Rate decision from Bank of Japan is a key event of the pre-Christmas week on the markets. Japanese central bank is set to announce its decision during the upcoming Asia-Pacific session. While there is no exact timing for the decision, it is usually released around 3:00 am GMT. Bank is not expected to change the level of interest rates this week, but markets hope for a hawkish guidance.

What is market expecting?

Expectations for this week's Bank of Japan announcement are clear - no change in the level of rates is seen by either economists or money markets. Out of over 50 economists surveyed by Bloomberg not a single one expects outcome other than leaving main rate unchanged at -0.10% and 10-year target yield at 0.00%. Money markets price in less than 2% chance of a rate move tomorrow.

Source: Bloomberg Finance LP

Focus on guidance

While the Bank of Japan is not expected to change the level of rates tomorrow, traders will look for shifts in BoJ guidance. Global central banks have been hiking rate aggressively in order to combat pandemic-driven and war-related inflation, but Bank of Japan stood on the sidelines and did not join the trend. However, Bank of Japan may be preparing for a rate hike that will push Japanese rate out of the negative territory.

A continued JPY weakness has prompted a few central bank intervention this year and currency started to regain ground as possibility of the negative rate exit by the end 2023 was hinted by BoJ officials. As recently as at the beginning of December 2023, BoJ Deputy Governor Himion speculated in a speech on the effects of negative rate exit would have on the Japanese economy, boosting hopes that such a move is imminent. However, around a week later media reports began to surface suggesting that BoJ is unwilling to hike rates at this year's final meeting.

Money markets are currently expecting the first 10 basis point rate hike for April 2024 meeting. While Bank of Japan is unlikely to provide hints on exact timing of the rate hike, any suggestions that the Bank is considering and discussing such a move would be a strong hawkish signal for JPY.

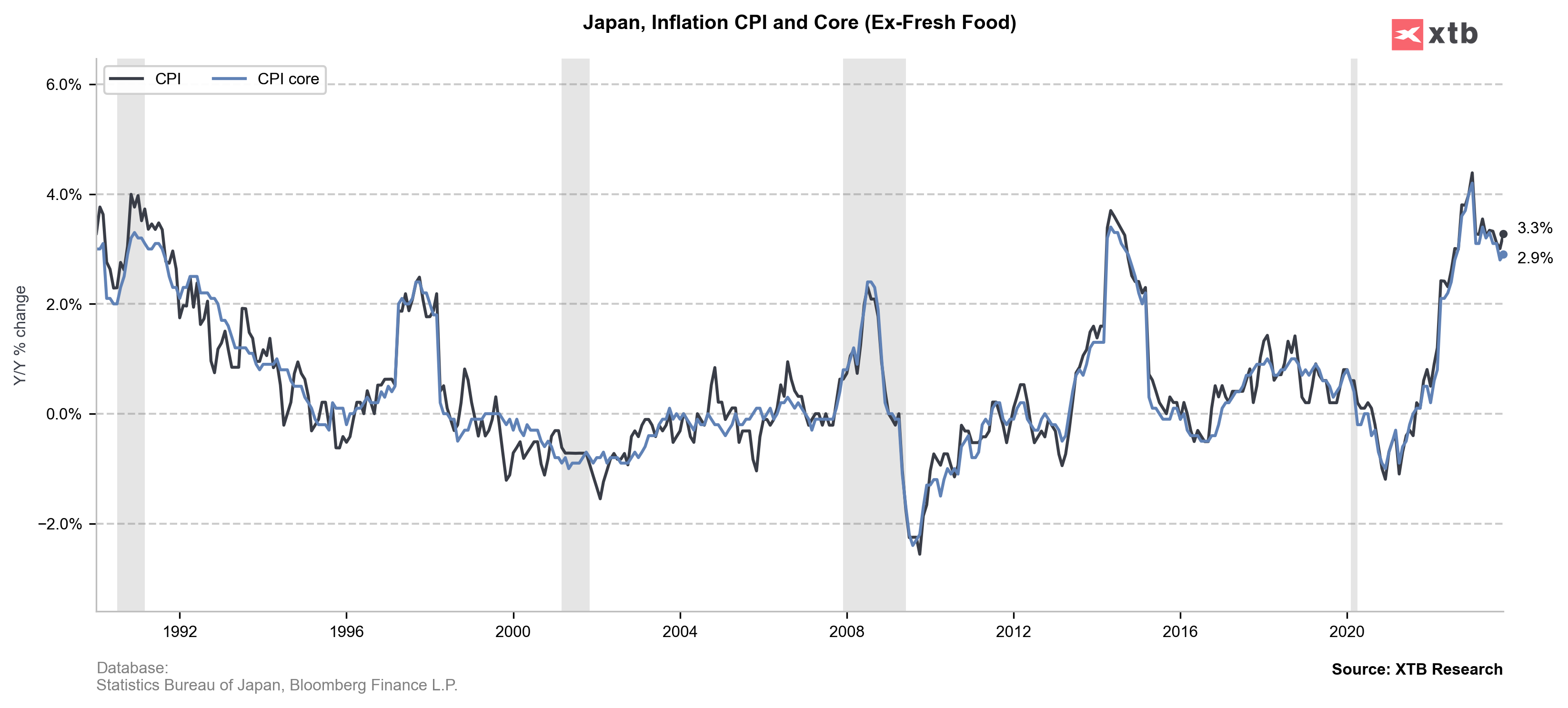

CPI inflation climbed above BoJ 2% target but whether this increase in price growth will be sustained is a different story. Source: Bloomberg Finance LP, XTB Research

