- The third-quarter 2025 results of the three major U.S. banks demonstrate the financial sector’s strong resilience amid a challenging macroeconomic environment.

- The banks showed high capital profitability, solid credit portfolio quality, and better-than-expected performance in trading and investment banking.

- The third-quarter 2025 results of the three major U.S. banks demonstrate the financial sector’s strong resilience amid a challenging macroeconomic environment.

- The banks showed high capital profitability, solid credit portfolio quality, and better-than-expected performance in trading and investment banking.

Today we received the latest quarterly results from the largest U.S. banks: Bank of America, Wells Fargo, and Morgan Stanley. These reports provide fresh insights into the health of the U.S. banking sector, showing how these institutions are navigating macroeconomic challenges and a changing market environment.

In the following article, we will analyze the detailed results of each bank, highlighting the key financial indicators and outlooks for the future.

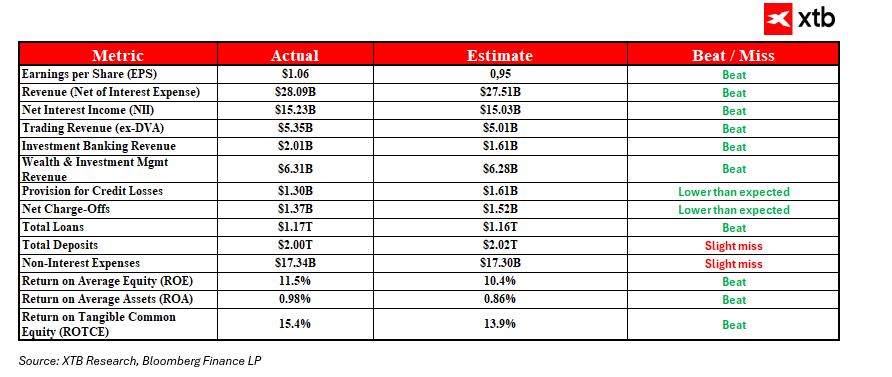

Bank of America – Key takeaways from Q3 2025 results

Revenues and net interest income beat expectations

The bank reported net revenues of $28.09 billion, clearly above forecasts ($27.51 billion). Net interest income reached $15.23 billion, also surpassing market expectations. This shows that Bank of America is managing its assets and liabilities well in a rising interest rate environment, which supports higher net interest margins.

Trading as a significant revenue growth driver

The trading segment generated $5.35 billion in revenue, beating estimates of $5.01 billion. Equity trading performed particularly well with $2.27 billion (vs. $2.08 billion expected). Increased market volatility and higher transaction volumes contributed to stronger results, demonstrating the bank’s ability to capitalize on market opportunities.

Improvement in credit portfolio quality

Provisions for credit losses declined to $1.3 billion, reflecting better risk control and improved asset quality. Lower reserves indicate the bank is less concerned about customer defaults, strengthening its financial stability.

Higher capital efficiency

Return on equity (ROE) reached 11.5%, and return on tangible common equity (ROTCE) was 15.4%, both exceeding analyst expectations. This means Bank of America effectively uses its capital to generate attractive returns for shareholders despite macroeconomic challenges.

Stable balance sheet with strong loan growth

The loan portfolio increased to $1.17 trillion, surpassing estimates and indicating growing demand for financing. Deposits remained solid at $2 trillion, highlighting strong customer trust and a stable funding base.

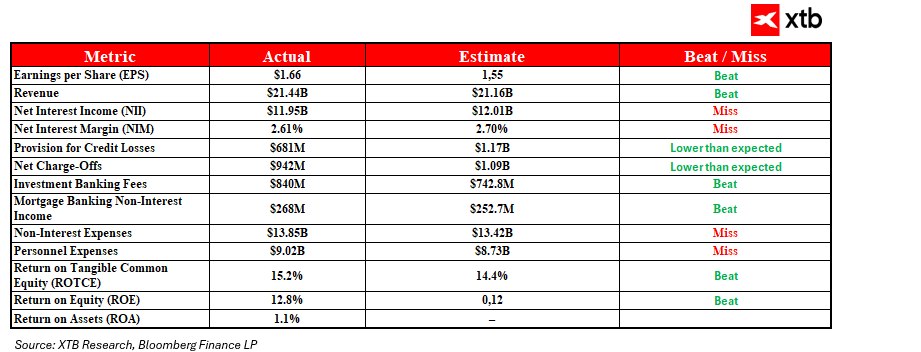

Wells Fargo – Key takeaways from Q3 2025 results

Stable revenues, net interest income slightly below expectations

Wells Fargo kept revenues close to forecasts, although net interest income was slightly lower at $11.95 billion compared to $12.01 billion expected. This reflects moderate loan portfolio growth and economic headwinds that slow expansion.

