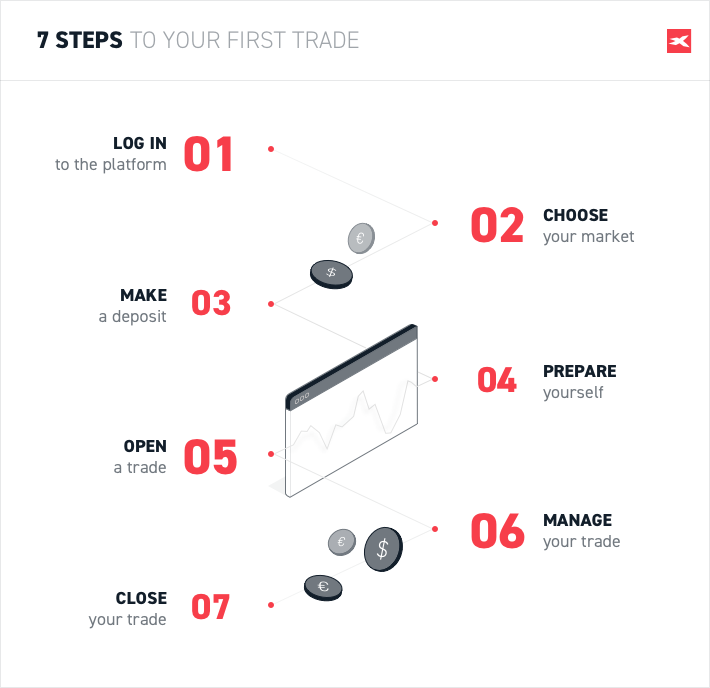

This article outlines seven steps you can take to prepare yourself before your first trade, and serves as a guide on your journey of exploring the global financial markets.

This article outlines seven steps you can take to prepare yourself before your first trade, and serves as a guide on your journey of exploring the global financial markets.

Making your first trade may seem challenging at first. However, regardless of whether you want to take a position on EURUSD via a CFD, or buy Apple shares, most traders prefer to rely on a solid plan that can guide them through the process.

This article outlines seven steps you can take to prepare yourself before your first trade, and serves as a guide on your journey of exploring the global financial markets.

Step 1 - Log in to the Platform

Our award-winning, intuitive platform, xStation5, was designed to help traders find everything they need quickly and easily, regardless of their level of experience.

The first step towards opening your first real trade is logging into the platform.

76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

If you need a bit of help while you get acquainted with our trading platform, feel free to explore XTB’s Trading Academy, including a range of articles on how to use xStation 5.

Download the platform today!

In most cases investments in the financial markets are taken to multiply capital, but at the beginning many investors have limited time to analyse the market and prepare an investment strategy.

The XTB trading platform gives you the opportunity to invest in a wide range of derivatives such as CFDs on forex, indices, commodities, stocks and ETFs. Contracts for Difference (CFDs) are extremely popular instruments, they are a leveraged product, meaning that traders are only required to deposit a small initial deposit in order to gain a much larger market exposure. But you should also bear in mind that due to the leverage, both the potential profits and the size of the possible loss are increased.

Learn more about leverage here.

Whatever your reason for joining the world of investing might be, you don’t have unlimited time and resources available to help you make every single decision. This is why many beginner traders decide to limit the number of instruments they trade when first starting out.

Explore XTB’s range of trading instruments here.

Step 3 - Make a Deposit

The first deposit to the investment account depends only on individual preferences of each trader. XTB doesn’t set the level of first payment; the trader should analyse how much of his capital he or she is able to spend on investments.

First of all, you should define your own expectations and attitude to risk. It should be remembered that the more ambitious goals an investor sets, the relatively more capital he or she may need to achieve them.

CFDs allow you to use the leverage, that’s why it’s perceived as a risky market. However, thanks to the leverage, you can open relatively larger positions.

The good news, however, is that making a deposit with XTB is quick and easy, with several methods available. This includes bank transfers, credit and debit cards.

Read more on our deposit methods here.

Step 4 - Prepare Yourself

Modern technology has provided us with quick access to global markets, which are now always at hand’s reach for any investor. However, this has caused many less experienced aspiring investors to enter the markets without proper knowledge or strategy. Make sure you don’t make the same mistakes!

Education is crucial for any trader, especially at the start of their journey, as mistakes most often occur at the beginning of one’s trading career. Whether you trade based on fundamental (economic reports) or technical analysis (technical signals), it’s important to be perfectly clear with yourself even before the trade when you want to open a trade and under what circumstances you would be willing to close it.

