- Wall Street’s indices continue their rally after PPI decreased close to 0%

- Delta Airlines and Pepsico kicked off the earnings season with great results and positive guidance

- US-listed Chinese stocks gain on hope for ending unilateral US sanctions

Decreasing inflation and a positive start of earnings season fuel further gains on Wall Street which aiming at all-time highs probably this year. PPI decreased significantly pointing that CPI may fall even lower in the coming months. Moreover, Delta Airlines and PepsiCo showed positive guidance, despite the fact that higher interest rates are coming in the US.

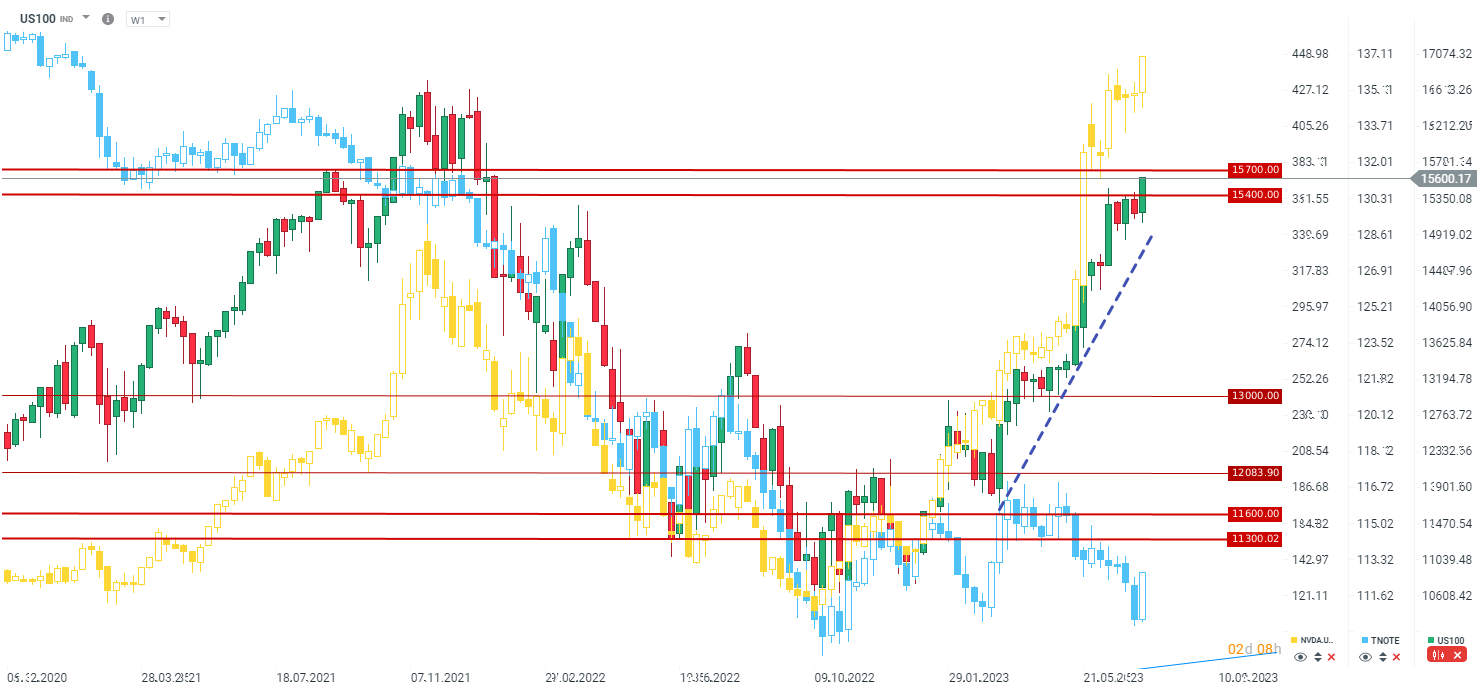

Following a 4-week consolidation, the US100 (Nasdaq 100) futures break an important resistance of 15 400 points and reached their highest since mid-January 2022! It is worth mentioning that the first half of this year was the best in history in terms of return, and the level of US100 is less than 9% short of all-time highs. Another important resistance at 15 700 points should not be a strong barrier to break if the results of tech companies surprise positively. However, the first major results of tech companies will be published in the coming weeks. On the other hand, the results of the banks, which will start publishing tomorrow, will be very important for the S&P 500 index.

NVidia indicates that the technology index may continue its rally. US bond prices (TNOTE - blue chart) have started a rebound which shows a lot of optimism about a further decline in inflation. Source: xStation5

NVidia indicates that the technology index may continue its rally. US bond prices (TNOTE - blue chart) have started a rebound which shows a lot of optimism about a further decline in inflation. Source: xStation5

Company news:

- Delta Airlines (DAL.US) is opening higher and gained nearly 4% as the company reported not only stronger-than-expected results but also the best-ever quarterly revenue and earnings. Revenue for Q2 2023 reached $14.6 billion vs $14.4 billion expected and EPS came out at $2.68 vs $2.41 expected. Due to the rebound of the flight demand, the company points to better results in the future, raising its full-year earning to $6-$7 versus $5-$6 earlier. The company is up 3.8% at the start of the session and nearly 50% up this year.

- Pepsico (PEP.US), the beverage and food company increased more than 2% at the opening bell after printing better-than-expected results. The company showed an adjusted EPS at $2.09 versus $1.96 expected on $22.32 billion revenue vs $21.73 billion expected. The company also raised its full-year guidance. It is worth mentioning that Pepsico is listed on Nasdaq.

- Alphabet (GOOG.US) gained about 1.5% at the start as the company released its Bard AI chatbot in the European Union and Brazil.

- Coinbase (COIN.US) fell about 1% as Barclays decided to downgrade the company to underweight from equal, ahead of the earnings report.

- Chinese companies, listed on US exchanges rise in early trading as China urges US to end unilateral sanctions on Chinese companies which may help with economic and international trade cooperation. Alibaba (BABA.US) gains 1%, Baidu (BIDU.US) is up 1.3% and JD.com (JD.US) increases 2.8%

Delta is up nearly 50% this year and is about 30% short of an all-time high from 2019. Source: xStation5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Boeing gains amid news about potential huge 737 MAX order from China 📈

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

BREAKING: Iran signals Europe will be 'a legitimate target' if EU joins war

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.