Significant improvement in asset quality

Provisions for credit losses dropped sharply to $681 million, well below the anticipated $1.17 billion. This is a clear sign the bank is effectively managing credit risk and its portfolio quality is improving.

Strong growth in investment banking revenues

The corporate and investment banking segment posted revenues of $4.88 billion, well above the $4.20 billion forecast. This was driven by increased M&A activity and a higher volume of transactions, generating meaningful advisory and transaction fees.

Rising operating costs impact efficiency

Operating expenses rose to $13.85 billion, above the $13.42 billion estimate, pushing the efficiency ratio (costs to revenues) up to 65%. The bank will need to focus more on cost control to maintain healthy margins.

Capital returns exceed expectations

ROE reached 12.8% (vs. 12% forecast), and ROTCE was 15.2% (vs. 14.4%), showing that despite rising costs, the bank improved efficiency and delivered higher returns to investors.

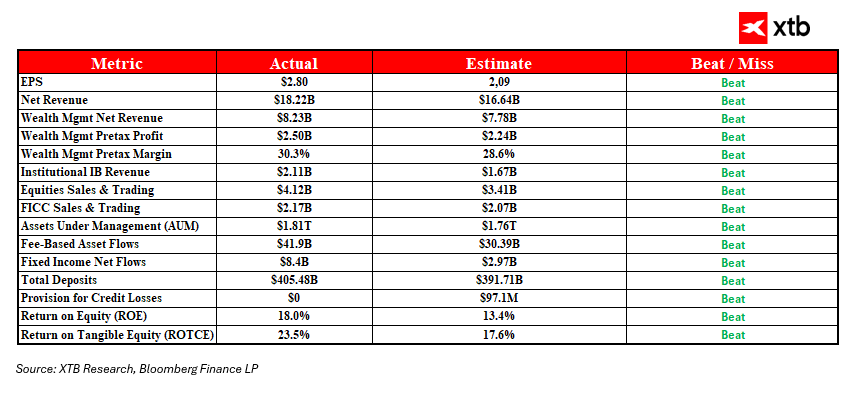

Morgan Stanley – Key takeaways from Q3 2025 results

Net revenues and wealth management segment surpass expectations

Morgan Stanley reported net revenues of $18.22 billion, well above estimates of $16.64 billion. The wealth management segment generated $8.23 billion, exceeding forecasts of $7.78 billion. This confirms the bank’s strong position in serving affluent clients and growing demand for wealth management services.

Record equity trading revenues

Equity trading revenues hit $4.12 billion, nearly 21% higher than expected. Increased market volatility and higher trading volumes enabled the bank to achieve excellent results in this segment.

Investment banking and advisory fees on the rise

Investment banking revenues increased to $2.11 billion, and advisory fees reached $684 million. A growing number of M&A deals and securities issuances point to a corporate activity rebound benefiting the bank’s results.

No need for additional credit loss reserves

Morgan Stanley did not increase its credit loss provisions, signaling portfolio stability and low risk — an important factor in the current economic environment.

High profitability and improved cost control

ROE reached an impressive 18%, well above expectations of 13.4%. This reflects efficient capital use translating into higher shareholder returns.

