A buzz word in the financial sector right now is private assets and there is a broad trend in wealth management towards increasing the retail trading community’s access to private markets.

These markets have long been the preserve of institutions and wealthy individuals. However, this sector is expanding, and retail traders are gaining access to a new suite of financial products that offer access to private assets.

A buzz word in the financial sector right now is private assets and there is a broad trend in wealth management towards increasing the retail trading community’s access to private markets.

These markets have long been the preserve of institutions and wealthy individuals. However, this sector is expanding, and retail traders are gaining access to a new suite of financial products that offer access to private assets.

Private markets offer potential to grow wealth

Back in 2023, the World Economic Forum suggested that retail traders should be given access to the same return and diversification benefits of private markets. This includes assets and securities that are not traded on public exchanges, for example, private equity, private debt, credit markets and even infrastructure like schools and hospitals.

The World Economic Forum argued that retail traders could boost their returns by having a slice, even a thin one, of the private asset market. This could help to boost retail investors’ wealth and ensure their long-term financial security.

Private markets expansion

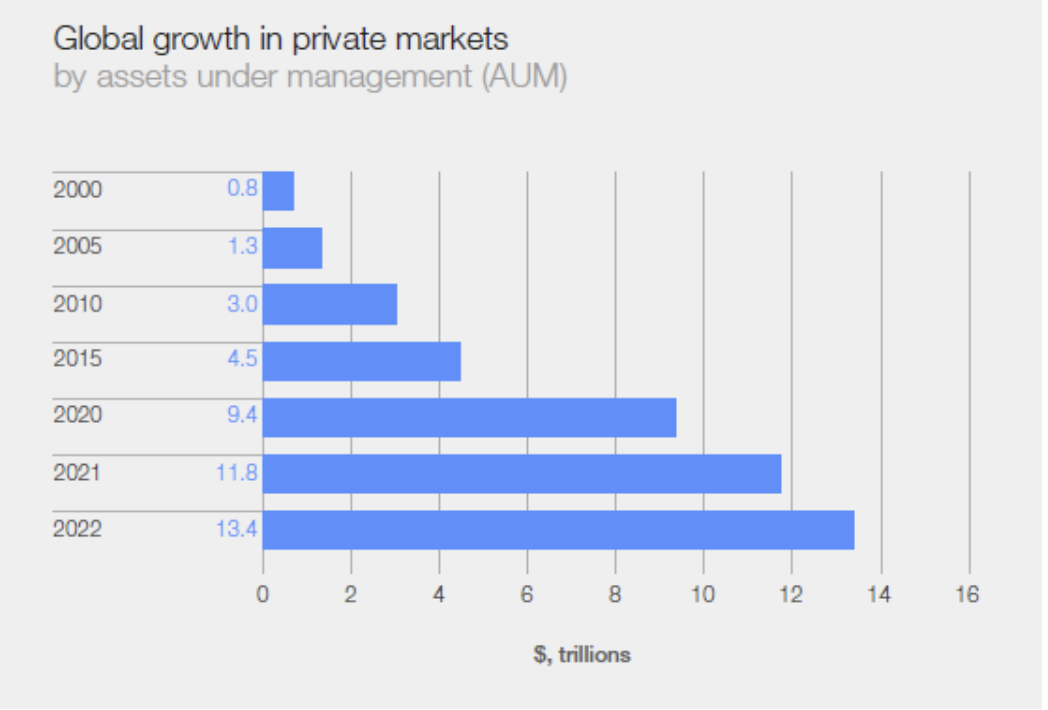

The World Economic Forum’s main argument is that more companies are choosing to stay private, rather than list on public exchanges. Due to this, the size of private markets has ballooned to $9.6 trillion in assets last year, from $4.5 trillion in 2015. Private markets are becoming an important part of the financial ecosystem, and the question of retail participation is gaining traction.

In 2025, a growing number of pension providers are allocating more pension contributions to private assets, in some cases 20-25%. This is a big shift from the time when pension funds were predominantly invested in listed shares and government bonds.

Some will argue that this makes perfect sense. The majority of UK government bonds have lost value in the past 3 years, due to rising interest rates and the bond market dislocation following Liz Truss’s mini budget in 2022. Although yields have risen, most bond holders have faced capital losses during this period, which is why retail investors are keen to diversify into alternative asset classes.

Return profile is attractive

Stock markets have had a much stronger performance than bonds, however, private markets have produced juicy returns that compare favourably to publicly traded assets. For example, in 2024, European growth capital funds returned nearly 15% and venture capital funds returned more than 12%. Private equity also has a strong history of producing good results. The British Private Equity & Venture Capital Association reports that PE funds have produced annual returns of 15.8% over the last 10 years. This compares to an 8% gain for the Eurostoxx 50 index in 2024, and a 6% gain for the FTSE 100.

Risks should not be underestimated

The attraction of private markets is clear, however there are plenty of risks. Retail access to these assets is often through sophisticated products. There is a lack of transparency in private markets, for example, companies are not forced to report quarterly results like they are on public exchanges. Investor protection is an issue, and ensuring that individuals know what they are investing in, and the risks and characteristics of the markets they buy in to is important

Private assets are inherently less liquid than public markets, and often investors are locked into investments for a specific period. If someone needs to access their investments quickly, that won’t be possible with private markets. In contrast, you can easily sell stocks and bonds. The regulatory framework is also different compared to public markets, which can also leave retail investors exposed.

Retail investors are vital for the future of private markets

While we have discussed the benefits of private markets for retail investors, private markets can also benefit from the retail trading community. For example, State Street reports that 50% of all flows into private markets in the coming years will come from retail investors. This is a huge chunk of fundraising and if retail flows do reach this level, then retail investors will drive growth in this industry, and the future profits for private equity funds, hedge funds and venture capital funds.

Added to this, McKinsey & Company’s Private Market Reports for 2025 found that private debt fundraising fell 22% last year, and infrastructure fundraising is also moderating. The private equity industry is still acclimatizing to the higher global interest rate environment, which has thwarted some buyout deals. There are also persistent challenges for private markets, including inflation and geopolitical risks like President Trump’s trade tariffs.

One way to smooth these concerns is to expand their capital base to the retail investor community. However, retail investors should understand that private markets need them as much as they need the returns available in private markets. The retail trader could become an important part of this industry, and they should have a voice to demand better regulation and more transparency, in return for their investments.

The growing importance of the retail investor

While private markets offer individuals the potential to boost their returns and grow their wealth, they also pose challenges because they are not as easy to invest in as publicly traded assets.

Retail traders are evolving. They are becoming increasingly important for financial markets. They account for 30-35% of trading volume in traditional public exchanges, and expectations are building that they could become a bigger force in private markets. As they grow in importance, retail investors need to demand higher standards, fair returns and create frameworks to take a more activist stance and deliver change at the top of private and public markets.

This will take time, but as part of a diversified portfolio, private market investments are an interesting opportunity for retail investors.

Chart 1: Global Growth in private markets, AUM, $ trillions.

Source: World Economic Forum. Past performance is not a reliable indicator of future results.

Best ETFs to Look Out For

Building Balance: How to Diversify Your Portfolio with XTB

Is the AI Trade a bubble?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.