Bank of Japan is scheduled to announce its monetary policy decision during the next Asia-Pacific session. Timing is tentative but announcement is usually made around 3:00 am GMT. Bank is not expected to change the level of interest rates but it does not mean that it won't do any move.

Expectations

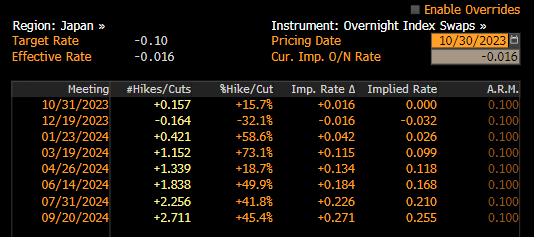

Bank of Japan is expected to keep its main interest rate unchanged at -0.10% at tomorrow's meeting. Such is a view of economists surveyed by Bloomberg and Reuters as well as pricing on the money markets. Swaps price in just 15% chance of a 10 basis point rate hike. The first full hike is currently priced in for March 2024. There is a growing feeling that the Bank of Japan may decide to make a move quicker than that. However, while rate hike at the coming meeting is unlikely, the Bank of Japan may announce some other actions.

Source: Bloomberg Finance LP

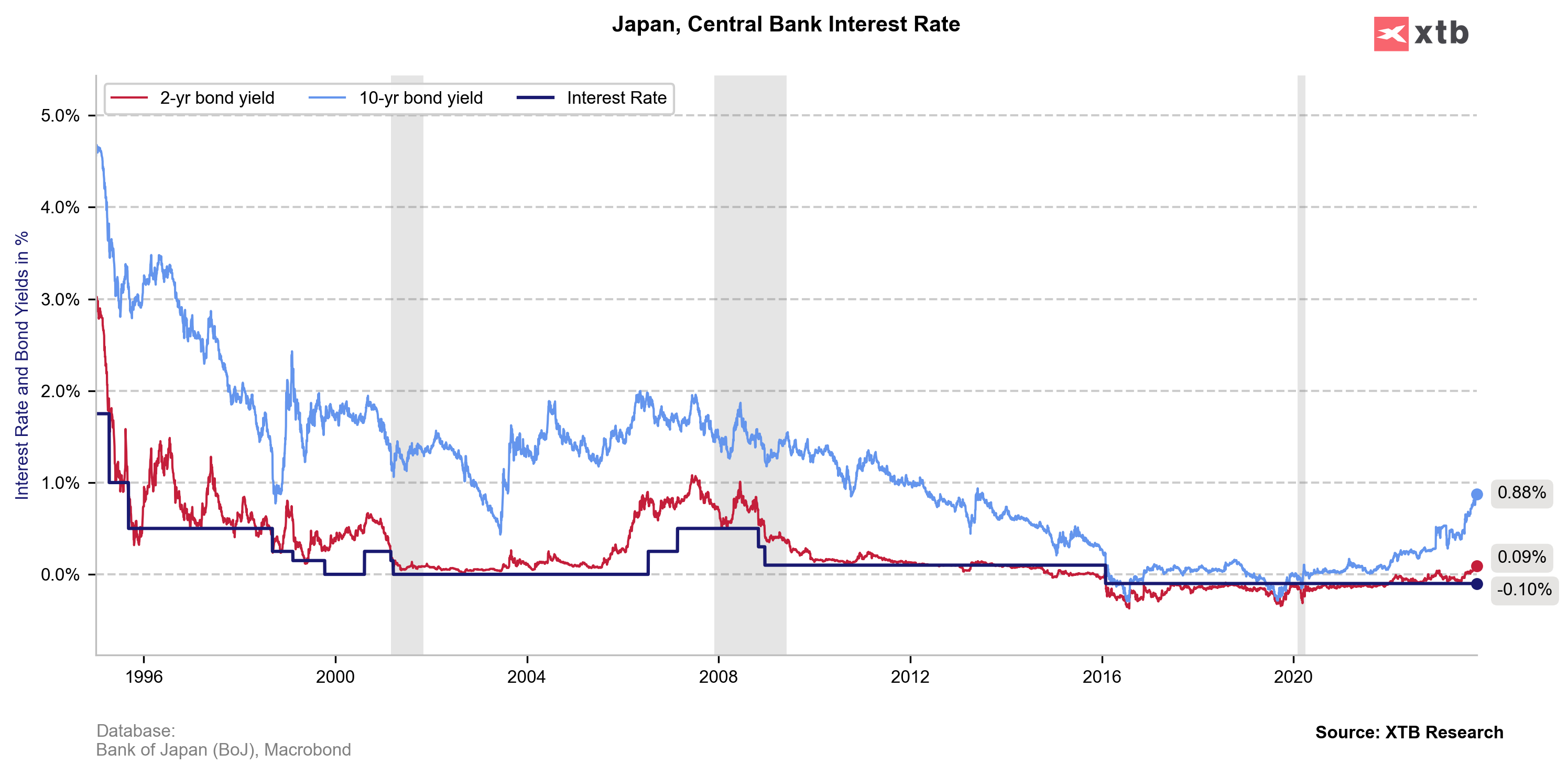

Yields keep pushing higher

An increase in yields can be seen all around the world and Japan is no exception. Bank of Japan maintained a 0% target on 10-year government yield with a 50 bps tolerance band. However, continued increase in yields caused BoJ to relax the band and allow for upside deviations of up to 100 bp. 10-year yield is currently sitting slightly below 0.90%. Maintaining such a band in a rising yield environment is costly and it cannot be ruled out that it will be relaxed further to allow long-term yields to rise above 1%.

Source: Bloomberg Finance LP, XTB Research

Source: Bloomberg Finance LP, XTB Research

A look at JPY

Japanese yen has been under pressure recently. USDJPY is trading near 150.00 - a level that was associated with Bank of Japan interventions. Tests of this level have been met with rapid reversals in the past therefore it could be a nice spot for a pullback. A hawkish surprise from Bank of Japan - for example relaxing band around target yield - should be JPY-positive, especially if it is accompanied with a hawkish guidance on rates. In such a scenario, USDJPY could see a strong pullback from current levels towards the lower limit of the channel. On the other hand, failure to deliver a hawkish message would likely trigger JPY weakness with pair pushing above 150.00 area.

Source: xStation5

Source: xStation5

Chart of the Day: USD/JPY highly volatile ahead of US CPI

Economic calendar: US CPI in the spotlight (13.02.2026)

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.