The cryptocurrency market started today in a weak mood, but it was clearly improved by a dovish statement from the Bank of England, which intends to buy Treasury bonds. We also see a moderate positive reaction on the indices. Will this be enough for Bitcoin to rise and leave the levels below $20,000 for longer?

- Bitcoin is back above $19,000 and has again defended key support levels. Ethereum is trading above $1,300 per token;

- FTX exchanges, which owns the cryptocurrency of the same name, has won a bid to acquire bankrupt cryptocurrency company Voyager, for $1.4 billion. Voyager filed for bankruptcy in July. FTX outbid Binance and Wave Financial. At the same time, news surfaced of the resignation of the CEO of another bankrupt cryptocurrency lender, Celsius Network;

- The head of the exchange, billionaire Sam Bankman-Fried has also considered buying out Celsius in the past. Voyager customers have until Oct. 3 to file claims for cryptocurrency recovery. Bankman-Fried reported over the summer that he wanted to reduce the negative effects of bankruptcies and improve sentiment toward the battered cryptocurrency industry.

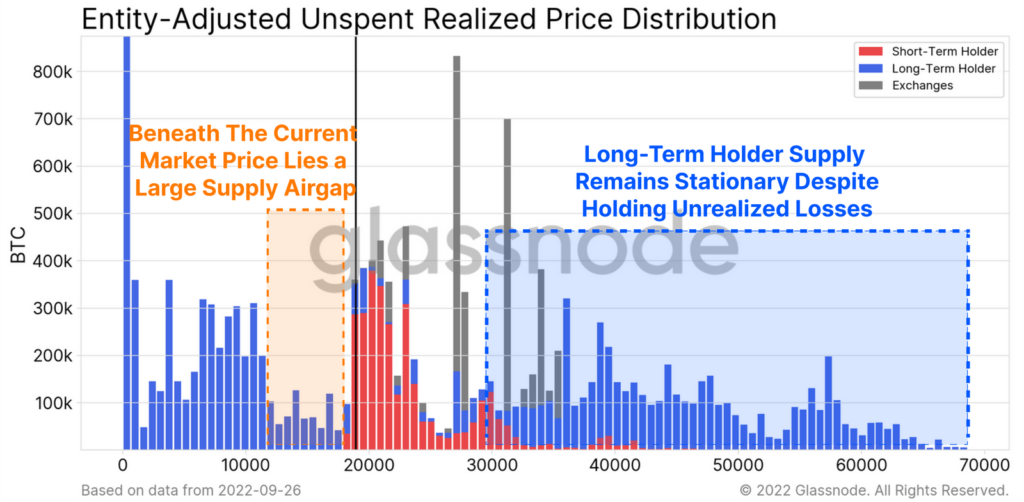

The chart analysis above shows the market for Short Term Holders (STH for short). Dividing Bitcoin supply between long and short term addresses, we can observe several phenomena. Bitcoins bought above $30,000 are already mostly owned by LTHs, and there is little supply from them, due to the significant unrealized loss and investors' belief in Bitcoin's upward potential. On the other hand, STH addresses want to purchase the cryptocurrency at the most attractive price possible. As we can see now, the volatility of investments on the part of STH is low, volumes are relatively similar to each other. In the face of a growing lack of supply from LTH addresses, it is the movements of STH that are most relevant for Bitcoin. A supply gap between $17,000 and $11,000 could trigger a massive sell-off if Bitcoin's price falls about 10% from current levels near $19,000. However, looking at the systematic supply reactions of the major cryptocurrency, such a large drop looks as possible once short-term investors lose faith in the price rebound and feel the breath of active supply on them. With the passage of time and the 'notorious' extinguishing of demand, sentiment may weaken leading to capitulation of STH. Source: Glassnode

The chart analysis above shows the market for Short Term Holders (STH for short). Dividing Bitcoin supply between long and short term addresses, we can observe several phenomena. Bitcoins bought above $30,000 are already mostly owned by LTHs, and there is little supply from them, due to the significant unrealized loss and investors' belief in Bitcoin's upward potential. On the other hand, STH addresses want to purchase the cryptocurrency at the most attractive price possible. As we can see now, the volatility of investments on the part of STH is low, volumes are relatively similar to each other. In the face of a growing lack of supply from LTH addresses, it is the movements of STH that are most relevant for Bitcoin. A supply gap between $17,000 and $11,000 could trigger a massive sell-off if Bitcoin's price falls about 10% from current levels near $19,000. However, looking at the systematic supply reactions of the major cryptocurrency, such a large drop looks as possible once short-term investors lose faith in the price rebound and feel the breath of active supply on them. With the passage of time and the 'notorious' extinguishing of demand, sentiment may weaken leading to capitulation of STH. Source: Glassnode

Bitcoin chart, H1 interval. Bitcoin is reacting negatively to the resistance of the 200-session moving average on 1 hour interval, near $19,080. Depending on Wall Street's opening, however, bulls may break through the resistance and attempt a $20,000 attack. If the sentiment towards risk continues to be weak a path south is not impossible. Currently, contracts point to a weak opening for indexes overseas. RSI is now on neutral level. Source: xStation5

Bitcoin chart, H1 interval. Bitcoin is reacting negatively to the resistance of the 200-session moving average on 1 hour interval, near $19,080. Depending on Wall Street's opening, however, bulls may break through the resistance and attempt a $20,000 attack. If the sentiment towards risk continues to be weak a path south is not impossible. Currently, contracts point to a weak opening for indexes overseas. RSI is now on neutral level. Source: xStation5

Politics batter the UK bond market once more, as Starmer remains under pressure

STM is growing stronger thanks to a new partnership with AWS!

The Week Ahead

Kongsberg Gruppen after earnings: The company catches up with the sector

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.