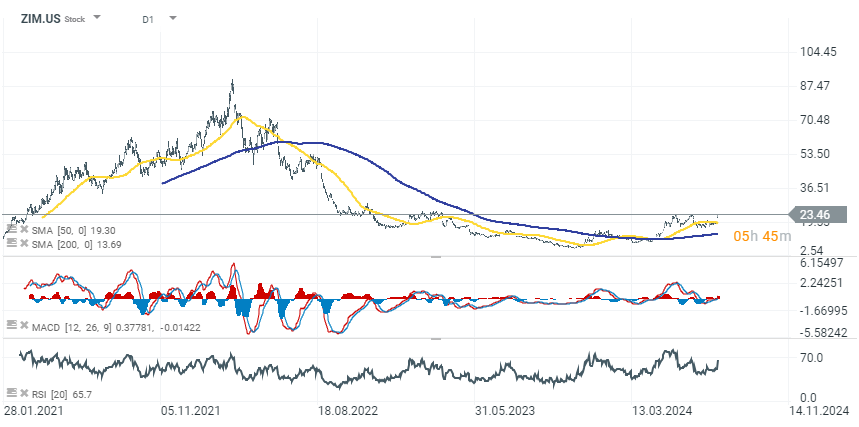

ZIM Integrated Shipping Services (ZIM.US) gains over 23% after the company reported strong second-quarter results that exceeded market consensus. The company saw a significant 48% year-over-year increase in revenues, reaching $1.93 billion. ZIM's carried volume grew by 11%, reaching a record 952 thousand TEUs, with a 40% rise in the average freight rate per TEU.

Highlights

- Total Revenues: $1.93 billion (a 48% year-over-year increase from $1.31 billion in Q2 2023)

- Net Income: $373 million (up from a loss of $213 million in Q2 2023)

- Earnings Per Share (EPS): $3.08 per share (up from a loss of $1.79 per share in Q2 2023)

- Adjusted EBITDA: $766 million (up 179% year-over-year)

- Carried Volume: 952 thousand TEUs (up 11% year-over-year)

- Average Freight Rate per TEU: $1,674 (a 40% year-over-year increase)

- Net Debt: $3.25 billion (up from $2.31 billion as of December 31, 2023)

- Updated Full-Year 2024 Guidance: Adjusted EBITDA of $2.6 billion to $3 billion, and Adjusted EBIT of $1.45 billion to $1.85 billion

The company raised its full-year 2024 guidance, now expecting adjusted EBITDA between $2.6 billion and $3 billion, and adjusted EBIT between $1.45 billion and $1.85 billion. This improvement reflects the company's strategic focus on increasing spot market exposure and capitalizing on favorable demand trends, particularly in the Transpacific trade. ZIM also declared a dividend of $0.93 per share, amounting to $112 million, representing 30% of second-quarter net income.

ZIM has made significant strides in upscaling its capacity and enhancing its cost structure, positioning itself for continued growth. With ongoing fleet modernization, including the delivery of fuel-efficient LNG-powered containerships, ZIM expects to achieve double-digit volume growth in 2024. Despite market challenges, the company remains confident in its ability to drive profitable growth in the upcoming quarters.

Source: xStation 5

Arista Networks closes 2025 with record results!

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.