Shares of the world's largest smartphone maker, Apple (AAPL.US) are losing nearly 10% today before the opening of the US stock market; slipping below the psychological support at $200 per share. Parallel to Apple, Nvidia shares are down by more than 13%; other stocks of the 'magnificent seven' companies are also recording serious declines in pre-session trading. Fears of a stock market crash in the United States are growing; US100 contracts are losing more than 5.5%.

- Q2 position updates revealed that Warren Buffett's investment vehicle sold off about half of the entire Apple stake. In the end of the second quarter of the year, Buffett's fund owns about $84 billion in Apple shares. Berkshire sold $75.5 billion worth of a various companies shares in Q2

- Apple's shares rose nearly 23% in Q2, and Berkshire took advantage of the period of high volume and buyers to 'stealth' consistent selling of shares. While Q2 year-over-year results were strong, increased fears of a recession have the market expecting weaker smartphone orders and weaker results from the debut of the next iPhone models.

- Berkshire Hathaway increased its cash position to $277 billion, an all-time high; the holding company's suspension of large investments raises additional concerns about current valuation levels and signals a 'wait for opportunity' mode.

After Berkshire selling multi-year, and the largest Berkshire's investment in Apple, according to Q2 statment, also main Apple suppliers such as Hon Hain (-10%) Murata Manufacturing (-15%) and Luxshare (-8%) precision stocks corrected.

Apple shares (D1 interval)

The catalysts of new AI products and strong results have not been enough to sustain Apple's valuation, as the market is pricing higher the chances of a slowdown in the US economy. Investors cannot wait to change positions, for months to come, and while a recession is not yet a foregone conclusion, Wall Street is already pulling back from stocks that could potentially be hit hardest at the prospect of a weaker economy. The first important support for Apple is around the SMA200 (red line) and the 38.2 Fibonacci retracement, near $190 per share.

