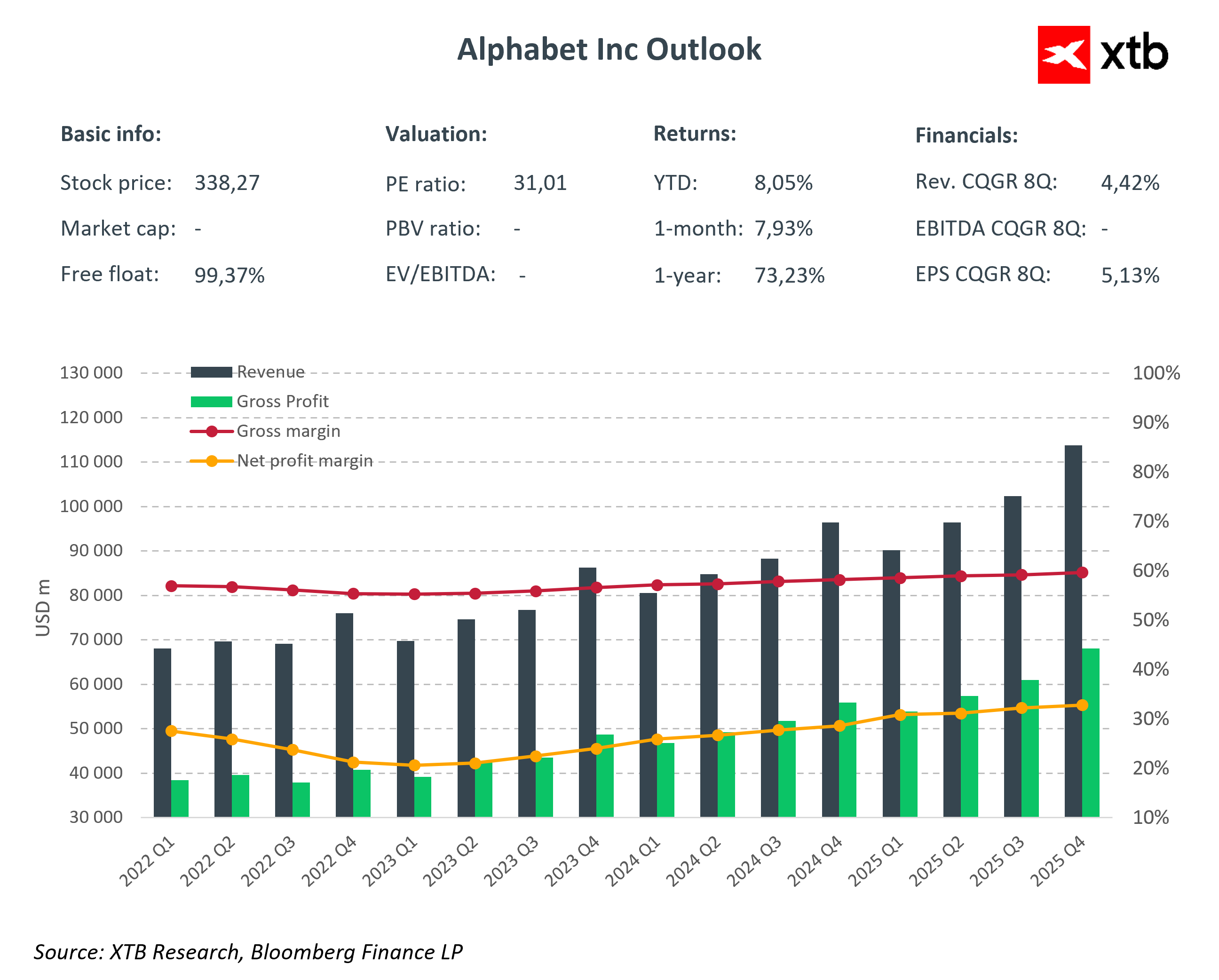

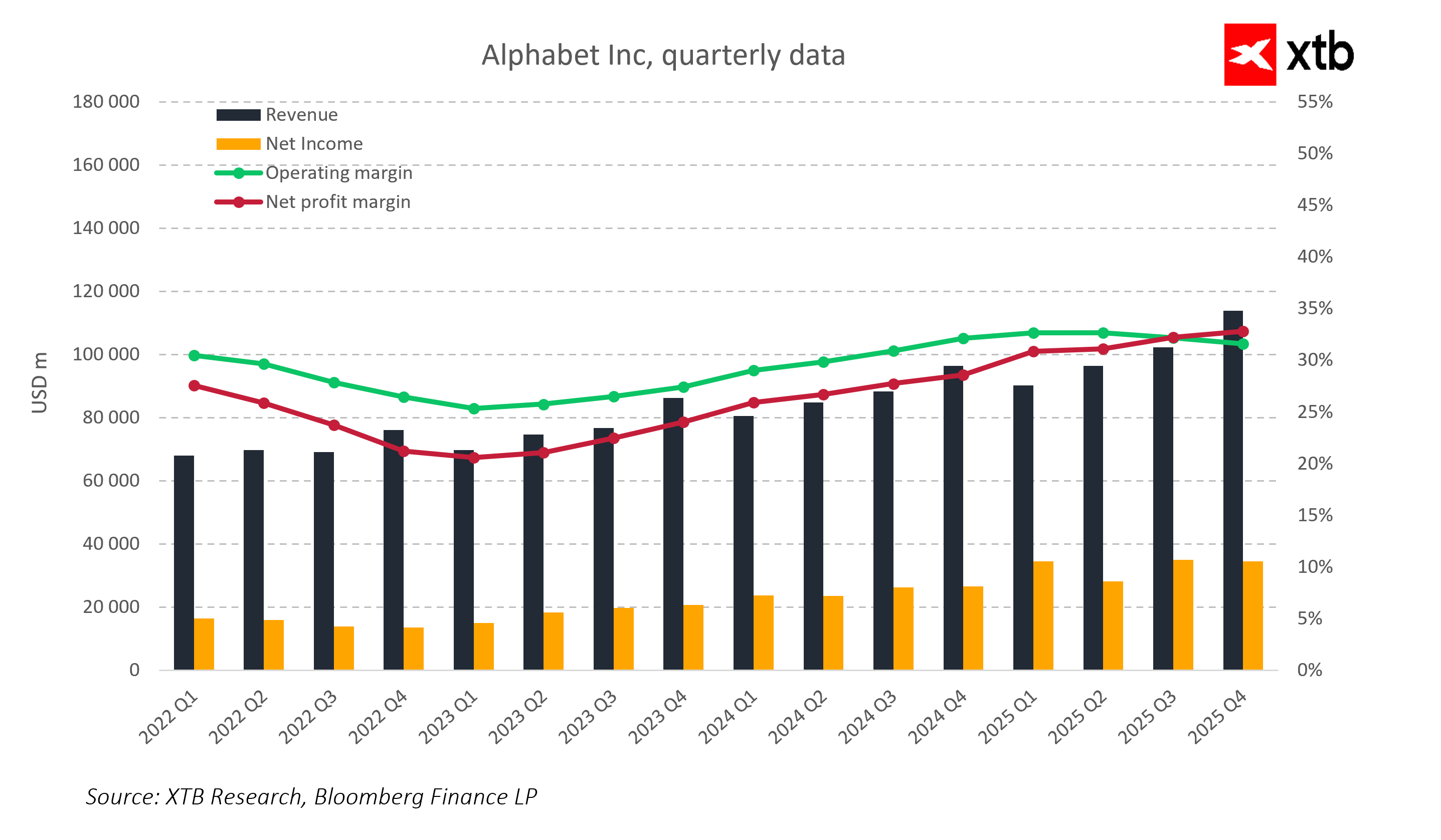

Alphabet released its fourth-quarter 2025 results, which clearly show that the company is accelerating in key areas of its business. Revenues reached a record $113.8 billion, marking a 14% increase year-over-year and surpassing market expectations of $111.4 billion. Earnings per share (EPS) came in at $2.82, above the forecast of $2.65, while net income reached $30.1 billion, representing a 20% year-over-year increase.

