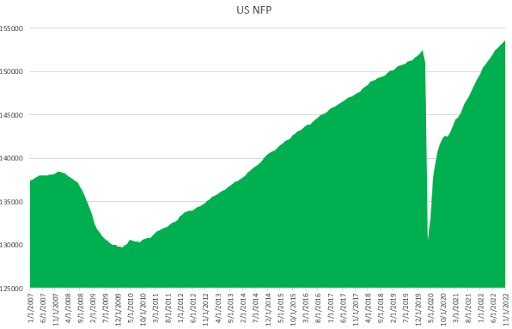

Highly anticipated NFP report was released at 1:30 pm GMT and showed the US economy unexpectedly added 263 k jobs in November, compared to 261k increase in October and well above market expectations of 200k. It is the lowest job gain since April last year, as the labour market is normalizing after the pandemic shock. Still, it continues to signal a healthy and tight market, above the pre-pandemic average of 150K-200K jobs created per month. Notable job gains occurred in leisure and hospitality, health care, and government while employment declined in retail trade and in transportation and warehousing. Monthly job growth has averaged 392K thus far in 2022, compared with 562K per month in 2021. Notable job gains occurred in leisure and hospitality (88K), including a gain of 62K in food services and drinking places; health care (45K); and government (42K), mostly in local government (32K). In contrast, employment declined in retail trade (-30K), namely general merchandise stores (-32K), electronics and appliance stores (-4K), and furniture stores (-3K); and in transportation and warehousing (-15K). Monthly job growth has averaged 392K thus far in 2022, compared with 562K per month in 2021.

The jobless rate remained unchanged at 3.7%, in line withmarket estimates. The jobless rate has been in a narrow range of 3.5% to 3.7% since March, suggesting that the tight labor market will likely continue to contribute to inflationary pressure in the world's largest economy for some time to come. The number of unemployed persons rose by 48 thousand to 6.01 million in November, while the number of employed decreased by 138 thousand to 158.5 million.

Closely watched wage growth rose to 5.10% YoY, after an upwardly revised 4.9% increase in October and above analysts' expectations of a 4.6% YoY.

Source: XTB, Macrobond

Source: XTB, Macrobond

Today's reading signals that the labour market is still tight and Fed will most likely remain committed to bringing down inflation with more rate hikes, however a lot will depend from US inflation reading which will be published on December 13.

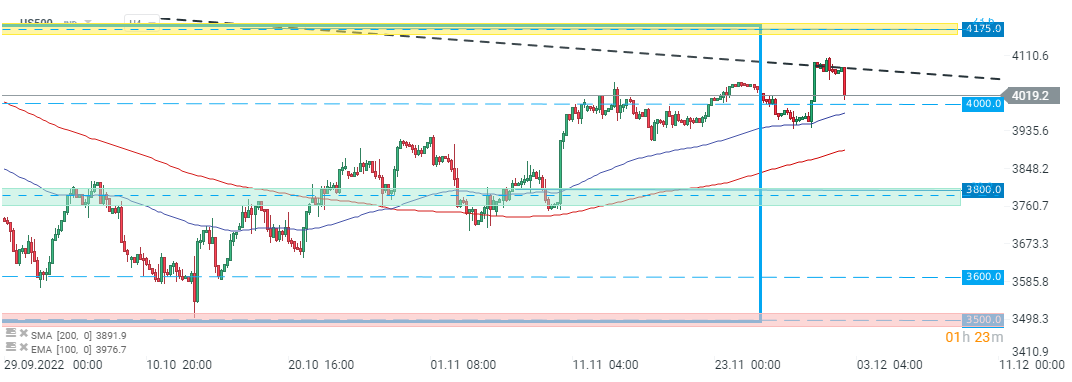

US500 failed ot break above long-term downward trendline and is heading towards major support at 4000 pts. Source: xStation5

US500 failed ot break above long-term downward trendline and is heading towards major support at 4000 pts. Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.