There was a time when Donald Trump could move global markets with a single tweet. Announce a tariff, and the Dow would tumble. Hint at a trade war, and the VIX would spike. Wall Street braced itself every time the caps-lock came out.

But not anymore! In 2025, markets have learned the pattern and they’ve stopped caring. Despite Trump’s repeated threats of sweeping tariffs on China, Mexico, or “every country that cheats us,” investors barely blink. The reason? A four-word acronym now guides their thinking: TACO — Trump Always Chickens Out.

The phrase, born half in jest and half in frustration, sums up a key lesson from years of policy whiplash: Trump talks tough, markets react... until they don’t. Because more often than not, the tariffs never arrive.

There was a time when Donald Trump could move global markets with a single tweet. Announce a tariff, and the Dow would tumble. Hint at a trade war, and the VIX would spike. Wall Street braced itself every time the caps-lock came out.

But not anymore! In 2025, markets have learned the pattern and they’ve stopped caring. Despite Trump’s repeated threats of sweeping tariffs on China, Mexico, or “every country that cheats us,” investors barely blink. The reason? A four-word acronym now guides their thinking: TACO — Trump Always Chickens Out.

The phrase, born half in jest and half in frustration, sums up a key lesson from years of policy whiplash: Trump talks tough, markets react... until they don’t. Because more often than not, the tariffs never arrive.

The Tariff Threats Get Louder

Trump has made tariffs a core theme of his 2025 messaging. Whether to protect American jobs, punish foreign “cheaters,” or assert “economic nationalism,” his proposals have grown more extreme over time:

- A 10% blanket tariff on all U.S. imports.

- A 60% tariff on Chinese goods, aimed at addressing “IP theft and currency manipulation.”

- A 20% tariff on Canadian dairy and autos, tied to accusations of unfair trade and undercutting American workers.

- Renewed threats to tear up USMCA (the successor to NAFTA) unless Canada and Mexico “get in line.”

On paper, these would have massive consequences. Economists warn they could add hundreds of billions in costs, spark global retaliation, and fuel inflation just as the U.S. is trying to bring it under control.

And yet… markets barely notice.

Market Reactions: Muted to the Point of Indifference

In 2018–2019, Trump’s tariff threats regularly shook global financial markets:

- The S&P 500 fell 6.6% in May 2019 alone due to U.S.–China trade tensions.

- The VIX volatility index soared past 25 on multiple tariff headlines.

- Currency markets saw the yuan and peso plunge on even small mentions of tariffs.

But compare that to 2025:

- The 60% China tariff threat in April caused the S&P 500 to dip just 0.3% — and recover by the close.

- The Canadian tariff letter incident in May triggered no meaningful move in the CAD or Canadian equities.

- The VIX has remained below 14 for most of Q2 2025, signaling persistent investor calm.

Market participants simply don’t believe the threats will stick. As one hedge fund trader recently told Bloomberg, “It’s always Day 1 of the trade war, but we never get to Day 2.”

The Canada Case: Letters, Bluster, and Shrugs

One of the most recent additions to the TACO narrative came when Trump turned his attention north.

In May 2025, his campaign confirmed that formal letters were sent to major Canadian exporters, warning of potential tariffs on:

- Dairy: A long-time Trump grievance, citing Canada’s supply management system.

- Autos: With claims that Ontario-made vehicles were undercutting U.S. manufacturing.

- Energy: Particularly oil from Alberta, accused of “dumping” into the U.S. at unfair prices.

It was pitched as a major escalation. Trump said he was “prepared to protect American workers even if our allies don’t like it.”

The Canadian response? Firm but diplomatic.

- TSX Composite barely moved.

- The loonie (CAD) wobbled slightly intraday, but stabilised.

- Canadian auto and energy companies were not re-rated by analysts.