The XTB trading platform offers many useful tools for market analysis, thanks to which the investor doesn’t have to look for additional information on external websites. The built-in economic calendar, updated in real time, allows you to observe the economic situation and track the publication of the reports that may have a significant impact on the market. Additionally, the market news, prepared by the XTB market specialists team, present the current situation from the point of view of macroeconomic data and interesting observations from the technical side. There is also the top movers table that shows the instruments which record the biggest change in price during a given period.

Moreover, the Education section is full of quality materials for traders at different levels of advancement.

Step 5 - Open a Trade

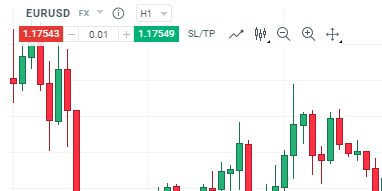

There are several ways to open a trade, both from the Market Watch window and from the chart.

Chart

Trading directly from the chart is the easiest way to make your first trade. All you have to do is to specify the transaction size and click on the green price button if you want to buy or the red button if you want to sell.

The second way is to open an order window by right clicking anywhere in the analysed chart area and selecting “new order”.

Past performance is not a reliable indicator of future results.

The information about your opened position will immediately appear in the order panel.

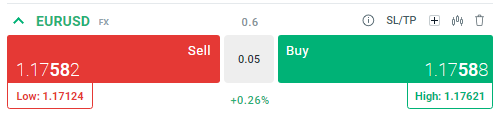

Market Watch

Another option is to use the click & trade panel that will appear after clicking on the selected instrument. You should only define the size of the trade and decide on its direction by clicking on the red SELL button or the green BUY button.

Past performance is not a reliable indicator of future results.

Another way is to open an order window by double-clicking on the instrument symbol.

The built-in calculator will inform you about the nominal value of the transaction, the required margin, spread value, commision, pip value and daily swap value. In case you decide to set the Stop Loss or Take Profit levels, the calculator will also provide an approximation of loss or profit in case either of the orders is activated.

Then you simply need to adjust the size of the order to your own investment style and click either the SELL or the BUY button.

Past performance is not a reliable indicator of future results.

Step 6 - Manage Your Trade

To secure your transaction you can use Stop Loss or Take Profit orders. The Stop Loss order will allow you to limit your losses when the price moves in an unprofitable direction, and Take Profit automatically ensures profit at a predefined level. Thanks to these orders, there is no need to constantly monitor the position.

They can be added at any time after placing the order or with trade. There are several ways to define parameters in the order window:

- setting their level

- specifying the distance in pips

- giving the nominal value

- by determining the percentage by which your current account balance will increase/decrease when SL/TP is activated

Past performance is not a reliable indicator of future results.

For more experienced traders there is a much faster method of determining these orders from the click & trade panel in the upper left corner of the chart.

Past performance is not a reliable indicator of future results.

To change your Stop Loss or Take Profit levels, simply drag the SL and TP symbols on the chart to the desired level.

You can also double your trade (open another trade of the same size) or invert it (close and open trade in the opposite direction) by clicking on the buttons on the right hand side of the open trade.

Past performance is not a reliable indicator of future results.

Step 7 - Close Your Trade

Closing the order is the most difficult part of the investment process, because you need to make a decision at the right moment to close both the one that brings profit and the one that generates loss. The trade can also be closed by executing Take Profit or Stop Loss orders, but if you change your mind you can easily close the transaction in a traditional way.

Closing an order on the XTB trading platform is easy and fast. You can do this in a few different ways:

- Hover over your position on the chart and click the “X” button

Past performance is not a reliable indicator of future results.

-

Click the red “X” button on the right hand side of the “Open positions” tab

In case you have more than one position open, in the “Open positions” tab you can click the “CLOSE” button and choose whether to close: all positions, only profitable positions or only losing positions.

Opening your first trade is not as difficult as it may seem at first glance. You should remember that an appropriate market analysis, adjusting transactions to your own investment style and managing open positions in accordance with the plan are key elements of the investments process to achieve positive results on financial markets.

FAQ

All retail Client Money is held in segregated client bank accounts in line with our regulatory obligations.

Your funds are held in ring-fenced accounts separate to our own accounts.

- One of Europe’s biggest brokers.

- Full access to our award-winning platform, xStation, with superior trade execution.

- Access to 5800+ instruments.

- Free comprehensive education via our free ebooks, educational content and Youtube Channel.

- Advanced technical analysis tools with free integrated market commentary.

Chart Patterns: A Detailed Guide

Building Balance: How to Diversify Your Portfolio with XTB

The Importance of Maintaining a Presence in the Financial Markets All Year Round

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.