Weaker than expected harvests across the Europe lifted December Chicago Wheat futures on CBOT (WHEAT). Prices are higher more than 1% on a daily basis, extending 'trend-reversal' pattern amid improving technicals and fundamentals. The new market structure has potential to put further pressure on commodity short-sellers. The Commitment of Traders (CoT) report from 27 August signals short covering across bearish-headed speculators.

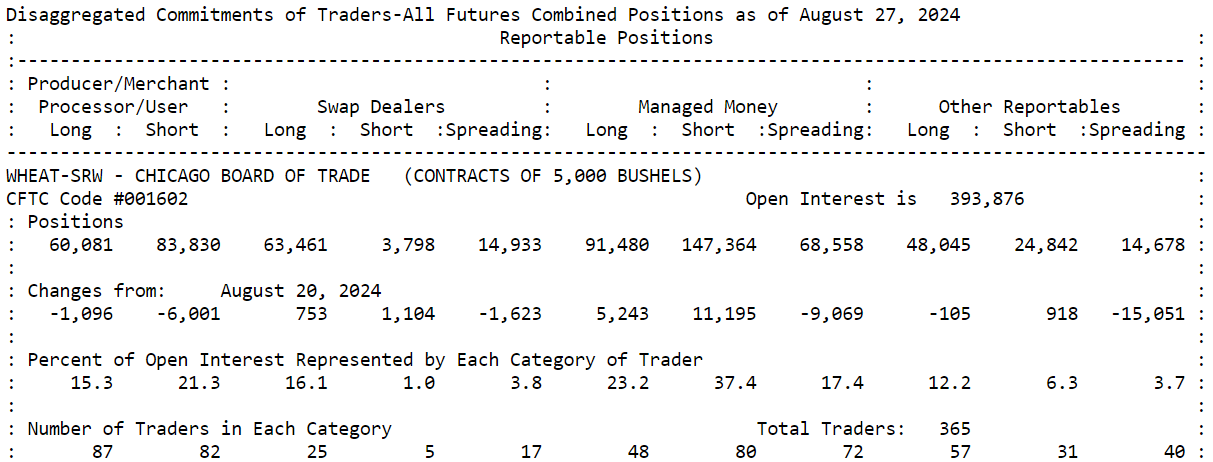

Managed Money held large bearish bets during risky summer months, but now are partially forced to short coverage. Source: Commitment of Traders

Managed Money held large bearish bets during risky summer months, but now are partially forced to short coverage. Source: Commitment of Traders

