What Is Hedging?

The first rule of legendary stock trader Warren Buffett is "never waste your money." And rule number two is: "never forget rule #1". Long-term and successful investors realise that protecting your current profits is often more important than any potential future profits.

Hedging can help with this - it is an investment technique used to reduce the risk of an unfavourable price change, for example in stocks, by taking an opposite position on derivatives. Unlike most investment techniques, the purpose of hedging is not to make a profit, but to reduce losses.

It may sound complicated, but in practice it is a technique that is very popular with investors at all levels, and easy to apply.

CFDs as an Instrument for Hedging Transactions

In the following text, we will focus primarily on hedging on the stock market, which consists in securing prices by selling CFDs. The choice of this type of contracts is not accidental - their undoubted advantages over other derivative instruments are their easy availability and high flexibility in terms of the selection of the transaction volume. It is also important that there is a wide range of underlying instruments for which this type of contracts is available, which allows traders to easily hedge both single positions and entire stock portfolios.

It is not without significance that CFDs are leveraged instruments - and therefore the capital involved needed to open and maintain a hedging transaction is smaller. Due to the above, CFDs can be a useful tool to reduce risk in an uncertain market situation.

Suppose an investor owns shares in a given company and wants to hedge against a sharp drop in their price. To this end, it sells a contact CFD on its shares with the same face value. In this situation, as long as he has an open short position, fluctuations in the price of this company's stock will not have any impact on the condition of his portfolio. This is because each decrease in the value of a share will mean an analogous increase in the value of the short position (and vice versa), while the investor does not lose the benefits of holding the securities (dividend, voting rights in the company).

If we have shares of several or a dozen or so companies against a decline in the value of which we want to protect ourselves, their sale and subsequent redemption may be problematic. To hedge such a portfolio, we can open short positions on CFDs for each of them, but a short position on a CFD based on the entire index may also be a solution worth considering. In this way, we significantly reduce the cost of security, because we will pay the opening commission only for one, not several or a dozen or so items. It is also worth emphasising that the leverage of CFDs based on indices (max 1:20) is often higher than CFD based on single shares (max 1: 5).

When hedging stocks, especially with CFDs on an index, it is very important to choose the right trading volume, so we will consider a few examples.

Example 1

Consider a situation in which an investor has shares of four German blue chips from the DAX30 index in his portfolio:

