The 10-year anniversary of Britain’s decision to leave the EU is coming up. A shock win for the leave campaign rocked financial markets back in 2016, although it was not until January 2020 that the UK ceased to be an EU member state. At the end of 2020, the UK left the single market and customs union and its new trading relationship with the EU came into effect.

The 10-year anniversary of Britain’s decision to leave the EU is coming up. A shock win for the leave campaign rocked financial markets back in 2016, although it was not until January 2020 that the UK ceased to be an EU member state. At the end of 2020, the UK left the single market and customs union and its new trading relationship with the EU came into effect.

Overall, the UK’s economic structure post Brexit remains in place. It is a large, advanced economy that has sluggish growth and is heavily reliant on the services sector. However, the evidence suggests that Brexit has created headwinds for the UK, and the UK economy has generally underperformed similar G7 economies since 2016. There are three impacts from Brexit that have limited UK growth in the past decade. This includes investment, which has been weaker than the prevailing trend before the Brexit vote, trade friction with the EU now that the UK is not part of the single market, and productivity growth, which has been sluggish in recent years.

UK Growth Constrained After Brexit

In the period after 2020, labour shortages also emerged, which constrained UK growth further. On balance, leaving the EU has had a major impact on the UK’s economy, and evidence gathered from the Decision Maker Panel (DMP) conducted by Kings College and the Bank of England, found that by early 2025, UK GDP was 6-8% lower than its pre-Brexit trend.

This was largely down to a sharp decline in business investment. This survey found that business investment in the UK was 12-18% lower than pre-Brexit levels, as the UK’s split with the EU caused a huge amount of uncertainty. This analysis also found that Brexit uncertainty and low levels of business investment after the vote caused productivity to fall 4% below the pre-Brexit trend.

The dangers of trade barriers

Interestingly, the decline in UK growth and productivity after 2016 was not down to reduced trade flows between the UK and the EU, as trade was able to flow freely until 2021. Instead, it came from a prolonged adjustment process and highlights the dangers between raising trade barriers between developed nations.

UK Remains Europe’s Dominant Financial Sector

The picture is not all doom and gloom. The UK’s services sector, which contributes 80% to overall GDP growth has been exceptionally resilient to Brexit and the unemployment rate remains low. London remains one of the world’s major financial centres and has not been usurped by another European city.

