Trading the rising wedge is a popular strategy among technical analysts and traders. A rising wedge is essentially a bearish chart pattern that forms when the price of an asset creates higher highs and higher lows, but the price range between the highs and lows narrows over time. This narrowing indicates that the bullish momentum is weakening, and a potential reversal to the downside may occur.

Trading the rising wedge is a popular strategy among technical analysts and traders. A rising wedge is essentially a bearish chart pattern that forms when the price of an asset creates higher highs and higher lows, but the price range between the highs and lows narrows over time. This narrowing indicates that the bullish momentum is weakening, and a potential reversal to the downside may occur.

How to trade the rising wedge?

A rising wedge can be traded in two ways:

- Short selling: If you believe that the pattern will break down, you can short sell the security at the breakout point. Your profit target would be the length of the wedge, measured from the breakout point to the top of the wedge.

- Put options: If you are not sure whether the pattern will break down, you can buy put options on the security. This will give you the right to sell the security at a certain price, even if the price goes down.

What is the significance of the breakout?

The breakout is the most important part of the rising wedge pattern. If the price breaks down below the lower trend line, it is a signal that the pattern has been invalidated and that the trend is likely to reverse.

However, if the price breaks up above the upper trend line, it is a signal that the pattern is still valid and that the trend is likely to continue.

The breakout is also important because it provides a trading opportunity. If you believe that the pattern will break down, you can short sell the security at the breakout point. Your profit target would be the length of the wedge, measured from the breakout point to the top of the wedge. However, if you believe that the pattern will break up, you can buy the security at the breakout point. Your profit target would be the length of the wedge, measured from the breakout point to the bottom of the wedge.

It is important to note that the breakout is not always a reliable signal. Sometimes, the price may break out of the pattern and then reverse back to the other side. This is why it is important to use other technical indicators to confirm the breakout before entering a trade.

Here are some other technical indicators that can be used to confirm the breakout:

- Volume: A surge in volume at the breakout point can be a sign that the breakout is real.

- Moving averages: The price crossing above or below a moving average can also be a sign that the breakout is real.

- Relative strength index (RSI): The RSI crossing above or below 70 or 30 can also be a sign that the breakout is real.

What to consider when trading the rising wedge?

Traders should use technical analysis to identify the rising wedge pattern on the price chart. Look for at least two higher highs and two higher lows that form the trendlines of the wedge. Draw these trendlines on the chart to visualise the pattern better. You should always double-check your analysis to ensure the rising wedge pattern is valid. False signals can occur, so look for clear and distinct trend lines with multiple touchpoints.

It is very important to determine your entry and exit points before entering the trade. For a rising wedge, you may consider entering a short (sell) position when the price breaks below the lower trendline, which signals a potential trend reversal. The target for your trade could be the height of the wedge projected downward from the breakout point. To manage risk, place a stop-loss order above the upper trendline of the rising wedge. This will help limit your losses if the price breaks out to the upside instead.

To confirm the potential reversal use additional technical indicators. For example, you could look for bearish divergences with oscillators like the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD).

This goes without saying but once you've entered the trade, keep a close eye on how it develops. Be prepared to adjust your position or exit the trade if the price action doesn't follow the expected pattern.

Having a clear price target in mind can help with taking profits. This could be a key support level or a predefined price objective based on the wedge's projected height. Trailing stop-loss orders can also help you lock in profits as the price moves in your favour.

Most importantly stay informed! Keep track of market news and events that may influence the asset you're trading. Unexpected news can impact the price and may invalidate the pattern.

What time frames are best for trading the rising wedge pattern?

The choice of timeframe for trading the rising wedge pattern depends on the trader's trading style, preferences, and objectives. Different timeframes offer unique advantages and challenges.

Short-Term Trading (Intraday):

- Timeframes: For intraday traders, short-term timeframes like 5-minute, 15-minute, and 30-minute charts may be suitable for spotting rising wedges.

- Advantages: Intraday traders can take advantage of quick price movements and execute multiple trades within a single trading session.

- Challenges: Short-term charts can be more volatile and subject to noise, requiring prompt decision-making and discipline.

Medium-Term Trading (Swing Trading):

- Timeframes: Swing traders may use hourly, 4-hour, or daily charts to identify rising wedges with longer-term implications.

- Advantages: Swing traders have more time to analyse the pattern and the market context, making it easier to manage trades.

