The stock market has been riding a wave of uncertainty lately, with new tariffs and trade tensions shaking investor confidence. Volatility has become the new normal, leaving many wondering where to put their money to work. In times like these, it's important to focus on companies that can weather the storm and offer long-term potential. With that in mind, here are five stocks to keep an eye on right now each offering a unique opportunity amid the market turbulence.

The stock market has been riding a wave of uncertainty lately, with new tariffs and trade tensions shaking investor confidence. Volatility has become the new normal, leaving many wondering where to put their money to work. In times like these, it's important to focus on companies that can weather the storm and offer long-term potential. With that in mind, here are five stocks to keep an eye on right now each offering a unique opportunity amid the market turbulence.

Apple

After a 22% drop in the last month, including a 17% drop in Apple’s share price since President Trump announced his reciprocal tariffs at the start of April, is it time for a reprieve for the tech giant? Analysts are still expecting the company to generate revenues of $94bn in the first three months of the year, and the risk is to the upside since iPhone sales could be front loaded due to the tariff risks.

The stock has been under pressure due to its exposure to tariffs since China is a main location for the manufacturing of iPhones. However, Apple is one of the largest, cash rich and nimble firms in the world right now. Within days of Trump’s tariff announcement, the company announced that it was looking at moving its production base to India to avoid the worst of the tariffs. There is still the chance that Apple could negotiate an exemption or a lower tariff rate, like it did during Trump’s first term as President. The weakness in the stock price is a sign that the market has been pricing in the very worst-case scenario around tariffs. If that doesn’t materialize, then Apple may stage a decent recovery, potentially back to the $200-$220 level.

Source: xStation, XTB, Past performance is not a reliable indicator of future results.

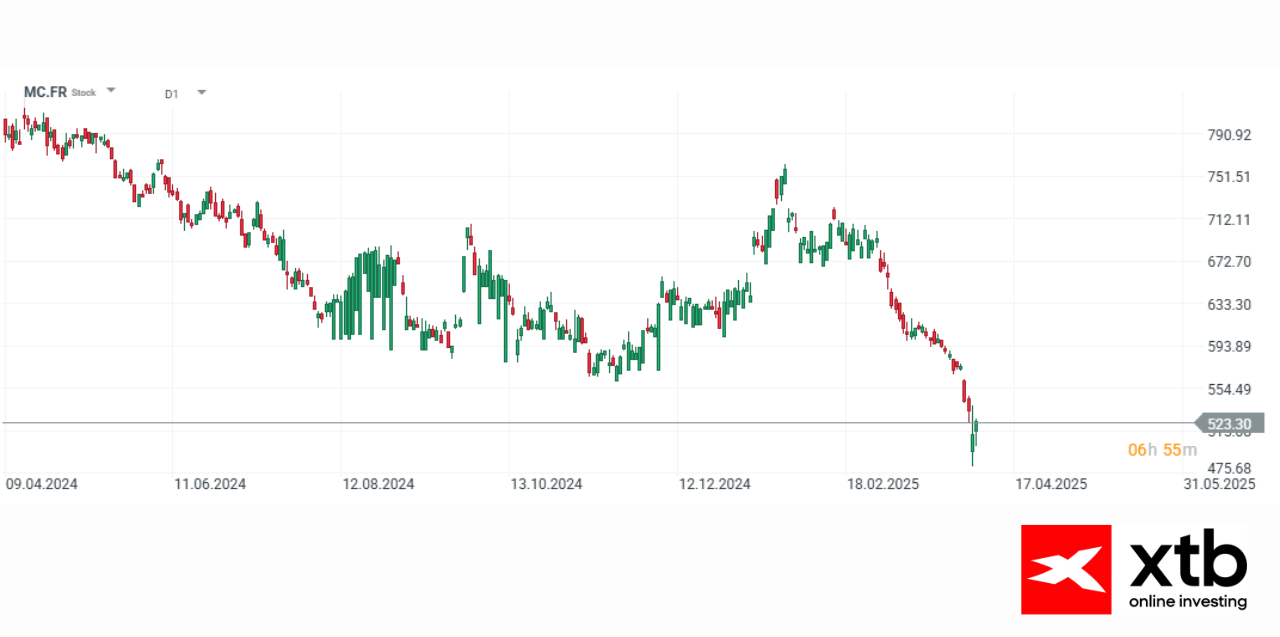

LVMH

The French luxury giant has been one of the most sold stocks on the Eurostoxx index so far in 2025, and it is down 18% YTD. The stock has fallen 20% since the announcement of reciprocal tariffs, which is bear market territory.

The sell off was justified earlier this year. Demand for luxury had stalled and tariff risks were mounting. However, has the market got too pessimistic? Earnings estimates have been revised higher since January, although they have backed away from early February highs. The company is expected to report earnings of $21bn for the first three months of this year, and analysts have only cut earnings expectations by 1.4% in the last 4-weeks, even though the stock has sunk into bear market territory. This is an opportunity for investors in our view, as earnings expectations vs. the stock price have diverged. If earnings surprise on the upside, then this stock could recoup recent losses.

