Why AMD’s Results Matter

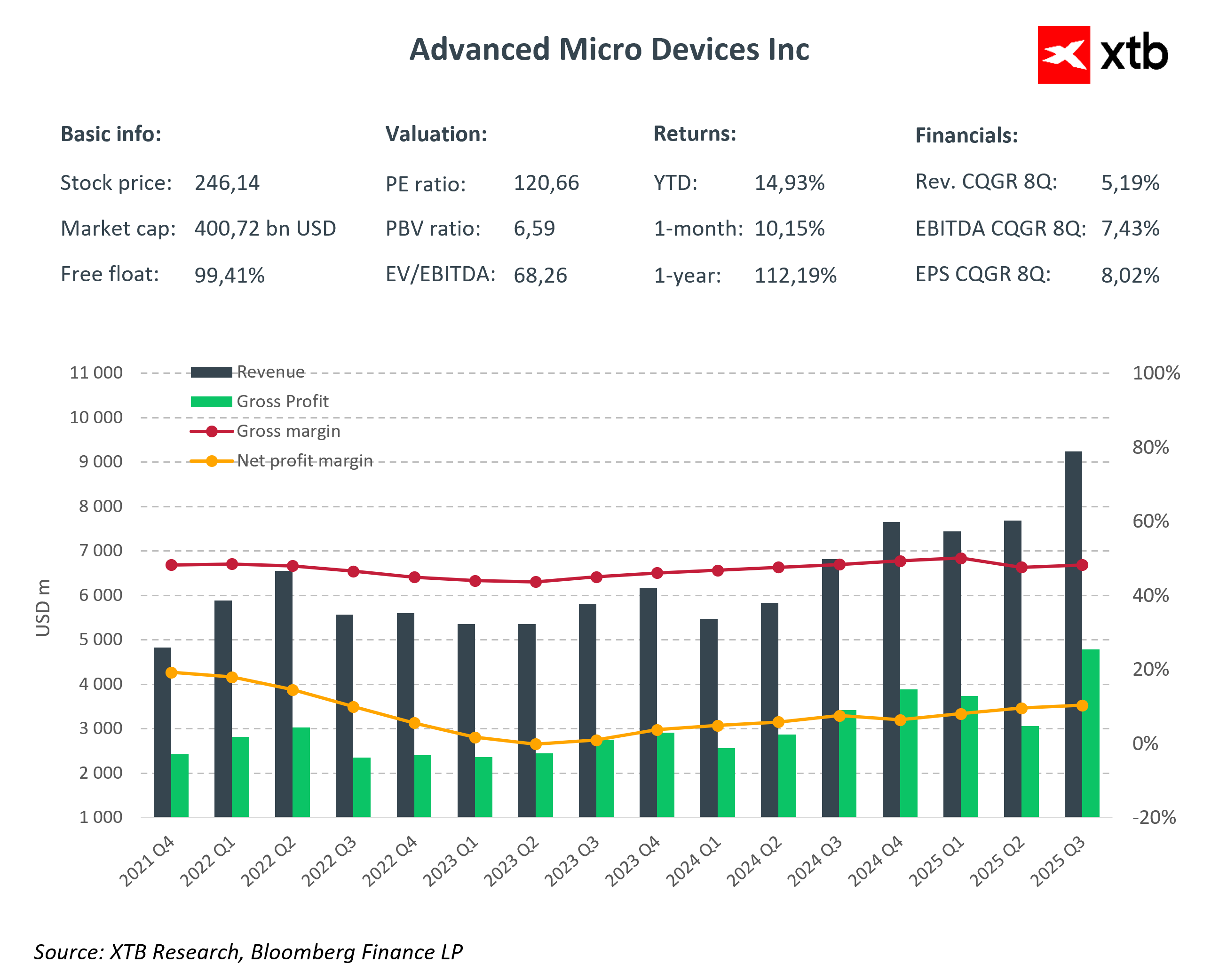

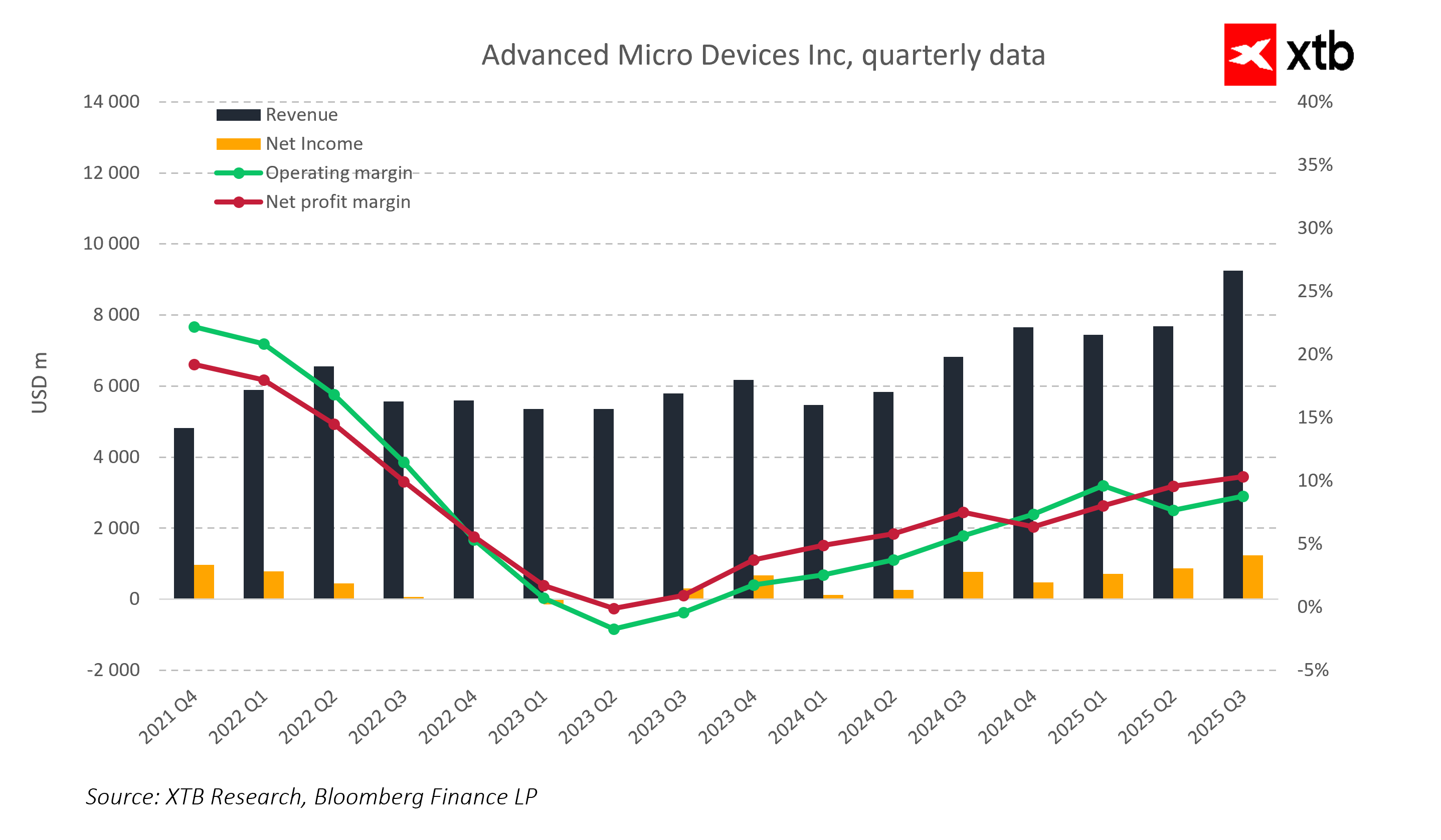

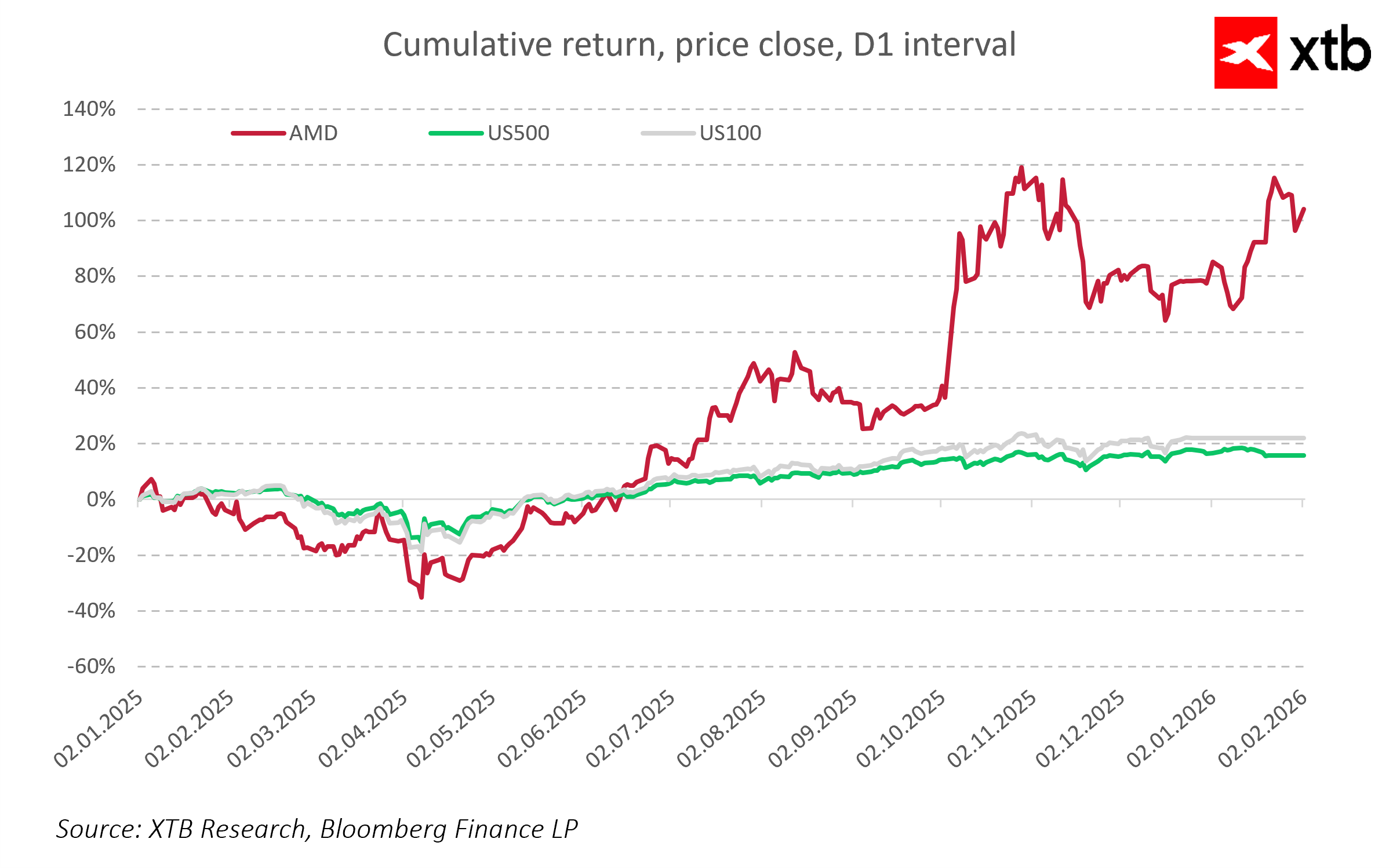

AMD enters earnings season as one of the key players in the global semiconductor sector. The company balances between the traditional CPU market and the dynamically growing GPU and AI accelerator segment, where it competes with giants such as Nvidia. After years of consistent expansion in data centers and increasing AI engagement, the market expects concrete evidence of AMD’s ability to maintain its competitive edge under conditions of high stock valuations, limited chip supply, and rising competition. Q4 2025 results will serve as a test of growth quality and will show whether the company can convert momentum in the CPU segment and developments in GPU and AI into tangible financial results while maintaining control over costs and investments in the future.