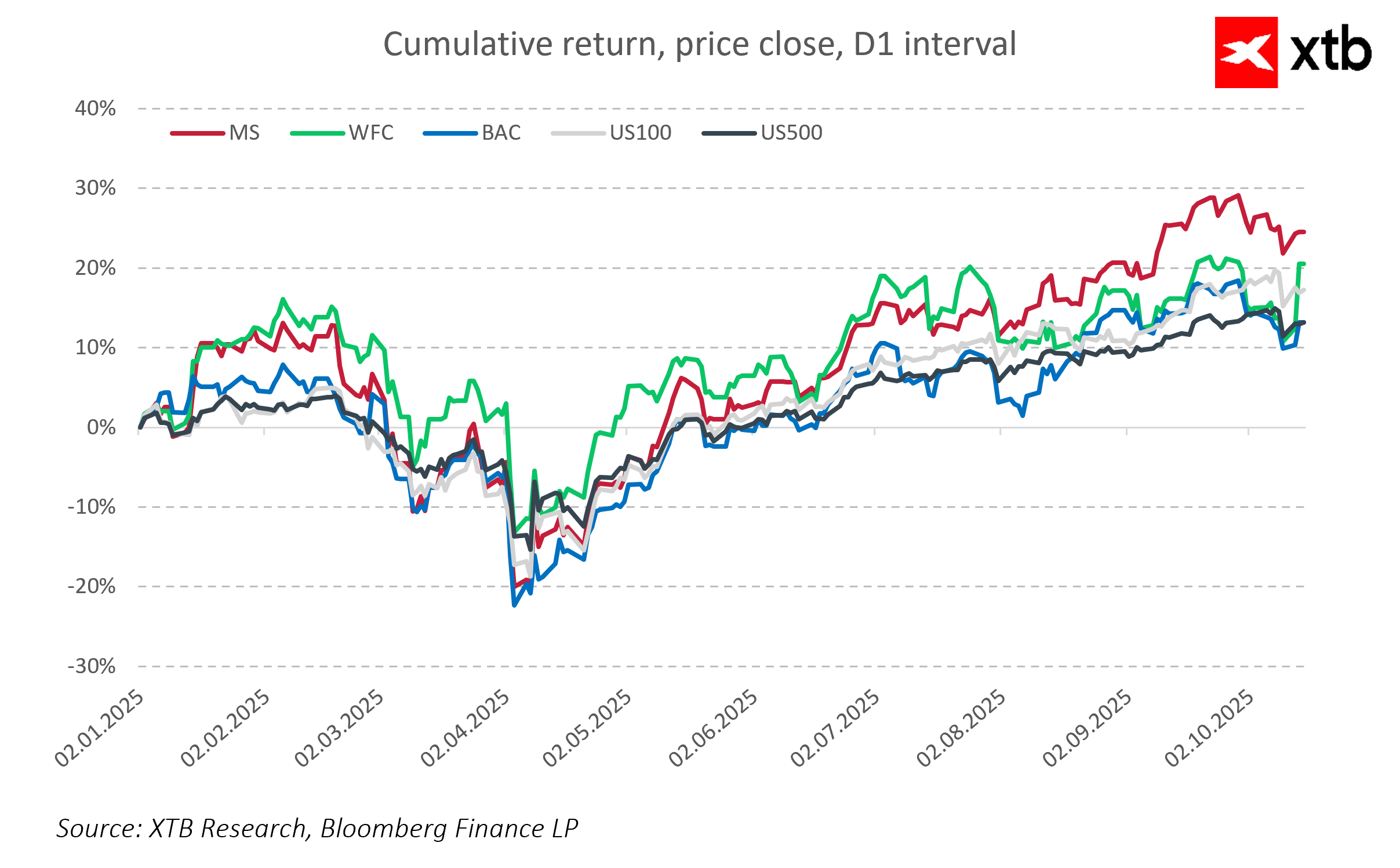

The third quarter of 2025 delivered solid results for the largest U.S. banks. Morgan Stanley stood out with strong wealth management revenues and record equity trading performance, highlighting its effective strategy and market position. Bank of America demonstrated skillful asset and liability management amid rising interest rates, driving revenue and net interest income growth. Wells Fargo confirmed financial stability and significantly improved credit portfolio quality, reducing credit risk.

While the returns of these banks are not as spectacular as those seen in the largest tech companies, they still clearly outperform key market benchmarks. Compared to the S&P 500 and Nasdaq 100 indices, the biggest U.S. banks show steady growth, proving their ability to generate value even in challenging market conditions. This makes them attractive options for investors seeking both stability and growth potential.

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Does the current sell-off signal the end of quantum companies?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.