Tariffs Update: Monday, July 14, 2025

Global markets opened the week lower following Donald Trump’s latest announcement of sweeping 30% tariffs on imports from the European Union and Mexico, effective August 1. However it is worth noting the reaction was relatively mute. Germany’s DAX fell by 0.9%, while France’s CAC 40 and the pan-European Stoxx 600 both saw declines of around 0.4%–0.5%. Companies like BMW, Mercedes, Hermès, and Pandora led the declines amid fears of shrinking U.S. demand.

In the currency markets, the euro dipped to a three-week low, briefly touching $1.1675 before stabilising. The U.S. dollar strengthened slightly across the board, with the Dollar Index up around 0.1%. GBP/USD traded lower near 1.3470, weighed down by both stronger U.S. dollar flows and lackluster UK economic data. Traders seem to be treating the tariff threat as a political maneuver rather than a confirmed policy shift, echoing Trump’s prior pattern of abrupt trade rhetoric followed by softer action.

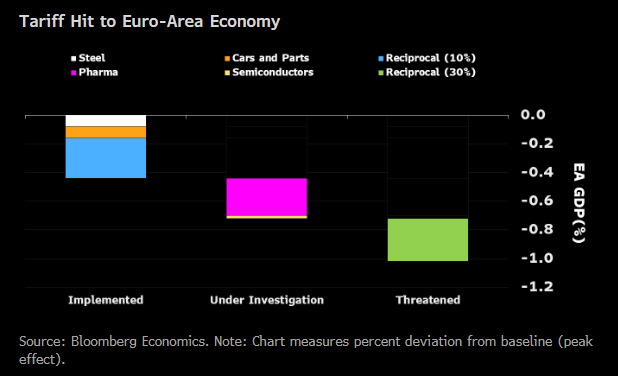

The EU economy will suffer from Trump's tariffs, but the current impact is limited compared to previous crises. Nevertheless, new 30% rates could double the current impact of tariffs on GDP. Source: Bloomberg Finance LP, XTB

Bond markets were active as well, with yields on German and Japanese government debt rising to multi-month highs. This move comes amid concerns about central bank independence following reports of renewed political pressure on the Federal Reserve. Meanwhile, safe-haven assets like gold and silver climbed slightly, supported by increased global uncertainty.

U.S. equity futures opened modestly lower in early trading. The S&P 500, Nasdaq 100, and Dow Jones all edged down between 0.1% and 0.5%. After a 30% rebound in major U.S. indices over the past three months, market strategists are growing cautious. Concerns center around the sustainability of corporate earnings, ongoing inflation dynamics, and the growing unpredictability of U.S. trade policy. With the U.S. CPI report for June due tomorrow (Tuesday, July 15, 2025,) traders are bracing for potentially market-moving inflation data that could recalibrate expectations around interest rates and bond yields.