- Challenges: Holding positions for several days or weeks involves overnight risk and potential exposure to larger market moves.

Long-Term Trading (Position Trading):

- Timeframes: Position traders may use daily, weekly, or even monthly charts to spot long-term rising wedge patterns.

- Advantages: Position trading allows traders to capture major price movements and trends, requiring less frequent monitoring.

- Challenges: Longer timeframes may require more significant capital, and positions could take longer to materialise.

Multiple Timeframe Analysis:

- Many traders use multiple timeframes to get a broader perspective of the market. For instance, they might use a higher timeframe (e.g., daily) to identify the overall trend and a lower time frame (e.g., hourly) to time their entries and exits.

Backtesting and Experience:

- Traders should backtest their strategies on various timeframes to see which one suits their trading style and provides consistent results.

- Experience and comfort level also play a role; some traders naturally perform better on specific timeframes based on their psychological preferences and available time for trading.

It's essential to remember that the rising wedge pattern can be seen on any timeframe, but its significance and impact may vary. Traders should always consider the broader market context, other technical indicators, and risk management when trading any pattern, including the rising wedge. Additionally, each trader's individual goals and risk tolerance will influence their choice of timeframe.

How can I differentiate between a rising wedge and a symmetrical/triangle pattern?

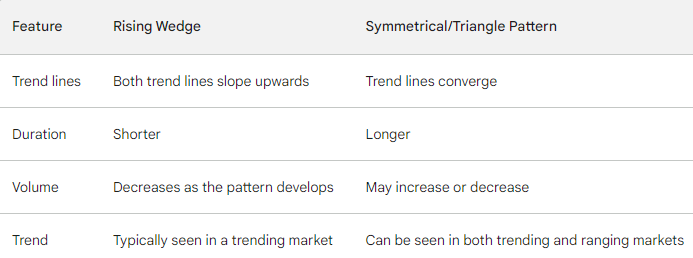

Distinguishing between a rising wedge and a symmetrical/triangle pattern requires a keen eye for chart patterns and understanding the key characteristics of each pattern. While both patterns involve converging trendlines, they have distinct features that can help you differentiate between them. Here are the main differences between a rising wedge and a symmetrical/triangle pattern:

To summarise, the main distinguishing factors between a rising wedge and a symmetrical/triangle pattern are the trend direction, the slope of the trendlines, and the expected breakout direction. While the rising wedge indicates a bearish trend with a downside breakout, the symmetrical/triangle pattern is neutral until the breakout occurs, and the breakout direction can vary.

Conclusion

It's important to note that pattern recognition should not be the sole basis for trading decisions. Remember, no trading strategy is foolproof, and it's essential to practise proper risk management. Trading patterns should be used in conjunction with other forms of analysis and not in isolation. If you're new to trading or unsure about implementing this strategy, consider paper trading or seeking advice from experienced traders.

FAQ

A rising wedge is a bearish chart pattern characterised by higher highs and higher lows, but with the price range between highs and lows narrowing over time. It indicates a potential trend reversal to the downside.

To identify a rising wedge, look for two upward-sloping trendlines, one connecting higher highs and the other connecting higher lows. The lines should converge, forming a wedge shape.

The reliability of the rising wedge pattern varies. While it can be a potent reversal signal, it's crucial to consider other factors like volume, price action, and overall market context before making a trading decision.

A common entry strategy is to sell (short) when the price breaks below the lower trendline of the rising wedge. The target for the trade could be the height of the wedge projected downward from the breakout point. Traders often use stop-loss orders above the upper trendline.

Yes, the rising wedge pattern can fail. Sometimes, the price breaks out to the upside instead, leading to a bullish continuation rather than a bearish reversal. Traders must be prepared for both scenarios and use proper risk management.

It's recommended to use the rising wedge pattern in conjunction with other technical indicators and analysis techniques. Combining multiple signals can provide more robust trading decisions.

Yes, the rising wedge pattern can be observed in various financial markets, including stocks, forex, cryptocurrencies, commodities, and more.

Traders often use other technical indicators like oscillators (RSI, MACD) or volume analysis to confirm the potential reversal signalled by the rising wedge.

Utilities, Homebuilders, Healthcare & Tech firms: Stocks To Look Out For ahead of the UK General Election

Investing during a crisis: Strategies and Tips

US Presidential Election 2024: Kamala Harris vs Donald Trump. Which candidate is better for stock markets?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.