its aggressive interest-rate hikes after July’s meeting.

The CPI rose by 3% y/y, with a 0.2% increase from May. Excluding food and energy, the core CPI rose by 0.2% from the previous month and 4.8% y/y. Treasury yields dropped, stock futures rose, and the dollar slid in response to the report. The likelihood of an additional Fed rate hike after this month dropped below 50%. Although price pressures have reduced since last year's peak, they remain above the Fed's target, leading policymakers to consider raising interest rates again at their upcoming meeting. The slowdown in overall inflation can be attributed to the comparison with June 2022, which experienced a surge due to rising energy prices following geopolitical events.

The CPI rose by 3% y/y, with a 0.2% increase from May. Excluding food and energy, the core CPI rose by 0.2% from the previous month and 4.8% y/y. Treasury yields dropped, stock futures rose, and the dollar slid in response to the report. The likelihood of an additional Fed rate hike after this month dropped below 50%. Although price pressures have reduced since last year's peak, they remain above the Fed's target, leading policymakers to consider raising interest rates again at their upcoming meeting. The slowdown in overall inflation can be attributed to the comparison with June 2022, which experienced a surge due to rising energy prices following geopolitical events.

After the publication, FED Barkin stated:

- Barkin says US inflation is still too high despite a slowdown in June

- Barkin warns that if the Fed backs off too soon, inflation could return stronger

- Recent data shows US inflation in June was the slowest in over two years

- Most Fed officials expect interest rates to rise due to persistent price pressures and a strong labor market

- Barkin emphasizes the risks of premature policy easing

- Fed Chair Jerome Powell is open to two consecutive rate hikes this year

US500 index is currently trading at 4512, marking the highest level reached this year. The index recently broke through a key resistance line at 4500, indicating bullish momentum. The next resistance level to watch is around 4550. If the index manages to close above 4500 on a daily basis, the previous resistance at 4500 is expected to become a new support level. However, if the bullish scenario is invalidated and the index fails to maintain support above 4500, the next support level to monitor is approximately 4400.

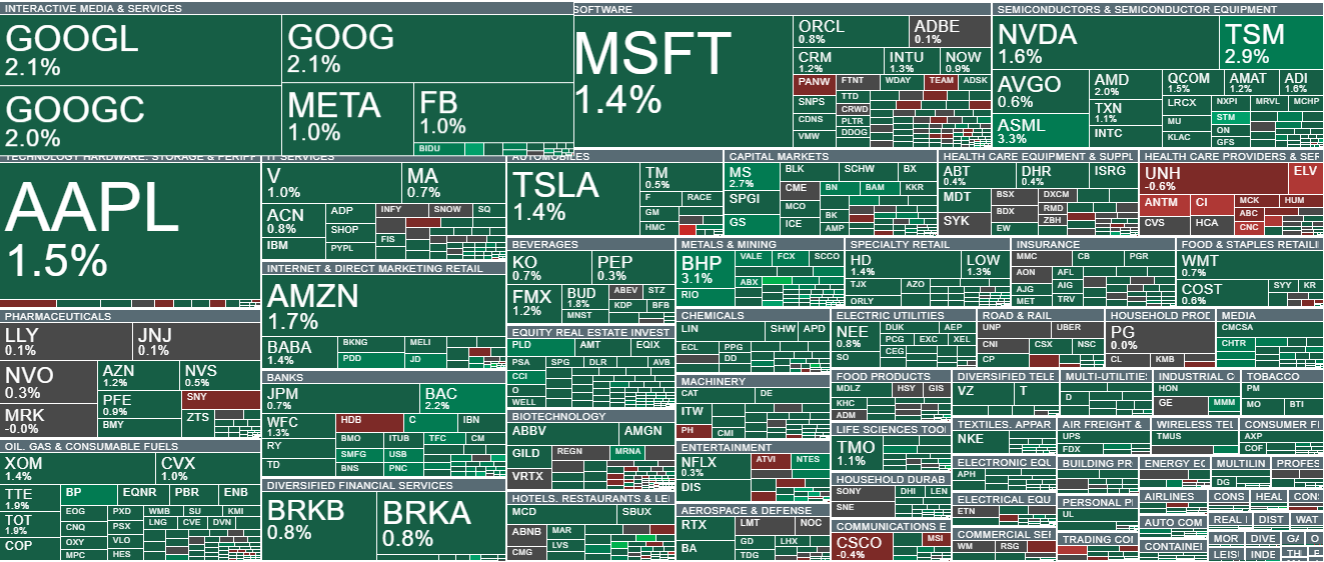

S&P 500 Index categorized by sector and industry, Software and Media&Services are among the biggest gainers so far. Size indicates market capitalisation. Source: xStation5

S&P 500 Index categorized by sector and industry, Software and Media&Services are among the biggest gainers so far. Size indicates market capitalisation. Source: xStation5

Company News:

- Domino’s Pizza (DPZ.US) climbs 10% on an agreement allowing US customers to order Domino’s products through the Uber Eats marketplace, with deliveries handled by Domino’s. Uber (UBER) shares are up 1.3%.

- GoodRx (GDRX.US) gains 7% after the drug-pricing comparison software company said it was partnering with CVS Health to launch a savings program that will help lower pharmacy out-of-pocket drug costs.

- Coty (COTY.US) shares jump 1.0% after the Wall Street Journal reported that Kim Kardashian was in talks to repurchase the minority stake of SKKN BY KIM, previously known as KKW Holdings, citing people familiar with the matter.

- JD.com (JD.US) and Alibaba (BABA.US) are among Chinese ADRs trading higher in the US after a report said China’s Premier Li Qiang met with executives from internet companies including JD and Meituan on Wednesday. JD is up 3% ahead of the bell, BABA gains 1.5%.

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.