Amazon (AMZN.US) was another US mega-tech that was disappointed with its Q3 earnings report, or at least this is what we can say judging by market reaction as the company's stock divided over 12% in the after-hours trading. This drop deepened further in today's premarket trade. However, results themselves were not that bad and the drop in share price can be reasoned with lackluster guidance for holiday Q4 2022. Let's take a close look at the release!

Results miss but not by a huge margin

Amazon reported a 15% YoY increase in Q3 net sales, to $127.1 billion. The results were slightly lower than $127.7 billion expected but the growth rate remained more or less unchanged compared to a year ago. Sales in online stores increased 7.1% YoY to $53.49 billion (exp. $54 billion) while sales in physical stores were 10% YoY higher at $4.69 billion (exp. $4.68 billion). Company reported a big 20% YoY jump in North American sales, to $78.84 billion (exp. $76.95 billion), but international sales lagged with an almost 5% YoY drop to $27.72 billion (exp. $29.28 billion).

Operating income dropped by almost a half compared to Q3 2021 and reached $2.53 billion, missing an estimate of $3.11 billion. While this is a miss, it is also the first positive earnings result after two quarters of profit declines. However, drop in profit in those two quarters was mostly driven by impairments in investment in Rivian EV automaker. One thing that is a source of concern is that Q3 2022 was the fifth straight quarter when Amazon sales grew at a slower pace than the company's costs.

Poor guidance for Q4 2022

As one can read from the paragraph above, results for Q3 2022 were not that bad and while they slightly missed expectations, growth rates remained solid. However, Amazon released very poor guidance for the final quarter of the year, which is seasonally the best for the company due to increased holiday spending. Amazon expects revenue to reach $140-148 billion, or to be 2-8% YoY higher. Even if sales came in at the high-end of the guidance range, it would mark the weakest Q4 sales growth on the record for the company. Market expected Q4 sales guidance of $155.5 billion. Moreover, Amazon also expects operating income to reach $0-4 billion in Q4 2020. This is not a typo - the company really expects that it can make no profit in a quarter when people spend loads of money online to buy Christmas gifts! The last time Amazon did not report any profit in the final quarter of the year was in Q4 2000.

AWS holds strong but growth slows

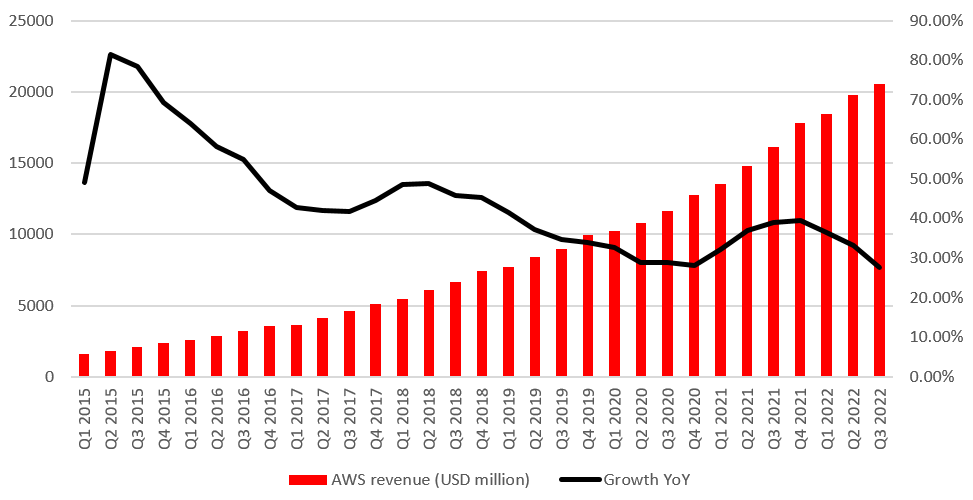

Market paid a lot of attention to how the AWS cloud business performed. Sales in the cloud segment grew at a pace of 27% YoY in Q3 2022, which was the slowest pace of growth since the company started reporting cloud segment results. This is concerning as AWS is widely seen as a new profit driver for the company. In fact, the company reported negative profit margins in International and North American segments in Q3 2022, meaning that profit in the previous quarter was driven almost entirely by the cloud segment. Further slowdown in AWS may be concerning but also should not be too surprising - as the segment grows bigger, it is hard to keep a high pace of business expansion.

Amazon reported the lowest growth rate on the record in its cloud segment. Source: Amazon, XTB

Amazon reported the lowest growth rate on the record in its cloud segment. Source: Amazon, XTB

Stock set to open below $100 for the first time since April 2020

Slight missed in headline results and poor Q4 guidance triggered a 12% drop in the after-hours trading. Shares continued to slide as premarket trade began and current quotes point to an around-14% bearish price gap at the launch of today's trading. This means that the is likely to trade below a mid-term support zone in the psychological $100 area for the first time since April 2020, erasing a whole post-pandemic share price jump. This also means taking out a June low and painting a new lower low in the current downtrend structure. This does not bode well for the stock going forward and overall poor sentiment towards the tech sector may keep the shares under pressure.

Amazon (AMZN.US) at weekly interval. Source: xStation5

Amazon (AMZN.US) at weekly interval. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.