Best Buy (BBY.US) stock jumped more than 7.0% before the opening bell , after the consumer electronics and appliances retailer posted upbeat results for the third quarter and raised its full-year outlook. Company said that demand for big-ticket consumer electronics held up despite inflation.

-

Company earned $1.38 per share, down 33.7% from the same period last year but topped market estimates of $1.03 per share. Revenue plunged 11.0% compared to last year to $10.3587 billion, but beat analysts’ estimates of a $10.31 billion tally. On the flip side, same store sales fell 10.4% from last year.

-

"We have strategically and effectively managed our inventory flow based on a shopping pattern that we believe looks more similar to historical holiday periods," said CEO Corrie Barrie.

-

“The holiday shopping season has begun, and now, more than ever, our customers are looking to bring joy back into their celebrations,” she added. “We have strategically and effectively managed our inventory flow based on a shopping pattern that we believe looks more similar to historical holiday periods, with customer shopping activity concentrated on Black Friday week, Cyber Monday and the two weeks leading up to December 25," said Barrie.

-

For fiscal 2023, the company now expects same-store sales to fall about 10% versus prior guidance of down about 11%.

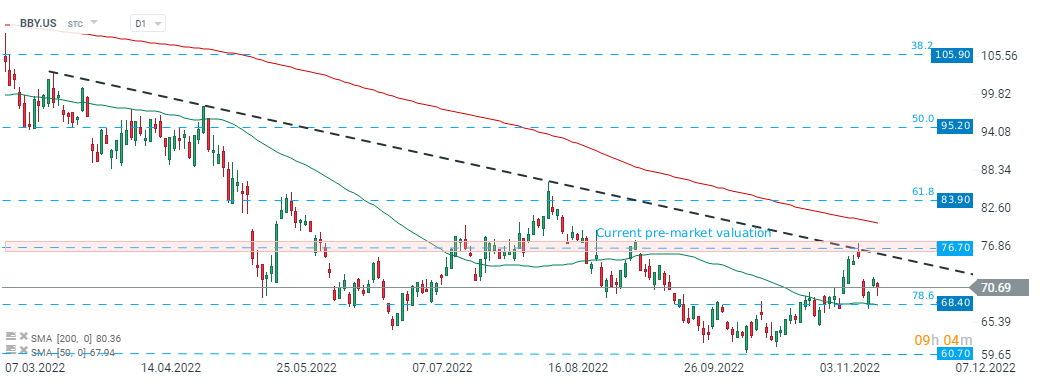

Best Buy (BBY.US) stock rose sharply in premarket and is currently testing a major resistance zone around $76.70, which is marked with previous price reactions and downward trendline. Should a break higher occur, upward move may accelerate towards resistance at $83.90 which coincides with 61.8% Fibonacci retracement of the upward wave launched in March 2020. On the other hand, if sellers manage to regain control, nearest support to watch is located at $68.40. Source: xStation5

Best Buy (BBY.US) stock rose sharply in premarket and is currently testing a major resistance zone around $76.70, which is marked with previous price reactions and downward trendline. Should a break higher occur, upward move may accelerate towards resistance at $83.90 which coincides with 61.8% Fibonacci retracement of the upward wave launched in March 2020. On the other hand, if sellers manage to regain control, nearest support to watch is located at $68.40. Source: xStation5

Nvidia expands into software AI sector? Wired reports on NemoClaw

Market Wrap: Energy Stocks Retreat as Hopes for End to Iran War Grow 🌍 (10.03.2026)

A wild ride for markets as dizzying market U-turns dominate

A wild ride for markets as dizzying market U-turns dominate

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.