These results demonstrate that Alphabet is not only able to maintain steady and systematic growth but also effectively monetize its investments in artificial intelligence, proprietary TPU processors, and cloud services development. The company shows that future technologies are becoming a tangible source of revenue and profit, strengthening its position as a leader in the global digital economy.

Key Financial Highlights – Q4 2025

-

Total revenue: $113.8 billion, +18% YoY

-

Google Services revenue: $95.9 billion, +14% YoY

-

Google Search revenue: $63.1 billion, +17% YoY

-

YouTube revenue: $11.4 billion, +9% YoY

-

Google Cloud revenue: $17.7 billion, +48% YoY

-

Alphabet operating income: $35.9 billion, +16% YoY

-

Operating margin: 31.6%

-

Net income: $34.5 billion, +30% YoY

-

EPS: $2.82, +31% YoY

Business Segments

Google Services remains a solid foundation of Alphabet’s revenue, accounting for the majority of quarterly results. The segment generated $95.9 billion in revenue, demonstrating that the traditional digital advertising model continues to deliver significant profits. Growth was driven by 17% in Search & other, 17% in subscriptions, platforms, and devices, and 9% in YouTube advertising, proving that online advertising remains a core financial engine despite rising competition and privacy regulations.

Google Services also serves as a strategic cash generator, allowing Alphabet to fund investments in other areas. Its high contribution to total revenue underscores that traditional advertising is not only resilient but is also enhanced by AI tools that improve targeting efficiency and attract global advertisers.

Google Cloud is Alphabet’s fastest-growing segment, with $17.7 billion in revenue, reflecting a staggering 48% year-over-year increase. This confirms that cloud and AI-related solutions are becoming an increasingly significant source of revenue. Growth is fueled by rising demand for AI infrastructure, enterprise solutions, and an expanding corporate client base. Alphabet continues to develop its own computing environments, including TPU processors and AI tools, giving it a technological edge over competitors.

Other Bets, which include experimental projects such as Waymo and Verily, generated $370 million in revenue, with an operating loss of $3.6 billion. Although still unprofitable, the reduction in losses and cost control demonstrates that Alphabet effectively manages risk in long-term investments that could generate substantial returns in the future.

Capital Expenditures and Outlook

Alphabet announced plans to allocate $175–185 billion for capital expenditures in 2026, over 60% higher than the previous year. This massive increase in investment is primarily aimed at expanding data centers, building AI infrastructure, growing Google Cloud, and modernizing existing advertising infrastructure.

The scale of these investments is unprecedented in the company’s history and shows that Alphabet is not merely maintaining its competitive advantage but actively laying the foundation for long-term growth in AI and cloud services. At the same time, the market continues to evaluate how these large expenditures may impact short-term margins and cash flows.

Perspectives and Conclusions

Alphabet demonstrates that it can effectively combine aggressive investment with profitable monetization. Steady growth in Google Services, dynamic expansion of Google Cloud, and controlled losses in Other Bets indicate a balance between expansion and profitability.

After months in which some market participants believed Alphabet had missed the AI boom, the company’s results show that it is actually taking the lead. The growth in Google Cloud revenues and increased AI monetization across advertising and cloud services prove that Alphabet is not only keeping up with trends but setting industry standards. Proprietary TPU processors, AI infrastructure development, and expanding data centers enable the company to scale products faster and increase revenues in key segments.