Most Impacted Economies

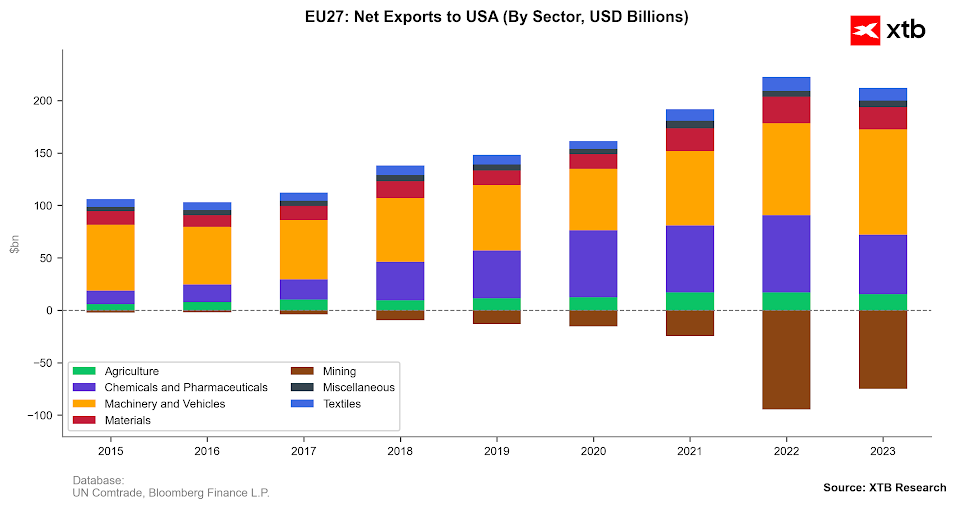

Germany, the largest economy in the EU, faces considerable exposure to the impact of U.S. tariffs. In 2023, the United States accounted for 10% of German exports, approximately $157.9 billion representing 3.7% of the country’s GDP. The automotive industry, a cornerstone of Germany’s economy, is especially vulnerable, with 13% of its vehicle production destined for the U.S. market. Notably, car exports to the U.S. dropped by 13% in April and a sharp 25% in May 2025. It’s important to highlight that car imports into the U.S. are already subject to a 25% tariff, meaning the effective tariff burden on EU exports is already higher than the general 10% average rate.

Net exports to the United States from the EU in recent years. As can be seen, machinery and vehicles, followed by chemicals and pharmaceuticals, account for the largest share of exports. The EU is a net importer of raw materials from the USA. Source: Bloomberg Finance LP, XTB

Ireland is also heavily exposed. Over 53.7% of its goods exports are sent to the U.S., with the pharmaceutical sector dominating that trade. Pharmaceuticals account for 55% of Irish exports, and shipments to the U.S. alone represent 18% of Ireland’s GDP. While pharmaceuticals are currently subject to lower tariff rates, Trump has floated the possibility of imposing a staggering 200% tariff on pharmaceutical imports within the next 12 to 24 months, a move that would directly target one of Ireland’s most critical economic lifelines.

How is Europe Reacting?

On the policy front, the European Union has held back from escalating the trade conflict. European Commission President Ursula von der Leyen reiterated the EU’s preference for a diplomatic resolution, announcing a continued freeze on retaliatory measures until August 1.

However, Brussels has prepared two tiers of countermeasures worth approximately €21 billion and €72 billion respectively should talks fail. There is also increasing momentum behind the use of the Anti-Coercion Instrument (ACI), an aggressive legal tool that would allow the EU to implement far-reaching trade restrictions and procurement bans.

At the same time, the EU is accelerating efforts to diversify its trade partners. Recent progress includes the signing of a Comprehensive Economic Partnership Agreement (CEPA) with Indonesia and advanced-stage negotiations with India, aimed at reducing reliance on U.S. markets. Brussels is also reportedly coordinating with Canada and Japan on potential joint responses to American trade pressure.

Despite the dramatic headlines, markets remain composed. Many analysts view the tariff threat as part of Trump’s negotiation tactics rather than a firm commitment including Oxford Economics having labeled the move “tariff theatrics,” while others note that the euro’s relative stability and the modest pullback in equities reflect a wait-and-see attitude from investors. That said, with just over two weeks until the August 1 implementation date, and critical U.S. inflation data due tomorrow, (Tuesday, July 15, 2025,) volatility is likely to increase in the near term.

Conclusion

Despite the bold headlines and market jitters, much of the financial world is treating Trump’s latest tariff threat as political posturing not policy. This wouldn’t be the first time. Traders have seen this movie before: tough talk followed by a quiet retreat.

Until there’s clear follow-through on these 30% tariffs, markets seem reluctant to fully price in worst-case scenarios. As always, the real risk lies not just in what’s said but in what actually sticks. For now, the base case remains negotiation over escalation. But as we've learned, with Trump, anything is possible until it isn’t.

Yield Meaning | What is A Yield?

All You Need to Know About Shares & Stocks

What Is A Yield In Finance ? A Short Guide

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.