Q4 2025 Financial Forecasts

-

Adjusted EPS: 1.32 USD

-

Total revenue: 9.65 billion USD

-

Data center revenue: 4.97 billion USD

-

Gaming revenue: 855.3 million USD

-

Client (PC) revenue: 2.89 billion USD

-

Embedded revenue: 960.7 million USD

-

Operating income: 2.47 billion USD

-

Operating margin: 25.4%

-

Gross margin: 54.5%

-

CapEx: 231.4 million USD

-

R&D expenses: 2.16 billion USD

Q1 2026 Forecasts

-

Total revenue: 9.39 billion USD

-

Gross margin: 54.3%

-

CapEx: 213.9 million USD

CPU – The Core of the Traditional Market

AMD continues to gain market share in server processors, where its x86 chips show performance advantages over Intel. Intel’s supply constraints and growing demand for high-performance servers create an opportunity for AMD to further strengthen its position. Momentum in CPUs remains the main driver of revenue growth and a key factor the market will closely monitor.

GPU – Competing with Nvidia

In the graphics processor segment, AMD is still catching up to Nvidia, particularly in the server GPU market. The launch of new Instinct MI455 chips and preparations for Helios deployments for OpenAI show that the company is targeting the growing demand for AI workloads. The pace of GPU adoption in data centers will be an important indicator of AMD’s ability to compete in the artificial intelligence segment.

AI and Collaboration with OpenAI

AMD has invested significant resources in AI development, planning deployments of six-gigawatt systems for OpenAI. This partnership represents the first major test of AMD’s AI strategy and could define growth momentum in this segment. Key questions for the market include whether AMD will expand its AI customer base, how quickly it can scale deployments, and whether investments in GPUs deliver adequate returns.

Growth Dynamics and Competitive Analysis

AMD remains a leader in the server CPU segment, leveraging performance advantages over Intel and its rival’s production constraints. This allows the company to gain an increasing share of the data center market, where processor performance and energy efficiency are key selection criteria. In GPU and AI, AMD is still trailing Nvidia, but the OpenAI partnership and the development of new Instinct MI455 and MI400 models create a real opportunity for breakthroughs in server AI workloads. Helios deployments could be a milestone in AMD’s AI strategy, demonstrating how the company handles growing demand for generative AI. The market will closely watch revenue growth from data centers and GPUs, the effectiveness of AI deployments, the ability to expand the customer base in this segment, and the dynamics of the PC market, which continues to support revenues but may be constrained by rising memory costs and consumer demand fluctuations.

