The cryptocurrency market reacted with panic to collapse of one of the largest cryptocurrency exchanges, FTX. FTX owner Sam Bankman-Fried's sale of the exchange to rival Binance ultimately failed to help cryptocurrencies stave off declines. Bitcoin reached new lows near $17,000 and is currently trading at $17,500. The market capitalization of the cryptocurrency market slipped from $1 trillion to around less than $900 million losing more than $100 million in just 2 days:

- FTX was plunged by a wave of customer withdrawals worried about the exchange's poor financial health. According to the latest findings, these concerns triggered $6 billion in withdrawals in just 3 days as a result of which FTX experienced a massive liquidity crisis and was forced to suspend withdrawals. A 'bailout' deal with Binance then ensued;

- Wall Street research firm Bernstein suggested the FTX exchange close the Alameda Research fund due to the risk of questionable collateral. In a note, the analysts wrote: " (...) FTX should terminate its relationship with Alameda. FTX cannot continue its existing ownership structure with Alameda. FTX must completely separate itself and potentially shut down Alameda's prop trading operations. If Alameda's trading operations affect FTX's customer confidence (the perception of Alameda trading against users on FTX and Alameda's financial condition), then there is more downside to running Alameda than otherwise."

- The collapse of FTX could spill over to the entire cryptocurrency market. The community and investors are baffled by the decision of Sam Bankman-Fried, who as recently as the beginning of the year was hailed as a 'cryptocurrency savior' after he acquired a number of cryptocurrency companies earlier in the year, and over the summer attempted to pull out of problems and offered to acquire bankrupt entities like Celsius Network and Voyager Digital. In an interview after the collapse of the 3AC fund, the FTX creator pointed out that there are entities in the market whose collateral is questionable and probably facing collapse, but they are keeping quiet about it without revealing themselves. It is worth noting that the exchange's venture capital division known as FTX Ventures has been a major investor in a large number of cryptocurrency startups such as Aptos Labs, Messari, Sky Mavis, LayerZero, YugaLabs and 1inch Network;

- The latest news indicates that the Binance exchange has agreed to purchase the fTX unit from outside the US, the US unit according to Bankman-Fried 'constituted a separate business and is not currently affected'. The billionaire also added that the acquisition by Binance will help the industry and is 'user-oriented.'

- The exchange is working on processing all outstanding payments and indicates that they will be covered 1:1. At the same time, however, Binance, according to the letter of intent, retains the right to withdraw from the FTX acquisition agreement at any time. According to a tweet by Chanpeng Zhao, owner of Binance, the exchange has already begun selling off FTX from its reserves in the face of 'revelations' that have come to light in recent days. Binance held nearly $500 million in FTX exchange tokens, it is not yet clear how much has been sold;

- TechDev analysts have indicated that cryptocurrencies could reverse their downward trend once the effects of FTX's collapse are fully priced into the market. The collapse of the exchange was not directly related to the functionality and opportunities offered by cryptocurrencies themselves, and it may also be optimistic that the weakening strength of the dollar should help risky assets.

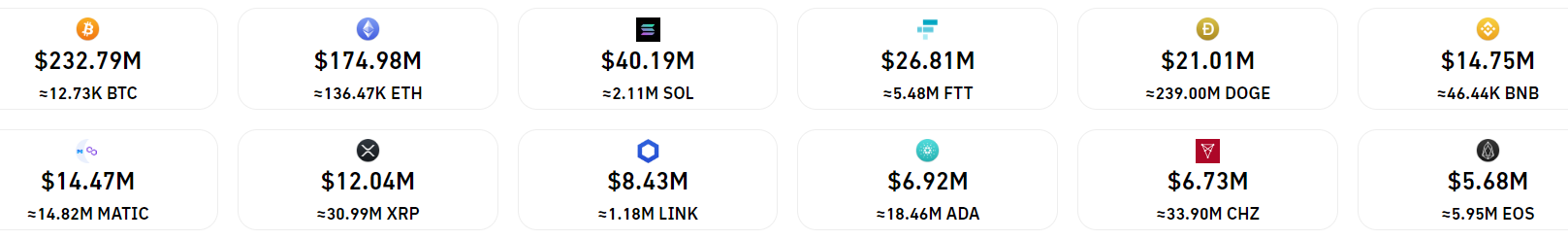

Over the past 24 hours, liquidations were dominated by Bitcoin and Ethereum where bulls experienced nearly $400 million in losses. Next in line is Solana and the FTX exchange token, which lost nearly 80% after Sam Bankman-Fried made the news of selling the exchange to its biggest competitor, Binance. The lower liquidations of FTX tokens indicate that the token's declines were likely driven by the supply of spot traders, with Binance also likely contributing to the declines, as it began selling off tokens at increasingly lower prices in the face of weak demand. Source: Coinglass

Over the past 24 hours, liquidations were dominated by Bitcoin and Ethereum where bulls experienced nearly $400 million in losses. Next in line is Solana and the FTX exchange token, which lost nearly 80% after Sam Bankman-Fried made the news of selling the exchange to its biggest competitor, Binance. The lower liquidations of FTX tokens indicate that the token's declines were likely driven by the supply of spot traders, with Binance also likely contributing to the declines, as it began selling off tokens at increasingly lower prices in the face of weak demand. Source: Coinglass During the past 24 hours, liquidations were dominated by Bitcoin and Ethereum where bulls experienced nearly $400 million in losses. Next in line is Solana and the FTX exchange token, which lost nearly 80% after Sam Bankman-Fried made the news of selling the exchange to its biggest competitor, Binance. The lower liquidations of FTX tokens indicate that the token's declines were likely driven by the supply of spot traders, with Binance also likely contributing to the declines, as it began selling off tokens at increasingly lower prices in the face of weak demand. Source: Coinglass

During the past 24 hours, liquidations were dominated by Bitcoin and Ethereum where bulls experienced nearly $400 million in losses. Next in line is Solana and the FTX exchange token, which lost nearly 80% after Sam Bankman-Fried made the news of selling the exchange to its biggest competitor, Binance. The lower liquidations of FTX tokens indicate that the token's declines were likely driven by the supply of spot traders, with Binance also likely contributing to the declines, as it began selling off tokens at increasingly lower prices in the face of weak demand. Source: Coinglass Bitcoin, H4 interval. The RSI relative strength index is pointing to levels near 14 points, which indicates a critical oversold phase and could herald a rebound if the bulls manage to stay above the 17 000 USD level. Source: xStation5

Bitcoin, H4 interval. The RSI relative strength index is pointing to levels near 14 points, which indicates a critical oversold phase and could herald a rebound if the bulls manage to stay above the 17 000 USD level. Source: xStation5

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?

Market wrap: Novo Nordisk jumps more than 7% 🚀

Crypto news: Bitcoin falls below $70k 📉Will crypto slide again?

Morning wrap: Tech sector sell-off (06.02.2026)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.