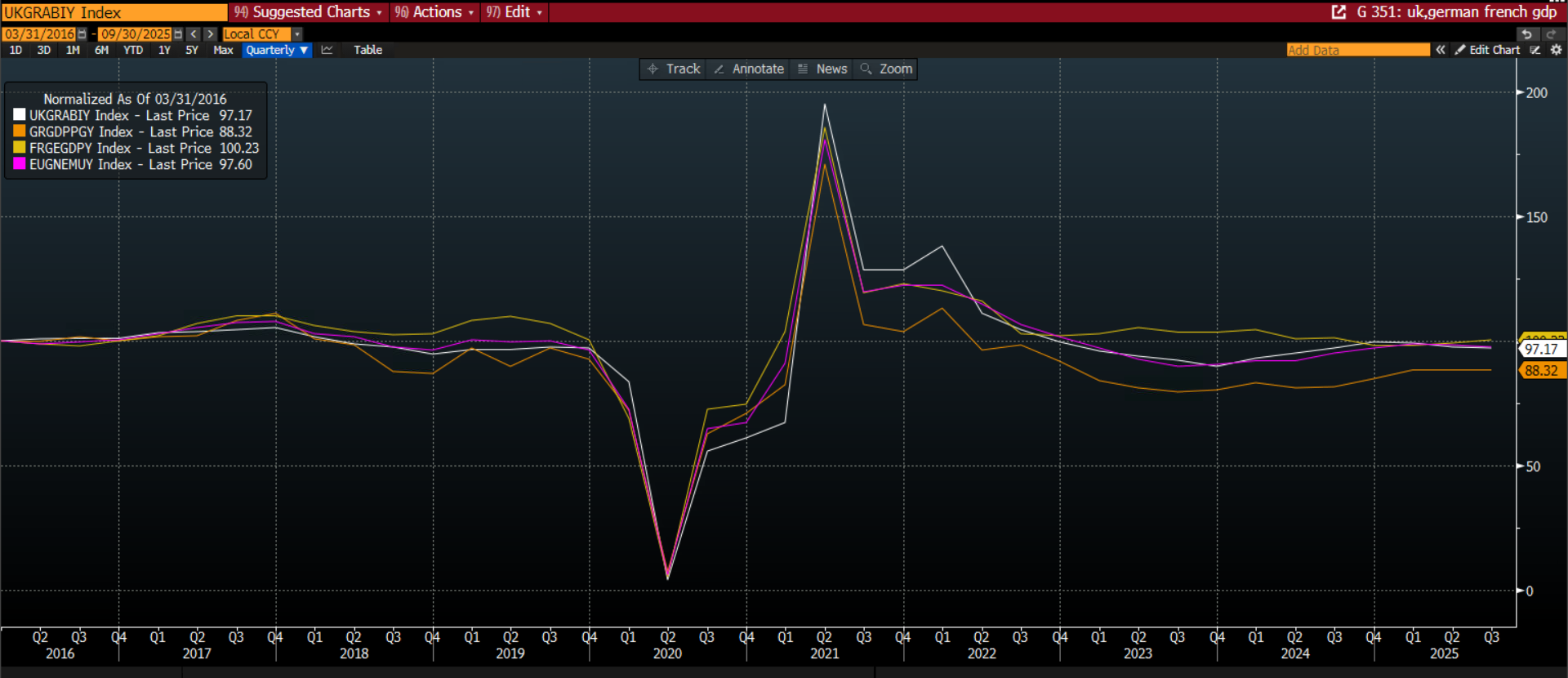

Added to this, while Brexit has undoubtedly had some negative impact on the UK economy, the overall trend in GDP growth in the UK is on par with Europe, where growth has been sluggish in recent years. In fact, Germany has seen the worst GDP outcome post Covid, and it is a major underperformer, as you can see below. The pandemic was a major shock to the global economy, and this had a much bigger economic impact compared to Brexit.

Chart 1: UK, France, Germany and Eurozone GDP since 2016, normalized to show ow they move together.

Source: XTB and Bloomberg, Past performance is not a reliable indicator of future results.

UK a Global Tech Leader

On the positive side, Brexit has not impacted the UK’s position as a global tech leader. The UK is experiencing a significant and growing investment in its technology sector, from both public and private sources with a strong focus on AI. The sector is already valued at close to £1 trillion, which means that the UK ranks as the third most valuable tech ecosystem globally, behind the US and China. In this area, the UK has pulled away from EU members, in 2024 it attracted venture capital investment of $16.2bn, which was more than France and Germany combined. The UK is also pulling ahead in quantum technologies and ranks second behind the US for the number of quantum companies and private investment in this sector.

Investors Punished the UK after Brexit

Undoubtedly, Brexit and the process to leave the European Union caused uncertainty. It is well known that investors despise uncertainty, and the Brexit vote had a negative impact on UK asset prices. As you can see below, the trade-weighted pound has lagged the trade-weighted euro and the dollar index in the past decade, which measures these currencies against a basket of their biggest trading partners.

GBP/USD has not managed to climb above $1.50 since the Brexit vote. Between 2010 and 2016 the average GBP/USD rate was $15770, however, after 2016 the average GBP/ USD rate has been just under $1.30. The underperformance of the pound is not all down to Brexit, Covid and Liz Truss’s mini budget all played a part. However, the demise in the USD in recent months, is raising hopes that a strong pound could be a feature once more, as the world moves on from Brexit and tries to navigate the changed economic world order since the inauguration of President Trump in the US.

Chart 2: Trade weighted GBP. EUR and DXY, normalized to show how they move together.

Source: XTB and Bloomberg, Past performance is not a reliable indicator of future results.

FTSE 100 Hit by Brexit, But is Making a Comeback

The performance of the FTSE 100 has also lagged its European peers since 2016, as you can see in the chart below. This suggests that Brexit and uncertainty about the UK, along with a decline in the pound, led to a flow of capital out of the UK. As you can see in chart 3 below, a rotation out of UK equities mostly went to the US. Over the last 10 years, the FTSE 100 has not dramatically underperformed the French Cac or the Eurostoxx 50 index, the Dax has been a stronger performer, but the past decade has seen massive US equity outperformance, especially since 2020.

However, this situation could change. UK equities are coming back into fashion. In the past 12 months, the FTSE 100 has outperformed European and US indices, as you can see in chart 4.

Chart 3: FTSE 100, Cac, Dax, Eurostoxx 50 and the S&P 500, normalised to show how they move together in the past 10 years.

Source: XTB and Bloomberg, Past performance is not a reliable indicator of future results.

Chart 4: FTSE 100, Cac, Dac, Eurostoxx 50 and the S&P 500, normalised to show how they move together in the past 12 months.

Source: XTB and Bloomberg, Past performance is not a reliable indicator of future results.

Overall, Brexit caused uncertainty and weighed on the performance of the pound and UK stocks in the past decade. It also reduced UK growth and weighed on productivity. However, there are signs that the UK is settling into its position outside of the EU, and growth is picking up. Likewise, the pound and the FTSE 100 are also showing signs of strength as we move through the 2020s. Once, Brexit was the main news in Europe and the UK, however, Donald Trump’s reordering of the global economy and his ‘America first’ policies has usurped Brexit as the main challenge for both the UK and Europe as we move through this decade.

Utilities, Homebuilders, Healthcare & Tech firms: Stocks To Look Out For ahead of the UK General Election

Taiwan Semiconductor Manufacturing Company (TSMC): A Global Semiconductor Powerhouse

5 Top Stocks to Watch out for Right Now

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.