Significant post-meeting volatility expected

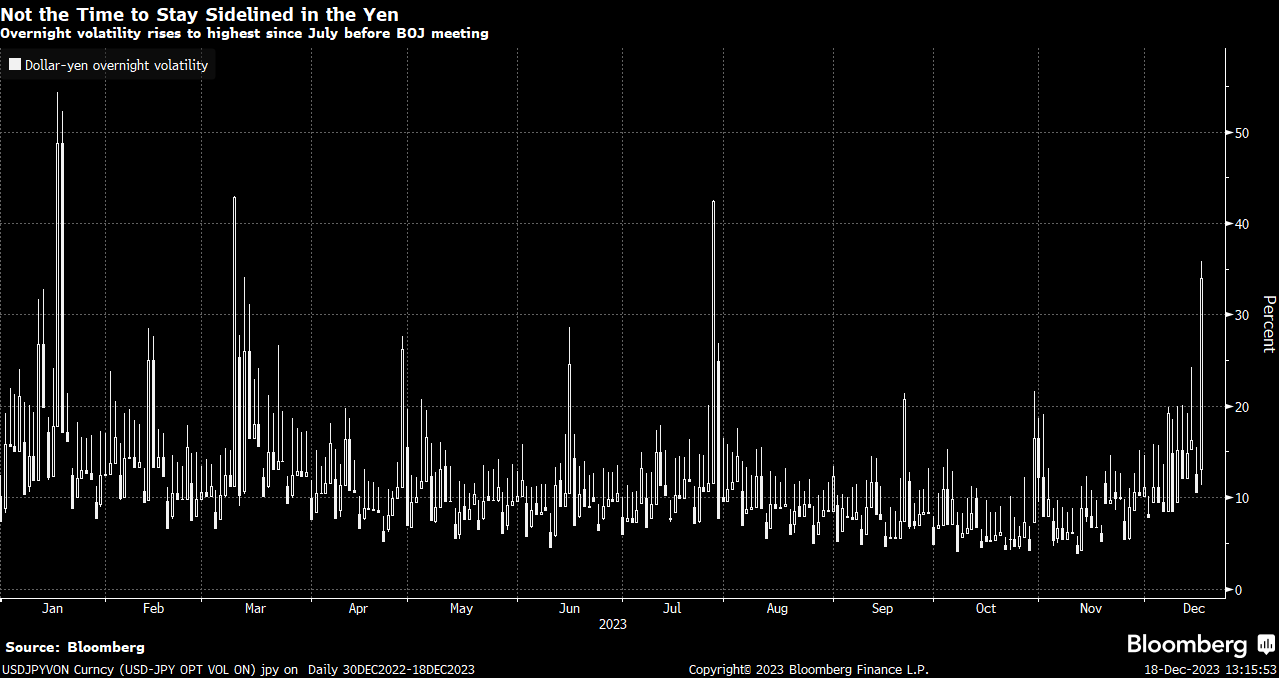

There is a lot of uncertainty on the markets heading into Bank of Japan meeting this week. Rate move seems unlikely but guidance will be crucial. Should Bank of Japan hint that rate hikes will come soon, JPY is likely to benefit. On the other hand, sticking to the previous narrative and failing to mention plans to hike would likely trigger JPY sell-off. Each of this outcomes seems as likely as the other so there is a huge scope for a surprise. Markets seem to be reflecting it with an overnight USDJPY volatility jumping to annualized 35% - the highest level since July 27, 2023.

Source: Bloomberg Finance LP

A look at the chart

FX pairs tied to Japanese yen are expected to be movers tomorrow. However, the pair that may see the biggest volatility spike is AUDJPY, as RBA minutes will also be released tomorrow (0:30 am GMT). Taking a look at the pair at D1 interval, we can see that a recent downward correction has been halted at the 200-session moving average (purple line). An initial attempt to break below this hurdle gained some traction but it was halted almost exactly at the lower limit of the market geometry, suggesting that the uptrend is still in play.

Pair is testing the 96.00 resistance zone at press time. Note that this resistance was also tested last week but bulls failed to break above. Moves on the pair has been largely limited to 95.00-96.00 range since. A hawkish BoJ could provide a fuel for a downside breakout from the range, with textbook target for such a breakout being the 94.00 swing area. However, a more important support can be found lower in the 93.00 area. On the other hand, failure to deliver onto hawkish expectations may see JPY slump and cause AUDJPY to rise. In such a scenario, the 97.00 swing area would be the first target for buyers.

Source: xStation5

Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

BREAKING: US100 jumps amid stronger than expected US NFP report

NFP preview

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.