Source: xStation, XTB, Past performance is not a reliable indicator of future results.

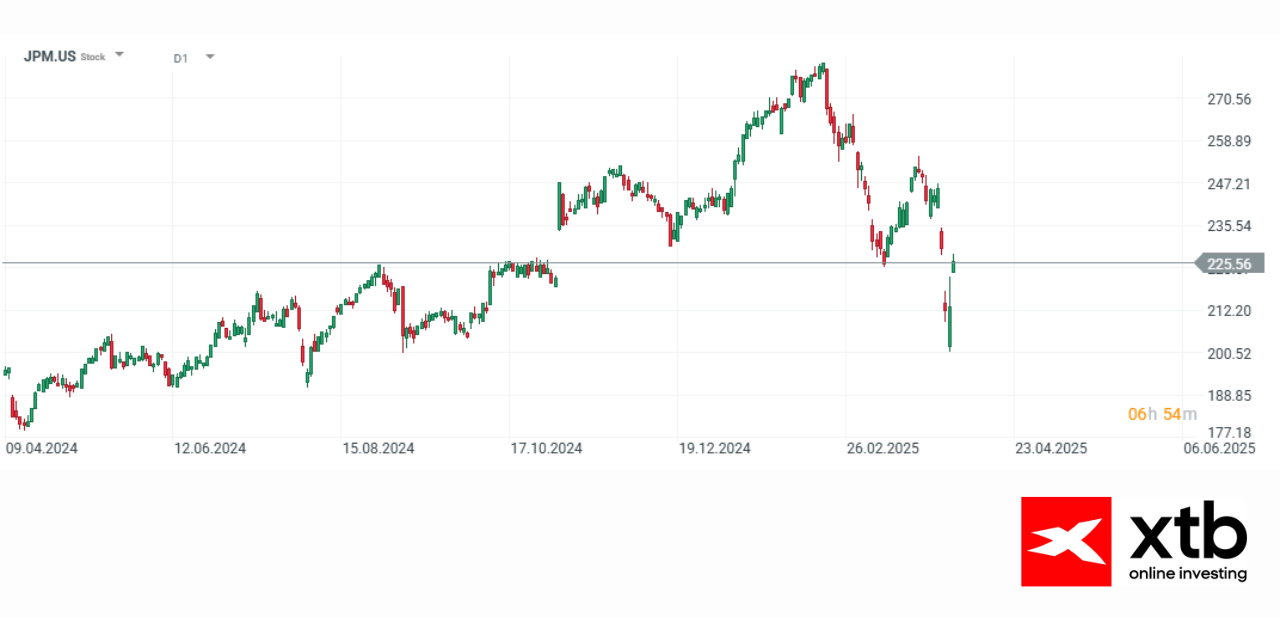

JP Morgan

US banks are in focus as they kick off Q1 earnings season. The main attraction for investors in JP Morgan is its extremely low valuation compared to other sectors of the US market. The 12-month forward price to earnings ratio is 11x, which is lower than the average for the S&P 500. Earnings estimates for Q1 have been revised higher by analysts, and Q1 revenues are expected to come in at $44.39bn, with net income expected to be $12.9bn. Although loan loss provisions are expected to rise, they could be countered by stronger trading revenue. Added to this, if the US economy manages to avoid a recession this year, and growth moderates rather than contracts, this would be good news for the bank’s loan business. The stock price is down by 11% YTD. This stock looks like good value.

This stock could also perform well if there is a recalibration of interest rate expectations for the Federal Reserve. If the market is too optimistic about the prospect of Fed rate cuts this year, then banks should benefit, since higher rates will protect its net interest income.

Source: xStation, XTB, Past performance is not a reliable indicator of future results.

Rolls Royce

The UK engine maker is one of the strongest performers in the UK right now. However, the disruption caused by US tariffs interrupted the uptrend in RR’s stock price. The stock price fell sharply in the aftermath of tariff announcements and was down 15%. The stock is still higher by 19% YTD, however, the sell off offers a decent entry point for those who may have missed RR’s rally the first time around.

Source: xStation, XTB, Past performance is not a reliable indicator of future results.

Shell

This is the ultimate recovery play. The UK oil and gas giant has seen its stock get sold sharply, as the price of oil has tumbled. Brent crude oil is lower by 13% YTD, and Shell has seen its share price fall a similar amount so far in 2025. If US growth is better than expected, or if tariffs are paused or dramatically scaled back, then the price of oil should rally.

Shell has an extremely low valuation, its 12-month forward P/E ratio is 9x earnings. A lot of bad news is in the price for this stock, so if the worst-case scenario for growth does not play out then it could help the Shell’s stock price to recover. Energy is considered a defensive sector, so even if there is a recession, Shell and other major energy companies could be more resilient than other sectors of the global stock market, which is another reason to take a second look at this stock.

Source: xStation, XTB, Past performance is not a reliable indicator of future results.

Source: xStation, XTB, Past performance is not a reliable indicator of future results.

What is Next for the AI Trade?

Investing during a crisis: Strategies and Tips

US Presidential Election 2024: Kamala Harris vs Donald Trump. Which candidate is better for stock markets?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.