Summary:

- Comments that China demands from Trump to remove tariffs imposed in September have lifted risk sentiment (it seems rather unlikely Trump refuses Chinese demands and re-escalates the ongoing trade war again)

- Reserve Bank of Australia leaves rates on hold and signals that the latest cuts have supported employment and income growth in

- Australia Australian dollar climbs 0.3% against the US dollar and is the best performing major currency this morning

The Australian dollar is by far leading the gains compared to its G10 peers largely due to two factors. The first one concerns the ongoing trade spat between the United States and China. Namely, according to Politico China is demanding that Trump eliminates a round of duties scheduled to go into effect in mid-December and also lifts tariffs imposed in September. Let us recall that Beijing was slapped with a 15% tariff rate on roughly $112 billion worth of Chinese goods at the beginning of September. Now, China wants Washington to remove these duties along with refraining from imposing an additional 15% rate on $160 billion worth of goods next month. As the newspaper reports, China is reportedly very eager to have a 25% tariff rate removed, or at least cut in half, on an additional $250 billion worth of goods. Nevertheless, it is not anticipated to be included in a deal between the two feuding countries.

Secondly, the Reserve Bank of Australia left interest rates unchanged, in line with expectations, and added one a bit cryptic paragraph in its statement. It says: “The easing of monetary policy since June is supporting employment and income growth in Australia and a return of inflation to the medium-term target range." This could imply that the RBA is quite satisfied with the effects of the previous rate reductions it delivered. If so, it could also signal the Australian central bank may be unwilling to keep cutting rates in the near-term. On top of that, the RBA mainly underlined downside risks from abroad and kept its pledge to ease policy further if needed to support sustainable growth. To sum up, we reckon that these two factors are supportive of the Aussie this morning.

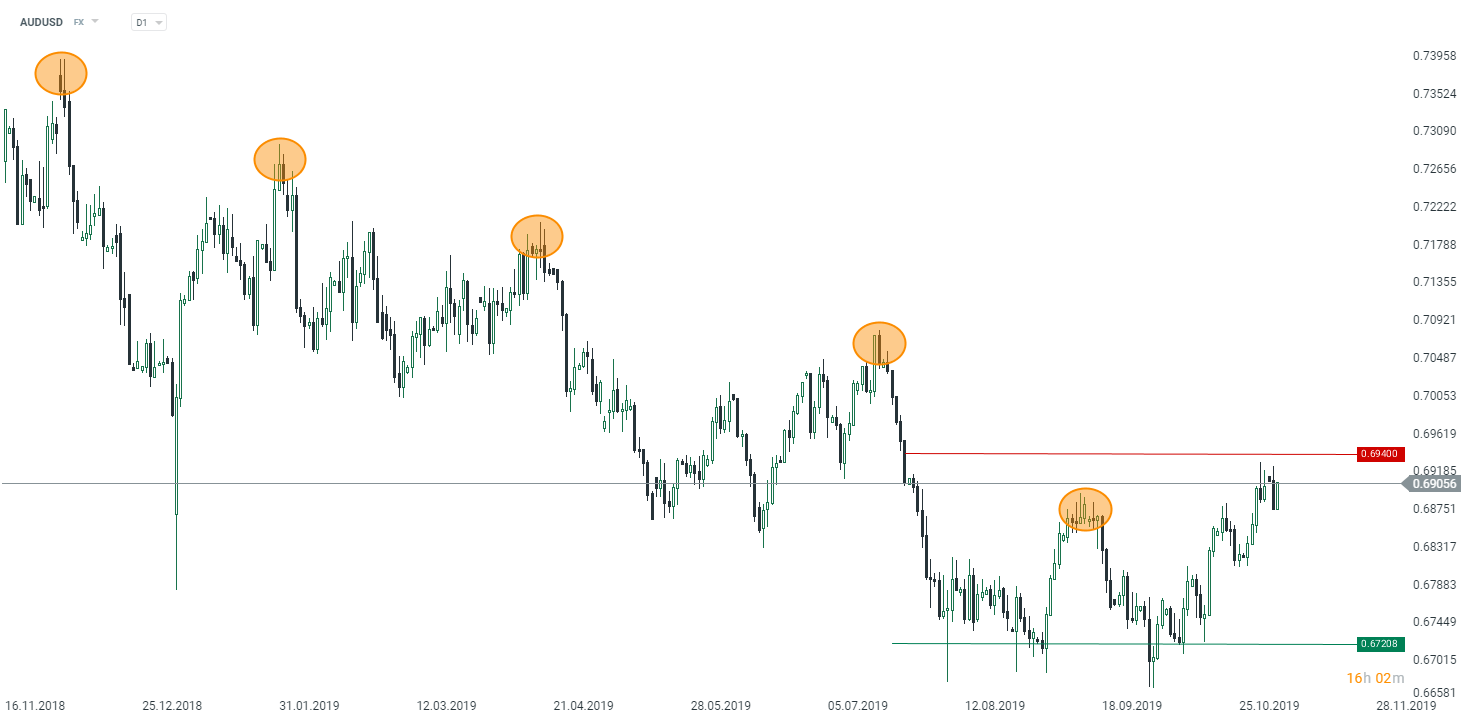

A sequence of “lower highs and lower lows” has been broken of late. Does it foretell upside for the Aussie? Source: xStation5

A sequence of “lower highs and lower lows” has been broken of late. Does it foretell upside for the Aussie? Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Politics batter the UK bond market once more, as Starmer remains under pressure

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.