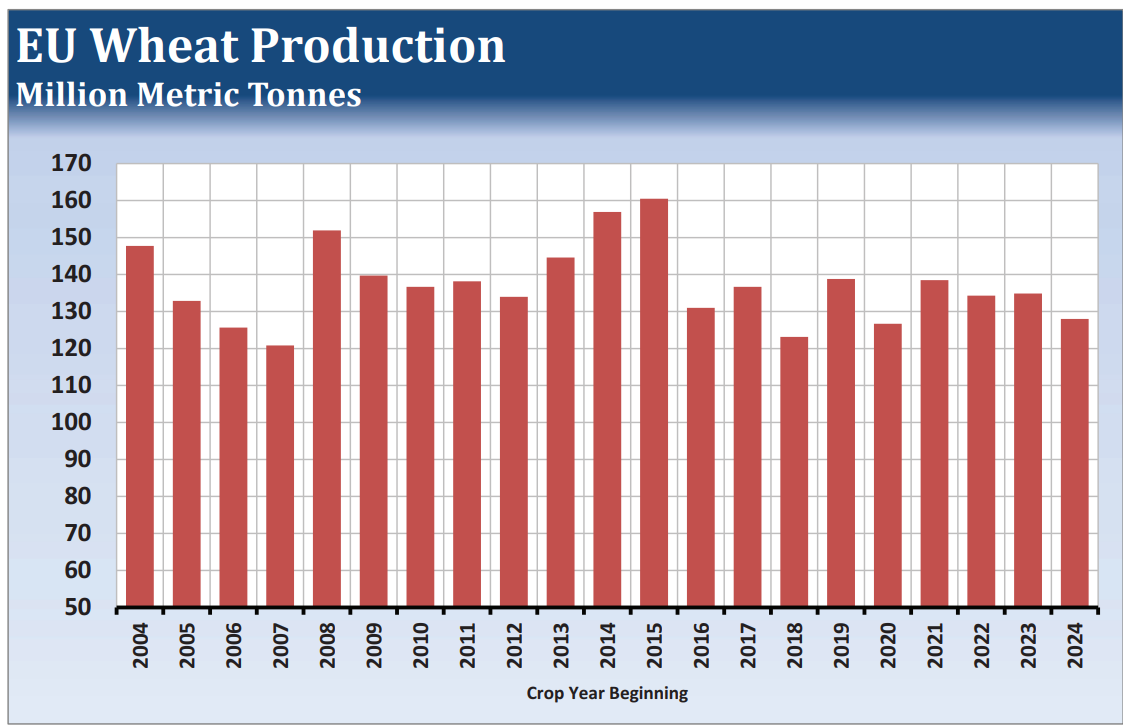

EU, Russia and Black-Sea region will report lower wheat production this year. EU Commission usable wheat production dropped from 121k tons to 116 k tons, expected now. Argus research also lowered France crops to 25.17 million tons this year (23% lower on a yearly basis). Also, Ukraine commented that production can drop 15% from current levels. Probably, US exports will be solid, amid lower supply across the major exporters.

European wheat production will be probably lower this year. Source: Hightower Report

European wheat production will be probably lower this year. Source: Hightower Report

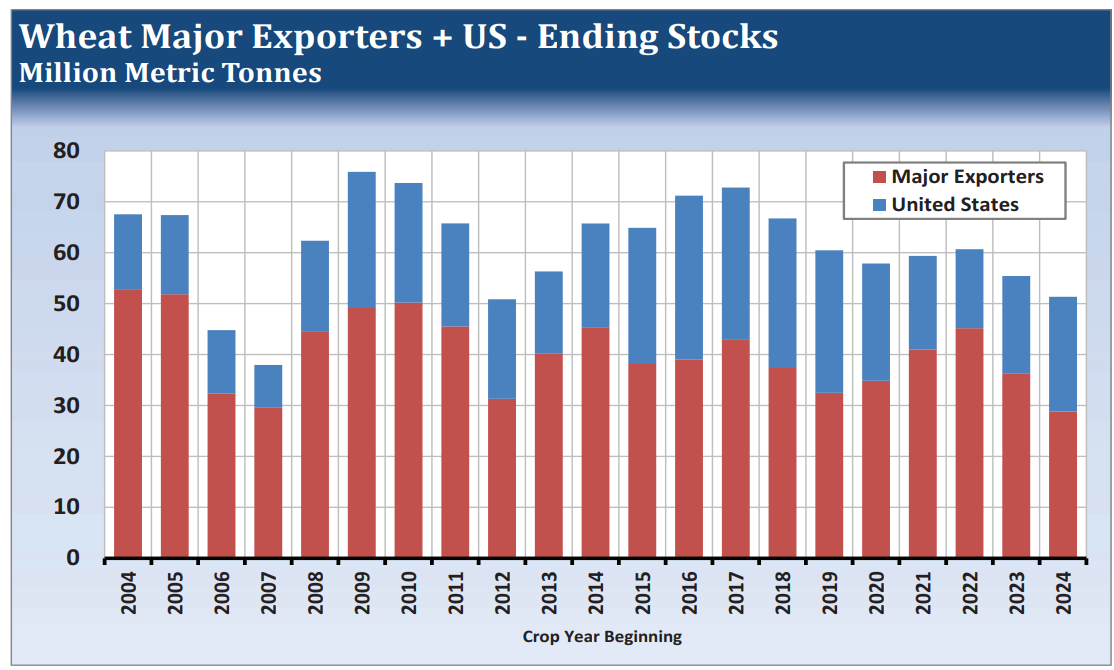

Major exporters ending stocks are down 3 years in a row, while US inventories are still solid. Source: Hightower Report

Major exporters ending stocks are down 3 years in a row, while US inventories are still solid. Source: Hightower Report

WHEAT (H1 interval)

Source: xStation5

Source: xStation5

Daily summary: Markets recover optimism at the end of the week

Three Markets to Watch Next Week (09.01.2026)

Rio Tinto and Glencore shake up the mining market🚨 Giants negotiate merger 🤝

Chart of the day: Silver rebound faces BCOM selling pressure🚨

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.