Source: XTB Team

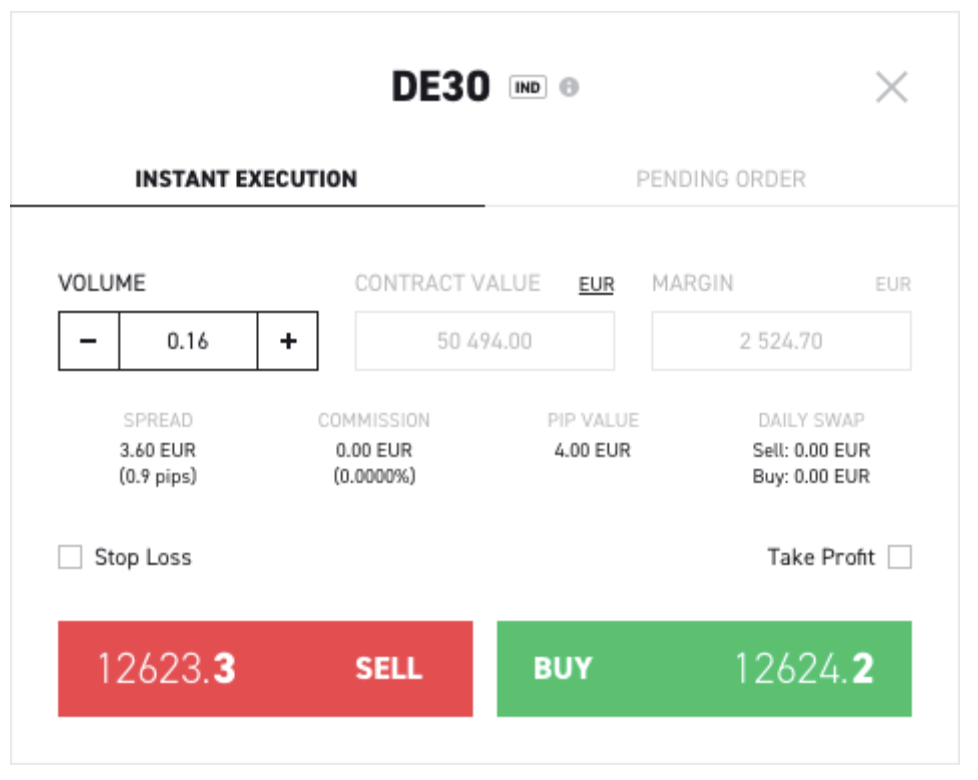

Their current value is around EUR 50,000. As we wrote earlier, we are dealing with a situation in which the investor does not want to sell these shares, but wants to protect themselves due to uncertain, in their opinion, market conditions. In this situation, the CFD contact on the DAX index, i.e. the DE30 instrument available at XTB, may be used as a hedge. The calculator available on the xStation platform will help in the most important one, i.e. choosing the volume of the hedging transaction, and will perform most of the calculations for us.

Source: xStation

Please be aware that the presented data refers to the past performance data and as such is not a reliable indicator of future performance.

As you can see in the above screenshot, the position to limit the risk will have a nominal value of EUR 50,494, and the volume needed to open such a transaction is 0.16 lots. It is worth noting that to maintain such a position, we need a security deposit of only EUR 2,524.70, and the cost of such security is only EUR 3.60 of the transaction opening fee.

Example 2

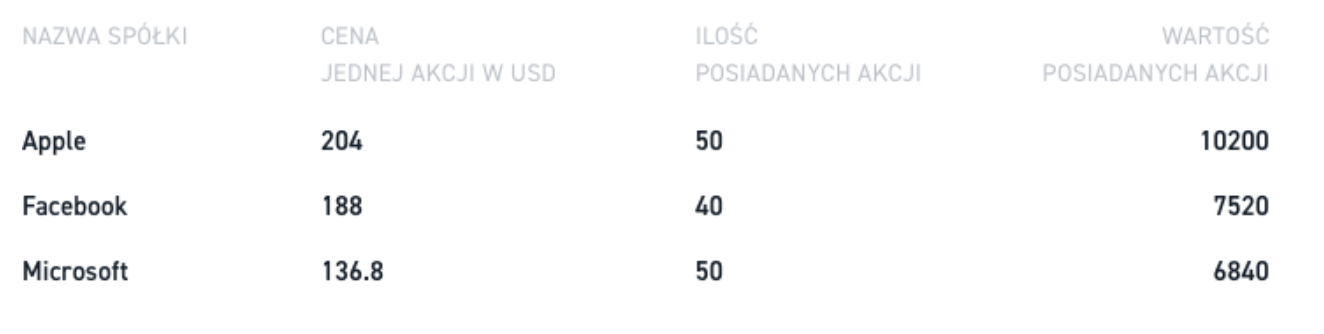

Let's also consider the same situation for a portfolio of US tech companies:

Source: XTB Team

The value of the shares in the above portfolio is approximately $ 25,000. All of the above companies are components of the NASDAQ index, so we can use a CFD on this index for hedging. In xStation, it is listed under the name US100.

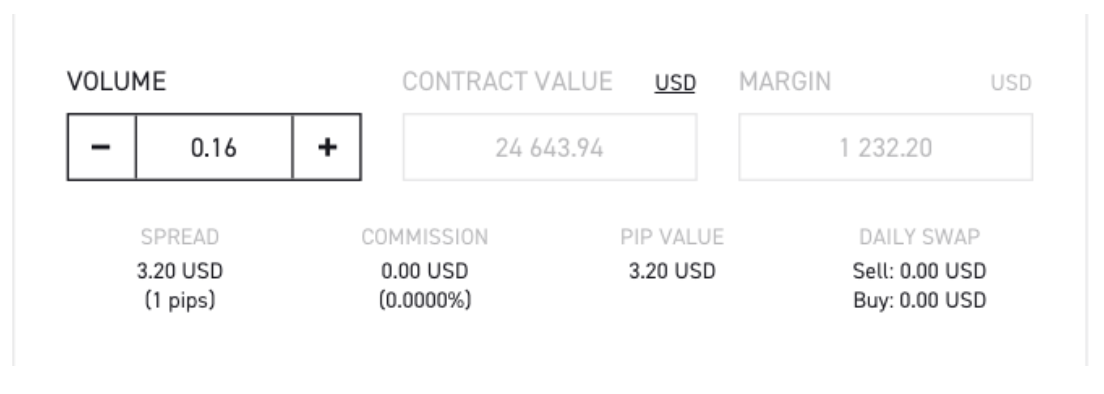

For calculations, we will again use the calculator built into xStation:

Source: xStation 5

As you can see above, the hedging position will have a nominal value of $ 24,643.94 and the volume needed to open such a trade is 0.16 lots. In this example, to hold this position we only need a margin of $ 1,232.20 and the cost is $ 3.20 in opening fees.

