Summary:

-

US500 still near 3000 handle

-

Disappointing US retail sales data has little impact

-

Canadian CPI misses forecasts

Stock markets across the pond have begun the new session not far from where they ended the last with the major benchmarks still near recent highs and not too far from their record peaks. Some positive trade in Europe with several indices hitting new 2019 highs is helping to boost sentiment while the pound also appears to be focusing on the good at the expense of the bad as far as recent Brexit stories go.

US100 has retested prior resistance around 7980 that has attracted sellers once more. A break above there would target a move up to the all-time high of 8050. Source: xStation

The latest figures on consumer spending were quite a bit worse than expected with both the headline and core retail sales releases missing forecasts. The data was as follows:

-

US September advance retail sales M/M: -0.3% vs +0.3% exp. Prior revised to +0.6% from +0.4%

-

Ex autos: -0.1% vs +0.2% exp. Prior revised up to +0.2% from 0.0%

When the upwards revisions to the prior are taken into account they don’t look so bad but this is still the first decline in 7 months. The next Fed meeting is at the end of the month (30th Oct) and after this all the main economic releases are out. There is little doubting the notion that the US economy has slowed somewhat and is far from firing on all cylinders, but it remains to be seen whether this is enough to see an additional rate cut and hints towards another before the year is out.

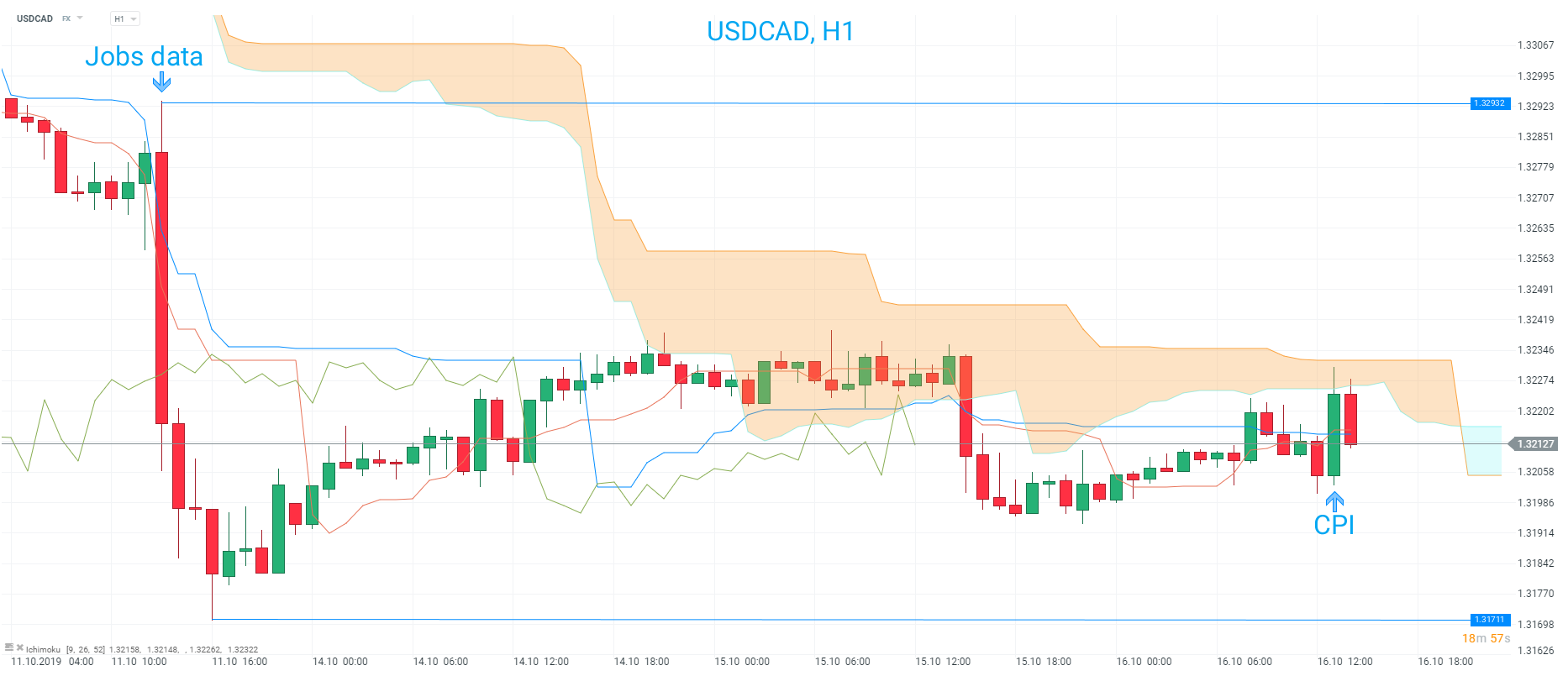

At the same time as the US data dropped we also got the latest look at price pressure north of the border with Canadian CPI coming in below forecasts. The CPI Y/Y remained at +1.9% despite expectations for an increase to 2.1% while the average of the 3 core measure came in at 2.1%. Overall these remain around the middle of the bank’s 1-3% target and while there was some initial weakness in the loonie, presumably on the headline miss, this has been subsequently pared somewhat.

USDCAD gained after the dual data releases but failed to break above the H1 cloud which resides around 1.3235. This is a possible region of resistance to watch going forward. Source: xStation

USDCAD gained after the dual data releases but failed to break above the H1 cloud which resides around 1.3235. This is a possible region of resistance to watch going forward. Source: xStation

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.