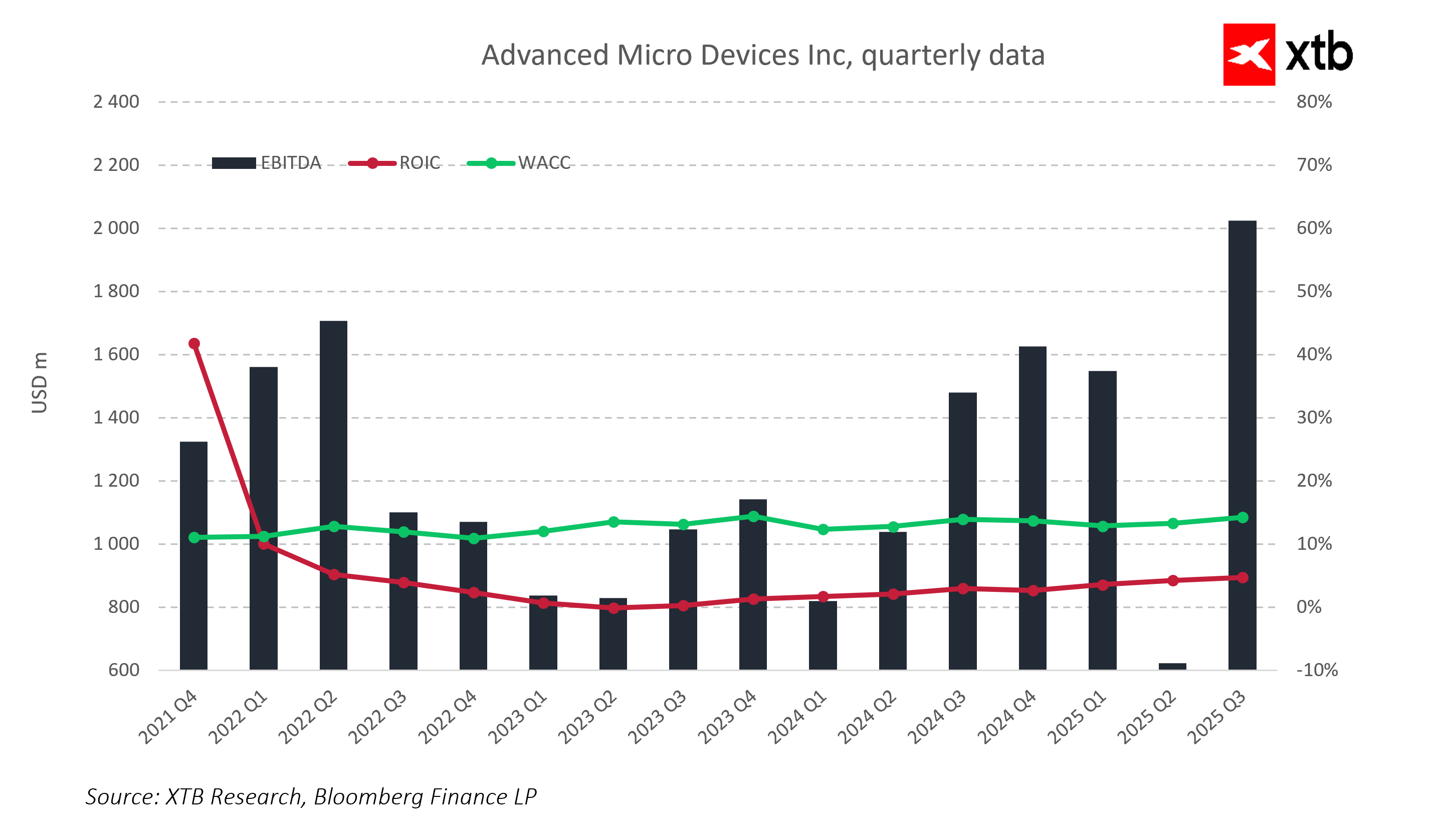

CapEx and Margins

Investments in data centers, GPUs, and AI are growing faster than revenues, creating cost pressures and requiring careful margin management. Investors will focus on management commentary regarding ROI, the schedule for AI GPU deployments, and the efficiency of new technology expenditures. Not only the speed of growth is important, but also its quality and AMD’s ability to scale operations profitably. Analyzing gross and operating margins alongside investments will help assess whether the company can effectively convert spending on data centers and AI into real financial results without compromising long-term profitability.

Investor Risks

Despite its strong market position, AMD faces several challenges. Competition in the CPU segment from Intel and in GPU and AI from Nvidia remains intense. Additionally, the entry of Arm into the server segment may increase pressure. High dependence on a key AI client, OpenAI, means the pace of partnership execution will significantly impact company results. Risks are further heightened by chip supply constraints, rising memory and energy costs for data centers, and potential regulatory and geopolitical changes that could affect raw material availability and operational costs.

Strategy Quality Test

Q4 2025 will be a test of whether AMD can effectively scale CPU and GPU sales in servers, expand AI partnerships with rising investment levels, maintain its competitive edge, and simultaneously generate free cash flow amid rising costs. The results of this quarter will show how well AI and data center investments translate into tangible financial outcomes, whether the company can maintain CPU growth momentum, expand its GPU and AI customer base, and control margins. Success in this quarter could confirm the effectiveness of AMD’s strategy, signaling to the market a durable competitive advantage and preparing the company for the next stage of value expansion.

Key Takeaways

-

AMD must prove it maintains performance advantages in server CPUs and can continue growing in the data center market.

-

The company must show that revenue growth from GPUs and AI deployments, including the OpenAI partnership, translates into tangible financial results.

-

AMD must demonstrate it can control costs amid rising investment levels, which will test the quality and efficiency of growth.

-

The company must prove that stability in PC and gaming segments allows aggressive AI and data center investments without excessive risk to cash flow.

-

Today’s Q4 2025 report will be an opportunity for AMD to confirm its lasting competitive advantage and show that its strategy drives further value growth.

AMD surges 14% AI mega-deal with Meta Platforms 📈

Market wrap: reshuffling in European markets after trade turmoil – what to watch? 🔎

Market Wrap: Europe is back to green 🇪🇺 📈 Business activity finally accelerating ❓

Blue Owl Capital: Local issue or a “Lehman moment”?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.