Example 3

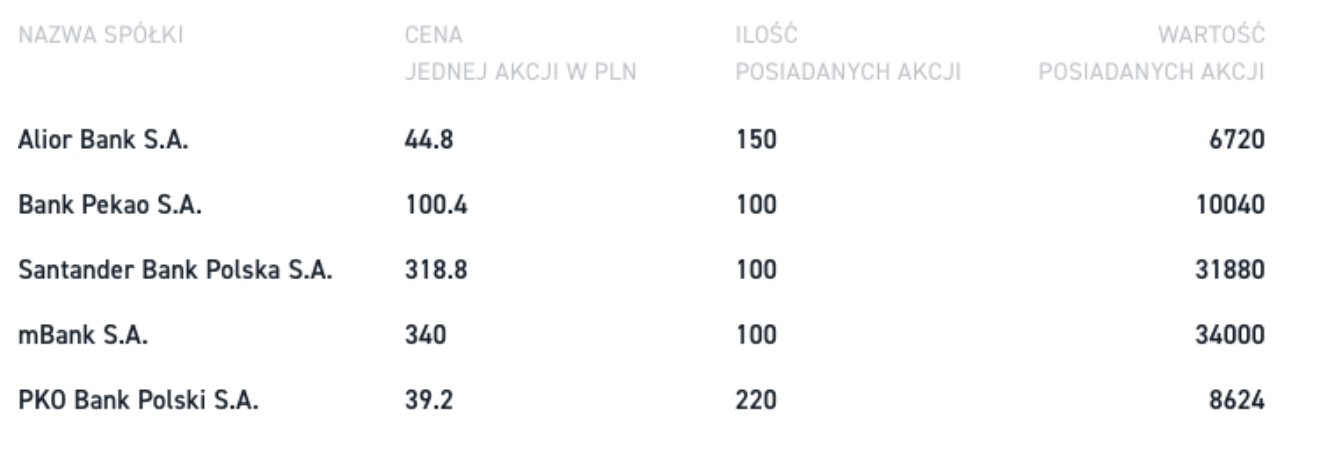

Consider the last example, this time on the Polish market, where the investor has a portfolio of approximately PLN 91,000 consisting of shares of banks listed on the WIG20 index:

Source: XTB Team

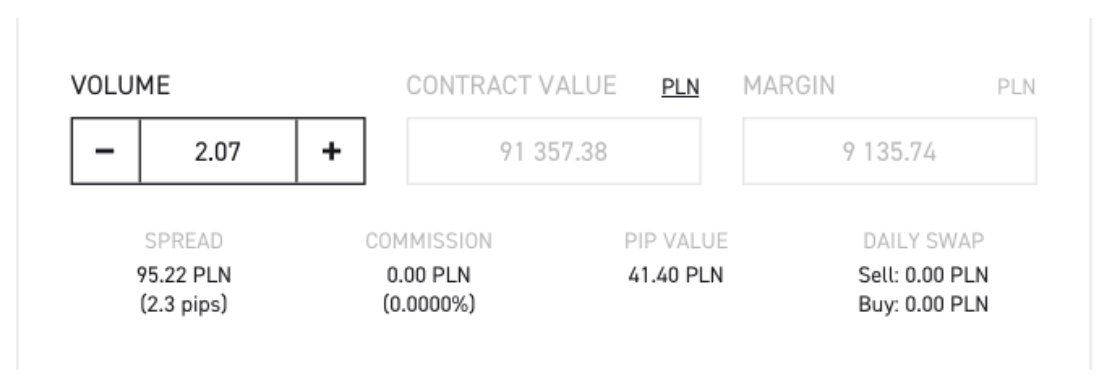

Using a CFD contract based on the WIG20 index to hedge the portfolio, our transaction may have the following parameters:

Source: xStation 5

Currency Hedge

It is also worth mentioning hedging as a form of hedging against changes in the value of shares, but not because of the change in their quotation on the stock exchange, but because of the change in the exchange rate of the currency in which the shares are quoted.

