Every trader will probably encounter the term “financial leverage” and the option of leveraged investing sooner or later. So what is leverage in trading? What are the potential advantages of leverage and what risks does it involve? What is a margin and a margin call, and how do they relate to leverage? You will find answers to all these questions and more in this article.

Every trader will probably encounter the term “financial leverage” and the option of leveraged investing sooner or later. So what is leverage in trading? What are the potential advantages of leverage and what risks does it involve? What is a margin and a margin call, and how do they relate to leverage? You will find answers to all these questions and more in this article.

Every trader will probably encounter the term “financial leverage” and the option of leveraged investing sooner or later. So what is leverage in trading? What are the potential advantages of leverage and what risks does it involve? What is a margin and a margin call, and how do they relate to leverage? You will find answers to all these questions and more in this article.

What Does Leverage Mean?

Financial leverage offers the possibility of investing or controlling much larger funds than those currently held. In everyday life, loans are the most popular form of leverage, and make it possible to finance a much larger investment, while having for example 10% or 20% of your own funds. The rest is borrowed.

The workings of this mechanism are a bit different on the financial market, but its outcome is very similar. Leverage allows traders to obtain potential gains from the entire transaction, while holding merely a fraction of their own funds. However, please note that in CFD trading, your potential losses can be just as easily magnified as your potential gains.

Leverage in Trading

Leveraged investing may be beneficial to traders as it does not require them to own large capital at the beginning in order to conclude high-value transactions. This is also related to risk, because the higher the transaction amount, the more significant is the effect of market changes on the balance of the entire account and the outcome of the transaction.

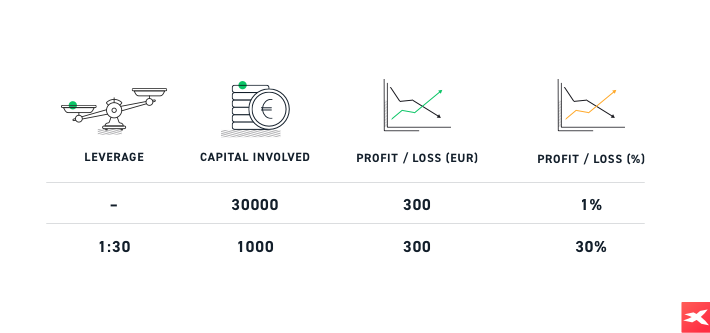

As an example, we will describe this situation on a EUR/USD currency pair and the leverage of 1:30. In this situation, the trader could control a position equivalent to EUR 30,000, while holding only an equivalent of EUR 1,000. Upon the conclusion of such a transaction, the trading platform will verify automatically whether there is at least EUR 1,000 in the account to open a 0.3 lot position on CFDs in EUR/USD. This amount will form a margin that we will explain in more detail below.

How Can Leverage Benefit the Trader?

If, as a result of an investment, the price of CFD in EUR/USD increases, yielding a profit of EUR 300 for the trader, this means a rate of return of 30% on the invested amount of EUR 1,000. Had it not been for the leverage of 1:30, the trader would have had to have EUR 30,000 in the account and the same potential profit of EUR 300 would mean a rate of return equal to 1%. Thanks to the leverage, rates of return on investments can be higher with lower own contributions. However, this is a two-edged sword. In the case of a decrease in the exchange rate and the transaction result of - EUR 300, the trader loses 30% and has only EUR 700 left of EUR 1,000.

The above example assumes maintaining only as much funds in the account so as to cover the margin, which is extremely rare in reality. Traders usually have more funds than only the required minimum, i.e. for example, EUR 5,000 can be deposited in the account instead of EUR 1,000. This provides greater flexibility and offers a possibility to open transactions in more markets simultaneously.

The Role of Margin in Leveraged Investing

Let us go back to the margin, which is a key element of leveraged investing. It is also known as deposit margin. In order to control a position of EUR 30,000 with a leverage of 1:30, you need to put aside EUR 1,000. This means that you can control EUR 30,000 with EUR 1,000, and EUR 1,000 is put aside as margin that was established for you to use the leverage.

The margin is frequently expressed as a percentage, which automatically shows what maximum leverage can be used. If the margin required for a given instrument is 3.33%, this means a maximum possible leverage of 30:1. In the case of 5%, the leverage will be 20:1, and for 10% – 10:1. Thus, the lower the percentage contributed as margin, the larger the leverage that can be used to open a larger transaction, and vice versa.

What If a Transaction Does Not Turn Out as Expected?

When the margin for a position starts to shrink, you will have the option to receive information about supplementing it, i.e. the so-called margin call. Otherwise, if the market continues to move in the wrong direction, the transaction will be closed automatically. Therefore, in the case of leveraged trading in many instruments and markets, the level of margin should always be controlled because it is crucial to maintaining the position.

A Comprehensive Example of a Leveraged Transaction

Let’s say you have an account in USD and you can trade in major currency pairs with a maximum leverage of 30:1, which means that each contributed dollar gives you USD 30 to trade with. You contribute USD 1,000 as margin. This means that you can initially open a position for a maximum of USD 30,000 (USD 1,000 x 30) on CFDs on major currency pairs.

An analysis that was conducted shows that EUR/USD exchange rate may record a decrease. In practice, this means planning to sell EUR and buy USD. You decide to allot EUR 20,000 for this – this is the transaction amount at the EUR/USD exchange rate of 1.3000, i.e. EUR 1 to USD 1.30. Opening a short position is tantamount to spending EUR 20,000 to buy USD 26,000 with a contributed margin of USD 1,000. This means that effective leverage amounts to USD 26,000 / USD 1,000 margin, i.e. 26:1. This accounts for the use of almost the entire margin.

