-

Revenue Shift Confirmed: Q1 miss was offset by a $10–$11B Q2 revenue guide, signaling a timing deferral and strong sequential growth.

-

Margin Headwinds Persist: Q2 EPS guidance came in low, confirming investor concerns about profitability and margin pressure.

-

FY Outlook Raised: SMCI increased its full-year guidance to $36B, underscoring confidence in long-term AI execution.

-

Revenue Shift Confirmed: Q1 miss was offset by a $10–$11B Q2 revenue guide, signaling a timing deferral and strong sequential growth.

-

Margin Headwinds Persist: Q2 EPS guidance came in low, confirming investor concerns about profitability and margin pressure.

-

FY Outlook Raised: SMCI increased its full-year guidance to $36B, underscoring confidence in long-term AI execution.

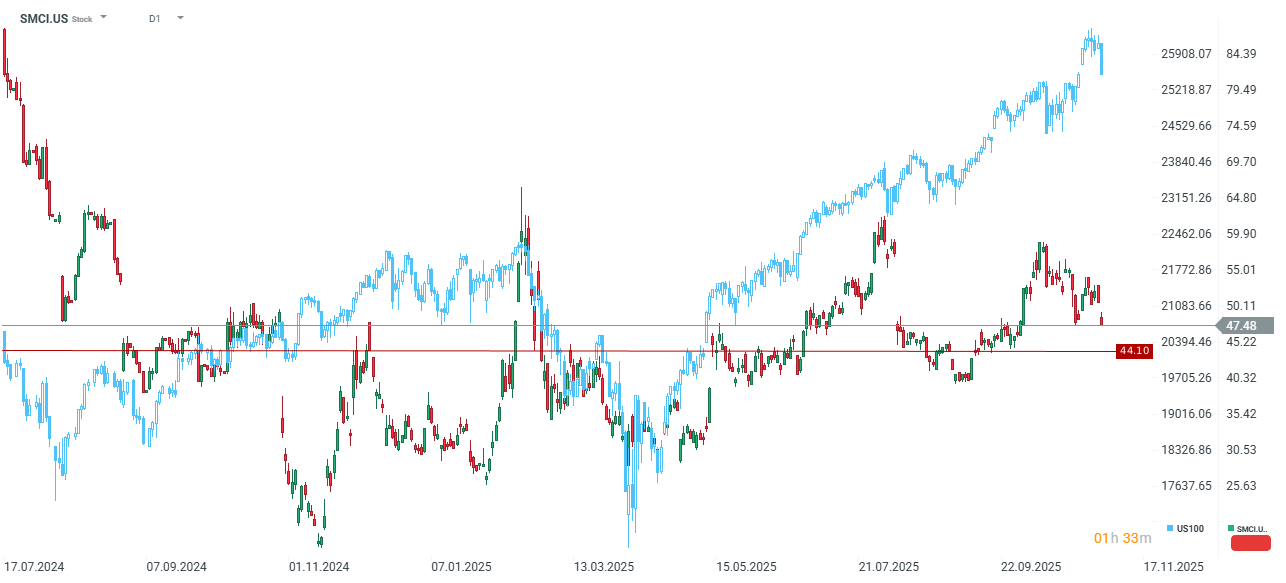

Super Micro Computer (SMCI) reported significantly disappointing results for Q1 FY2026, though forward guidance points to a robust recovery and sequential growth surge.

Key Q1 FY2026 Misses

-

Revenue came in at $5.02 billion, falling short of the $6.09 billion consensus, representing a 17.5% miss.

-

Adjusted Earnings Per Share (EPS) was $0.35, a 14.6% disappointment against the expected $0.41.

-

The Adjusted Gross Margin was 9.5%, narrowly missing the 9.63% expectation.

Forward Guidance Signals Volatility and Margin Pressure

-

Q2 Revenue guidance was set between $10 and $11 billion, significantly exceeding the consensus of $8.05 billion and implying a substantial 24% to 37% sequential increase.

-

However, Q2 EPS guidance of $0.46–$0.54 fell well below the $0.62 consensus, suggesting continued margin compression despite the revenue acceleration.

-

SMCI raised its full-year FY2025 revenue guidance to at least $36 billion, up from the previous at least $33 billion.

Analysis: Timing Shift Over Fundamental Disappointment

-

The company's poor Q1 performance was attributed to a clear revenue deferral into Q2, caused by customers awaiting "design win upgrades" related to new NVIDIA and AMD chip generations.

-

This backlog suggests the Q1 result is primarily a timing issue rather than a fundamental demand deterioration. The Q2 revenue forecast, implying a potential 100% sequential jump, reinforces this view.

-

Crucially, the company's decision to increase its ambitious full-year target to $36 billion underpins management's confidence in execution, even as the lower-than-expected Q2 EPS guidance highlights ongoing concerns about profitability and margins.

-

The 8% drop in after-hours trading reflects typical market asymmetry, where investors prioritize the quarterly miss over the optimistic long-term revenue forecast, while also reacting to the weak profitability outlook.

Boeing gains amid news about potential huge 737 MAX order from China 📈

Wall Street tries to stop the deeper decline 🗽Marvell Technology jumps 10%

Brent tops $90 per barrel

RyanAir shares under pressure amid Middle East conflict 📉

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.