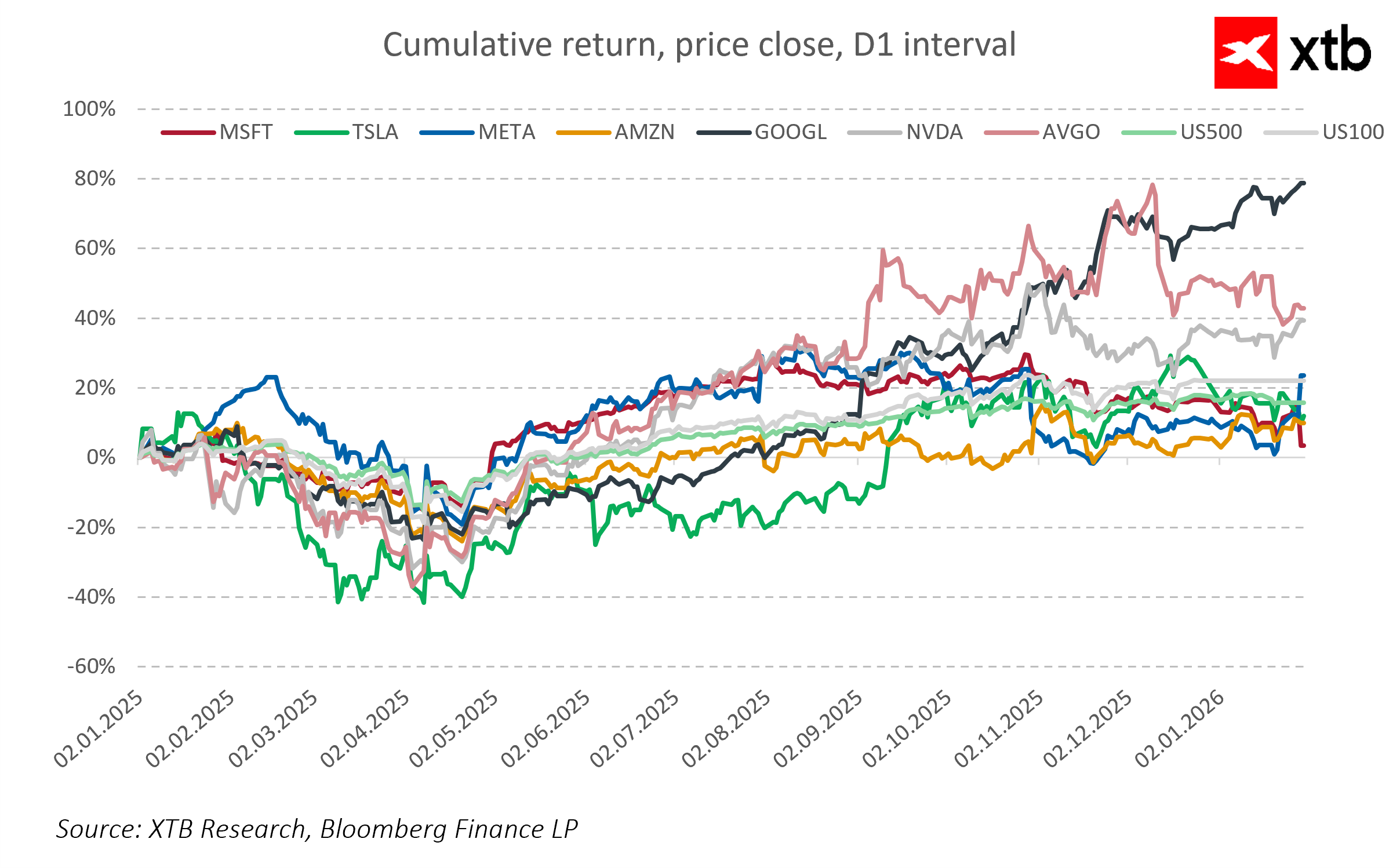

These developments are also reflected in the capital markets. Alphabet’s shares have outperformed other Magnificent Seven companies over the past 12 months, reflecting growing investor confidence in the company’s ability to generate AI-driven revenues and maintain its lead in cloud technology. Alphabet is entering a new growth phase, where systematic revenue expansion in advertising and cloud services is paired with aggressive capital deployment, potentially defining the company’s market position for years to come, especially in the context of AI’s growing importance in the global digital economy.

A tale of two earnings releases: Rolls Royce beats Nvidia, because its European

D‑Wave Quantum: Concrete Results Today, Big Dreams Tomorrow

Will Nvidia’s report reignite optimism on Wall Street?

Nvidia’s report blows past expectations on Blackwell 📈 Will the AI boom last?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.