Summary:

-

Final Australian budget performance surprises to the upside matching the latest S&P decision

-

EU will establish a special purpose vehicle to facilitate transactions with Iran

-

Chinese stocks decline amid calm trading across FX

Asian trading was quite calm when it comes to the currency market albeit Chinese stocks saw widespread declines as investors responded to new tariffs which kicked in yesterday. In terms of macroeconomic releases it is worth noting the final budget outcome from Australia where the country unveiled much better than initially projected results. The overall 2017/2018 deficit was 10 billion AUD or 0.6% of GDP meaning a 19.3 billion AUD improvement compared to the original forecast presented before the beginning this fiscal year. Total revenue was 456.3 billion AUD (11.9 billion higher than the first budget estimate) where the amount of revenue generated by taxes accounted for 427.4 billion AUD which was 12 billion above the initial projection. On the other hand, total expenses stood at 460.3 billion AUD, the number turned out to be 4 billion lower suggesting a greater degree of fiscal discipline. Of course, stronger economic growth and the firm labour market helped the budget improve substantially as well. The 19.3 billion AUD improvement this fiscal year came after the government had been able to make a 4 billion improvement last year - both numbers were achieved partly due to favorable economic conditions.

Australian Finance Minister Mathias Cormann said after the release “We came into government with a plan to deliver stronger growth, more jobs, and to repair the budget, and what this final budget outcome for 2017/18 demonstrates is that our plan is working, the economy is stronger, the economic growth outlook is stronger, employment growth has been much stronger than anticipated, and indeed the budget is in a much stronger position than was anticipated when we delivered the 2017/18 budget,” Let’s note that this year deficit is the smallest one in a decade. The peak of 4.2% deficit was reached in the 2009/2010 year. Notice that the budget performance coincides with the latest S&P decision which saw the Australia’s credit outlook raising to stable from negative. Then, the rating agency cited budget reasons anticipating surpluses in the years to come. Despite the positive picture of Australian public finance the local dollar has been barely changed in response to the data being marginally offered this morning. Note that the latest increase of Antipodean currencies might be continued in the nearest future but these currencies might come under pressure anew after the midterm elections in the US when a Trump’s stance on trade potentially toughens.

Technically, the Aussie dollar is moving slightly down this morning but the short-term demand zone could save buyers. Source: xStation5

On top of that it is worth noting that five world powers - the UK, France, Germany, Russia and China - agreed on Monday to set up a special purpose vehicle in the European Union to facilitate payments for Iranian imports and exports after sanctions reimposed by the US on Iran will be enacted at the beginning of November. In a joint statement we could read that the special financial facility will “assist and reassure economic operators pursuing legitimate business with Iran”. Let’s recall that Donald Trump pulled out his country from the nuke agreement in May earlier this year accusing Tehran of promoting international terrorism. This special entity will allow the EU and Iran to do payments (including payments for oil) when US sanctions come into effect. Both grades of oil are trading roughly 0.4% higher as of 7:01 am BST.

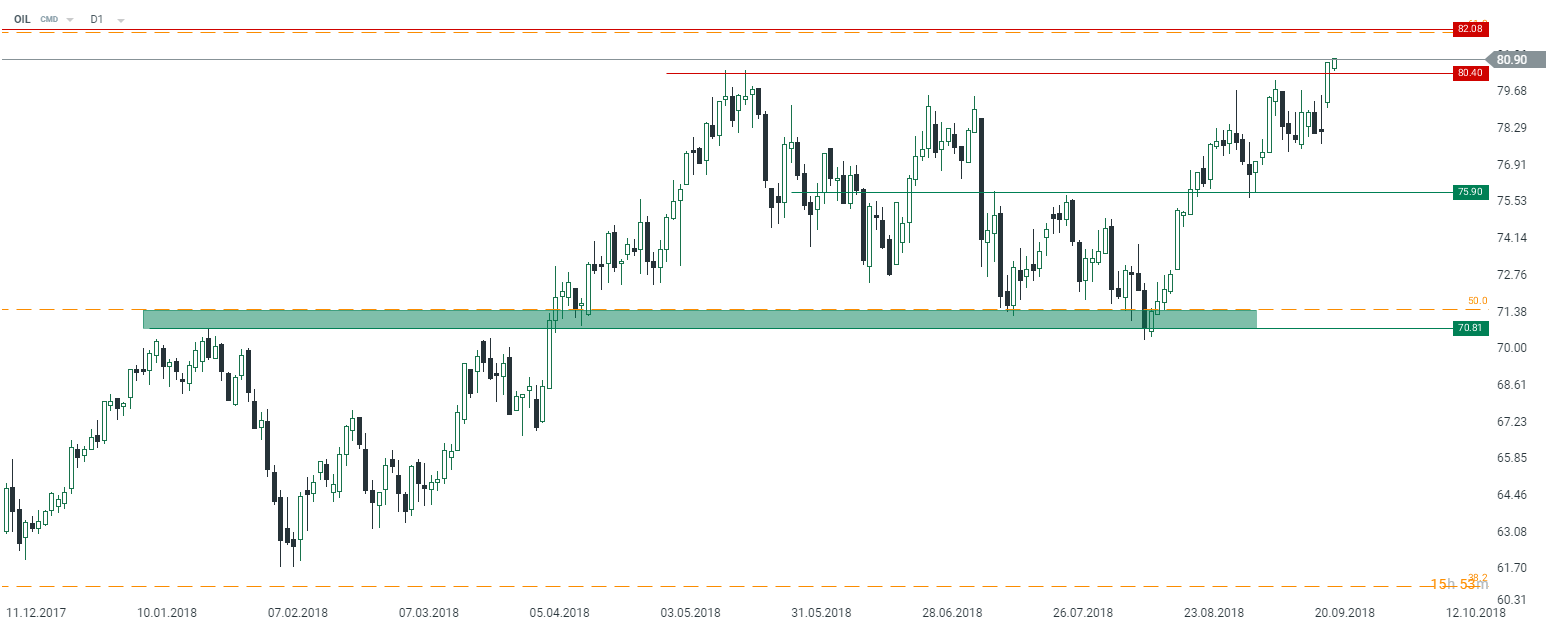

Brent prices managed to break through $80.4 on Monday fuelled by hopes that the OPEC would not pump more crude next year. The next target for bulls might be localized at $82. Source: xStation5

Brent prices managed to break through $80.4 on Monday fuelled by hopes that the OPEC would not pump more crude next year. The next target for bulls might be localized at $82. Source: xStation5

Finally let’s notice that Chinese investors are back today after a holiday on Monday and therefore stocks there are declining in response to new $200 billion duties which kicked in yesterday. The Shanghai Composite is falling 0.7% while the other indices are experiencing even deeper decreases. Moreover, downbeat moods seen across Chinese equities today might be, in part, due to the worse performance of stocks in the US where both the SP500 and the Dow Jones dipped by 0.35% and 0.7% respectively. Unlike Chinese stocks, the Japanese NIKKEI (JAP225) ended the day with a 0.3% gain.

In the other news:

-

The Australian weekly consumer sentiment gauge decreased to 117.2 from 118

-

Head of BP’s trading business thinks any oil spikes fuelled by a supply decrease of Iranian crude are likely to be unsustainable

-

China will set up a budget performance evaluation and management system that will supervise all investment and financing activities by both central and local governments

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.