Each pip will amount to USD 2 for the position discussed. Thus, the entire margin would be reached if the EUR/USD exchange rate changed by 500 pips. After a while, the EUR/USD exchange rate declines to 1.2700. You close the trade with a profit of 300 pips which translates into USD 600.

In terms of a classic conversion, you sold EUR 20,000 and bought USD 26,000 at the exchange rate of 1.30. Upon the decline of the exchange rate to 1.27, you repurchased EUR 20,000 for USD 25,400. The difference of 26,000 – 25,400 is the profit. Thanks to leverage, you generated a rate of return on the invested USD 1,000 of 60% (USD 600). Had it not been for the leverage, you could have only sold EUR 769.23 and bought USD 1,000. At the exchange rate of 1.2700, you can repurchase EUR 769.23 for USD 976.92, which yields a profit of USD 23. Thus, it is 26 times lower.

It should be remembered that in the case of the exchange rate changing in the opposite direction, the losses incurred are increased in a similar way by using the leverage mechanism. This may result in quickly losing the invested capital.

Which Instruments Are Suitable for Leveraged Investing?

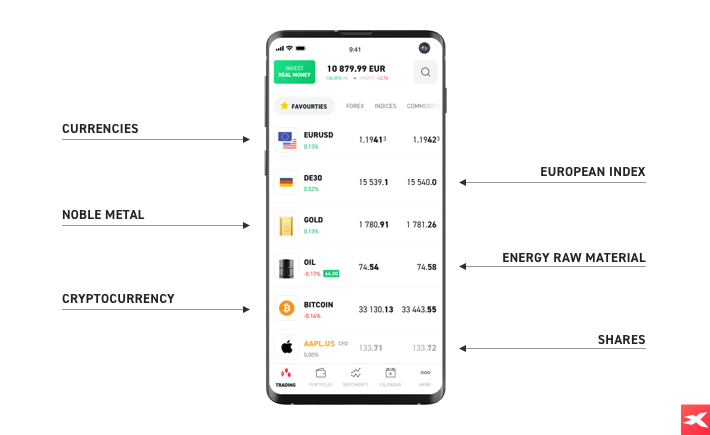

Both novice and experienced traders can use leverage for CFDs on all classes of assets. This means that leveraged trading is available for CFDs on currency pairs, commodities, stock indices, bonds, ETFs and individual stocks. The most popular leveraged instruments include major currency pairs, such as EUR/USD, GBP/USD and USD/JPY, commodities such as gold (GOLD), crude oil (OIL.WTI) and coffee (COFFEE), stock indices, for example, DAX (DE30), S&P 500 (US500) and NASDAQ 100 (US100) and CFDs on stocks such as Facebook (FB.US), Amazon (AMZN.US) and many more.

The Advantages of Financial Leverage

Increased Capital

The financial leverage increases capital available for trading on various markets. For example, you effectively control USD 60,000 with leverage of 30:1, while having only USD 2,000 at your disposal. This means that you can allot larger amounts to different positions in your portfolio. But remember that this also involves a greater risk of losing capital.

Interest-Free ‘Loan’

Financial leverage can be compared to a loan granted by a broker in exchange for pledging a margin which allows for taking a larger position on the market. However, this “loan” does not entail any liabilities in the form of interest or commission, and it can be used in any way while trading.

Method for Low Volatility

Periods of low volatility can be particularly tiring for traders due to minor changes in prices. However, thanks to leveraged transactions, traders can potentially generate larger profits even during low volatility periods on the market. In such a case, even a slight change in price or exchange rate can mean a larger change in the trader’s account.

Potential Disadvantages of Financial Leverage

Increased Losses

The most important risk related to leveraged trading is the fact that similarly to profits, losses are also increased when the market heads in the direction opposite to the assumed one. Financial leverage may require minimum capital expenditure, but because trading results are based on the total size of the position controlled by you, losses can be substantial.

Margin Call

If losses exceed the margin used by you, a call to supplement the margin appears. Due to the fact that leverage increases losses, the risk of a margin call will always exist, and in the absence of new available funds in the account, the positions will be automatically closed with a loss. Please note that when trading CFDs, all positions are stopped automatically when the margin level reaches 50%.

PLEASE NOTE! CFDs are not suitable for investors who have a low risk appetite and wish to invest over the long term.

FAQ

Leverage in trading enables traders to open a position worth much more than the money they deposit. For example, a trader might be able to multiply their position size by 5, 10, 20 or even 33x the amount of their initial outlay when trading with leverage.

A 20x leverage means your broker will multiply your account deposit by 20 when trading on leverage. For example, if you deposit $500 in your wallet and open a position with a 20x leverage, your $500 turns into $10,000. It’s important to bear in mind, however, that in leveraged trading your potential losses are increased as much as your potential gains.

For conservative investors, or new ones, a low leverage ratio of 5:1 or 10:1 could be a good start. For seasoned investors, who are more prone to risk, leverages may be as high as 50:1 or even 100:1 plus.

10x leverage means multiplying your initial investment by 100. For example, $100 x 10 = $1,000. Thus, you could buy $1,000 worth of stock with only $100.

As a new trader, you should consider limiting your leverage to a maximum of 10:1. Trading with too high a leverage ratio is one of the most common errors made by beginner traders. Until you become more experienced, it’s recommended to trade with a lower ratio.

Coffee Trading - Investing in Coffee CFDs

Emissions Trading - How to Invest in Carbon CO2?

How to Look for the Best CFD Broker

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.