Source: xStation5

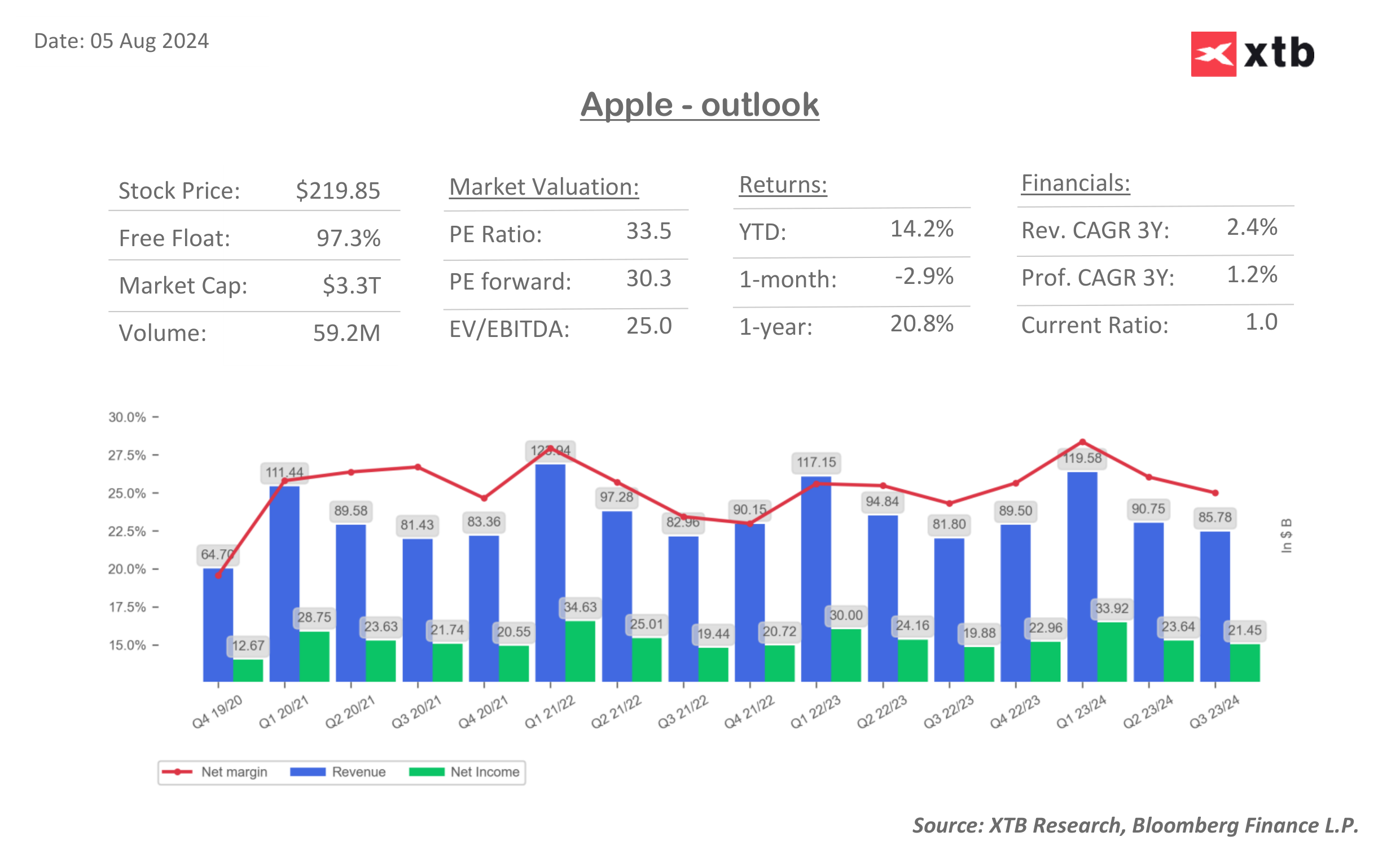

Źródło: XTB Research, Bloomberg Finance L.P.

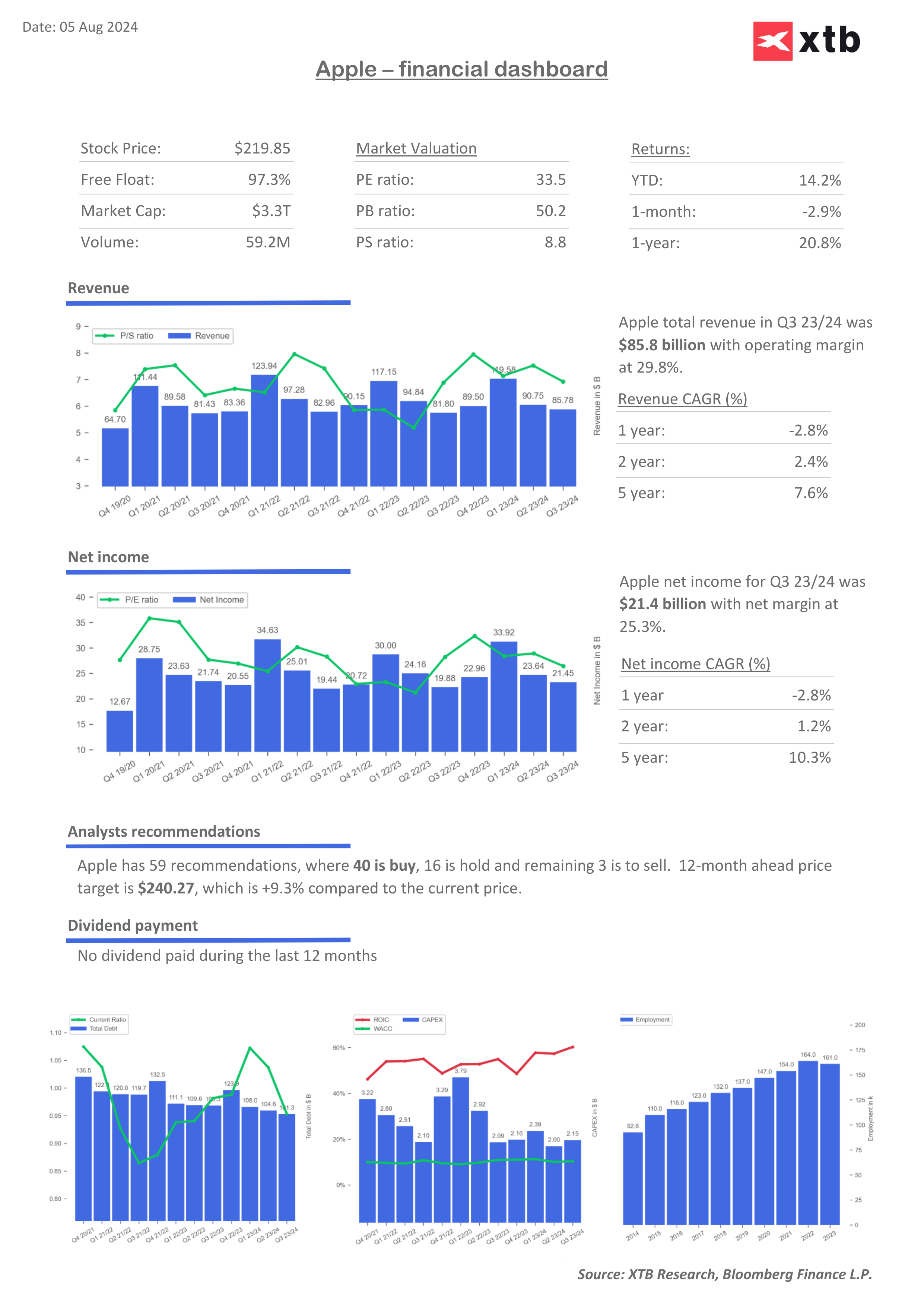

Źródło: XTB Research, Bloomberg Finance L.P.

Source: XTB Research, Bloomberg Finance L.P.

Source: XTB Research, Bloomberg Finance L.P.

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.