Let's follow what transactions are made when we have an investment account in EUR and want to buy stocks listed in the US:

- purchase of USD for EUR

- purchase of shares for USD

At the time of sale of shares, analogously:

- Selling shares for USD

- Selling USD for EUR

The xStation transaction platform converts the currency automatically, buying or selling the appropriate amount of currency for us. Nevertheless, it should be remembered that for the duration of the investment, its value becomes dependent on the exchange rate - with the increase in the EURUSD price, the value of the investment decreases (there is a strengthening of the EUR and a weakening of the USD), and with a decrease in the price, the value of our investment increases (strengthening of the USD and weakening of the EUR). In order to reduce the exchange rate risk in this case, it is enough to open a long position on the EURUSD CFD.

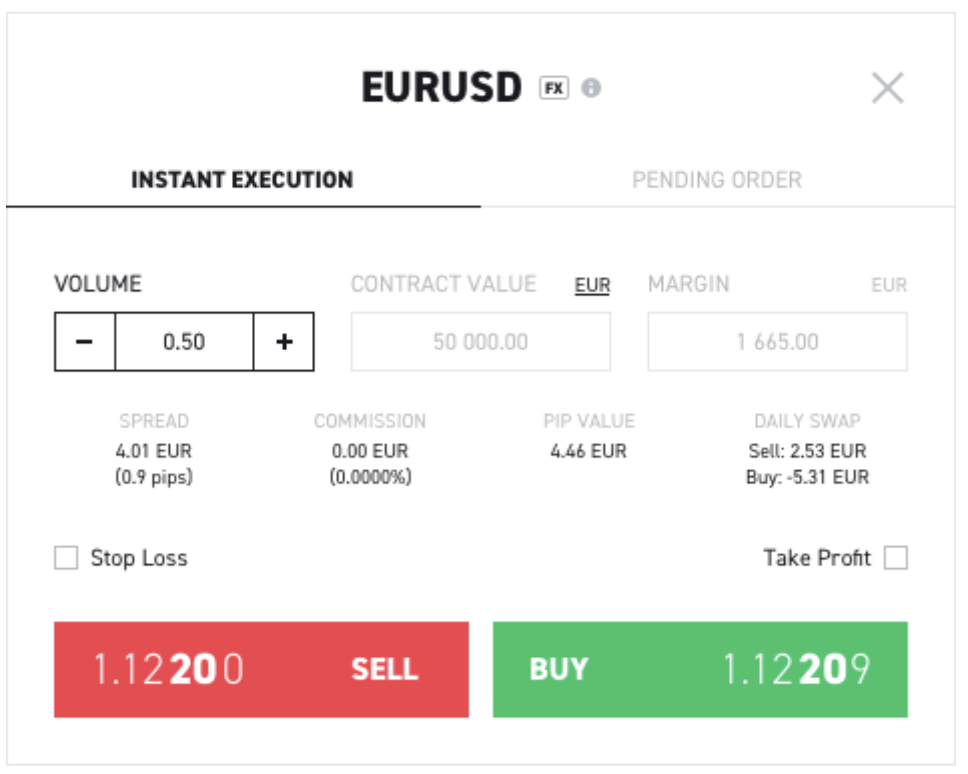

In selecting the appropriate transaction volume, setting the margin and calculating the costs of our hedging transaction, the investment calculator built into the xStation 5 platform will help us again.

Source: xStation 5

Please be aware that the presented data refers to the past performance data and as such is not a reliable indicator of future performance.

At this point, it is worth mentioning the swap points resulting from the difference in the interest rates of currencies - in the above example, for a short position, they are positive, which means that the value of our short position will gain an additional EUR 2.53 each day.

Summary

Investment hedging is a very popular investment technique among professional investors, primarily used to secure already achieved profits and reduce risk. Nowadays, in the age of easy access to information and to various financial instruments, virtually every investor can use this simple and effective technique. Finally, it is worth emphasising that this is not a perfect tool - hedging will never completely eliminate the risks associated with an investment, but it may reduce them to some extent.

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.